罕见操作!特斯拉公布分析师预测:Q4 交付量或下滑 15%,税收补贴退坡与竞争加剧冲击需求

分析师预计特斯拉第四季度交付量同比下滑 15%,2025 年全年交付量将在在 160 万辆至 165 万辆之间,同比约降 8%,面临连续两年销量萎缩。受美国税收抵免到期、全球竞争加剧及需求透支等多重冲击,尽管特斯拉推出廉价版车型,但北美与欧洲市场依然疲软。

由于美国税收抵免政策失效以及全球竞争日益激烈,特斯拉在第四季度面临显著的销售收缩压力,预计将录得连续第二个年度交付量下滑。

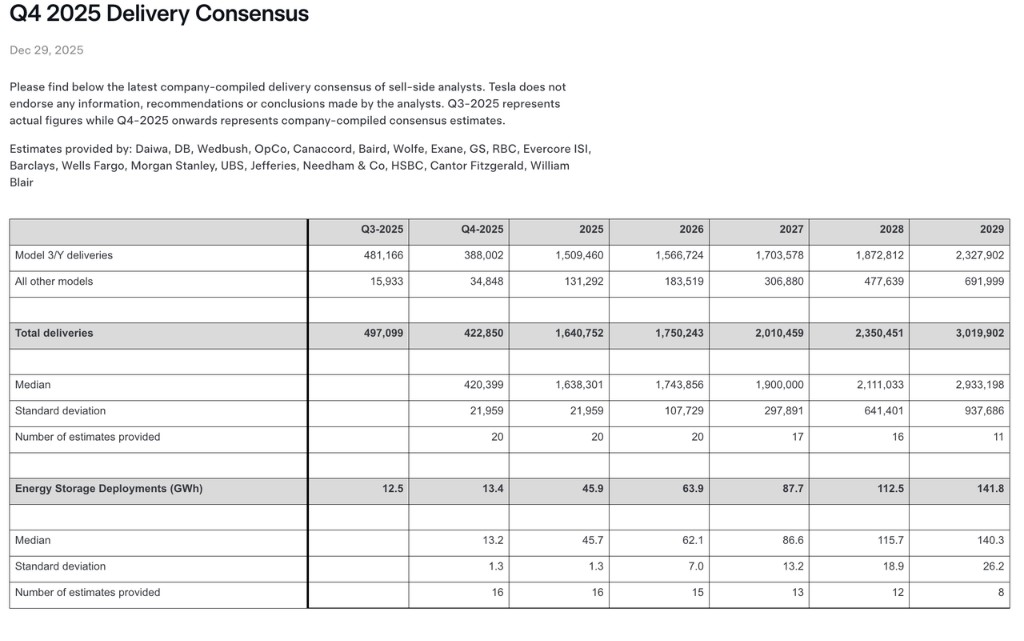

特斯拉周一在其网站上罕见发布了分析师预测汇总,数据显示,分析师平均预期特斯拉第四季度交付量为 422850 辆,同比下降 15%。这一由公司内部汇总的预期数据,比彭博此前调查得出的平均值(445061 辆,降幅 10%)更为悲观。

这一疲软的季度表现将拖累全年的业绩数据。根据 Visible Alpha 的调查以及特斯拉汇总的数据,该公司2025 年全年交付量预计在 160 万辆至 165 万辆之间,同比下降约 8%。这将是该汽车制造商连续第二年出现年度销量下滑,且降幅较上一年更为剧烈。

尽管特斯拉在季度初推出了价格更低的车型版本以试图抵消补贴退坡的影响,但市场需求依然承压,投资者正密切关注将于本周五发布的最终生产与交付数据。

税收抵免到期冲击需求

第四季度交付量的下滑,很大程度上源于美国联邦税收优惠政策的变动。7500 美元的联邦税收抵免已于 9 月底到期,这导致买家在第三季度纷纷提前购车以锁定优惠,从而透支了第四季度的需求。

为了应对这一不利因素,特斯拉在 10 月推出了 Model Y SUV 和 Model 3 紧凑型轿车的标准版本,售价均低于 4 万美元,比之前的基本款低约 5000 美元。尽管推出了更廉价的车型,但分析师指出,税收抵免的缺失以及全球竞争的加剧仍在削弱需求。

德意志银行分析师 Edison Yu 在一份报告中表示,此次销量的下滑将主要由北美和欧洲市场的表现疲软所驱动。此外,特斯拉不仅面临雪佛兰和福特等传统车企预计在未来两年内推出的平价电动车的竞争,还在欧洲和亚洲市场面临中国电动车企不断扩大的市场份额。

市场预期趋于谨慎

特斯拉此次主动在投资者关系页面公布分析师预估均值的举动并不常见。根据特斯拉汇总的数据,市场对其第四季度的看法比外部机构的调查更为保守。Visible Alpha 的调查显示,分析师预计特斯拉第四季度交付量为 432810 辆,同比下降约 13%,略好于特斯拉内部汇总的 15% 跌幅。

回顾全年,特斯拉的销售在年初就遭遇了滑坡。年初销量的暴跌部分归因于公司为生产重新设计的 Model Y 而对装配线进行了改造。此外,首席执行官马斯克早些时候在政治言论引发的舆论反弹,也在今年前两个季度对销售造成了一定影响。

尽管 Visible Alpha 的分析师预计,随着更廉价的标准版本帮助公司捍卫销量,特斯拉的销售有望在明年复苏,但目前的市场共识仍指向该公司将面临连续两年的年度交付量萎缩。

股价表现与长期目标

尽管汽车销售放缓,但特斯拉的股价并未随之低迷。截至周一收盘,特斯拉股价今年以来已上涨超过 14%,尽管这一表现仍落后于标普 500 指数 17% 的涨幅。

投资者的热情在很大程度上建立在马斯克将战略重心转向 Robotaxi(自动驾驶出租车)、人形机器人以及改进自动驾驶技术上。尽管如此,电动汽车销售目前仍是该公司收入的主要来源。

随着结束了因参与特朗普政府成本削减部门而引发的争议,他表示将重新专注于自己的业务。近期法院的一项裁决为马斯克重新获得此前被特拉华州法院撤销的薪酬方案扫清了障碍。股东们也在 11 月批准了一项新的薪酬方案,这笔在未来 10 年内价值约 8780 亿美元的方案,将实现累计交付 2000 万辆汽车设定为关键考核目标之一。