Four International Rules for Stabilizing and Rebounding Housing Prices

CSC stated that, first, the trading volume stabilizes ahead of price recovery; second, core city housing prices rebound first; third, monetary easing (with the 10-year government bond yield not exceeding 200 basis points above core inflation) is a necessary condition; fourth, improving economic growth expectations are a fundamental prerequisite. The experience of most countries shows that the monetary policy cycle lasts 4-7 years, and the real estate cycle also requires 4-7 years to bottom out and recover. In special circumstances (such as Japan), it may take a longer cycle to emerge from negative drag

The current market is closely watching one question: where exactly is the bottom of the real estate market?

The macro team at CSC, led by Zhou Junzhi and Xie Yuxin, summarized four international rules for judging the transition of real estate from weak to strong in their latest report, based on a review of multiple real estate cycles in Japan, South Korea, and the United States since World War II:

First, stable transaction volume leads price recovery; second, core city housing prices rebound first; third, monetary easing (10-year government bond yields not exceeding 200 basis points above core inflation) is a necessary condition; fourth, improvement in economic growth expectations is the fundamental premise.

Referring to international experience, CSC stated that the current Chinese real estate market is in a deep adjustment period and requires patience to wait for the simultaneous emergence of four signals: stabilization of sales volume, decline in inventory in first-tier cities, sufficient monetary easing, and improvement in economic growth expectations. Only when these conditions are met can it be confirmed that the real estate market has truly reached an inflection point.

Additionally, the report pointed out that almost every decade, the world experiences a widespread real estate cycle. The global economic and monetary cycles are highly correlated, which determines the strong association of global real estate cycles. The experience of most countries shows that the monetary policy cycle lasts about 4-7 years, so the real estate cycle also requires 4-7 years to bottom out and recover.

Two Resonances of the Global Real Estate Cycle

- 1970s: Global real estate turmoil triggered by stagflation

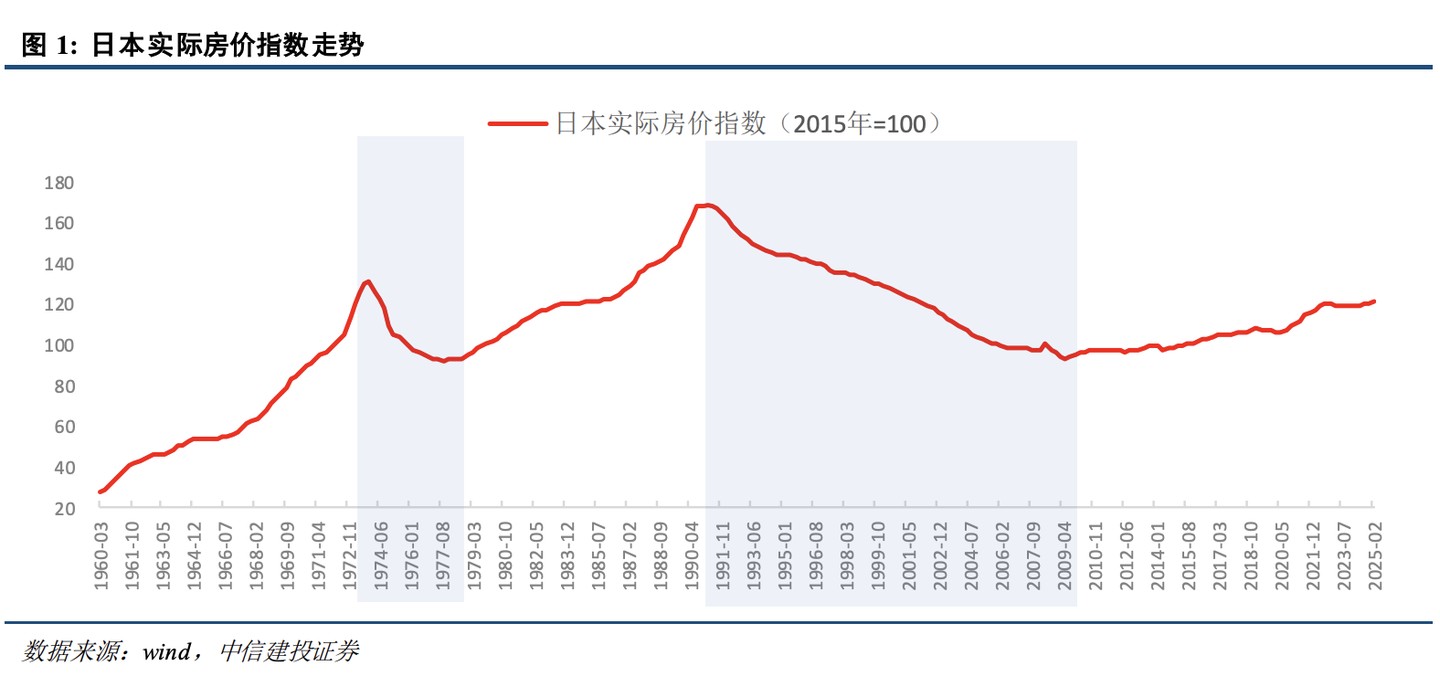

The report noted that in the 1970s, the real estate cycles of Japan, South Korea, and the United States were highly resonant, essentially caused by global stagflation triggered by the oil crisis. At that time, the oil crisis led to significant fluctuations in inflation, which in turn triggered synchronized tightening of global monetary policy. In 1973, the Bank of Japan raised the discount rate from 4.25% to 9.0%, causing housing prices to drop by about 29%. In 1979, South Korea raised its benchmark interest rate from 12% to 18%, coupled with GDP growth dropping sharply from 9.7% in 1978 to -1.7% in 1980, leading to a deep adjustment in housing prices. The United States also experienced two rounds of real estate fluctuations during the same period.

The stabilization of real estate during this period also had common characteristics. In 1977, Japan's real estate stopped falling and began to recover, thanks to the shift to monetary easing after stagflation receded, along with the rise of emerging industries such as automobiles and electronics driving economic recovery. Crucially, the population of young adults aged 25-44 remained high, with strong rigid housing demand, and the household leverage ratio was only 38.8%, far below the levels in the U.S. and Germany.

- 1990s: Cyclical synchronization under the wave of globalization

The real estate cycle of the 1990s was more complex. Japan reached the peak of its long real estate cycle in 1990, and it wasn't until 2002 that signs of stabilization appeared, with an adjustment period lasting 12 years. South Korea also experienced a downturn in real estate at the end of 1991, continuing until the end of 2001. However, the underlying logic of the real estate cycles in the two countries was quite different: Japan faced a cyclical inflection point driven by the resonance of population structure, growth, and tightening financial conditions; South Korea was just beginning to take over the industrial transfer from Japan and was in a peak economic growth period In the 1990s, the United States experienced the "Goldilocks Era." Despite being disturbed by the savings and loan crisis, factors such as population, growth, and technology were favorable, and real estate was in a golden development period. This period coincided with the wave of globalization following the changes in Eastern Europe, where the global economy was highly synchronized under the winds of globalization. Even though the endogenous growth drivers of different economies varied, economic and monetary cycles remained highly coordinated.

Four International Rules for Stabilizing and Recovering Housing Prices

If the real estate market is already in a downward trend, how can it stabilize? CSC provides four regular clues.

Rule One: Sequence of Volume and Price - Transactions Lead, Prices Follow

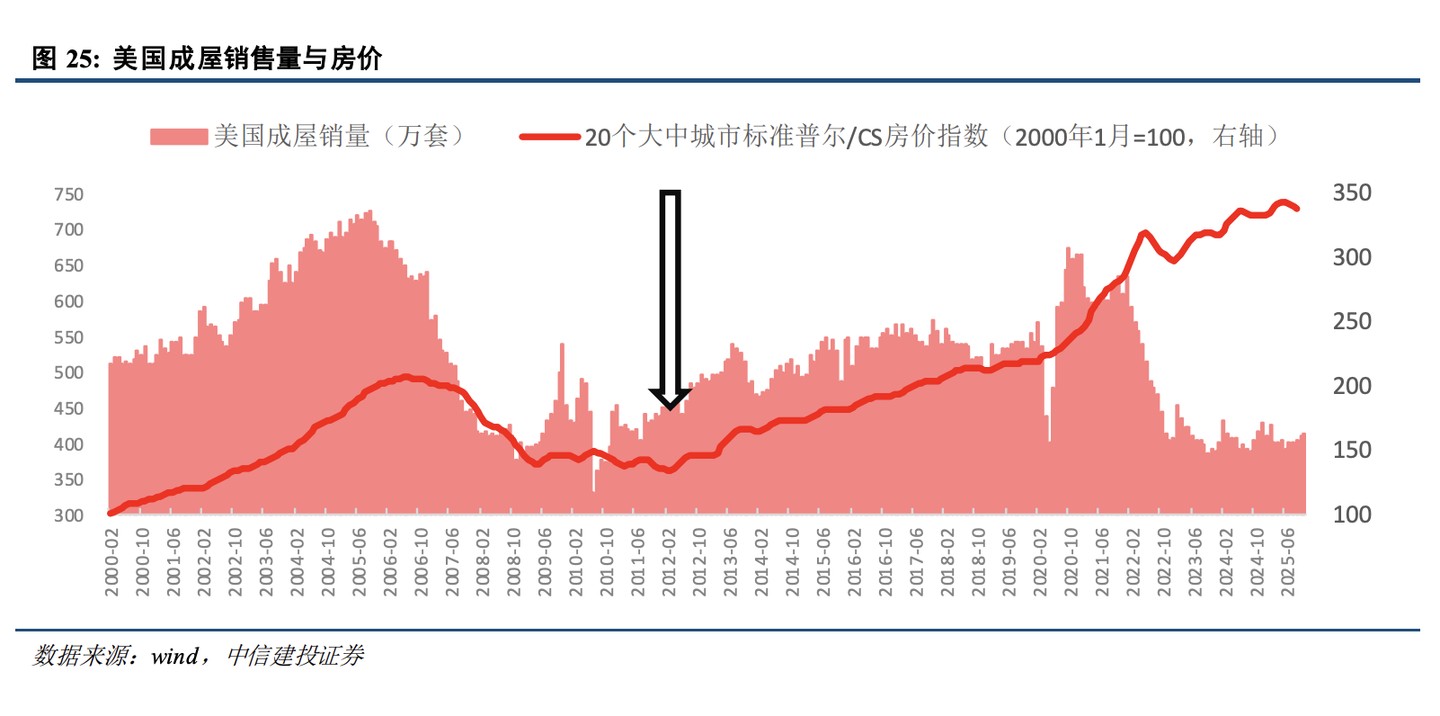

A review of historical data reveals that the stabilization of real estate follows a clear sequence: first, transaction volumes increase, then inventory decreases, and finally, prices stabilize. This rule is particularly evident in the United States and Japan.

The report provides an example: In July 2010, the sales of existing homes in the U.S. hit a new low of only 3.3 million units, followed by a rebound stabilizing around 4 million units. However, housing prices did not hit bottom until March 2012, after which they stabilized and began to rise. In Japan, the sales of newly built apartments in the Tokyo metropolitan area stabilized at 90,000 units starting in 2000, with sales in the 23 wards of Tokyo remaining above 30,000 units, but prices did not hit a new low and begin to rebound until 2003.

The underlying logic is that when the real estate market is in a downward phase, the commodity attributes need to warm up first before discussing financial attributes. Once sales stabilize, the timing of short-term housing price stabilization depends on the actual supply and demand structure of housing, namely the vacancy rate and inventory levels. This is closely related to whether the scale of demand-driven population is expanding and the speed at which the population is gathering in core urban areas.

Rule Two: Core City Housing Prices Rebound First

Experiences from South Korea and Japan show that housing prices in core urban areas often provide stabilization signals earlier. After 2001, housing prices in South Korea stabilized and rebounded, with prices in Seoul rising by 91% from 2001 to 2007, far exceeding the national increase of 56%. In Japan, when the real estate market stabilized in 2004, housing prices in the 23 wards of Tokyo rebounded first, with an increase of 8.1%, higher than the overall 7.1% in the metropolitan area.

The fundamental reason for the early rebound in core cities is the "re-concentration" of population. High incomes in core urban areas attract a continuous influx of people. Despite Japan's overall population decline, core urban areas maintained positive growth until 2019, when the population growth rate of urban agglomerations with over 1 million people turned negative. From 2015 to 2022, rents in the Tokyo metropolitan area increased by 27.1%, while the Kinki region only saw a 16.9% increase, and the rental premium in core cities also confirms this trend.

Rule Three: Necessary Scale of Monetary Easing

The stabilization of real estate is inseparable from monetary easing, which is a necessary but not sufficient condition. According to historical experience, when real estate moves from a deep downturn to a stabilization phase, the phenomenon accompanying this is that the 10-year Treasury yield does not exceed the core inflation rate by more than 200 basis points.

In 1998, Japan initiated unconventional monetary policies to address low inflation, maintaining the 10-year Treasury yield around 1%, with the real interest rate after inflation around 2%, preventing excessively high real interest rates from further dampening demand. In 2003, Japan's core CPI saw a significant narrowing of decline, with April at -0.4% and October reaching 0.1%, marking the first positive change since 2000 After the U.S. subprime mortgage crisis in 2007, the Federal Reserve decisively launched unconventional monetary policies, and the spread between the 10-year Treasury yield and core inflation also followed the rule of not exceeding 2%.

To cope with the savings and loan crisis, the U.S. cut interest rates more than 20 times between 1989 and 1992, with a total reduction of 680 basis points, bringing the federal funds rate down from 9.8% to 3%, and fixed mortgage rates from 11% to 8%, creating conditions for the recovery of housing prices in 1992.

Rule Four: Improvement in Growth Expectations is the Fundamental Premise

Another necessary premise for the stabilization of the real estate market is the improvement in growth expectations. From a micro perspective, real estate is priced based on leveraged expectations of income, so each stabilization and recovery of the real estate market corresponds to the continuation or improvement of economic growth momentum.

Before the stabilization of the Japanese real estate market in 2004, it cleared non-performing assets in the real estate chain in 2002 and welcomed a new growth momentum with a rebound in exports in 2003. In April 2003, Japan's core CPI year-on-year was -0.4%, with a significant narrowing of the decline, turning positive to 0.1% in October, the first positive reading since 2000. The consumer confidence index rebounded significantly, rising from 35 in 2003 to around 48. The improvement in economic growth led to a recovery in residents' income, and housing prices stabilized and rebounded accordingly.

The stabilization of housing prices in South Korea after 2001 also benefited from three major factors: the clearing of financial bad debts and interest rate cuts promoting economic recovery; after China joined the WTO in 2001, South Korea's exports to China increased from 12.1% to 21.8% (2001-2005), with total trade growing by 211%; and the continuous concentration of population in the capital region, revealing a shortage of housing supply again.

The underlying logic of the real estate rebound in the U.S. in the 1990s is even more evident: the internet wave arrived at that time, coupled with a continuous increase in the population aged 25-44 bringing new demand. Even with a short-term decline, a slight easing of monetary policy could quickly stabilize and rebound.

Three Underlying Rules Affecting Real Estate Trends

By analyzing multiple rounds of real estate cycles in Japan, South Korea, and the U.S., the report summarizes three underlying rules affecting real estate trends:

First, the property and commodity attributes of real estate come from the population, while the financial attributes are priced based on growth expectations (determining future income) and monetary liquidity (determining the discount rate);

Second, the ups and downs of small real estate cycles are often related to monetary tightening or easing, and the solidity of stabilization depends on growth momentum, while long-term trends are determined by population;

Third, when the three factors of monetary easing, strong growth, and a booming population resonate, real estate enters a strong cycle; conversely, it experiences a weak long cycle.

The report points out that to determine whether the real estate market has stabilized, it is necessary to track four leading indicators: whether transaction volumes have rebounded first, whether inventory in core cities has fallen to low levels, whether the spread between the 10-year Treasury yield and core inflation has narrowed to within 200 basis points, and whether consumer confidence index and other growth expectation indicators have improved. Most countries' experiences show that monetary policy cycles last 4-7 years, and real estate cycles also require 4-7 years to bottom out and rebound; in special cases (such as Japan), it may take a longer cycle to emerge from negative drag.

The current Chinese real estate market is in a deep adjustment period. Referring to international experience, it is necessary to patiently wait for the simultaneous emergence of four signals: stabilization of sales volume, decrease in inventory in first-tier cities, sufficiently loose monetary conditions, and improvement in economic growth expectations. Only when these conditions are met can we confirm that the real estate market has truly reached an inflection point and is entering a medium to long-term allocation opportunity

The current Chinese real estate market is in a deep adjustment period. Referring to international experience, it is necessary to patiently wait for the simultaneous emergence of four signals: stabilization of sales volume, decrease in inventory in first-tier cities, sufficiently loose monetary conditions, and improvement in economic growth expectations. Only when these conditions are met can we confirm that the real estate market has truly reached an inflection point and is entering a medium to long-term allocation opportunity