闪迪:涨价,且必须全款!

在 AI 服務器需求爆發與原廠產能傾斜的雙重驅動下,存儲市場進入極度缺貨的賣方週期。據報道,閃迪近期不僅計劃在 3 月份將企業級 NAND 價格環比上調超 100%,更打破行業慣例,要求客户支付 100% 現金預付款以鎖定長約。谷歌、Meta 等科技巨頭正被迫重組採購團隊以搶奪貨源。

存儲芯片市場正經歷一場由 AI 浪潮引發的供給側劇變,賣方市場的強勢迴歸令買家不得不接受前所未有的苛刻條款。

據科技媒體 Digitimes 等多方消息顯示,供應鏈知情人士透露,閃迪已向部分下游客户提出了一項被業界稱為 “前所未聞” 的合同形式:要求客户支付全額現金預付款,以鎖定未來 1 至 3 年的供應配額。

儘管條款嚴苛,但面對 AI 基礎設施建設對存儲設備的剛性需求,部分雲服務供應商(CSP)正在考慮接受這一條件,以規避未來的斷供風險。

與此同時,價格的劇烈波動已迫在眉睫。據野村證券發佈的客户報告,閃迪計劃在 3 月份期間,將其用於企業級固態硬盤(SSD)的高容量 3D NAND 閃存芯片價格環比上調超過 100%。野村證券指出,這一漲價計劃歸因於短期內的供應短缺以及 AI 領域對服務器級存儲的中期需求增長。

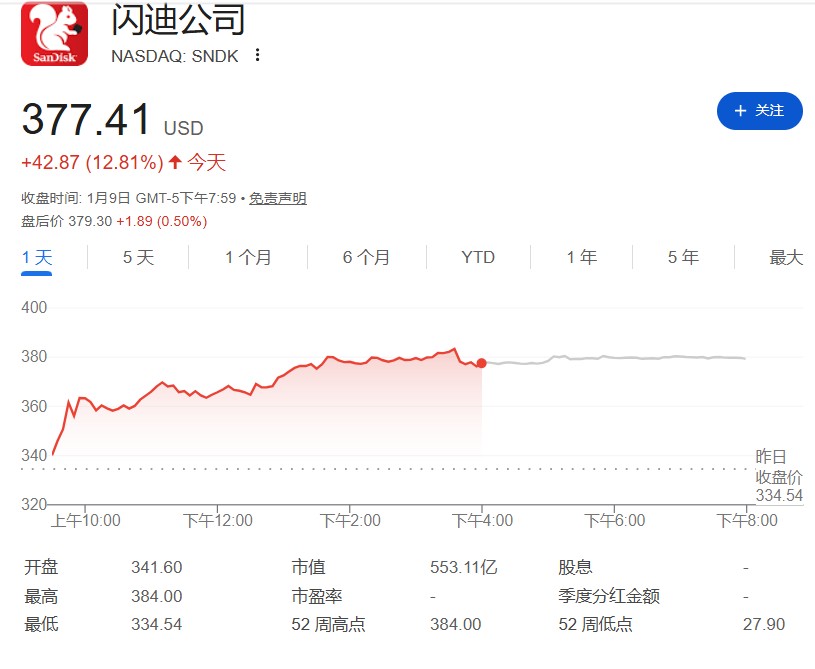

本週五,閃迪股價再度大漲 13%,續創歷史新高。

現金為王:前所未有的全款預付制

據報道,自 2025 年以來,NAND 大廠閃迪頻頻發動漲價攻勢,而近期的 “鎖單” 要求更是打破了行業慣例。供應鏈消息人士稱,閃迪提出的 “100% 現金預付” 條款,旨在換取 1 到 3 年的供應保障。

這種非常規的合同形式在行業內引發了劇烈震動。通常情況下,供應鏈合作多采用分期付款或信用賬期模式,全額預付對買方的現金流提出了巨大挑戰。

然而,報道指出,由於 AI 需求持續增長,而存儲原廠擴產需要大量時間,部分急需擴充算力的雲服務供應商不得不考慮接受這一條款。此外,閃迪也將此類合同談判範圍擴大到了 PC、智能手機及模組廠商。

價格翻倍:企業級存儲領漲

在要求全款的同時,產品報價也在飛漲。野村證券的渠道調查顯示,多家存儲供應商持續推高價格,其中企業級 NAND 面臨的漲幅最為激進。野村證券在報告中明確指出:“閃迪用於企業級 SSD 的 NAND 報價,在 3 月份期間可能環比上漲超過 100%。”

野村證券分析認為,英偉達的推理上下文內存存儲 (ICMS) 平台是推動今年企業級存儲需求的關鍵因素之一。該平台基於 BlueField-4 DPU,配備了 512 GB 的 SSD。據估算,如果英偉達每年出貨 50,000 個 VR NVL144 機架,僅此一項就需要消耗約 0.439 EB 的 3D NAND。

雖然目前尚不清楚企業級產品價格翻倍將在多大程度上波及消費級市場,但野村證券警告稱,由於智能手機和 PC 使用的 3D NAND 與企業級芯片產自同一晶圓廠,通常情況下,消費級產品價格會跟隨企業級產品上漲。

產能擠壓:AI 優先下的供應危機

造成當前局面的根本原因,在於全球三大存儲原廠(三星、SK 海力士、美光)的產能分配策略發生了根本性轉移。據相關分析,原廠將大多數產能傾斜給了利潤更高、主要用於 AI 市場的 HBM(高帶寬內存),導致原本用於生產標準型 DDR4/DDR5 及 NAND 的產能被大幅壓縮。

這種結構性短缺引發了供應鏈的混亂與恐慌:

- 科技巨頭搶貨:據報道,谷歌旗下的 TPU 極度依賴 HBM,在向 SK 海力士與美光尋求額外產能時收到了 “不可能” 的回覆。為此,谷歌甚至解僱了一名負責存儲供應的採購主管,並正在招聘專門的全球存儲商品經理。Meta 也計劃聘請專門的 “存儲全球採購經理”,以加強與上游晶圓廠的直接聯繫。

- 恐慌性囤貨:為了避開漲價和短缺,PC 品牌如聯想(Lenovo)已開始積極囤積庫存,甚至提前下訂 2026 年的全年需求。

- 亂象叢生:市場傳出三星總部低調派員前往台灣調查員工和代理商疑似收賄問題,顯示出在極度缺貨的情況下,市場出現了不規範的獲利行為。

目前,更有資本實力的買方已開始放棄傳統的長期契約模式,轉而接受短契約和高價,甚至出現 “不問價格,有貨就買” 的現象。