Demand for AI chips remains strong, TSMC's net profit in Q4 increased significantly by 35%, with total capital expenditure reaching $40.9 billion in 2025 | Financial Report Insights

More news, ongoing updates

In the fourth quarter of 2025, Taiwan Semiconductor Manufacturing Company (TSMC) achieved strong performance growth, with after-tax net profit increasing by 35% year-on-year to NT$505.74 billion, primarily due to sustained strong demand for advanced process technologies. The company's quarterly revenue surpassed NT$1 trillion for the first time.

According to TSMC's financial report released on Wednesday, consolidated revenue for the fourth quarter reached NT$1.05 trillion, a year-on-year increase of 20.5%, with earnings per share rising to NT$19.50. In US dollar terms, the quarterly revenue was $33.73 billion, an increase of 25.5% compared to the same period last year and a quarter-on-quarter increase of 1.9%.

This financial performance exceeded market expectations, reflecting further release of profitability from advanced process nodes. The company's gross margin climbed to 62.3% this quarter, and operating margin reached 54.0%, both at historically high levels. TSMC's total capital expenditure for 2025 amounted to $40.9 billion.

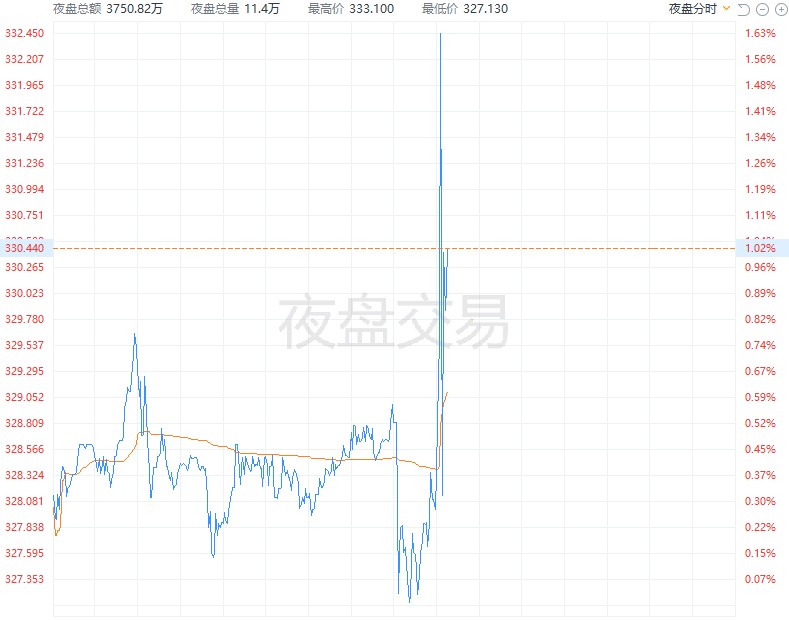

TSMC's US stock surged nearly 2% in after-hours trading.

Contribution of Advanced Processes Continues to Expand

TSMC's advanced process technologies (including 7nm and more advanced processes) have become its absolute revenue pillar. Financial report data shows that the shipment value of advanced processes accounted for 77% of total wafer sales for the quarter.

Among these, the shipment proportion of the currently leading 3nm process further increased to 28%, indicating that key customers are accelerating their migration to the latest process nodes. The 5nm process remains the largest single node contributor, accounting for 35% of total sales for the quarter. The 7nm process holds a 14% share. This revenue structure, dominated by high value-added products, ensures that the company can maintain a high level of profitability amid market fluctuations.

More news will be updated continuously