商品基准指数 “重置” 在即,面临抛售风险,金银开年 “冲高回落”

Starting next Thursday (January 8), the annual weight reset of the Bloomberg Commodity Index will result in over $6 billion in gold futures and more than $5 billion in silver futures being sold during a five-day roll period. Institutional strategists warn that in the next two weeks, positions equivalent to 13% of the total open interest in the Comex silver market will be liquidated, "which will lead to a significant downward price reassessment." Additionally, the low liquidity after the holidays may amplify price fluctuations

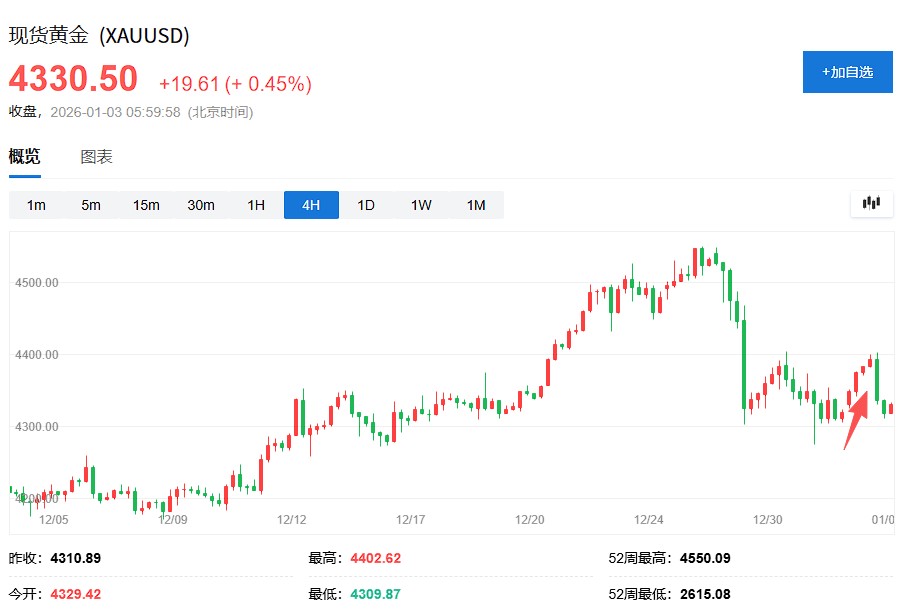

Gold and silver opened high on the first trading day of the year but fell back, as traders assess the potential market impact of the commodity benchmark index weight adjustments starting next week. Gold and silver have just concluded their best annual performance since 1979, but they are about to face concentrated selling pressure from passive funds.

On Friday (January 2), gold rose by as much as 1.9% during the trading session but retraced most of its gains during U.S. trading hours, closing up only 0.2% at $4,328.35 per ounce. Silver saw a maximum increase of 4% in the morning session but later fell back to 1.3%, reporting $72.61 per ounce.

Analysts point out that while traders expect further interest rate cuts from the Federal Reserve and a weaker dollar to support precious metals' continued rise this year, the recent index rebalancing may put pressure on prices. It is reported that the annual weight reset of the Bloomberg Commodity Index will lead to over $6 billion in gold futures and more than $5 billion in silver futures being sold during the five-day roll period from January 8 to 14.

Daniel Ghali, a senior commodity strategist at TD Securities, warned that in the next two weeks, the Comex silver market will see positions equivalent to 13% of the total open interest being sold, "which will lead to a significant downward price reassessment." He noted that low liquidity after the holidays could amplify price volatility.

Unprecedented Scale of Index Adjustment

The Bloomberg Commodity Index is widely used as a benchmark for commodity investments, with total assets tracking the index nearing $109 billion as of last October. This weight reset involves a massive amount of funds.

According to Bloomberg, silver futures currently account for 9% of the index's weight, while the target weight for 2026 is just below 4%, meaning that over $5 billion in positions need to be liquidated during the five-day roll starting next Thursday (January 8). Gold futures are expected to see about $6 billion sold.

According to reports from the trading desk, JP Morgan's research report released on December 12 quantified the scale of the sell-off: Silver will face the heaviest selling pressure, with the sell-off accounting for about 9% of its total open interest in the futures market, and the report specifically emphasized that this year's selling pressure on silver is "more pronounced than last year." The expected sell-off scale for gold is about 3% of its total open interest in the futures market.

JP Morgan's report also pointed out that for gold investors, the upcoming January will be a fierce battle of bullish and bearish factors.

On one hand, JP Morgan's report reaffirmed the traditional strong seasonal pattern of gold from the end of the year to the beginning of the next year. Data shows that over the past 10 years, gold prices have averaged a 4.6% increase during the last 10 trading days of each year to the first 20 trading days of the next year, with an 80% probability of rising (8 out of 10 times). This "holiday buying" usually also transmits to silver and platinum.

On the other hand, the significant technical selling triggered by the aforementioned index rebalancing will directly counteract this seasonal bullishness. The report cautioned that although similar index sell-offs last year did not prevent the seasonal upward trend, considering the significantly greater selling pressure on silver this year, investors need to closely monitor whether this variable will break historical patterns

Investment Banks Optimistic About Long-Term Gold Price Outlook

Despite facing short-term technical pressures, major investment banks continue to support further increases in gold prices this year, especially with the Federal Reserve expected to lower interest rates further and Trump reshaping the leadership of the Federal Reserve. Goldman Sachs stated last month that its base case is for gold prices to rise to $4,900 per ounce, with upside risks.

Precious metals like gold and silver recorded strong gains last year, despite significant volatility in late December due to profit-taking by some investors and technical indicators showing overbought conditions.

Gold is expected to repeatedly set record highs in 2025, driven by central bank purchases, accommodative Federal Reserve policies, and a weakening dollar. Geopolitical tensions and safe-haven demand stemming from trade frictions have also boosted gold prices.

Silver's gains last year even outpaced those of gold, breaking through levels that most market observers, except the most optimistic, deemed unattainable. In addition to the factors supporting gold, silver has also benefited from ongoing market concerns that the U.S. government may eventually impose import tariffs on refined metals