Bridgewater's Dalio warns: Trump's policies may trigger a "capital war"

達利歐認為,貿易緊張局勢加劇和財政赤字增加可能削弱外界對美國債務的信心,促使投資者轉向黃金等硬資產。他建議投資者將黃金作為關鍵對沖工具,在典型的投資組合中配置 5% 至 15% 的黃金。

全球對沖基金巨頭橋水基金(Bridgewater Associates)的創始人達利歐(Ray Dalio)本週二警告,美國總統特朗普的政策可能導致其他國家政府和投資者減少對美國資產的投資,從而引發 “資本戰”。這位億萬富翁投資者。

在 20 日週二於瑞士達沃斯世界經濟論壇的講話中,達利歐表示,貿易緊張局勢加劇和財政赤字增加可能削弱外界對美國債務的信心,促使投資者轉向黃金等硬資產。他重申多元化投資的重要性,建議投資者將黃金作為關鍵對沖工具,在典型的投資組合中配置 5% 至 15% 的黃金。

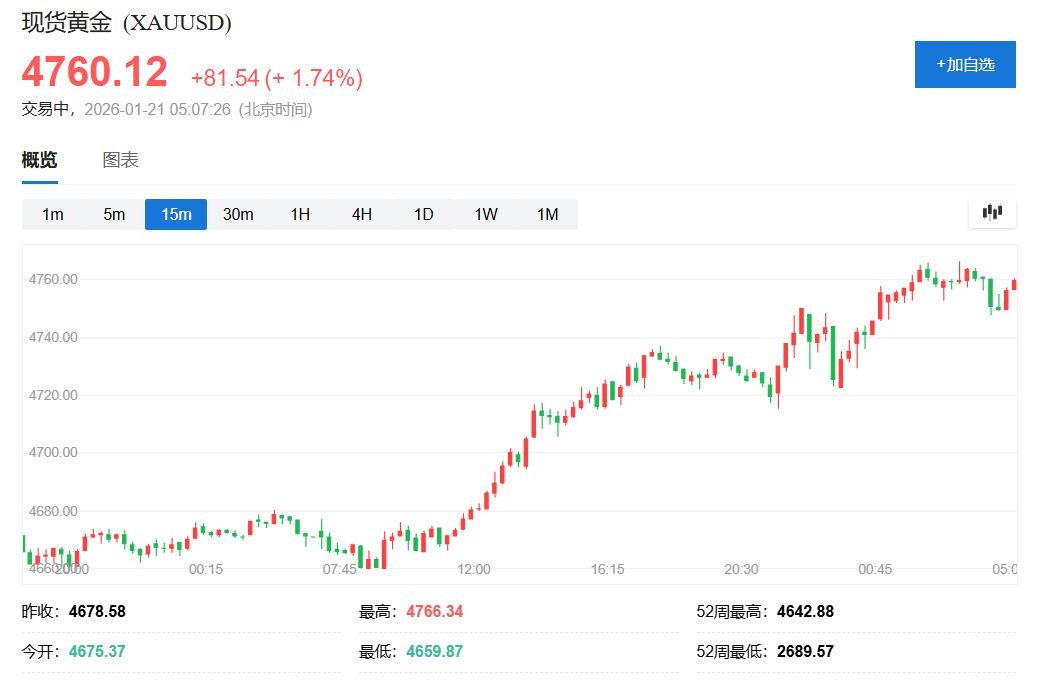

達利歐講話當天,週二美股午盤,黃金連續第二日創盤中歷史新高。現貨黃金史上首次漲至 4760 美元上方,日內漲約 2%,體現了投資者在美歐可能爆發關税戰之際紛紛湧入避險資產。

據央視新聞,特朗普 1 月 17 日上週六表示,將從 2 月 1 日起對丹麥、挪威、瑞典、法國、德國、英國、荷蘭和芬蘭出口至美國的所有商品加徵 10% 關税,直至就 “完全、徹底購買格陵蘭島” 達成協議。這一將關税與領土交易直接掛鈎的做法,迅速被歐洲方面定性為不可接受的政治脅迫。

華爾街機構對這場潛在 “資本戰” 的後果發出警告。德意志銀行在最新研報中指出,作為美國最大 “債主” 之一,歐洲手握超過 8 萬億美元的美國資產籌碼。一旦歐洲決定將資本 “武器化”,爭端將不再侷限於關税互搏,而是升級為直擊美債命門的資本層面衝突。

“資本戰” 風險浮現 黃金是關鍵對沖

達利歐本週二對媒體表示:

“貿易逆差和貿易戰的另一面是資本和資本戰。如果考慮到這些衝突,你就不能忽視資本戰的可能性。換句話説,也許人們不再像以前那樣熱衷於購買美國國債等資產。”

達利歐擔心,在信任侵蝕的情況下,持有大量美元和美國國債的國家可能變得不太願意為美國赤字提供融資。與此同時,美國繼續大量發債,如果雙方信心減弱,將造成嚴重問題。

達利歐指出:“我們知道,美元持有者和需要美元的美國,彼此都在擔心對方。如果其他國家持有美元,他們互相擔心,而我們又在大量發行美元,那將是個大問題。"

達利歐表示,在歷史上有多個經濟衝突從貿易升級到資本流動和貨幣爭端的類似案例。“當你面臨衝突、國際地緣政治衝突時,即便是盟友也不想持有彼此的債務。他們更傾向於轉向硬通貨。這符合邏輯,也是事實,而且在世界歷史上屢見不鮮。”

達利歐重申多元化投資的重要性,認為投資者不應過度依賴任何單一資產類別或國家。他強調黃金是金融壓力時期的關鍵對沖工具,建議其在典型投資組合中佔比 5% 至 15%。

達利歐表示:“當其他資產表現不佳時,黃金錶現很好。它是有效的多元化工具。”

歐洲的反制選項

華爾街機構正在評估歐洲可能採取的反制措施及其對資本市場的影響。據高盛分析,歐盟可能存在三種層級的回應路徑。

最温和的選項是擱置此前已談妥的歐盟 - 美國貿易協議。該協議需要歐洲議會批准,而在當前背景下,多名歐洲議會議員已明確表示"此時不具備批准條件"。

第二種選項是動用去年已準備好的對等反制清單,對美國商品加徵關税。歐盟領導人正討論可能對 930 億歐元(1080 億美元)的美國商品加徵關税。

最具衝擊力的是第三種選項——啓動反脅迫工具(ACI)。該工具專為應對"第三國試圖通過經濟手段脅迫歐盟或成員國"而設計。與傳統關税不同,ACI 允許歐盟採取一系列非關税反制措施,包括限制投資、限制進入公共採購市場、對外國資產和服務徵税,甚至涉及數字服務和知識產權領域。

德銀警告:"8 萬億美元籌碼"

德意志銀行在最新策略報告中指出,美國在歐洲擁有高達 8 萬億美元的資產敞口,包括龐大的直接投資和金融資產。如果爭端升級到資本層面,這一規模遠超貿易逆差的影響。

德銀分析認為,一旦歐盟啓動 ACI 工具,針對這 8 萬億美元的美國資產進行監管收緊、税務調查甚至限制利潤回流,將對美國企業界造成不對稱的打擊。"在貿易戰中美國或許佔優,但在資本戰中,深度交融的金融資產讓歐洲擁有了實質性的反制籌碼,"德銀表示。

根據美國財政部數據,歐盟持有的美國資產總額超過 10 萬億美元,英國和挪威還持有更多此類資產。這些資產包括美國國債和股票,部分由公共部門基金持有,其中最大的是挪威 2.1 萬億美元的主權財富基金。

實施障礙與市場影響

不過,多數策略師認為歐洲採取極端措施的可能性較低。荷蘭國際集團由 Carsten Brzeski 領導的研究團隊指出,歐盟幾乎無法強迫歐洲私營部門投資者出售美元資產,它只能嘗試激勵對歐元資產的投資。

法國興業銀行的 Juckes 週一表示,歐洲公共部門的美國資產投資者可能會停止增持或開始拋售,但局勢需要進一步大幅升級,他們才會為了政治目的而損害投資業績。

德銀同時提醒市場,不要忽視"資本戰"風險對美國本土資產定價的反噬。"8 萬億美元資產的安全性一旦受到地緣政治威脅,可能導致資金回流受阻或避險情緒急升,這將使得美債收益率曲線在通脹預期和增長擔憂的夾擊下出現劇烈波動。"

高盛測算顯示,如果 10% 的關税最終落地,將使受影響國家的實際 GDP 下降約 0.1% 至 0.2%,其中德國受衝擊相對更大。如果税率升至 25%,GDP 衝擊可能擴大至 0.25% 至 0.5%。不過在通脹方面,高盛認為關税對通脹的影響"非常小",主要因為需求走弱本身具有抑制價格的作用。

本週一市場已出現緊張情緒,美股期貨、歐洲股市和美元承壓,黃金、避險貨幣瑞郎和歐元成為主要受益者,顯示"拋售美國"交易可能捲土重來。