Trump "Make Global Stock Markets Great Again"? Non-US markets surged 30%, US stocks posted the worst performance in 33 years

特朗普在重返白宮的第一年,全球股市(剔除美國)上漲約 30%,是標普 500 指數漲幅的兩倍,顯示美股表現創 33 年來最差。儘管美股未陷入熊市,但其漲幅在歷任總統中僅排名第九,低於多位前任。市場分析指出,特朗普的政策不確定性導致資本流向其他市場,投資者對其減税和放松管制的預期與現實複雜交織。

儘管唐納德·特朗普在重返白宮的第一年裏宣稱美國已轉變為全球 “最熱” 的國家,但金融市場的實際表現卻呈現出截然不同的圖景:在其任期的首個年份,全球股市的表現顯著優於華爾街。

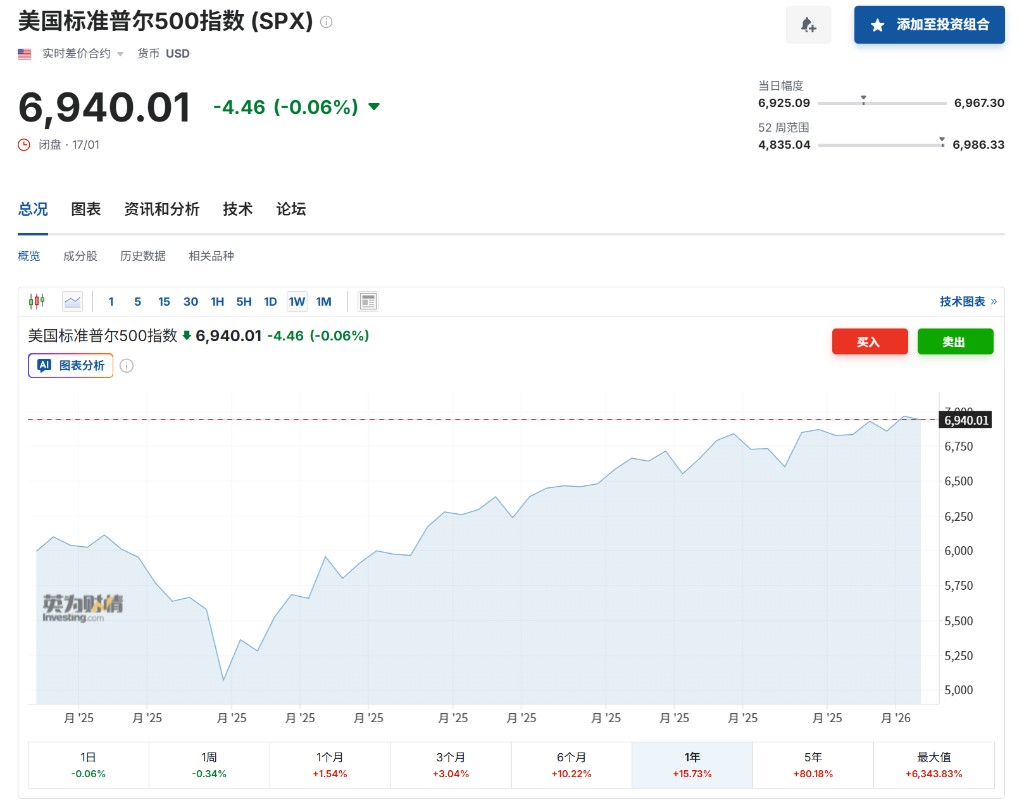

據彭博報道,自特朗普一年前上任以來,剔除美國後的全球股市(以 MSCI 指數衡量)已上漲約 30%,這一漲幅大約是標普 500 指數同期的兩倍。這標誌着自 1993 年以來,美股在總統任期第一年相對於全球市場的表現出現了最嚴重的落後。

儘管標普 500 指數並未陷入熊市並屢創新高,但根據 CFRA 的數據,特朗普第二任期首年的美股漲幅在二戰以來的歷任總統中僅排名第九。這一表現不僅不及里根、老布什、克林頓、奧巴馬、和拜登,甚至落後於特朗普自己的第一個任期。

市場分析指出,雖然人工智能熱潮和富有韌性的經濟為美股提供了支撐,但特朗普政府在貿易、外交政策以及對美聯儲獨立性的挑戰等方面帶來的一系列不確定性,令投資者感到不安。這種政策層面的動盪,正促使資本加速流向亞洲、歐洲及拉丁美洲等復甦中的市場。

政策干預引發劇烈波動

投資者在 2024 年底曾預期特朗普的減税和放松管制議程將進一步刺激經濟,然而現實情況卻更為複雜。特朗普上任初期即引發了市場大幅波動:他授權億萬富翁埃隆·馬斯克削減聯邦開支,並與前任的政策決裂。

此外,特朗普試圖對關鍵行業施加更廣泛控制的舉措令市場措手不及。據報道,這包括宣稱對委內瑞拉石油擁有主權、試圖命令銀行限制信用卡利率、抨擊國防承包商,以及指示聯邦政府入股英特爾等公司。外交政策方面的意外,例如推動美國收購格陵蘭島,也加劇了市場的不安。今年 4 月,其關税政策一度導致市場陷入混亂,直到隨後有所回調。

美銀的高級投資策略總監 Rob Haworth 表示:“贏家和輸家變化得相當快,投資者很難保持靈活。”巴萊克的數據顯示,這種動盪在數據上表現得尤為明顯:2025 年,標普 500 指數中最大的 100 家成分股出現了 47 次超過 5 個標準差的大幅下跌,為 1998 年以來之最。

資金流向非美市場

在美元上半年走軟、美國就業市場降温以及特朗普施壓歐洲盟友增加國防開支的背景下,全球其他地區的股市開始發力。據彭博數據,MSCI 新興市場指數去年上漲超過 30%,創下自 2017 年以來的最大漲幅。

Purpose Investments 的首席策略師 Craig Basinger 指出,認為非美股市將繼續跑贏美股的觀點已不再是逆向思維,“資金正在追逐績效”。

儘管美股表現相對落後,但其絕對收益依然可觀。標普 500 指數連續第三年實現兩位數增長,華爾街預測人士對 2026 年仍持樂觀態度。Wayve Capital Management LLC 的首席策略師 Rhys Williams 認為,儘管政策高層帶來動盪,但只要忽略噪音關注價格,AI 帶來的長期利好仍將推動經濟向正確方向發展。

中期選舉與美聯儲前景存疑

隨着 2026 年中期選舉的臨近,市場正面臨新的風險。歷史數據顯示,中期選舉年通常是股市表現較弱的年份,部分原因是反對黨獲勝可能導致總統議程受阻的風險。

面對低支持率以及選民對通脹和高利率的不滿,特朗普近期將矛頭指向了抵押貸款利率、信用卡利率以及因 AI 數據中心激增而上漲的電力成本。此外,特朗普對美聯儲施加了前所未有的壓力,其政府甚至對現任主席傑羅姆·鮑威爾發起了刑事調查,這一舉動加劇了投資者對央行獨立性的擔憂。隨着鮑威爾的任期將於 5 月結束,特朗普將提名繼任者。

Nationwide Funds Group 的首席策略師 Mark Hackett 總結道:

“中期選舉年曆來是日曆上表現最差的年份。一般來説,中期選舉往往充滿爭議,而市場不喜歡不確定性。”

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。