Bottom-fishing moment for Apple? Goldman Sachs: Super upgrade cycle + Siri reshaping, iPhone remains the preferred hardware entry point in the AI era

Goldman Sachs holds an optimistic view on Apple's upcoming F1Q26 financial report, expecting iPhone revenue to grow by 13%. Analysts emphasize that this is due to the continuation of Apple's iPhone upgrade cycle, the anticipated launch of foldable smartphones, and the implementation of AI features. The key now is to ignore short-term noise and focus on Apple's strong pricing power and the resilience of its services business. In the face of external concerns about memory chip costs, Goldman Sachs expects Apple to offset cost pressures through supply chain management, product redesign, and price increases

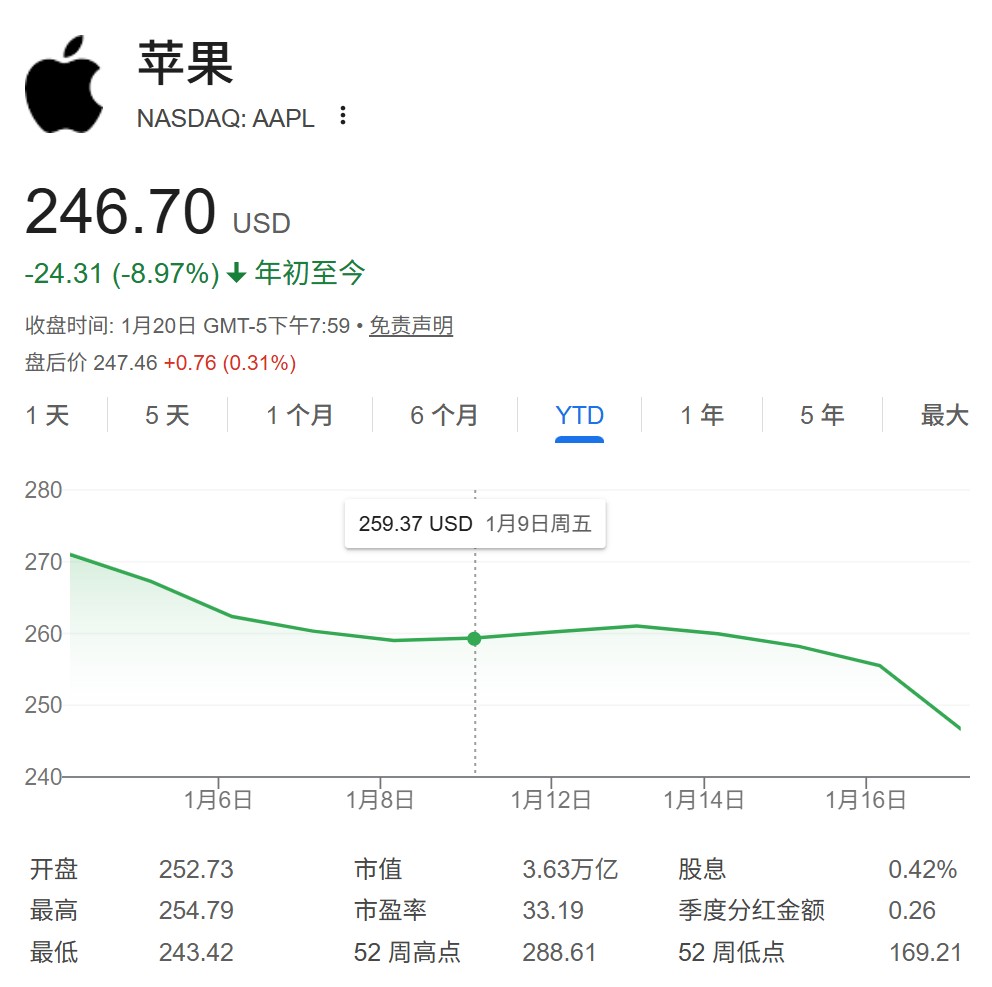

Despite Apple's stock price falling 5% in early 2026 due to commodity cost inflation and concerns over the App Store, Goldman Sachs believes this is a buying opportunity.

According to information from the Wind Trading Desk, Goldman Sachs maintained its "Buy" rating on Apple with a target price of $320 in a report dated January 20. Analysts emphasized that considering the continuation of the iPhone replacement cycle, the anticipated launch of foldable phones, and the implementation of AI features, the key now is to ignore short-term noise and focus on Apple's strong pricing power and the resilience of its services business.

iPhone Revenue Soars 13%, Foldable Phones and AI to Continue the Super Cycle

Goldman Sachs holds an optimistic view on the upcoming F1Q26 earnings report, expecting Apple to deliver results that exceed market expectations.

The report predicts that Apple's revenue for the quarter will reach $137.4 billion, a year-on-year increase of 11%. The most notable aspect is the strong performance of the iPhone business, with expected revenue reaching $78 billion, a year-on-year increase of 13%.

This growth is driven by two main factors: a 5% year-on-year increase in sales (with an astonishing 26% increase in shipments in China) and an 8% year-on-year increase in average selling price (ASP).

Goldman Sachs pointed out that demand for the iPhone 17 series is outperforming previous models, and the future product pipeline will further support this growth momentum. It is expected that Apple will launch the highly anticipated foldable iPhone (iPhone Fold) in the fall of 2026, and the iPhone 18 base model and iPhone Air 2 will be released in the spring of 2027. This shift to a "twice a year" release cycle, combined with software upgrades to iOS and Siri 2.0, will effectively sustain the replacement craze.

Additionally, Apple's collaboration with Google Gemini on Siri also demonstrates to the market that the iPhone remains the preferred terminal for consumers accessing AI tools, alleviating competitive concerns.

Concerns Over Soaring Storage Costs: In the Worst Case, Gross Margin Could Be Severely Impacted, But Apple Has the Ability to Mitigate

Currently, the biggest point of contention in the market is the erosion of Apple's profit margins due to storage cost inflation.

Global shortages of DRAM and NAND have led to skyrocketing prices, with industry reports indicating that the cost of a 12GB LPDDR5X RAM chip has surged from $30 to $70.

Goldman Sachs' stress test model shows that in a "worst-case" scenario without any mitigation measures, if storage costs rise by 120%-140%, Apple's product gross margin could decline by 8 to 10 percentage points, with overall gross margin dropping by 6 to 7 percentage points.

However, Goldman Sachs emphasizes that this is merely a theoretical risk.

**In reality, Apple possesses strong defensive capabilities due to its large purchasing scale and long-term supply agreements. Even though long-term agreements are nearing expiration, Apple can still offset cost pressures through supply chain management, product redesign, and price increases. Compared to lower-margin competitors, as a premium brand, Apple is better positioned to absorb these costs without suffering severe impacts like low-cost competitors **

Service business grows 14%, App Store slowdown does not affect overall situation

Although revenue growth from the App Store is expected to slow to 7% in F1Q26, this is not enough to shake the overall growth logic of the service business.

Goldman Sachs predicts that Apple's service revenue will grow 14% year-on-year, reaching $30 billion. This growth is mainly driven by strong momentum in other categories, including Traffic Acquisition Costs (TAC), iCloud+, AppleCare+, and subscription services.

Investor concerns about the App Store are mainly focused on third-party payment diversion and macroeconomic impacts, but Goldman Sachs believes that iCloud+ will continue to expand with the increasing demand for data storage (driven by AI capabilities and higher quality media), and the rise in subscription prices for Apple TV+ will also support revenue. Additionally, the improvement in Google search traffic supports long-term growth in TAC revenue, demonstrating the stickiness of browser searches compared to AI chatbots.

Valuation premium is reasonable

From a valuation perspective, Apple's current expected price-to-earnings (P/E) ratio is about 30 times, and Goldman Sachs believes that its stable earnings growth is sufficient to support this valuation premium.

For the F1Q26 quarter, Goldman Sachs predicts earnings per share (EPS) of $2.66, in line with market consensus. The gross margin is expected to be 47.7%, at the midpoint of the company's guidance range (47%-48%), which has already accounted for approximately $1.4 billion in tariff-related costs.

Looking ahead to F2Q26 (March quarter), Goldman Sachs expects revenue to reach $104.4 billion, with gross margin rising to 49.1%, above the market expectation of 47.7%.

With the continued strong sales of the iPhone 17 series and the scale effects of the service business, Apple is expected to continue achieving robust financial returns while maintaining high shareholder returns (over $110 billion in buybacks and dividends in fiscal year 2024)