The simultaneous rise in volume and price drives a significant increase in performance, Zijin Mining's net profit for 2025 is expected to increase by 60% year-on-year | Financial Report Insights

Zijin Mining expects a net profit of 51-52 billion yuan in 2025, a year-on-year increase of 59%-62%. The growth in performance is mainly driven by the simultaneous increase in both volume and price of key products such as gold and copper, with lithium carbonate production achieving several times growth. The company also announced its production targets for 2026, planning to further expand the capacity of various metals, especially increasing lithium carbonate production to 120,000 tons. Since the beginning of this year, the company's stock price has risen by a cumulative 118%

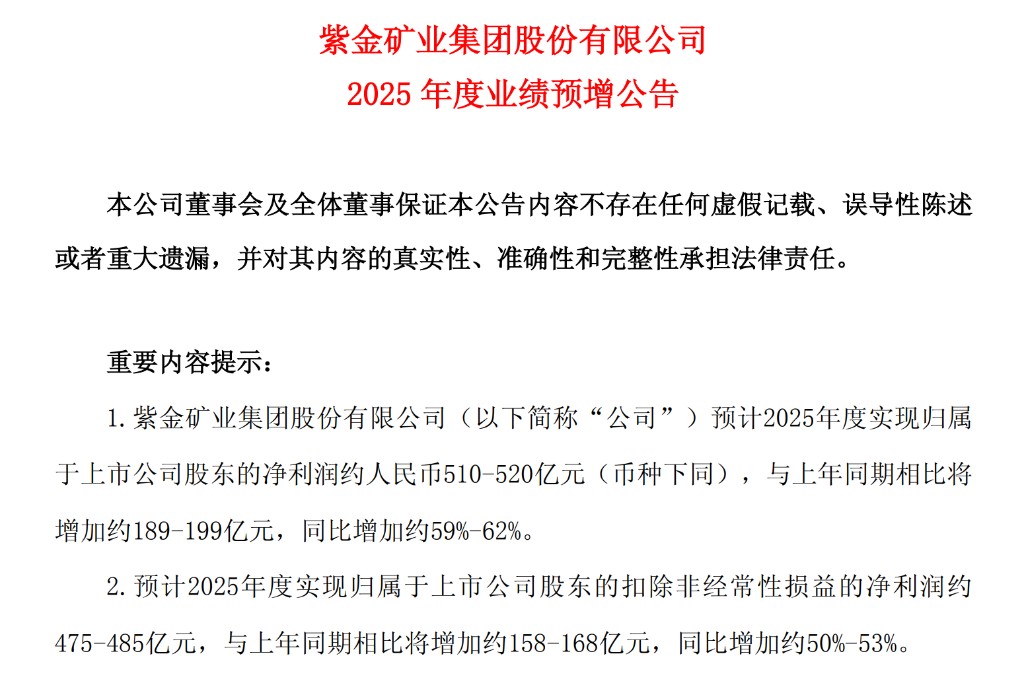

Zijin Mining Group Co., Ltd. announced on December 30 that it expects a significant increase in performance for the year 2025, with the net profit attributable to shareholders of the listed company expected to reach RMB 51 billion to 52 billion, an increase of approximately RMB 18.9 billion to 19.9 billion compared to the same period last year, representing a year-on-year increase of about 59%-62%. The net profit after deducting non-recurring gains and losses is expected to be RMB 47.5 billion to 48.5 billion, a year-on-year increase of 50% to 53%.

The growth in performance is mainly driven by the dual factors of increased production and rising prices, with the output of major mineral products achieving year-on-year growth, while the sales prices of major mineral products also increased simultaneously. The announcement also disclosed the production targets for 2026, further clarifying the strategic path for continuous expansion.

On December 30, Zijin Mining's A-share price rose by 2.36%. Since the beginning of this year, its stock price has accumulated an increase of 118%.

Comprehensive Growth in Major Mineral Product Output

In 2025, Zijin Mining achieved comprehensive growth in the output of major mineral products. The output of mined gold is approximately 90 tons, an increase of about 23% compared to 73 tons in 2024. The output of mined copper (including Kamoa equity output) is approximately 1.09 million tons, a slight increase from 1.07 million tons in 2024. The output of mined silver is approximately 437 tons, essentially flat compared to 436 tons in 2024.

Notably, the company's equivalent lithium carbonate output (including the output from Zangge Mining from December) significantly increased to approximately 25,000 tons, compared to only 261 tons in 2024, demonstrating the company's rapid expansion in the new energy mineral sector.

During the reporting period, the sales prices of mined gold, mined copper, and mined silver all experienced year-on-year increases, becoming important factors driving performance growth. The rise in metal prices and the increase in output created a dual benefit, jointly driving the company's net profit to achieve an increase of nearly 60%.

Further Increase in 2026 Production Targets

Zijin Mining announced the production plan for major mineral products in 2026, continuing the overall expansion pace. The target for mined gold is 105 tons, an increase of about 17% compared to the expected output in 2025; the target for mined copper is 1.2 million tons, an increase of about 10%; the target for equivalent lithium carbonate output has significantly jumped to 120,000 tons, nearly quadrupling compared to 2025; the target for mined silver is 520 tons, a year-on-year increase of about 19%