Bank of America Asia Fund Manager Survey: India Loses Favor, China's Narrative Reverses, Semiconductors Remain the "Most Attractive"

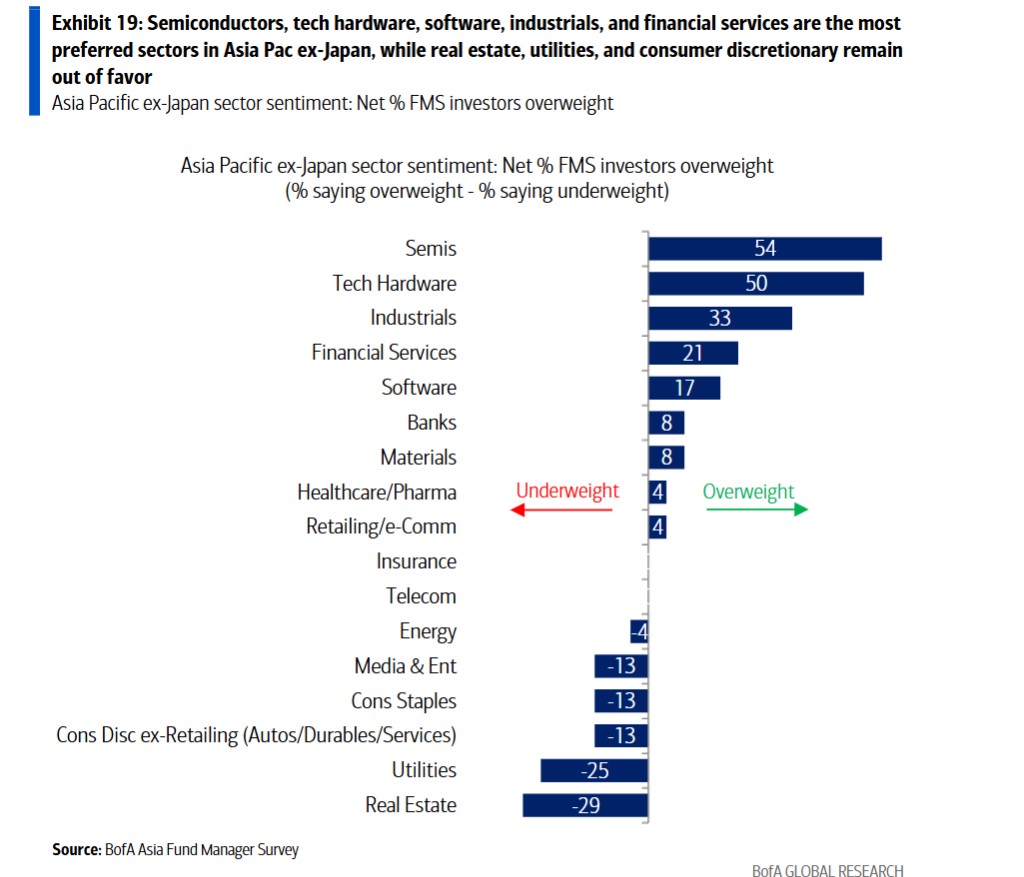

For the Chinese market, investor sentiment has reached a new high in the survey, with AI and semiconductors becoming the core allocation theme. The Indian market has shifted from a slight overweight last month to a net 8% slight underweight, possibly reflecting investor disappointment over the delay in its trade agreement with the United States. Overall, the semiconductor sector continues to dominate investor preference, with 54% of respondents overweighting this sector, the highest among all industries

The latest Bank of America Asia Fund Manager Survey shows that regional market sentiment is undergoing a significant reconstruction. Japan has maintained its position as the most favored market for investors for the 27th consecutive month, while India has shifted from a slight overweight last month to a slight underweight. The long-term structural narrative of the Chinese market has reversed, with investor optimism about its prospects reaching the highest level since the survey began.

According to the Wind Trading Desk, in the January survey covering 112 fund managers managing $280 billion in assets, the return expectations for the Asia-Pacific region, excluding Japan, surged to the historical 92nd percentile, marking a two-year high. Global growth expectations have risen to the highest level since October 2021, while inflation expectations remain low at the historical 29th percentile, allowing space for Asian central banks to maintain a dovish policy stance.

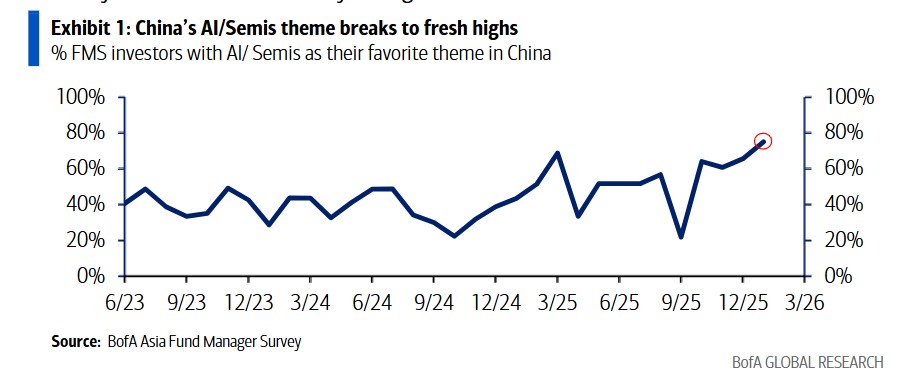

The semiconductor sector continues to dominate investor preference, with 54% of respondents overweighting this sector, the highest among all industries. In the Chinese market, the popularity of AI and semiconductor themes has reached a new high in the survey, with 66% of respondents listing them as their most favored themes. This trend is also significant in markets like Japan, South Korea, and Taiwan, with the proportion of respondents expecting a strengthening semiconductor cycle nearing a three-year high.

The cooling of the Indian market may reflect investor disappointment over the delay in its trade agreement with the United States. In contrast, investors maintain a constructive attitude towards Taiwan and South Korea, benefiting from strong expectations for a reinforced semiconductor cycle.

Japan Continues to Lead, Policy Expectations Moderate

Japan continues to top investor preference with a net overweight ratio of 54%, remaining the regional favorite every month since being included in the survey in October 2023. Investors are raising their market return expectations, focusing on the potential productivity-enhancing policies that the government may implement through active investment in growth areas to achieve economic growth and fiscal consolidation.

Monetary policy normalization is currently a secondary focus, with two-thirds of respondents expecting the Bank of Japan to raise interest rates next in June. The economic outlook for Japan is optimistic, with 63% of respondents expecting the economy to "slightly strengthen," 21% expecting it to "significantly strengthen," and almost no one expecting economic weakness.

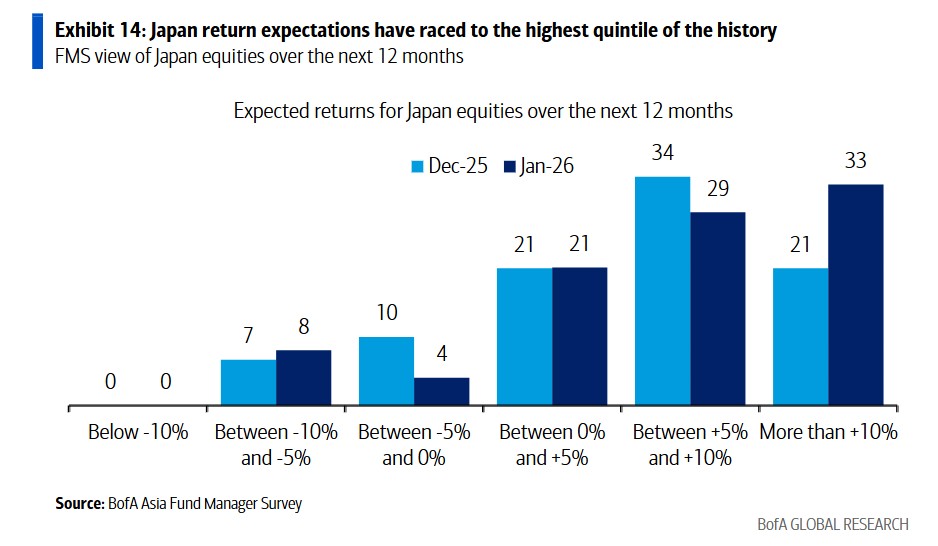

In terms of sector allocation, banks and semiconductors continue to be favorites among investors in the Japanese market, with 50% and 38% of respondents overweighting these two sectors, respectively. Banks are key beneficiaries of rising interest rates, while semiconductors are core targets of AI investment themes. Return expectations for the Japanese market have risen to the highest historical quintile, with 33% of respondents expecting returns exceeding 10% over the next 12 months.

Chinese Narrative Reverses, Household Risk Appetite Rises

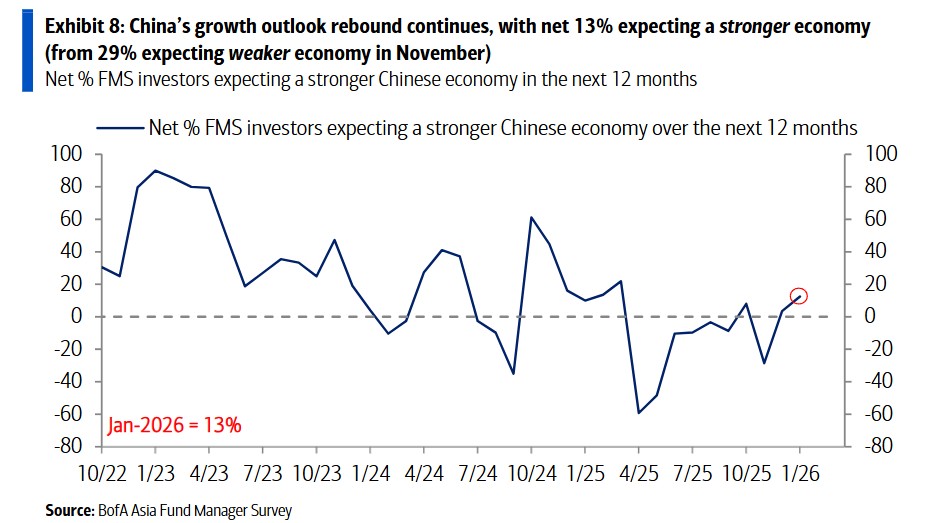

The Chinese market is experiencing a significant shift in sentiment. Growth momentum is stabilizing and gradually improving, with a net 13% of respondents expecting the Chinese economy to strengthen, marking a significant reversal from a net 29% expecting economic weakness last November

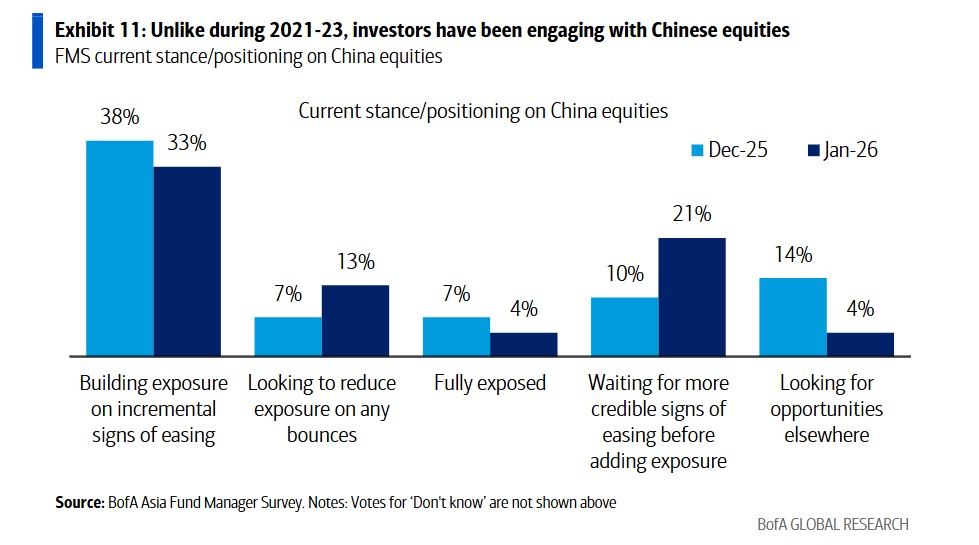

More importantly, the proportion of respondents who believe that the Chinese stock market is undergoing a structural valuation adjustment has dropped to 38%, the lowest level since the survey began. Household risk appetite is beginning to recover, with 58% of respondents believing that Chinese households will prioritize asset allocation (stocks, bonds, or real estate) over depositing in savings accounts.

The dominance of AI and semiconductor themes in the Chinese market has further strengthened, with 66% of respondents listing them as their preferred themes, setting a new high for the survey. The internet and anti-involution themes ranked second with support rates of 21%. Meanwhile, 83% of respondents expect further easing of China's monetary policy, maintaining a high level.

In terms of investor stance, 21% of respondents indicated that they are "building exposure," with a considerable proportion of investors maintaining a positive participation attitude, contrasting sharply with the general avoidance of the Chinese market from 2021 to 2023.

Semiconductor Cycle Expectations Heat Up, India Turns to Underweight

The semiconductor sector's overweight ratio across the Asia-Pacific region, excluding Japan, reached 54%, far exceeding other industries. Technology hardware, industrials, and financial services followed with net overweight ratios of 50%, 33%, and 21%, respectively. In contrast, real estate, utilities, and non-retail consumer goods sectors are the least favored, with net underweight ratios of 29%, 25%, and 13%.

The net proportion of respondents expecting the semiconductor cycle (Korea/Taiwan export growth) to strengthen rose to 58%, approaching the highest level since July 2024. This expectation supports investors' constructive attitudes towards the Taiwan and Korea markets, with net overweight ratios of 25% and 21%, respectively.

The Indian market shifted from a slight overweight last month to a net 8% slight underweight, possibly reflecting investor disappointment over the delay in its trade agreement with the United States. In the Southeast Asian market, Malaysia, Singapore, and New Zealand maintained neutral allocations, while Thailand, Indonesia, and the Philippines were in an underweight position.

Optimism Soars, Valuations Still Appear Reasonable

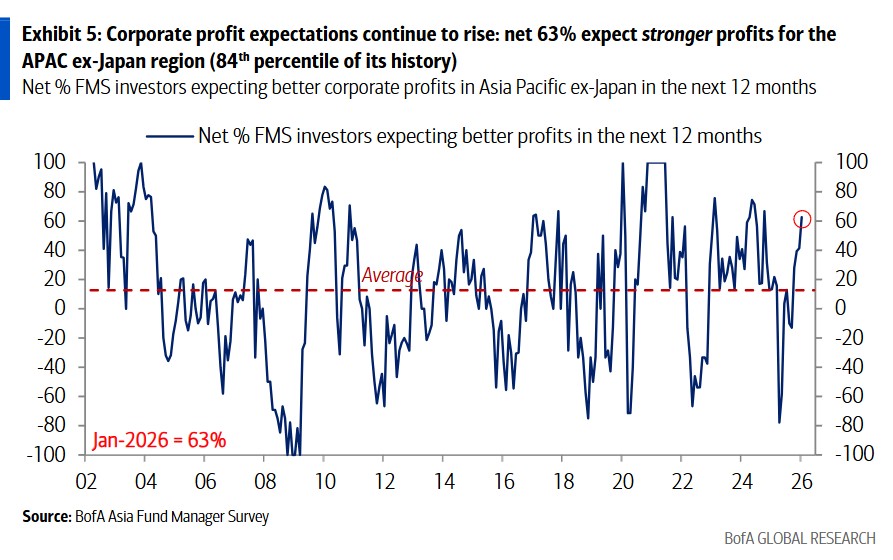

The surge in market return expectations is supported by a strong earnings rebound. A net 63% of respondents expect corporate earnings in the Asia-Pacific region, excluding Japan, to improve, a proportion that is at the historical 84th percentile. Meanwhile, only 17% of respondents believe that the market consensus earnings per share estimates are too high, leaving room for future earnings upgrades

Despite high return expectations, respondents generally believe that regional stock market valuations are roughly reasonable. A net 17% of respondents believe that the Asia-Pacific region, excluding Japan, is undervalued rather than overvalued. This "Goldilocks" scenario—strong growth expectations, moderate inflation outlook, and reasonable valuations—supports continued market gains.

The strengthening of global growth expectations is a key factor driving optimism. The economic outlook for the Asia-Pacific region, excluding Japan, has risen to a two-year high, while Japan's growth expectations remain close to the survey peak. Against a backdrop of low inflation expectations, Asian central banks, excluding Japan, have retained the space to maintain an accommodative stance, providing additional policy support for the market.

This survey was conducted from January 9 to 15, 2026, with 227 fund managers managing $646 billion in assets participating, of which 112 fund managers managing $280 billion in assets answered regional questions