摩根大通:欧洲不大可能大举抛售美债,下一阶段关键变量在技术面

摩根大通認為,市場對歐洲會因貿易爭端而報復性拋售美債的擔憂過度了。報告指出,歐洲持有的美債主要為私人資產,政府難以強令拋售,且當前市場久期倉位已很低,缺乏類似去年 4 月因擁擠平倉導致收益率飆升的基礎。不過,在戰術上仍需對技術面破位保持警惕。

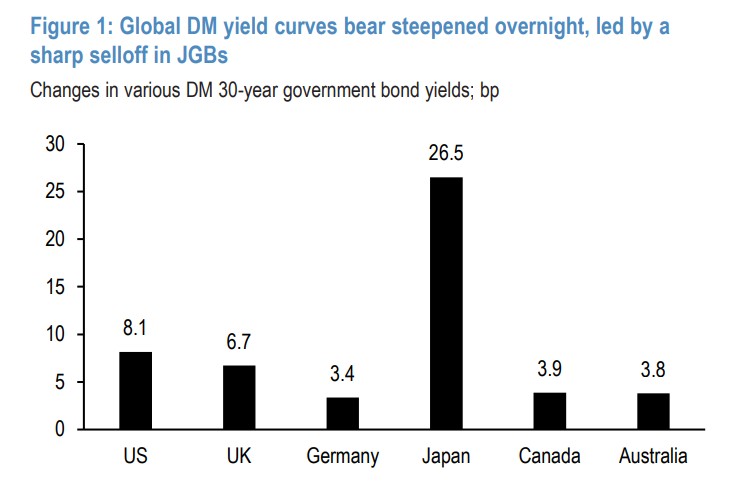

全球債券市場正經歷着劇烈的波動,一方面,日本政壇的突變導致日債收益率飆升,帶動全球收益率曲線陡峭化;另一方面,特朗普總統關於格陵蘭島的關税威脅引發了市場對 “去美元化” 和歐洲報復性拋售美債的恐慌。

據追風交易台,1 月 20 日,摩根大通在最新報告中發出了與市場恐慌情緒截然不同的聲音。該行認為,儘管地緣政治緊張局勢升級,但歐洲國家像亞洲央行那樣大規模拋售美債作為報復的可能性微乎其微。

這背後的關鍵邏輯在於美債持有者的結構性差異以及當前更為健康的投資者倉位。對於投資者而言,這意味着不必過度恐慌於 “末日拋售” 的情景,但需要在戰術上保持謹慎。摩根大通建議投資者此時應獲利了結 10 年期/30 年期美債收益率曲線的平坦化交易,並警惕 5 年期美債收益率已經在這個關鍵點位出現的技術性破位。

歐洲手中美債多為 “私產”,政府難以強令拋售

市場目前最大的擔憂源於特朗普總統週末的威脅:對任何反對美國接管格陵蘭島的國家徵收 10% 的關税,並在 6 月 1 日逐步提高至 25%。這種極端的貿易保護主義言論讓人回想起此前的 “解放日” 聲明,市場參與者開始瘋狂猜測歐洲國家是否會拋售其持有的鉅額美債進行報復。

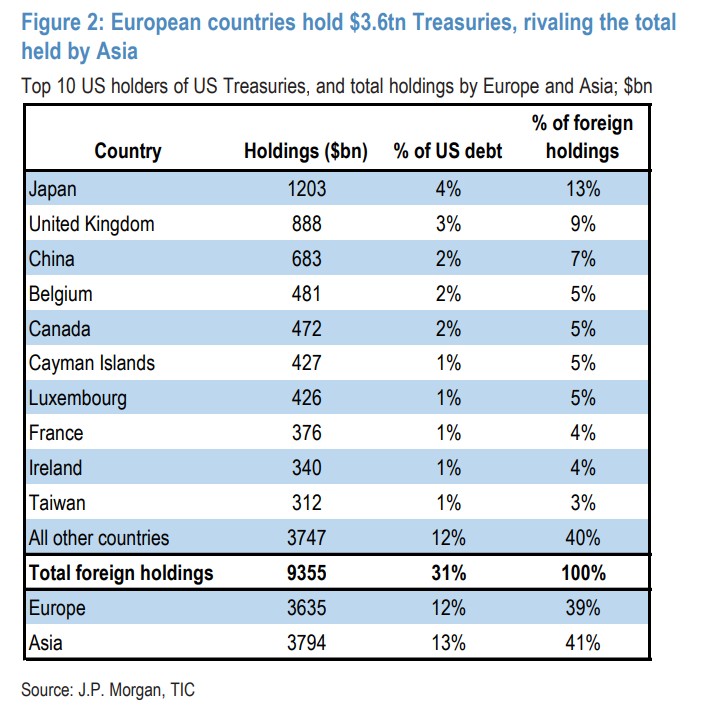

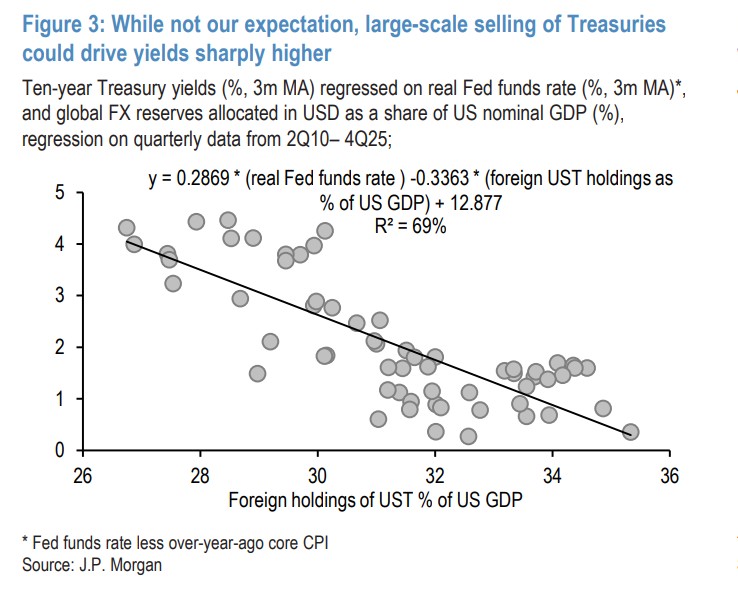

畢竟,數據顯示歐洲國家總共持有 3.8 萬億美元的美國國債,這一規模足以與亞洲國家的持有量相匹敵。摩根大通的模型顯示,如果外國持有的美債佔美國 GDP 的比例每下降 1 個百分點(約 3000 億美元),5 年期美債收益率往往會上升超過 33 個基點。

但是,摩根大通在其分析中指出了這一恐慌邏輯的致命缺陷。該行認為,亞洲和歐洲持有美債的性質存在根本差異。中國和日本合計擁有超過 4.5 萬億美元的儲備資產,其美債持倉主要反映了官方(政府)的意志。相比之下,歐洲的官方儲備規模要小得多。、

摩根大通判斷,歐洲持有的美債主要集中在私人手中。雖然比利時、盧森堡等國在數據上顯示持有大量美債,但這些小國作為全球資金中心,其持倉很大一部分是外部實體的託管賬户。因此,歐洲各國政府根本沒有能力像亞洲國家那樣,通過行政命令強迫私人部門重新配置資產並拋售美債。基於此,摩根大通認為所謂 “去美元化” 引發收益率飆升的風險被市場高估了。

倉位極度 “輕盈”,市場技術面好於去年四月

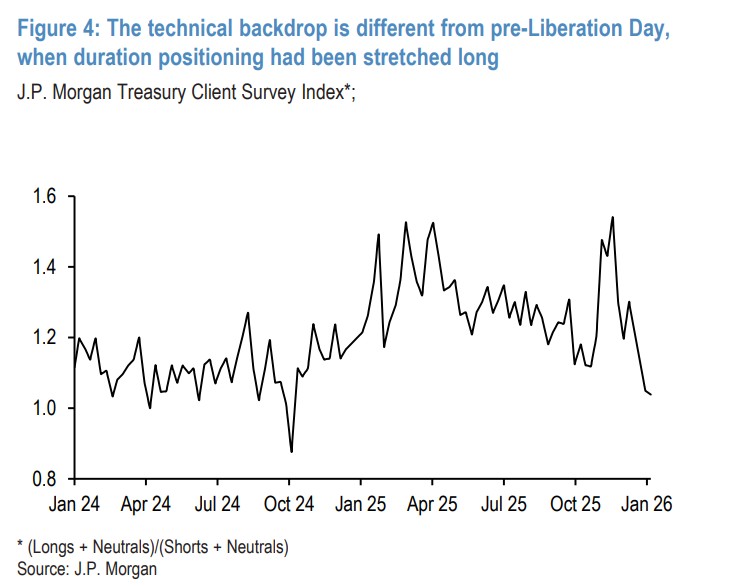

除了持倉結構,摩根大通認為當前的技術面背景也為美債市場提供了一層保護墊。在此前的 “解放日” 衝擊前,市場普遍擔憂經濟衰退,導致投資者在久期上過度做多,倉位極度擁擠。當風向從衰退轉為滯脹擔憂時,這種擁擠的多頭倉位引發了踩踏式的平倉,導致長端收益率飆升。

而在當前環境下,情況完全不同。摩根大通的國債客户調查指數顯示,投資者的久期倉位正處於過去兩年來的最低水平附近,比一年平均水平低了兩個標準差以上。

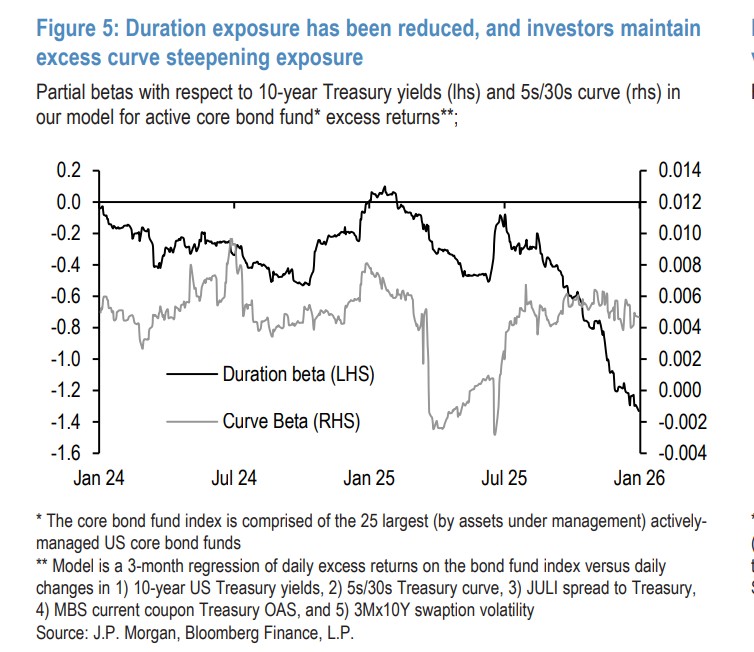

該行的核心債券基金模型也發出了類似信號,久期貝塔值在 1 年期的 Z 分數基礎上接近-2。這意味着,市場目前並沒有大規模的多頭頭寸需要平倉。摩根大通指出,主動型核心債券基金目前相對於基準維持了顯著的曲線陡峭化敞口,這進一步限制了投資者削減長端敞口的風險。簡而言之,市場已經提前 “防禦” 了,這使得收益率進一步大幅飆升的動能減弱。

戰術調整:獲利了結平坦化交易,並在 20 年期國債拍賣前保持警惕

儘管基本面分析並不支持恐慌性拋售,但摩根大通在交易策略上選擇了更為穩健的戰術。

該行宣佈解除其 10 年期/30 年期美債收益率曲線平坦化交易,並獲得小幅收益。摩根大通此前在 1 月初發起這筆交易,理由是長端曲線過度陡峭。雖然曲線隨後出現了一定程度的均值迴歸,但目前仍比該行的公允價值模型高出約 6 個基點。

摩根大通認為,考慮到日本國債市場的波動性在 2 月 8 日大選前可能持續高企,加上圍繞格陵蘭島的政治風險難以迅速消退,繼續持有空頭敞口的風險回報比已經不再具有吸引力,因此建議轉向中性。

此外,摩根大通對即將進行的 130 億美元 20 年期國債續發拍賣持謹慎態度。儘管收益率已經隨大市走高,但從相對價值來看,20 年期美債在控制了利率水平和曲線形狀後,估值依然顯得昂貴(超過 1 個標準差)。

鑑於投資經理在 12 月的拍賣中需求大幅下降,以及當前缺乏吸引力的估值,摩根大通預計市場需要一定的折價才能順利消化這批供應。

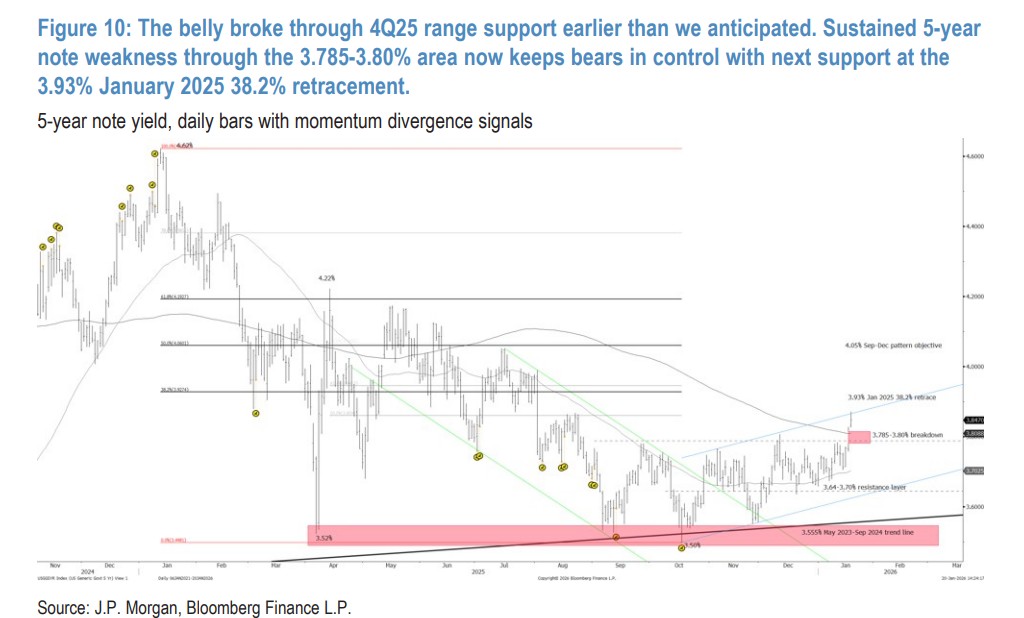

最後,摩根大通對技術圖形發出了嚴厲的警告。該行技術分析指出,5 年期美債收益率已經跌破了關鍵的支撐區域(3.785-3.80%),這一破位發生的時間比該行預期的更早。摩根大通強調,這次破位意味着空頭已經完全掌控了局勢。隨着這一關鍵防線的失守,5 年期美債收益率的下一個有意義的支撐位將直接指向 3.93%,即 2025 年 1 月行情的 38.2% 回撤位。只要市場價格無法重新收復 3.785-3.80% 的失地,看跌的趨勢動能就將保持完好。