Bank of America Hartnett discusses "Q1 Strategy": Trump to "suppress inflation and lower interest rates" for the midterm elections, investors to "go long on economic prosperity and short on the AI bubble"

美银认为,特朗普政府为了赢得中期选举,正全力以赴压低通胀并降低资金成本,这迫使投资者采取 “做多经济繁荣(Long Boom)、做空资产泡沫(Short Bubble)” 的策略。一季度的正确策略是 “轮动而非撤退”。投资者应减少对 2025 年过热的 AI 概念(尤其是 AI 衍生品和高资本开支相关的债券)的敞口,转而增持价值周期股。

美国银行策略师 Michael Hartnett 在新年首份 Flow Show 报告中表示,尽管美银的 “牛熊指标” 已触及 9.0 的 “卖出信号” 高位,且市场通常应在此刻获利了结,但本次情况有所不同。特朗普政府为了赢得中期选举,正全力以赴压低通胀并降低资金成本,这迫使投资者采取 “做多经济繁荣(Long Boom)、做空资产泡沫(Short Bubble)” 的策略。

Hartnett 认为,2026 年一季度的正确策略是 “轮动而非撤退”。尽管科技股出现资金流出,但全球股市的广度非常强劲(98% 的国家指数高于 200 日均线),且美银全球基金经理调查(FMS)的现金头寸处于创纪录低位的 3.3%。在此背景下,投资者应减少对 2025 年过热的 AI 概念(尤其是 AI 衍生品和高资本开支相关的债券)的敞口,转而增持价值周期股。简而言之,这是一场 “没有债券崩盘的繁荣”,市场广度的表现将优于集中度。

Hartnett 认为,2026 年一季度的正确策略是 “轮动而非撤退”。尽管科技股出现资金流出,但全球股市的广度非常强劲(98% 的国家指数高于 200 日均线),且美银全球基金经理调查(FMS)的现金头寸处于创纪录低位的 3.3%。在此背景下,投资者应减少对 2025 年过热的 AI 概念(尤其是 AI 衍生品和高资本开支相关的债券)的敞口,转而增持价值周期股。简而言之,这是一场 “没有债券崩盘的繁荣”,市场广度的表现将优于集中度。

对于 2026 年的核心配置,Hartnett 提出了 “Long BIG, Trading MID” 的框架:即长期做多债券(Bonds)、国际股市(International)和黄金(Gold);交易策略上做多中盘股(Mid-caps),同时做空投资级债券(IG)和美元。

政治必需性:特朗普为中期选举 “干预” 价格

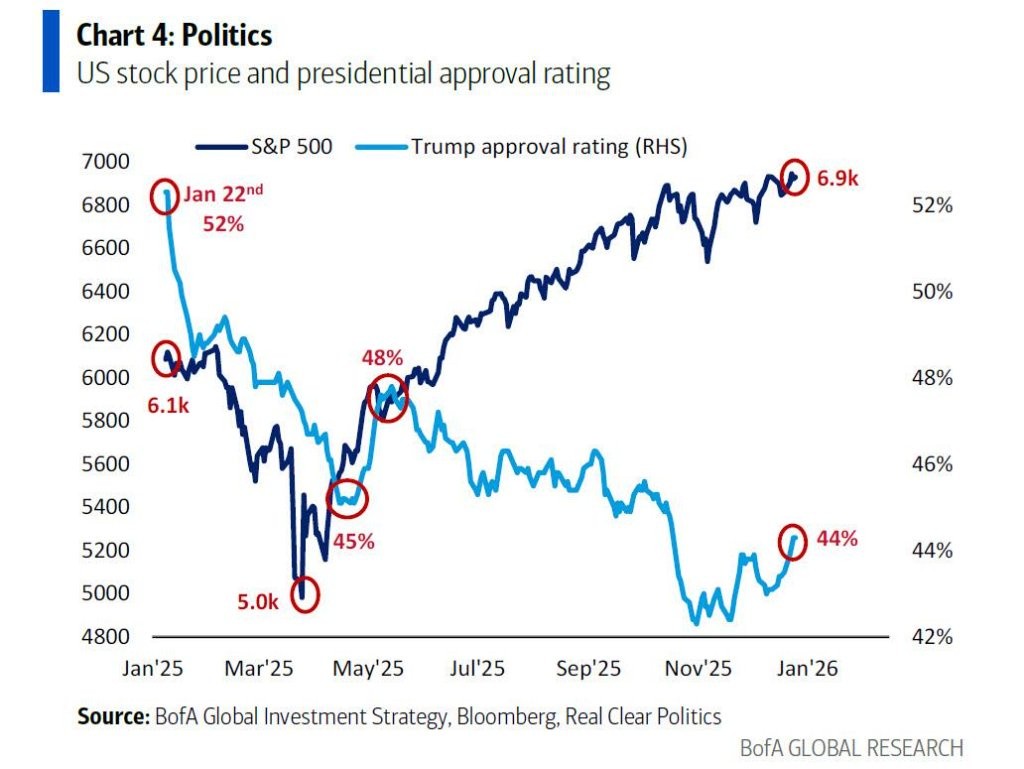

当前的宏观背景深受美国国内政治驱动。Hartnett 指出,特朗普的支持率正处于低位(仅为 43%),其中经济支持率为 41%,而通胀处理的支持率更是低至 36%。为了在中期选举前获得优势,特朗普政府必须降低通胀。

这解释了为何当前的货币政策旨在降低资金价格(通过美联储购买国库券的 QE,以及特朗普针对 MBS 的 QE),地缘政治政策旨在压低油价,贸易政策转向降低关税,而产业政策则干预医药、住房、保险和电力价格。正是这种政策转向,促使投资者押注 “经济繁荣” 和 “风险平价牛市”,并做多市场广度。

资金流向异常:创纪录的现金涌入与 “卖出信号”

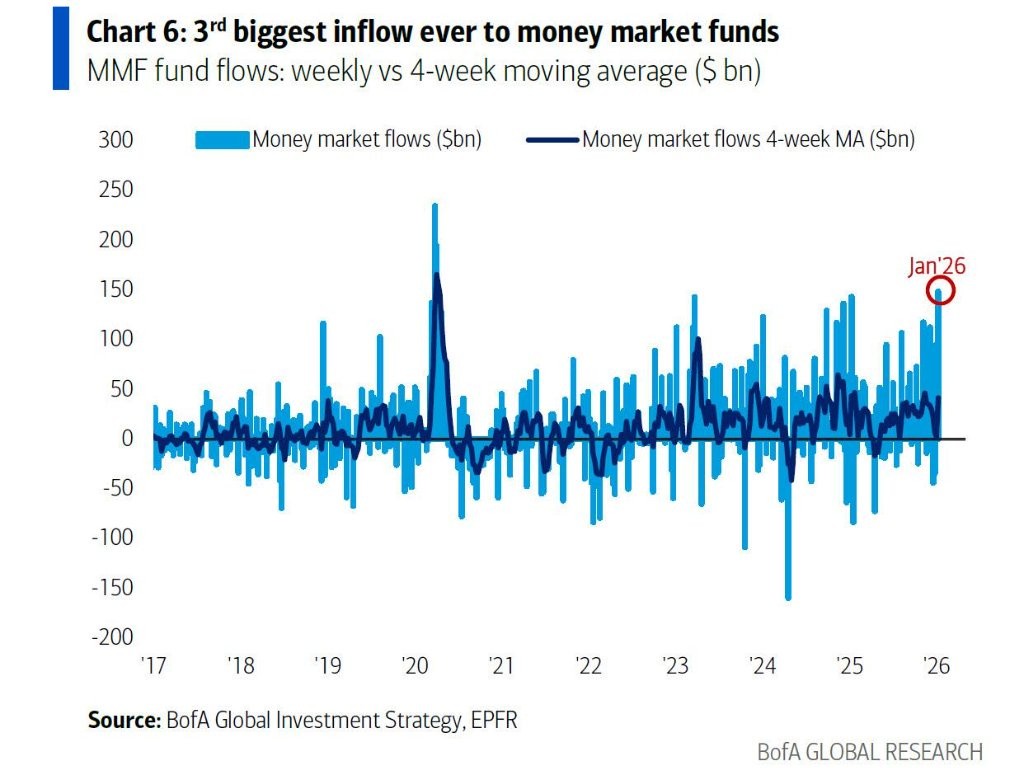

资金流向数据展示了极端的市场情绪。2026 年第一周,货币市场基金(Cash Money Markets)迎来了惊人的 1485 亿美元($148.5bn)流入,这是有史以来第三大规模的单周流入。

与此同时,美银私人财富客户(资产管理规模 4.3 万亿美元)的仓位显示,股票占比高达 64.2%,债券占 17.6%,现金占 11%。

值得注意的是,“七巨头”(Mag 7)股票占据了其资产管理规模的 17%。但在过去四周,私人客户正在买入高股息股票、市政债券和房地产信托(REITs),同时卖出银行贷款、投资级债券和科技股。此外,美国家庭权益财富在 2025 年激增约 9 万亿美元,延续了 2024 年增长 9 万亿美元和 2023 年增长 8 万亿美元的趋势。

美银的牛熊指标在 12 月 31 日已达到 9.0 的 “极度看涨” 水平(触发反向卖出信号),但这被全球股市的强劲广度和对冲基金通过期货增加标普 500 多头头寸所抵消。

Q1 交易指南:买入周期股,做空 AI 泡沫外围

基于上述背景,Hartnett 给出了明确的一季度资产配置建议。目前的轮动策略应进一步深化:

增加价值周期股敞口: 重点关注银行、房地产、原材料、工业以及中小盘股。

维持但不再增持 “七巨头”: 自 10 月 29 日和 11 月选举以来,这些防御性的大型科技股实际上是下跌的。

削减泡沫资产: 坚决削减那些属于 “第二衍生品” 或 “无法承受资本开支” 的 2025 年 AI 交易,例如做空 AI 超大规模计算公司的债券(AI hyperscaler bonds)。

逆向投资逻辑:为何债券和黄金是关键

在 Hartnett 最近的伦敦路演中,客户认为 “做多债券” 是最具逆向思维的观点。对此,Hartnett 的反驳逻辑非常清晰:

债务压力迫使 QE: 美国国债在未来 100 天内将增加 1 万亿美元。为了维持债券市场的买盘并防止市场测试新任美联储主席(自 1970 年以来,7 次提名后的 3 个月内收益率均上升),特朗普政府必须实施量化宽松(QE)。

就业与通胀的双重约束: 特朗普需要降低 CPI 以赢得选票,而美联储需要降息以防止失业率升至 5% 以上(青年失业率已达 9%)。

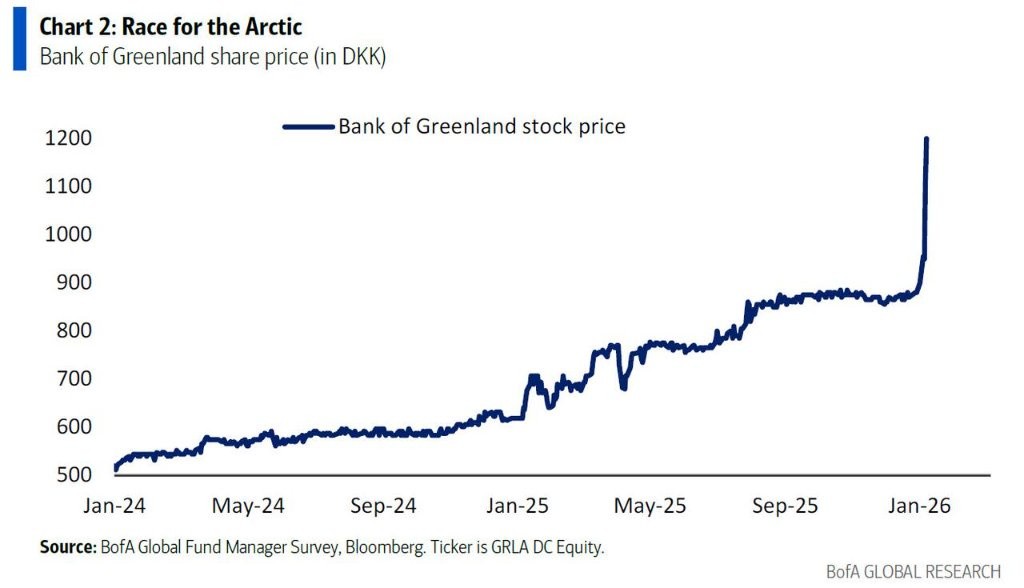

在地缘政治方面,市场正在追逐对冲资产。格陵兰银行股价在 4 天内上涨了 33%,反映了市场对美国可能 “收购” 格陵兰岛的猜测。Hartnett 指出,投资者正在抢先布局能源和原材料储备(委内瑞拉拥有全球 17% 的探明石油储量,北极拥有全球 13% 的未发现石油和 30% 的天然气)。

历史数据显示,自 1939 年以来,战争爆发后 6 个月表现最好的资产是黄金(+18.9%),其次是铜(+6.7%)和股票(+4.9%)。

随着美元可能从 “例外主义” 转向 “扩张主义”,以及美联储和特朗普试图通过货币贬值来稀释债务,这构成了做多黄金和反向做多美元的最佳理由。对于国际股市,Hartnett 认为英国和中国的消费板块具有最佳的上行空间。