2025 Commodity Review: Crazy Gold and Silver, Advancing Copper and Lithium, Disappointing Crude Oil

The commodity market in 2025 presents a historic divergence pattern. Precious metals lead an epic bull market, with silver rising over 140%, achieving the largest annual increase in history, and gold rising over 60%, recording its strongest performance since 1979. Copper prices rose over 40%, marking the largest annual increase since 2009, repeatedly hitting historical highs throughout the year. Due to improvements in supply and demand dynamics, lithium carbonate saw a cumulative increase of over 50% for the year. Energy and agricultural products, on the other hand, are deeply entrenched in a bear market, with crude oil falling over 15% for the year, recording the largest annual decline since 2020; cocoa plummeted nearly by half

In 2025, the commodity market showed a differentiated pattern, with precious metals like gold and silver experiencing an epic bull market, industrial metals rebounding strongly, while energy and agricultural products fell into years of lows.

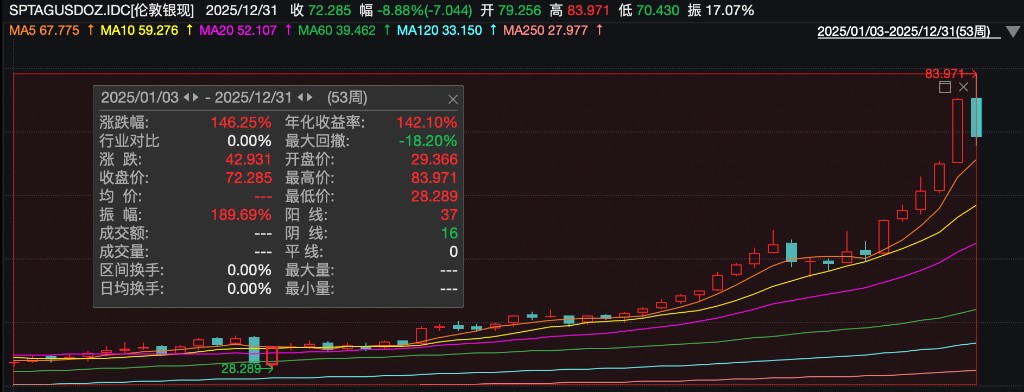

The precious metals market created a historic surge. Silver surged over 146%, marking the largest annual increase ever, while gold rose over 60%, recording its strongest performance since 1979. The frenzy in precious metals was mainly driven by expectations of interest rate cuts from the Federal Reserve, geopolitical conflicts, continued central bank gold purchases, and increased holdings in exchange-traded funds.

The base metals market also performed strongly. London copper rose nearly 44% for the year, marking the largest annual increase since 2009, and reached a historic high of $12,960 at the end of the year.

In contrast, the energy market showed a slightly disappointing trend. WTI crude oil fell over 18% for the year, recording the largest annual decline since 2020, as production growth from non-OPEC+ countries and expectations of a slowdown in global economic growth exacerbated concerns about a persistent oversupply in the market, which thoroughly suppressed oil prices.

Meanwhile, the agricultural products market generally performed weakly under supply pressure. Cocoa prices plummeted 48% due to a shift from tight to ample supply, making it the annual loser; major agricultural products such as raw sugar, coffee, wheat, and corn also generally faced downward pressure.

Silver Leads, Gold Soars to Record

In 2025, spot silver became the best-performing commodity with an annual increase of about 146%. The price of spot silver once broke through $83 per ounce, setting a historic high.

This epic rise was mainly driven by four structural factors: First, a policy value reassessment. Silver was designated as a critical mineral by the United States, fundamentally elevating its strategic status; Second, the rigid constraints on silver supply supported prices. Mine output growth was slow, while global exchange inventories remained at historically low levels; Third, an explosion in industrial demand. The global energy transition, especially the surge in silver usage in the photovoltaic industry; Finally, the financial attributes of silver were strengthened. Under the interest rate cut cycle and geopolitical risks, its safe-haven and investment demand surged.

The gold market also showed historic strength in 2025, with spot gold prices increasing nearly 60% for the year, once refreshing the record to $4,550 per ounce. Ilya Spivak, global macro director at Tastylive, pointed out that the factors driving gold prices up, such as geopolitical risks, central bank gold purchases, and easing expectations, have formed a positive cycle, predicting that by the end of the first quarter of 2026, gold prices may challenge the $5,000 mark.

Platinum and palladium also recorded strong gains. Platinum rose over 110%, marking the largest annual increase in history, reaching a historical high of $2,478.50 at one point. Palladium increased by 66%, achieving its best annual performance in 15 years. Regarding the recent market volatility, Jigar Trivedi, a senior research analyst at Reliance Securities in Mumbai, pointed out that concentrated profit-taking operations at the end of the year, along with a phase of dollar strengthening, have jointly posed short-term pressure on the precious metals sector.

Platinum and palladium also recorded strong gains. Platinum rose over 110%, marking the largest annual increase in history, reaching a historical high of $2,478.50 at one point. Palladium increased by 66%, achieving its best annual performance in 15 years. Regarding the recent market volatility, Jigar Trivedi, a senior research analyst at Reliance Securities in Mumbai, pointed out that concentrated profit-taking operations at the end of the year, along with a phase of dollar strengthening, have jointly posed short-term pressure on the precious metals sector.

Industrial metals perform strongly, with London copper rising over 40%

In the collective strength of global industrial metals in 2025, copper's performance is particularly noteworthy, rising nearly 40% for the year, making it the best-performing commodity among the six base metals on the London Metal Exchange (LME). Copper prices reached new highs throughout the year, hitting a historical peak of $12,960 per ton at one point. The market trading structure has undergone significant changes, with traders rushing to transport physical copper to the United States to avoid potential trade barriers, leading to a sudden tightening of spot supply in major global markets outside the U.S., significantly increasing price volatility.

Analysis indicates that the logic behind copper's rise has transcended simple cyclical categories, gaining solid macro and structural support. An important indicator shows that the number of ounces of gold required to purchase one ton of copper has fallen to a historical low. This means that the deep forces driving this round of the gold bull market, such as the shift in monetary easing by major global central banks, the wave of technology capital expenditure represented by artificial intelligence, and strategic stockpiling driven by supply chain security, are also being transmitted to the copper market and may provide continued momentum for its upward trend in 2026.

Other industrial metals have also generally strengthened. Aluminum prices rose 17% for the year, primarily supported by the growth in technology demand related to energy transition globally. Tin prices increased similarly to copper, with its upward momentum mainly stemming from supply disruptions and tightened export policies in major global production areas.

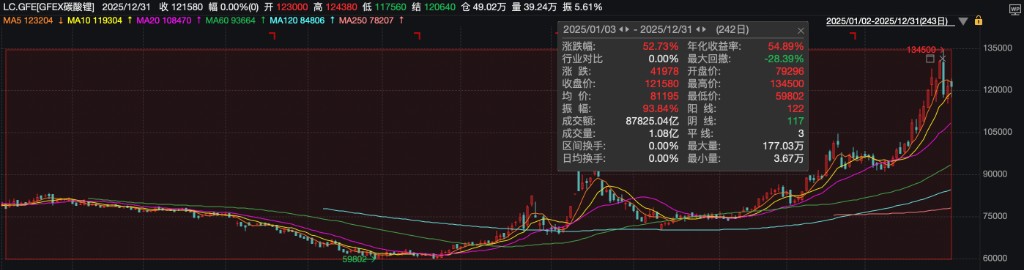

Supply-demand dynamics improve, lithium carbonate stabilizes and rebounds

As a core material for new energy vehicle power batteries and energy storage systems, the lithium carbonate market welcomed a critical turning point in 2025. After experiencing a long downward cycle, its price stabilized and achieved a strong rebound within the year, with a cumulative increase of over 50% for the year.

Behind this trend is a substantial improvement in the market's supply-demand dynamics. On the demand side, the continuous expansion of new energy vehicle production and sales and the rapid release of energy storage demand form a stable demand foundation. On the supply side, some high-cost, low-efficiency capacities have gradually been eliminated during the prolonged price trough, leading to a healthier supply side in the industry. As a key strategic resource indispensable for the global green energy transition, the price center and market attention for lithium carbonate and similar materials have received strong support.

Oversupply Continues to Pressure, Crude Oil Deeply Stuck in Price Quagmire

In 2025, due to the dual pressures of slowing global economic growth and strong supply from non-OPEC+ oil-producing countries, international oil prices showed weak performance throughout the year, with WTI crude oil prices falling over 15%.

For the upcoming year of 2026, the market generally expects the oversupply pattern to continue. Authoritative institutions such as the International Energy Agency have predicted a significant oversupply next year, even the usually more optimistic OPEC Secretariat anticipates a moderate surplus in the market.

Kotak Securities analyst Kaynat Chainwala pointed out that structural oversupply is the core contradiction. Production from non-OPEC countries such as the United States, Brazil, Guyana, and Argentina continues to grow, exceeding the uneven recovery in global demand. She expects that, in the absence of major supply shocks, oil prices will fluctuate widely in the range of $50 to $70 per barrel.

In the face of this market environment, OPEC+'s policy direction has become a key variable. The alliance plans to hold a video conference on January 4, and according to three representatives attending, it is expected to maintain its plan to pause further production increases. Morgan Stanley global oil strategist Martijn Rats interprets this by stating that OPEC+'s response strategy will depend on price levels: if oil prices experience a "substantial" significant drop, the alliance may be forced to cut production; if current price levels are maintained, it may choose to continue gradually easing production limits after the pause in production increases ends in the first quarter of 2026.

Cocoa Nearly Halved, Agricultural Products Market Generally Under Pressure

In 2025, the agricultural products market faced overall pressure, with cocoa becoming the worst-performing commodity of the year, with prices plummeting by 48%. In 2024, New York cocoa prices soared by 178% due to crop failures in West Africa's main producing regions, but this year, a significant increase in supply led to a price collapse.

Raw sugar and robusta coffee also faced downward pressure, with prices dropping by about one-fifth over the year. In contrast, Chicago soybeans are expected to see a slight increase, while wheat and corn ended weakly due to ample global supply.

Among other commodities, Malaysia's benchmark palm oil prices fell by 9%, mainly suppressed by abundant supply, but Indonesia's mandatory biodiesel blending policy is expected to provide support to the market in the future. Rubber prices also dropped by 9%, as improved weather conditions in Thailand boosted supply, while demand for tires in the automotive industry remained sluggish