Space Photovoltaics: Reliable Energy from Beyond Earth, Targeting a Trillion-Dollar Market

東吳證券表示,發射成本驟降推動衞星部署爆發,2025 年發射量超 4300 顆,備案數量突破 10 萬。大規模部署推升太空光伏需求,Starlink V3 太陽翼面積擴大逾 10 倍,假設年發射 1 萬顆衞星可形成約 2000 億元市場。隨着太空算力興起,若構建 10GW 級系統,太陽翼空間或上看數萬億元。

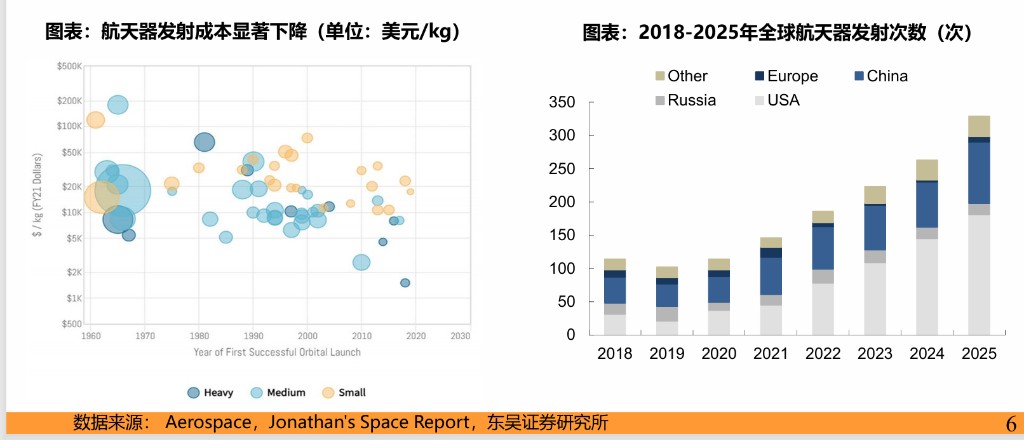

隨着可回收火箭技術成熟推動發射成本斷崖式下降,商業航天正迎來 “摩爾定律” 時刻,進而引爆了對太空基礎設施核心組件——太空光伏的巨大需求。

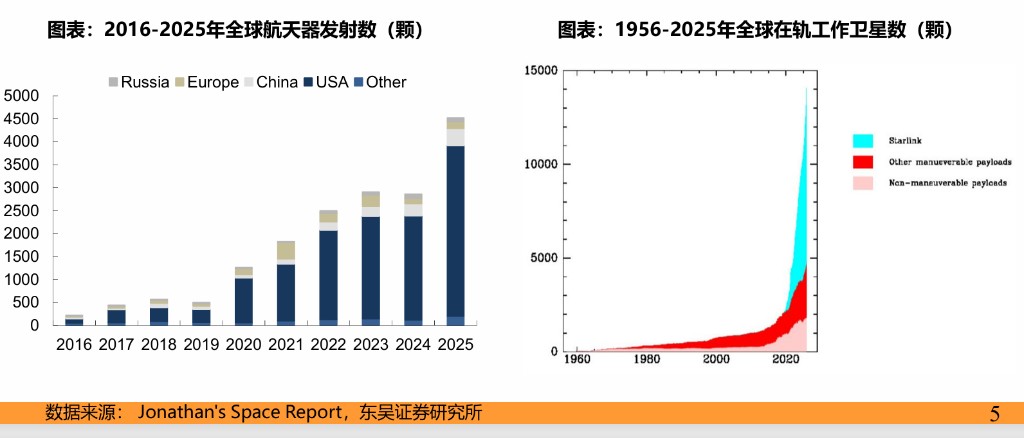

據東吳證券曾朵紅團隊 6 日發佈的行業深度報告,2025 年全球航天器發射數量超過 4300 顆,同比增長超 50%,近十年複合增速達 34%。在國際電信聯盟(ITU)頻軌資源 “先登先佔” 的規則驅動下,全球低軌衞星部署進入爆發期。

截至 2025 年底,全球備案衞星數量已超 10 萬顆,其中美國以 Starlink 為主導,中國通過 GW、千帆等計劃申報超 5.1 萬顆。大規模星座的建設將直接轉化為對高性能光伏電池的剛性需求,若假設年發射 1 萬顆衞星,有望帶來近 2000 億元的太陽翼市場空間。

這一趨勢正在重塑太空光伏的技術路徑與市場格局。隨着低軌星座向多功能、重型化演進,單星功率需求急劇攀升,例如 SpaceX 的 Starlink V3 衞星太陽翼面積較早期版本增長超 10 倍。與此同時,AI 算力向太空遷移的願景正在打開行業的遠期天花板,利用太空無限能源與低温散熱環境構建 “太空數據中心” 已成新風口,若未來構建 10 GW 級的太空算力系統,太陽翼市場規模或達數萬億元。

發射成本下行與頻軌爭奪戰

東吳證券表示,商業航天的快速崛起,核心動力在於運載成本的指數級下降。可回收火箭技術的成熟徹底打破了進入太空的經濟壁壘,SpaceX 獵鷹 9 號的發射成本已降至約 1400-1800 美元/公斤,遠低於傳統航天發射。成本紅利推動全球航天發射活動進入 “指數級” 增長週期,2025 年全球航天器發射次數預計超 300 次,較 2021 年實現翻倍。

除了經濟性驅動,戰略資源的稀缺性也是各國加速部署的關鍵。由於近地軌道頻段與位置具有 “不可再生” 屬性,且 ITU 規定了申報後 7 年內必須發射首星、14 年內完成整個星座發射的嚴格時限,搶佔軌道資源迫在眉睫。目前,美國在發射數量與在軌存量上佔據主導,中國正加速追趕,隨着 “千帆”、“GW” 等星座計劃的推進,數萬顆規模的衞星發射將成為行業確定性趨勢。

光伏:衞星價值鏈的 “能量心臟”

在衞星系統中,電源系統佔據了舉足輕重的地位。數據顯示,電源系統在衞星整星製造成本中佔比約 20%-30%,其中太陽翼(空間太陽電池陣)作為發電核心,價值量佔比高達電源系統的 60%-80%。這意味着光伏電池實際上決定了衞星的供電能力及功率上限。

東吳證券表示,隨着衞星載荷的升級,尤其是通信及算力需求的增加,航天器的功率需求穩步提升,帶動太陽翼向大面積、高功率方向發展。以 SpaceX 的 Starlink 衞星為例,其太陽翼面積已從 V1.5 版本的 22.68 平方米演進至 V3 版本的 256.94 平方米,實現了數量級的增長。載荷升級推動太空光伏產業從單純的組件製造邁向 “量價齊升” 的階段,大面積、高轉換效率的太陽翼已成為商業航天競備的關鍵資源。

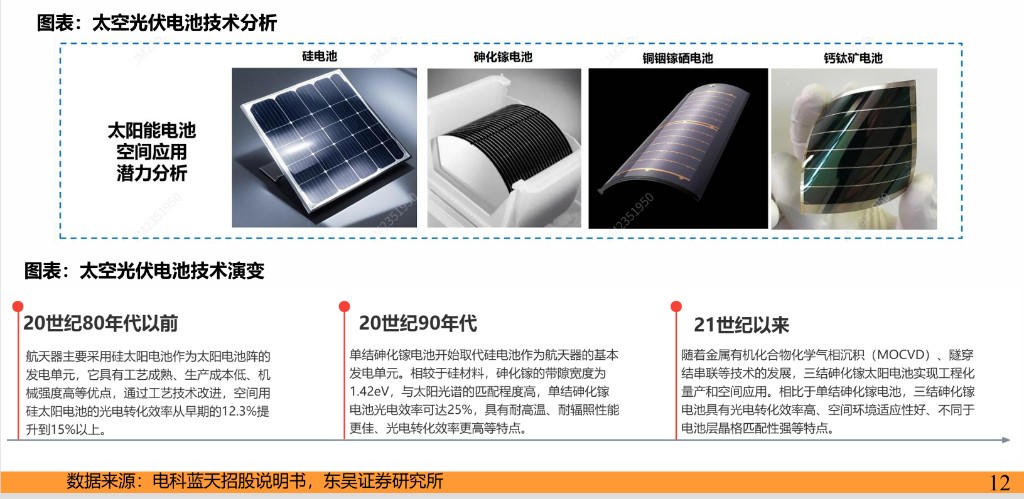

技術路線:成本與性能的博弈

東吳證券表示,當前太空光伏的技術路線呈現出多元化競爭態勢,核心在於成本與性能的平衡。

- 砷化鎵(GaAs): 目前國內的主流選擇。其優勢在於轉換效率高(組件效率可達 30%+)、抗輻照能力強、高温穩定性好,完美適配長壽命、高可靠性的高端任務。但其劣勢在於成本高昂(約 20-40 萬元/平方米,測算約 1200 元/W)且產能有限,難以支撐大規模星座的低成本爆發需求。

- 晶硅電池: SpaceX 的選擇。得益於極低的發射成本,Starlink 採用了成本更低的地面級加固型晶硅電池,通過增大電池面積來彌補效率(約 20%)的不足。對於發射成本較高的主體,晶硅電池較低的能質比(功率重量比)是主要制約。

- 鈣鈦礦及疊層技術: 未來的潛在顛覆者。鈣鈦礦具有極高的能質比(可達 30W/g)、輕量化以及低成本製造潛力。雖然目前在太空極端環境下的穩定性仍需驗證,但其與晶硅結合的疊層技術有望突破效率瓶頸,成為太空供電的更優方案。

太空算力:打開萬億級遠期空間

除了通信星座,太空經濟正向算力與數據中心延伸。東吳證券表示,AI 算力需求的激增使得地面數據中心面臨巨大的能耗與散熱挑戰,而太空具備天然的真空散熱環境與無限的太陽能資源,是部署高性能計算節點的理想場所。

目前,包括北京 “辰光一號”、之江實驗室 “三體計算星座” 以及國星宇航的 “星算計劃” 等已啓動技術驗證。海外方面,馬斯克曾表示星艦將實現在軌吉瓦級基礎設施,Starcloud 也提出了建設 5GW 軌道數據中心的構想。太空算力對能源的需求遠超傳統衞星,若未來實現 10 GW 級的太空算力部署,按現有價格體系測算,太陽翼市場規模有望達到數萬億元級別。