Space photovoltaics and "orbital data centers": Why will the next generation of energy and computing power battleground be at an altitude of 800 km?

With the intensification of satellite frequency orbit resources between China and the United States, the 800km orbit has become a scarce production factor. Dongxing Securities pointed out that due to the five times the solar radiation intensity and the naturally zero-energy dissipation environment at high altitudes, this area is becoming an "orbital data center" for AI computing power breakthroughs. The surge in single satellite power and the planning of GW-level space data centers are giving rise to a trillion-level energy market and promoting the evolution of technology from high-cost gallium arsenide to high-cost performance HJT and perovskite tandem, reshaping the value boundaries of the photovoltaic industry chain

Space-based photovoltaics are evolving from supporting systems for spacecraft to core energy solutions that support the next generation of space infrastructure. This is not merely a technological upgrade or capacity expansion, but a systemic resonance formed by four key elements: energy supply, carrying capacity, orbital resources, and computing power demand, against the backdrop of accelerated global satellite deployment and emerging demand for space computing power.

According to the Shanghai Securities Journal report on the 10th, China applied to the International Telecommunication Union (ITU) for frequency orbit resources for over 200,000 satellites by December 2025, of which 190,000 are from the newly established "national team" Radio Innovation Institute; according to a previous article from Wall Street Insight, the U.S. Federal Communications Commission approved SpaceX to deploy an additional 7,500 second-generation Starlink satellites, bringing the total approved number to 15,000. These intensive applications for orbital resources and satellite deployment plans are reshaping the supply and demand landscape of the space industry.

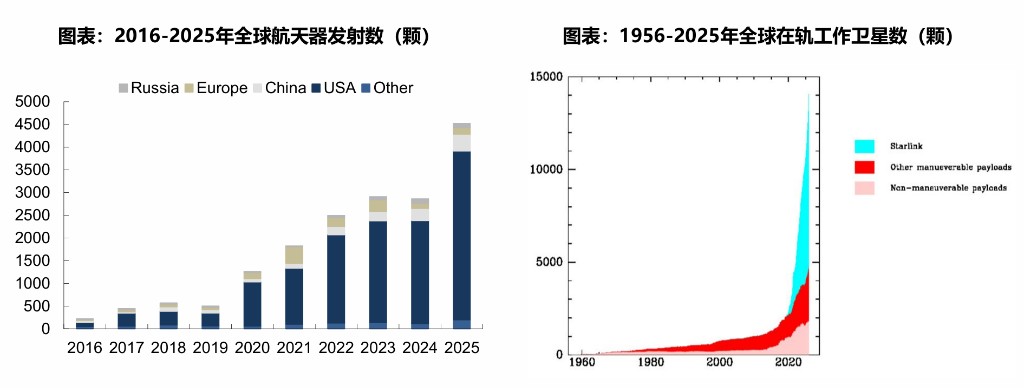

According to a research report published on the 6th by the Dongwu Securities team led by Zeng Duohong, the global spacecraft launch volume has maintained a compound annual growth rate (CAGR) of 34% over the past decade, with the number of launches expected to exceed 4,300 in 2025, a year-on-year increase of over 50%. With the evolution of low-orbit constellations towards multifunctionality and heavier payloads, the power per satellite has significantly increased—SpaceX's Starlink V3 satellites have solar wing areas that have grown more than tenfold compared to earlier versions, reaching 256.94 square meters.

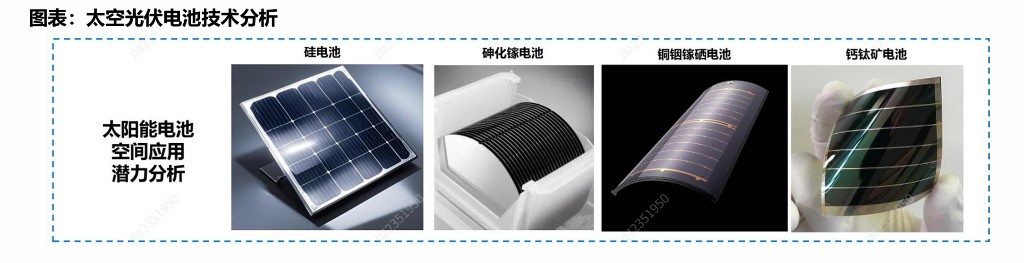

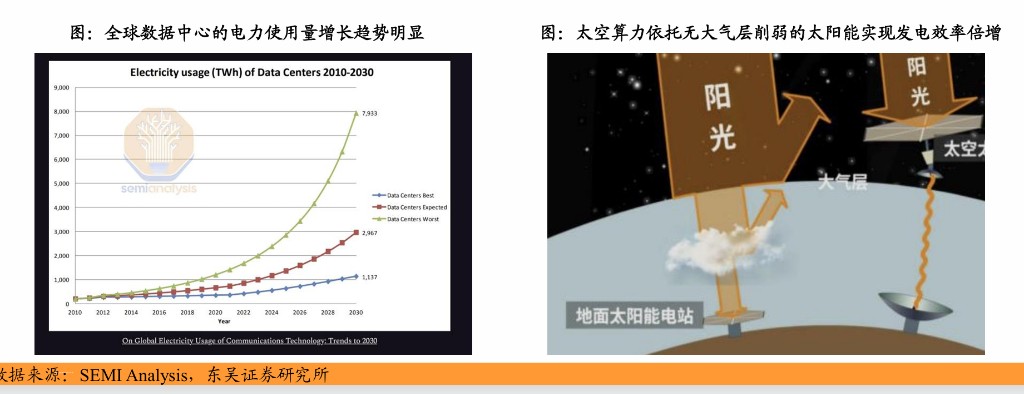

The rise of space computing centers further opens up imaginative possibilities. Projects such as the "Three-Body Computing Constellation" from the Zhejiang Lab in China, the "Star Computing Plan" from Guoxing Aerospace, and overseas projects like Starcloud, which is invested in by SpaceX, Google, and NVIDIA, all aim at building space data centers. If a 10GW space computing power system is subsequently constructed, the market size for solar wings could reach trillions of yuan. The Dongwu Securities team led by Zhou Ershuang believes that due to the five times higher light intensity and naturally zero-energy heat dissipation environment at high altitudes, this area is becoming an "orbital data center" for AI computing power breakthroughs. The photovoltaic technology route is also diversifying: Gallium arsenide occupies the high-end market due to its high efficiency, while silicon-based heterojunction (HJT) and perovskite tandem technologies target large-scale applications with cost advantages.

Unlocking Capacity and Orbital "Land Grabbing"

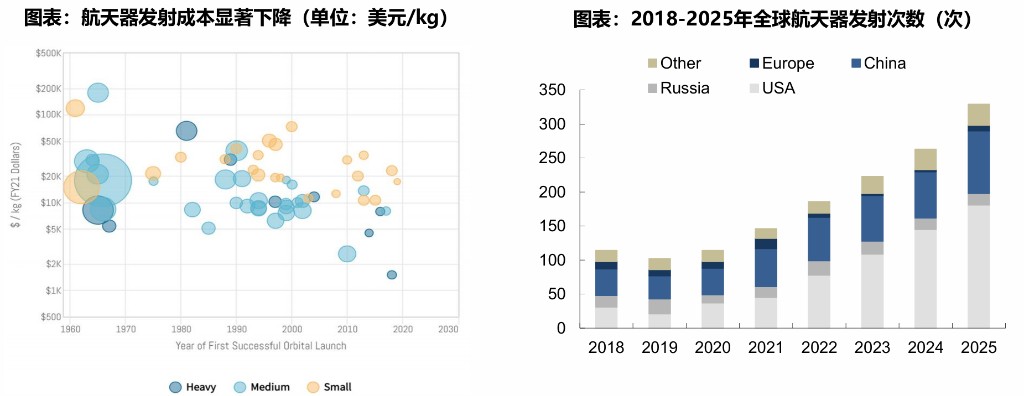

The explosion of commercial space began with the decline in launch costs. According to data from Dongwu Securities research reports, as reusable rocket technology matures, the cost of space launches has significantly decreased, breaking the economic barriers to entering space. Over the past decade, the global spacecraft launch volume has achieved an average annual compound growth rate (CAGR) of 34%, with the number of global spacecraft launches expected to exceed 4,300 in 2025, a year-on-year increase of over 50%.

However, physical space is not infinite. The frequency bands and orbital positions in Low Earth Orbit (LEO) and Sun-Synchronous Orbit (SSO) have "non-renewable" attributes. The ITU's "first come, first served" rule and strict requirements for launch schedules (the first satellite must be launched within 7 years of application, and the constellation must be completed within 14 years) force countries to accelerate their "land grabbing."

However, physical space is not infinite. The frequency bands and orbital positions in Low Earth Orbit (LEO) and Sun-Synchronous Orbit (SSO) have "non-renewable" attributes. The ITU's "first come, first served" rule and strict requirements for launch schedules (the first satellite must be launched within 7 years of application, and the constellation must be completed within 14 years) force countries to accelerate their "land grabbing."

Currently, the number of registered satellites worldwide has exceeded 100,000. In addition to SpaceX's dominant Starlink, China has applied for over 51,000 satellites through plans like GW (State Grid) and Qianfan. This high-density launch plan has directly spurred explosive demand for the satellite manufacturing supply chain, where the power system, as the "heart" of the satellite, accounts for about 20%-30% of its value, making it a key component second only to the payload.

Energy Anxiety Triggered by Payload Upgrades

The evolution of satellite functions is reshaping the requirements for energy systems. As low-orbit constellations develop towards multifunctionality and heavier designs, the power demand per satellite has surged dramatically. Taking SpaceX as an example, its Starlink satellites have evolved from version V1.5 to version V3, with solar wing area increasing by more than ten times to 256.94 square meters.

Dongxing Securities points out that photovoltaics are the only efficient and long-term stable energy form for satellites in space. The upgrade of payloads, especially the addition of direct mobile phone connections, laser links, and future space computing modules, has directly led to energy anxiety. Larger solar wings mean higher weight and costs, which contradicts the logic of commercial aerospace pursuing extreme cost-effectiveness.

Therefore, the space photovoltaic industry is facing a situation of "simultaneous increase in quantity and price": On one hand, there is the "quantity" brought about by the surge in the number of satellites, and on the other hand, there is the "price" and technological iteration demand brought about by the increase in power density per satellite.

Space Computing Power: From "Sky Sensing, Ground Computing" to "Sky Sensing, Sky Computing"

In addition to communication, the migration of AI computing power to space is opening up long-term imaginative possibilities for the photovoltaic industry. Ground data centers are facing power shortages and cooling bottlenecks, while space has natural advantages: solar energy without atmospheric attenuation can achieve efficient power supply, and the ultra-low temperature environment in deep space can achieve natural cooling, significantly reducing energy consumption.

Dongxing Securities analyst Zhou Ershuang pointed out in the report that space computing power centers have disruptive advantages compared to ground data centers. For example, for a 40MW computing cluster running for 10 years, the total cost of the space solution is only about 5% of that of the ground solution. This encourages the satellite working mode to upgrade from "sky sensing, ground computing," which transmits raw data back to the ground, to "sky sensing, sky computing," which processes data in orbit.

Currently, the "Three-Body Computing Constellation" of Zhijiang Laboratory, the "Star Computing Plan" of Guoxing Aerospace, and overseas projects like Starcloud have all been launched. Future space data centers may evolve into large "mothership" platforms or multi-satellite clusters, such as Starcloud's plan to build a space computing mothership equipped with a 4km×4km ultra-large photovoltaic array. This gigawatt (GW) level infrastructure will impose extreme requirements on the efficiency and lightweight nature of photovoltaic cells.

Currently, the "Three-Body Computing Constellation" of Zhijiang Laboratory, the "Star Computing Plan" of Guoxing Aerospace, and overseas projects like Starcloud have all been launched. Future space data centers may evolve into large "mothership" platforms or multi-satellite clusters, such as Starcloud's plan to build a space computing mothership equipped with a 4km×4km ultra-large photovoltaic array. This gigawatt (GW) level infrastructure will impose extreme requirements on the efficiency and lightweight nature of photovoltaic cells.

Divergence in Technical Routes: Gallium Arsenide to the Left, Silicon-Based to the Right

In the face of massive demand, the technical routes for space photovoltaics are undergoing differentiation.

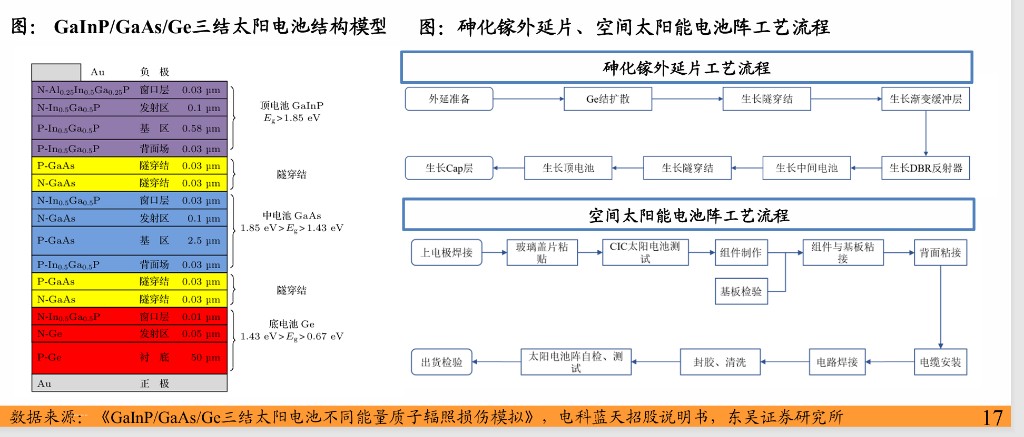

For a long time, gallium arsenide (GaAs) batteries, with their high efficiency (30%+) and strong radiation resistance, have been the absolute mainstream for spacecraft. However, their high cost (about $60-70 per watt) and complex manufacturing processes make it difficult to support the low-cost deployment needs of large-scale low-Earth orbit constellations.

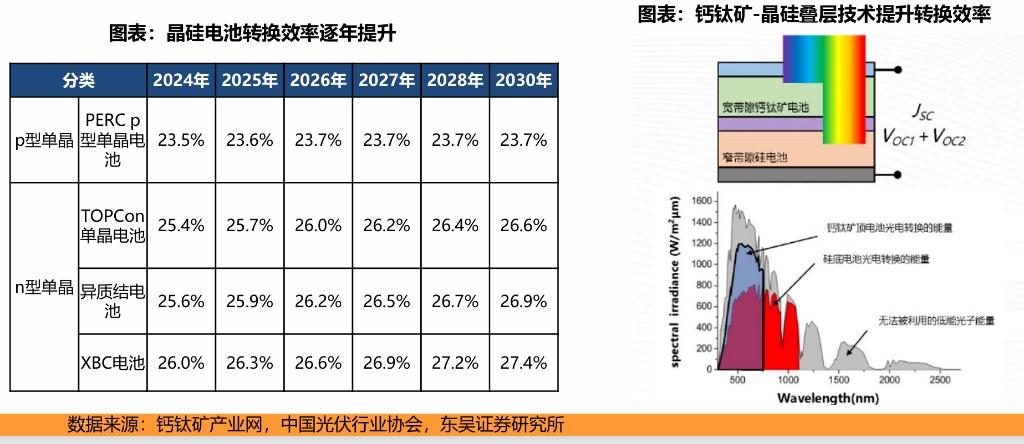

In contrast, silicon-based batteries (especially HJT heterojunction technology) and perovskite technology are becoming the new favorites in commercial aerospace. Dongxing Securities points out that HJT batteries, with their low-temperature processes, ability to produce ultra-thin silicon wafers (such as 60μm) to significantly reduce weight, and good flexibility for roll-out adaptability, have become the preferred solution for large-scale constellations.

There is an economic calculation based on transportation costs:

- SpaceX Model: Due to extremely low launch costs (about $1500 per kilogram), SpaceX tends to use lower-cost silicon-based batteries, compensating for efficiency shortcomings by increasing area.

- China Model: Currently, domestic launch costs are relatively high, so there is still a tendency to use high energy-to-weight ratio but expensive gallium arsenide batteries. However, with the improvement and cost reduction of domestic commercial rocket payload capacities, the trend towards transitioning to silicon-based HJT or perovskite stacked technologies has become irreversible.

The explosion of space photovoltaics is reshaping the value logic of the photovoltaic industry chain. This market is opening up from a closed military aerospace system to commercial photovoltaic companies with large-scale manufacturing capabilities.

According to calculations by Dongxing Securities, assuming 10,000 satellites are launched annually in the future, the low-Earth orbit satellite market alone is expected to bring nearly 200 billion yuan in solar wing market space. If considering the long-term construction of a 10GW-level space computing system, the market scale will reach several trillion yuan.

Overall, space photovoltaics are no longer just energy components; they are a key link connecting rocket payload capacity, orbital resources, and space-based computing power. In this "energy—payload—orbit—computing power" system, the degree of breakthrough in photovoltaic technology will directly define the boundaries of human development of commercial value in space