美股盤前|納指期貨漲 1%,中概股大漲,金銀領銜貴金屬反彈

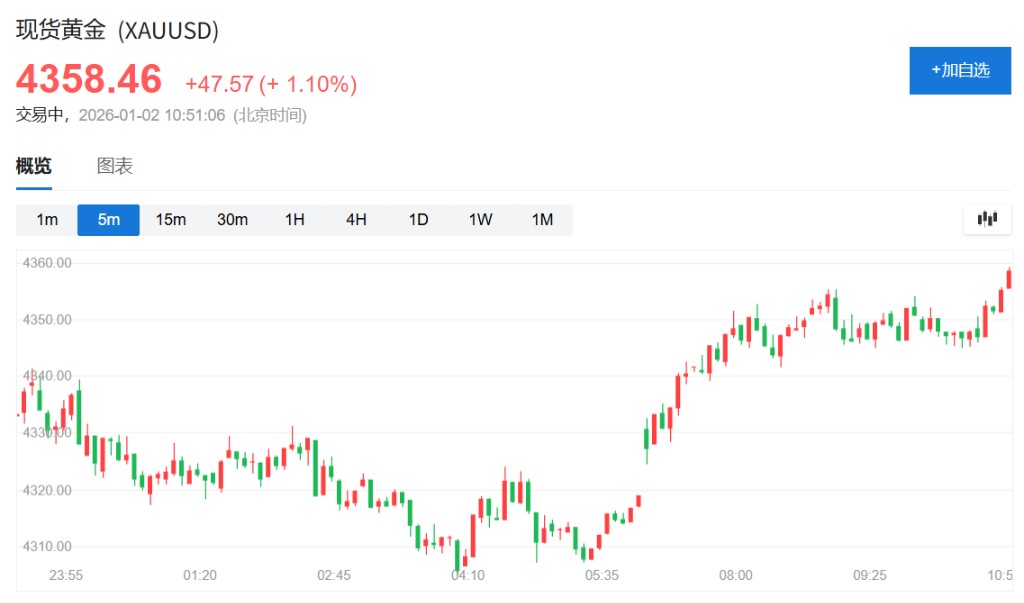

The MSCI Asia-Pacific Index rose by 0.5%, directly driving the Nasdaq 100 futures up by 0.58% during the Asian session, while the S&P 500 futures followed with a gain of 0.39%. The precious metals market also strengthened, with spot gold rising by 1% during the day and stabilizing above USD 4,350 per ounce. The US dollar index continued its worst annual performance since 2017, slightly declining during the day

On the first trading day of 2026, gold and silver led the rebound in precious metals, and U.S. stock indices are expected to end a four-day decline, with the dollar weakening.

On Friday, U.S. stock futures rose alongside Asian markets, as the former attempted to end a four-day decline that began at the end of last year. Led by Samsung and TSMC, the MSCI Asia-Pacific Index rose 0.5%, directly boosting U.S. Nasdaq 100 futures by 0.58% during the Asian session, while S&P 500 futures followed with a 0.39% increase.

The market is holding its breath for Tesla's fourth-quarter delivery data to be released this week, with analysts generally expecting a year-on-year decline of 11% to 440,900 units. Meanwhile, BYD, with its strong growth, is likely to officially surpass Tesla in 2025, claiming the title of the world's largest electric vehicle manufacturer.

The precious metals market also strengthened, with spot gold rising 1% during the day and stabilizing above $4,350 per ounce.

Silver saw a larger increase, rising 2.6% to $72.87 per ounce.

Platinum also rose nearly 2%. Palladium briefly rose 2.8% during the session, but the increase narrowed to less than 2%.

Due to the strong gains in precious metals in 2025, their weight in broad investment portfolio indices has exceeded established targets, which will force passive funds to make adjustments. A large-scale rebalancing of investment portfolio indices may put pressure on prices.

Daniel Ghali, Senior Commodity Strategist at TD Securities, noted in a research report that it is expected that 13% of the total open interest in the Comex silver market will be sold off in the next two weeks, leading to a significant repricing of prices downward.

In the foreign exchange market, the U.S. dollar index continued its worst annual performance since 2017, with a slight decline during the day. Westpac Banking Corporation believes that as market expectations for deeper rate cuts by the new Federal Reserve chairman increase, the dollar faces extremely high structural downside risks in January.