December Electric Vehicle Report Card: Xiaomi first breaks the 50,000 mark, Nio and Hongmeng Zhixing deliveries reach new highs, Leapmotor grows over 40% year-on-year

12 月,比亞迪以 42.04 萬輛的月銷規模持續領跑;鴻蒙智行交付 89,611 輛,連續三個月刷新紀錄;小米汽車首破 5 萬大關;蔚來交付新車 4.8 萬台,創歷史新高,同比增長 54.6%;理想交付 44,246 輛,保持穩定。

2026 年開年伊始,各大車企相繼發佈 2025 年 12 月產銷數據,為全年收官定調。

在新能源汽車市場的年末衝刺階段,頭部企業普遍刷新單月交付紀錄,全年銷量格局日趨明朗。比亞迪憑藉 42 萬輛的月銷表現持續鞏固行業領先地位,而造車新勢力及跨界入局企業則在最後一月展現出顯著的環比增長態勢,為全年業績注入強勁動能。

具體來看,比亞迪 12 月新能源汽車銷量達 42.04 萬輛,全年累計銷量 460.24 萬輛,同比增長 7.73%,與年度目標持平。小米汽車 12 月交付量突破 5 萬台,標誌着這家手機制造商在汽車領域站穩腳跟。蔚來公司第四季度交付 124,807 台新車,創下歷史新高,同比增長 71.7%。

鴻蒙智行 12 月交付 89,611 台,刷新單月紀錄,全年累計交付 589,107 台。零跑汽車 12 月交付 60,423 台,全年交付量達 596,555 台,同比翻倍增長 103%。小鵬汽車和理想汽車也分別在 12 月交付 37,508 輛和 44,246 輛,全年交付量均突破 40 萬輛大關。

這一輪交付高峰恰逢購置税優惠政策調整前。從 2026 年 1 月 1 日起,新能源汽車購置税優惠將由免徵調整為減半徵收,各車企普遍推出金融優惠和限時權益以刺激年末購買需求。

比亞迪全年銷量同增 7% 達成年度目標

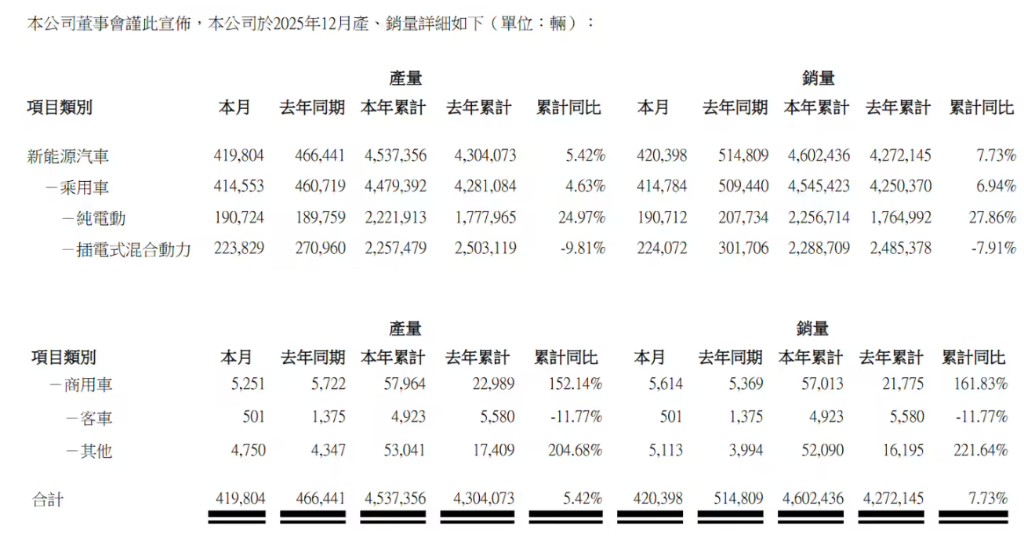

比亞迪 2025 年 12 月新能源汽車產量 41.98 萬輛,銷量 42.04 萬輛。全年累計產量 453.74 萬輛,同比增長 5.42%;累計銷量 460.24 萬輛,同比增長 7.73%,與年度目標持平。數據顯示,2025 年比亞迪海外年銷量首次突破 100 萬輛,同比增長 145%。

小米汽車 12 月交付量突破 5 萬大關

小米汽車延續強勁增長態勢,12 月交付量突破 5 萬輛大關。為進一步提振銷售,小米 YU7 首次推出新年專項金融政策,全系可享 “3 年 0 息” 分期方案。用户在 2 月 28 日 24 點前下訂 YU7,即可享受首付 7.49 萬元起,月供低至 4961 元的全新政策。同期下訂用户還可享 48000 元限時購車權益。

此外還有預約試駕贈送合金車模,邀請好友鎖單可獲得 8000 積分等福利。小米方面表示,小米汽車開年全新的金融方案的推出,響應了廣大用户希望擁有更優的金融方案的訴求,也大幅降低高品質 SUV 的擁有門檻和購車成本。

蔚來三品牌齊創紀錄

12 月,蔚來公司交付新車 48135 台,創歷史新高,同比增長 54.6%。其中蔚來品牌交付 31897 台,創歷史新高,同比增長 54.8%,交付量連續五個月增長;樂道品牌交付新車 9154 台;firefly 螢火蟲品牌交付新車 7084 台,創歷史新高,環比增長 16.4%,交付量連續五個月增長。

2025 年第四季度,蔚來公司實現新車交付 124,807 台,創單季度歷史新高,同比增長達 71.7%。旗下三大品牌季度交付量同步刷新紀錄:主品牌蔚來交付 67,433 台,同比增長 27.8%;面向家庭市場的樂道品牌交付 38,290 台,同比增長 92.1%;聚焦年輕與入門市場的螢火蟲品牌交付 19,084 台,環比增長 52.8%。

2025 年全年,蔚來累計交付新車 326,028 台,同樣創下年度歷史新高,同比增長 46.9%。三大品牌中,蔚來品牌全年交付 178,806 台,樂道品牌交付 107,808 台,螢火蟲品牌交付 39,414 台,形成階梯化、差異化的產品矩陣。

值得關注的是,從 2026 年 1 月 1 日起,車輛購置税優惠政策將由免徵調整為減半徵收。新政利好可車電分離的換電車型,用 BaaS 電池租用方案買蔚來、樂道、firefly 螢火蟲車型,可享額外購置税減免。

小鵬全年交付量同增 126% 理想全年突破 154 萬輛

小鵬汽車 2025 年 12 月交付新車 37,508 輛,實現同比 2% 的穩健增長,並呈現環比回升態勢。2025 年全年,公司累計交付量達 429,445 輛,同比大幅增長 126%,展現出強勁的市場擴張力與產品競爭力。

理想汽車在 2025 年第四季度共交付新車約 10.92 萬輛,其中 12 月單月交付 44,246 輛,持續保持穩定的市場表現。截至 2025 年底,理想汽車累計交付量突破 154 萬輛,成為國內首個達成這一成績的新勢力品牌,標誌着其規模化發展進入新階段。

理想汽車董事長兼 CEO 李想表示,2026 年會繼續以創業公司的管理模式,集中精力和資源做真正的價值創造,讓汽車成為更懂用户需求、自動和主動為用户提供服務的智能夥伴。

數據顯示,零跑汽車 12 月交付達 60,423 台,同比增長 42%;全年累計交付達 596,555 台,同比增長 103%,成為增速最快的新勢力之一。

鴻蒙智行 12 月交付量創新高

鴻蒙智行 12 月交付 89,611 台,連續三個月創月度交付歷史新高。2025 年全年累計交付 589,107 台,同比增長 32%。

具體來看,問界 M9 累計 20 個月交付量獲五十萬級銷冠;問界 M8 連續 6 個月蟬聯 40 萬級銷冠。享界 S9T 在 9-11 月躋身 30 萬以上新能源中大型轎車銷量 TOP1;尊界 S800 連續 3 個月佔據 70 萬級豪華轎車銷量榜首。