"Storage surge" is fundamentally reshaping the bill of materials structure for hardware manufacturers

I'm PortAI, I can summarize articles.

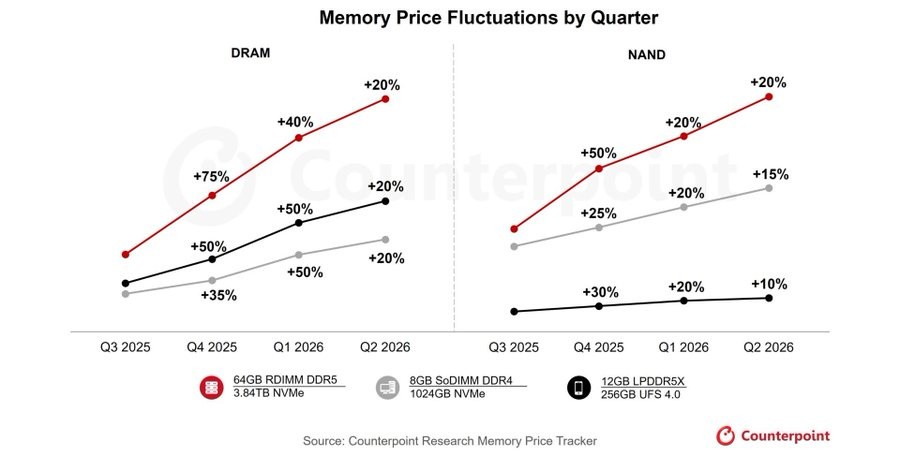

存儲市場進入 “超級牛市”,價格漲幅超過 2018 年曆史峯值。受人工智能和服務器需求推動,供應商定價權達到歷史最高。預計 2025 年第四季度內存價格將上漲 40%-50%,2026 年第一季度再漲 40%-50%,第二季度上漲約 20%。內存對 iPhone 17 Pro Max 物料清單的影響顯著,預計佔比將超過 20%。

存儲市場已進入 “超級牛市” 階段,其漲幅超過了 2018 年的歷史峯值。在人工智能和服務器容量持續旺盛的需求推動下,供應商的定價權已達到歷史最高水平。根據韓國 Counterpoint Research 近期發佈的《內存月度價格追蹤報告(2026 年 1 月)》,** 預計 2025 年第四季度內存價格將上漲 40% 至 50%,2026 年第一季度將再上漲 40% 至 50%,2026 年第二季度還將進一步上漲約 20%**。

對智能手機的影響:截至 2025 年,內存佔 iPhone 17 Pro Max 物料清單 (BoM) 的 10% 以上,較 2020 年 iPhone 12 Pro Max 的 8% 大幅增長。對於配備 16-24GB LPDDR5X 內存和 512GB-1TB UFS 4.0 存儲的旗艦機型,近期的價格上漲可能會使內存成本佔總物料清單 (BoM) 的 20% 以上。