The stock god takes a bow! In the final year of his Berkshire career, Buffett firmly "sells stocks and hoards cash"

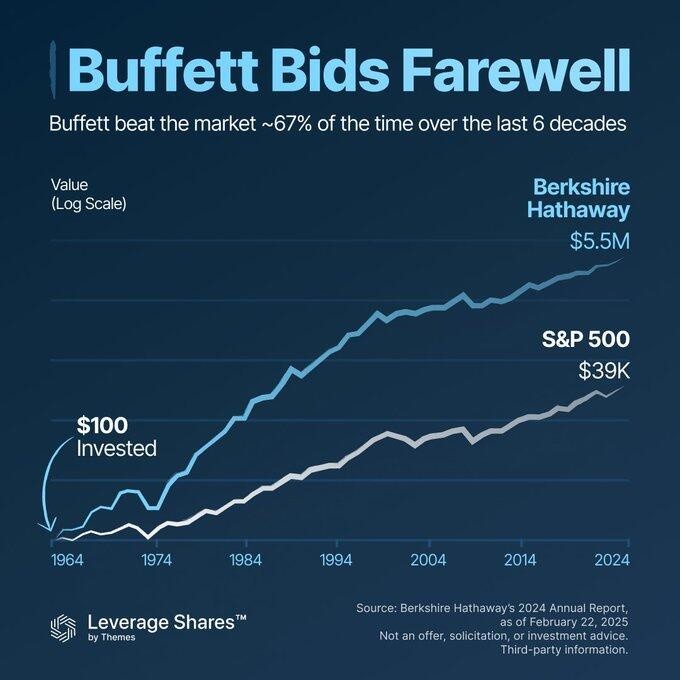

巴菲特今日正式卸任伯克希尔·哈撒韦 CEO。伯克希尔今年前九个月净卖出股票 100 亿美元,连续第三年成为股票净卖家,现金储备飙升至 3580 亿美元的历史高点。自巴菲特执掌伯克希尔以来,一笔 100 美元的初始投资已增长至约 550 万美元,而同期标普 500 指数带来的回报约为 3.9 万美元,其投资组合的表现约有 67% 的时间超过市场基准水平。

在担任伯克希尔·哈撒韦首席执行官的最后一年,94 岁的沃伦·巴菲特坚守了他六十年来的投资原则:在市场高位保持耐心。今年以来,他持续出售股票,将现金储备推至历史新高。这位传奇投资者今日正式卸任,将公司交给继任者格雷格·阿贝尔。

在美股屡创新高、人工智能概念股暴涨的 2025 年,巴菲特选择了 “卖股票,囤现金”。伯克希尔今年前九个月净卖出股票 100 亿美元,连续第三年成为股票净卖家,现金储备飙升至 3580 亿美元的历史高点。

巴菲特留下的是一份载入金融史的记录:自其执掌以来,一笔 100 美元的初始投资已增长至约 550 万美元(以伯克希尔·哈撒韦 A 类股股价计),而同期标普 500 指数带来的回报约为 3.9 万美元。其投资组合的表现约有 67% 的时间超过市场基准水平。

今年 5 月,沃伦·巴菲特在伯克希尔·哈撒韦年度股东大会上宣布,将于年底卸任公司首席执行官一职,由长期担任副董事长的格雷格·阿贝尔接任。这一重大人事变动甚至令阿贝尔本人都感到意外。在 11 月发布的致股东信中,巴菲特以标志性的坦率表示,自己未来将 “保持安静”,并再次表达了对阿贝尔领导能力的充分信任。

在其任职的最后一年,巴菲特继续减持苹果股票,并以 100 亿美元现金收购了西方石油公司旗下的化工企业 OxyChem,这是他在伯克希尔 CEO 任期内的最后一笔重大收购。

坚守价值投资原则

在市场一片狂热中,沃伦·巴菲特展现了一如既往的、近乎严苛的投资纪律。Semper Augustus 投资集团总裁兼首席投资官 Chris Bloomstran 对此评价道:

“巴菲特在最后一年的做法,与他过去六十年的信条完全一致:保持耐心、寻找机会,并且绝不将公司置于险境。”

在今年的股东大会上,当被问及伯克希尔持续攀升的现金储备时,巴菲特的回应重申了这一经典哲学。他表示,公司只是在遵循久经时间检验的策略。巴菲特进一步阐明,一旦出现 “有意义” 的重大机遇,他将毫不犹豫地动用 1000 亿美元进行收购。他表示:

“投资业务的一个难题在于,机会不会按部就班地出现。这种情况一定会再次发生。我无法预知是在下周,还是在五年后,但绝不会是五十年后。届时,我们会庆幸自己手头持有充足的现金。”

继续减持苹果持仓

伯克希尔·哈撒韦在 2025 年第二及第三季度连续减持其核心持仓苹果公司,且三季度减持力度显著加大。

具体来看,继第二季度启动减持后,伯克希尔在第三季度进一步卖出约 4179 万股苹果股票,持股总数较第二季度末环比下降逾 14.9%,对应持仓市值减少约 106 亿美元。至此,两季度累计减持规模已超 6000 万股。

值得注意的是,这一系列操作发生在苹果公司股价年内仍上涨 9% 的背景下。尽管持续减仓,苹果目前仍是伯克希尔投资组合中规模最大的持仓之一。回顾历史,伯克希尔自 2016 年建仓苹果以来,截至 2024 年底已获得 834% 的巨额回报,该头寸曾被巴菲特称为公司 “四大支柱” 之一。

此次在市场对科技股极度乐观时选择阶段性离场,再次印证了巴菲特 “在价格过高时囤积现金” 的经典策略。其过往记录显示,他善于在市场狂热时储备流动性,以等待类似 2008 年金融危机期间投资高盛、通用电气那样的重大机会出现。

最后一笔重大收购

在 2025 年,伯克希尔·哈撒韦完成了其标志性的最后一笔大型收购:以 100 亿美元收购西方石油公司旗下的化工生产商 OxyChem。这笔交易为寻求缩减债务的西方石油提供了急需的现金,而伯克希尔则可能因此获得了具备吸引力的价格。晨星分析师格雷戈里·沃伦指出,数十年来,正是这类价格具有吸引力的企业收购,持续驱动着伯克希尔的利润增长。

然而,即便在具备优势的领域,伯克希尔也展现了极大的纪律性。尽管身为美国核心铁路运营商之一,当联合太平洋铁路于 7 月宣布收购诺福克南方铁路、引发市场对其旗下 BNSF 铁路将参与行业整合的广泛猜测时,巴菲特并未追逐潮流。他迅速否认了相关交易传闻,并在之后选择与另一家铁路公司 CSX 建立新的商业合作伙伴关系,而非进行大规模收购。

交接班引发人事变动

在 11 月的致股东感恩节信中,沃伦·巴菲特以他一贯的节制与幽默向投资者表示,自己将 “保持安静”——他随即补充道 “在某种程度上”——并重申了对继任者格雷格·阿贝尔的坚定信心。作为伯克希尔非保险业务的副董事长,阿贝尔的能力获得了巴菲特的极高评价。他表示:

“格雷格对我们财产与意外险业务的上行潜力及风险的理解,远超许多在这一领域深耕多年的资深高管。”

然而,领导层的更迭也伴随着核心团队的变动。与此同时,其关键副手之一、Geico 首席执行官 Todd Combs 将离职并加入摩根大通,而长期担任首席财务官的 Marc Hamburg 也计划于次年 6 月退休。

自巴菲特宣布卸任以来,伯克希尔股价已累计下跌超过 6%。对此,持有伯克希尔股份的 Glenview Trust 首席投资官比尔·斯通评论道:“当公司不再拥有巴菲特作为核心引力时,它就会变得更像一家普通公司,人才会流失去做其他工作,或在适当的年龄退休。”