How to save Japanese bonds? The Japanese Finance Minister's "rhetoric" is useless; only the central bank can "print money."

The Japanese government bond market has experienced a historic collapse due to structural imbalances, with Goldman Sachs bluntly stating that verbal interventions have failed. The Bank of Japan is being forced towards the only "logical conclusion"—restarting unlimited bond purchases. However, this "money printing to save the market" may lower yields but is highly likely to cause the yen exchange rate to breach the 160 barrier, leaving the central bank in a dilemma between "protecting bonds" and "protecting the currency."

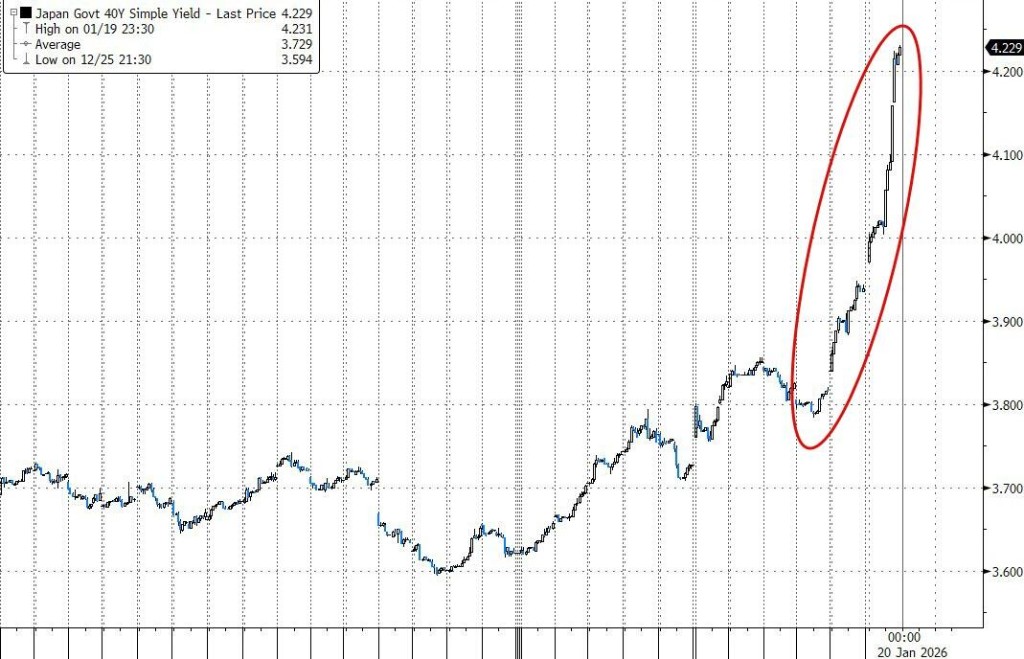

The Japanese government bond market is experiencing a "collapse" that is sending shockwaves through global investors. With long-term government bond yields soaring to historic highs, confidence in Japan's fiscal discipline has sharply eroded. Goldman Sachs bluntly stated that, faced with a severe supply-demand imbalance, Japanese policymakers have few options left; despite the finance minister's attempts to verbally reassure, the "logical endgame" points to the Bank of Japan being forced to intervene again.

The severity of this crisis has been confirmed by U.S. Treasury Secretary Janet Yellen. In Davos, she described the volatility in Japanese bonds as an astonishing "six standard deviations," which has already created "spillover effects" impacting the U.S. bond market. Although Japan's finance minister, Shunichi Suzuki, immediately called for the market to "stay calm," causing a brief retreat in the 40-year yield, analysts generally believe that mere verbal intervention cannot reverse this trend driven by structural imbalances and political uncertainty.

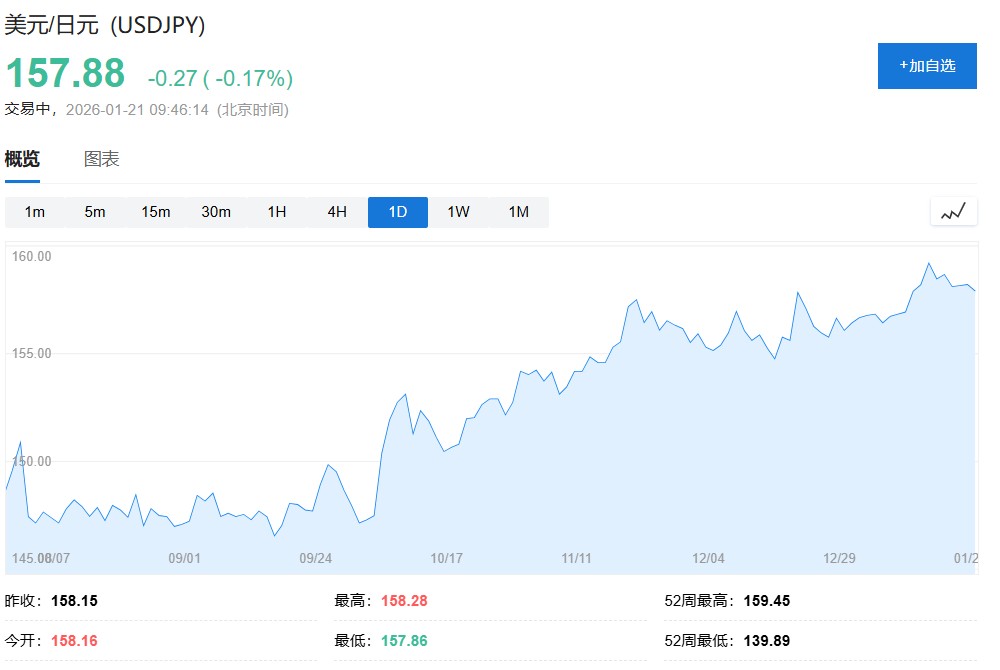

As panic spreads, analysts warn that if the decline deepens, the Bank of Japan may have no choice but to resort to its unlimited bond-buying tool for intervention. However, this "printing money to save the market" move is a double-edged sword—it can lower yields but is likely to severely impact the yen's exchange rate, pushing it below the critical psychological barrier of 160.

Goldman Sachs' Judgment: This is Not Emotional Overreaction, but "Structural Breakdown"

After a lukewarm response to the 20-year bond auction, Japanese government bonds faced a sell-off described by traders as "everyone, at all maturities, selling at once." The yields on 30-year and 40-year bonds jumped more than 25 basis points in a single day, with long-term rates briefly exceeding 4%.

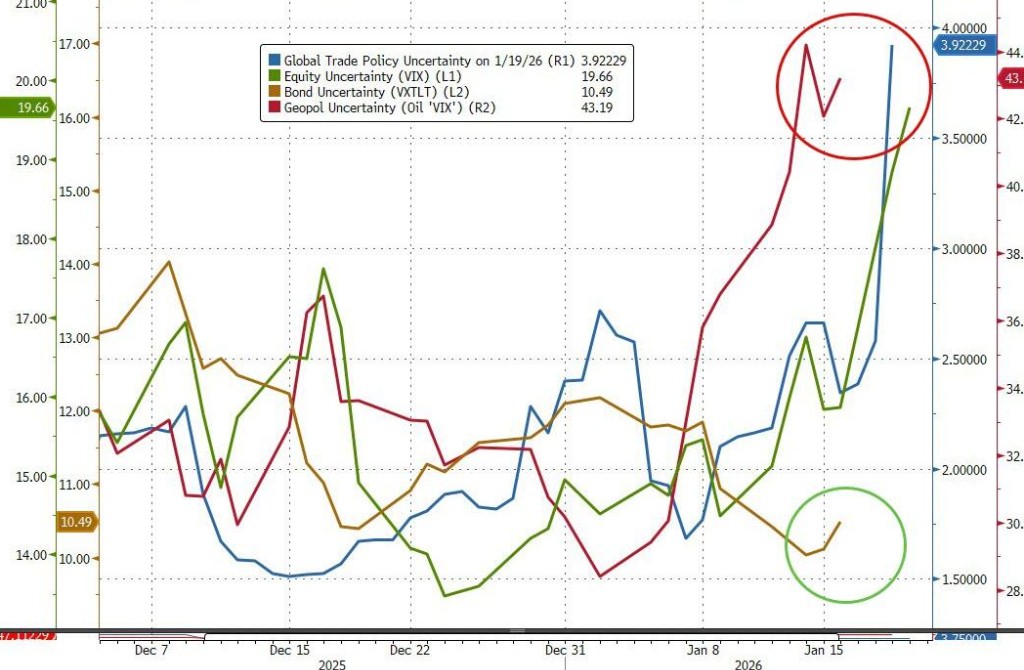

On the surface, the market has pointed fingers at Prime Minister Fumio Kishida's campaign promise to lower the food consumption tax without a clear source of funding. However, according to Rich Privorotsky, head of Goldman Sachs' Delta-One trading desk, this is not merely a simple external shock or a short-term emotional outburst, but a concentrated exposure of the structural issue of "lack of natural demand" in the Japanese government bond market over many years.

Goldman Sachs believes that the Japanese government bond market is in an extremely fragile state of supply-demand imbalance, a trend that is difficult to reverse and has been obscured until now, rapidly magnified under the stimulus of fiscal policy headlines.

The core of this market turmoil is not geopolitical but a limit test of Japan's fiscal capacity.

Goldman Sachs: Japan Faces a Dilemma, Central Bank Intervention May Be the Endgame

Faced with the pressure of the yield curve's back end breaking 4%, Rich Privorotsky pointed out in a report that Japan is facing two difficult choices:

-

Significant Spending Cuts: This is politically almost "toxic." Especially for Fumio Kishida, who hopes to gain a majority in the upcoming elections, she is trying to unify the campaign platform through tax cuts (such as suspending the food consumption tax) As Privorotsky rhetorically asked: "Who would be willing to pay taxes on food?"

-

The Bank of Japan is forced to return to YCC (Yield Curve Control): This is a high-risk option, especially for the yen exchange rate, but it feels like the "logical endgame."

Privorotsky pointed out that if Japan approaches the theoretical limit of its fiscal capacity, one side must make a concession. The former (cutting spending) seems hard to swallow, so the latter (central bank intervention) becomes the most likely path.

Gareth Berry, a strategist at Macquarie Bank in Singapore, stated: "If the sell-off continues, especially if it spreads globally, we should see the Bank of Japan re-enable its unlimited bond purchase tool."

The Cost of Exchange Rates: The 160 Defense Line is on the Brink

However, this intervention does not come without a cost.

Ryutaro Kimura, a senior fixed income strategist at AXA Investment Managers Ltd., warned: “If the Bank of Japan takes aggressive intervention measures to suppress interest rates, the USD/JPY exchange rate could at least break through the government's 160 defense line.”

Currently, the yen exchange rate hovers around 158, with growing market concerns about currency depreciation triggered by central bank intervention.

Goldman Sachs summarized that during fiscally dominated periods, governments often rely on inflation while central banks limit nominal interest rates, resulting in persistently low real rates and structurally weak currencies. This seems to be the script Japan is currently heading towards.

Why "Verbal Intervention" Can't Save Japanese Bonds: Market Pricing for the "Truss Moment"

This also explains why Japanese Finance Minister Shunichi Suzuki's "calm rhetoric" can only temporarily alleviate volatility but cannot reverse the trend. The Ministry of Finance can emphasize the scale of deficits, debt structure, and medium- to long-term plans, but it cannot change one reality: the market is no longer willing to unconditionally buy long-term Japanese bonds.

Data shows that Japanese life insurance companies were net sellers of Japanese government bonds in December, further exacerbating market concerns about the lack of "natural demand." Colin Finlayson, an investment manager at Aegon Asset Management, stated: "Long-term bonds have almost no natural demand, and it's hard to see anything supporting Japanese government bonds in the short term."

The judgments of several institutions echo Goldman Sachs:

-

Ultra-long-term Japanese bonds "lack natural demand";

-

Without official intervention, selling pressure is unlikely to spontaneously dissipate;

-

A certain form of policy "circuit breaker" may be inevitable.

As the February 8th election approaches, market panic is further escalating. Investors are concerned that high-profile early-stage aggressive fiscal stimulus plans may trigger a "Truss moment" similar to that of the UK in 2022.

UBS traders pointed out that if the Bank of Japan is forced to follow fiscal policy for expansion, it will find itself in a dilemma between bond yields and currency exchange rates. This is no longer just a fluctuation in a single market, but a repricing of policy credibility.

"Essentially, the market is pricing in Japan's Truss moment," said Masahiko Loo, a senior fixed income strategist at State Street Investment Management