Metal trends are diverging, silver rebounds, gold's gains significantly narrow, London copper rises nearly 4%, and London nickel hits a 14-month high

I'm PortAI, I can summarize articles.

現貨白銀漲近 5.6% 至 76.16 美元/盎司,此前一個交易日曾暴跌 9%。現貨黃金一度漲超 1.5%,觸及 200 小時均線後回落,美聯儲會議紀要後漲幅進一步縮窄、逼近昨日紐約尾盤價格 4335 美元附近。基本金屬普漲,倫銅漲約 3.7%,倫鎳漲超 6%,倫錫漲 3.56%,倫鋅漲超 1%。

年末金屬市場延續劇烈波動態勢,此前強勁漲勢出現反覆。投資者繼續密切關注這一板塊的價格走勢。

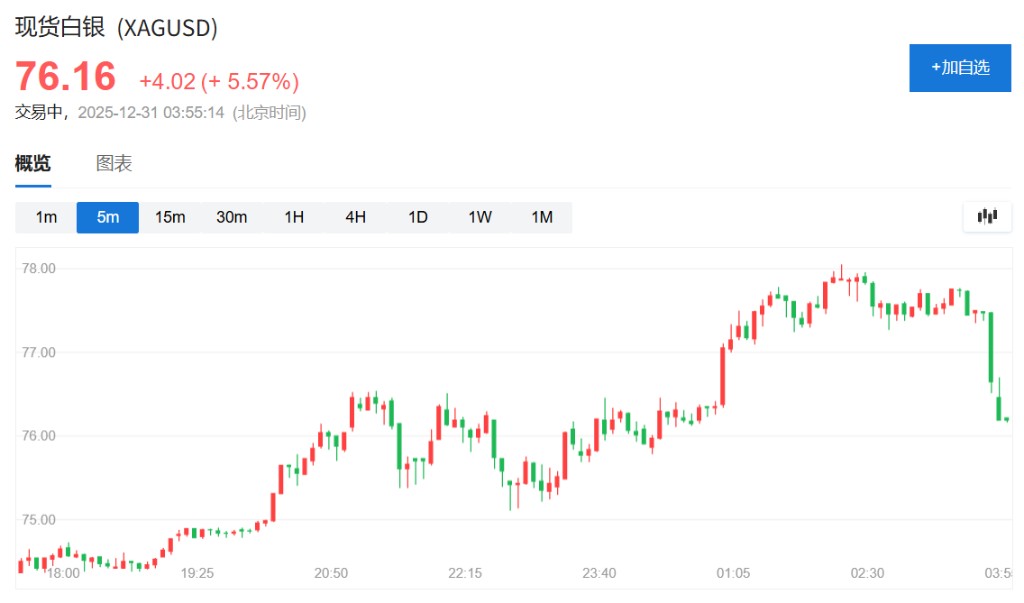

30 日,現貨白銀漲近 5.6% 至 76.16 美元/盎司。此前一個交易日曾暴跌9%。這輪拋售發生在投機性交易和供應短缺擔憂推動白銀價格創歷史性飆升之後。

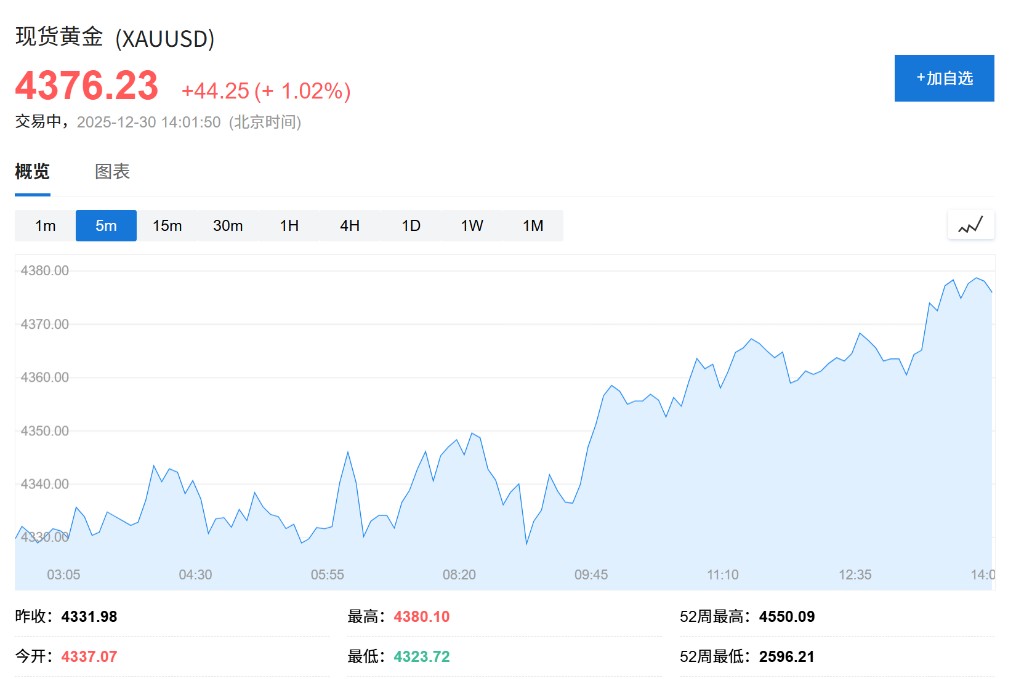

現貨黃金一度漲超 1.5%,觸及 200 小時均線後回落,美聯儲會議紀要後漲幅進一步縮窄、逼近昨日紐約尾盤價格 4335 美元附近。該金屬週一曾下跌逾 4%。貴金屬市場的大幅震盪凸顯出年底交投的不確定性。

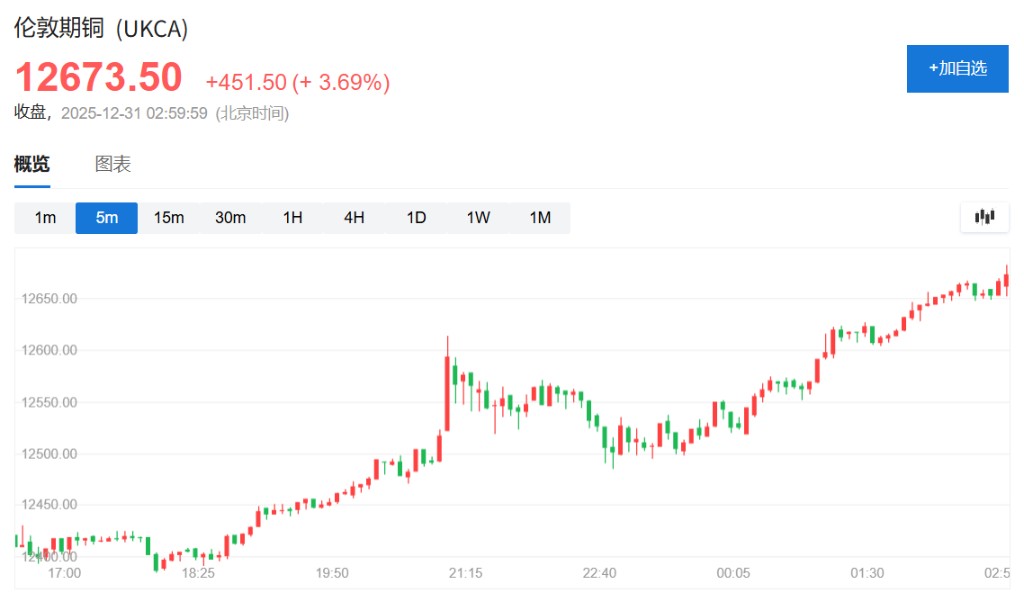

基本金屬普漲,倫銅漲約 3.7%,銅價有望錄得 2017 年以來最長連漲週期。12 月的這輪漲勢受到供應鏈面臨更多壓力預期的提振。倫錫漲 3.56%,倫鋅漲超 1%。

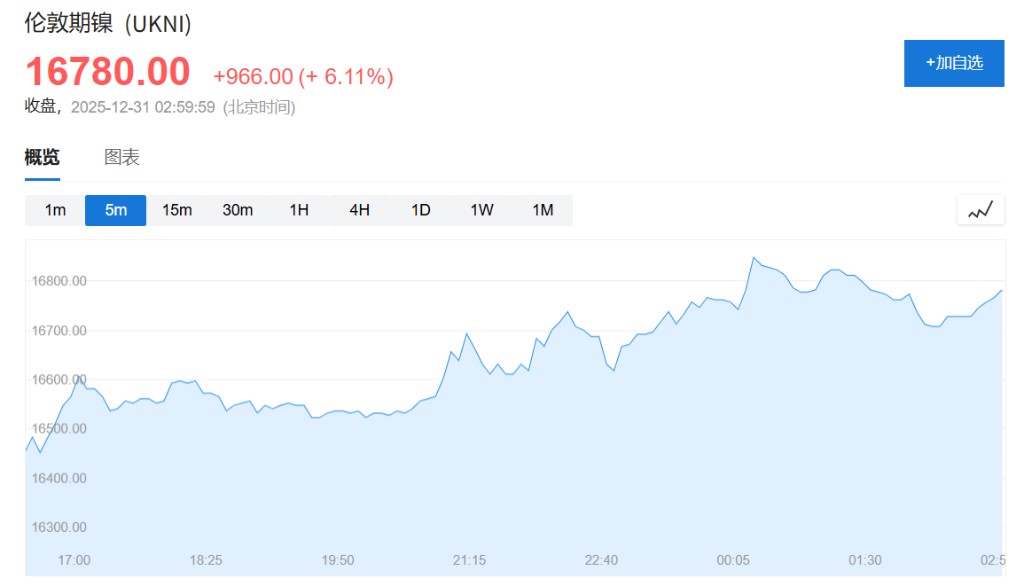

倫鎳漲超 6%,創 14 個月最高水平,達到每噸 16780 美元,延續了自 12 月中旬以來的反彈。全球最大鎳生產國印度尼西亞釋放出減產計劃的信號,旨在提振價格,推動鎳價走高。