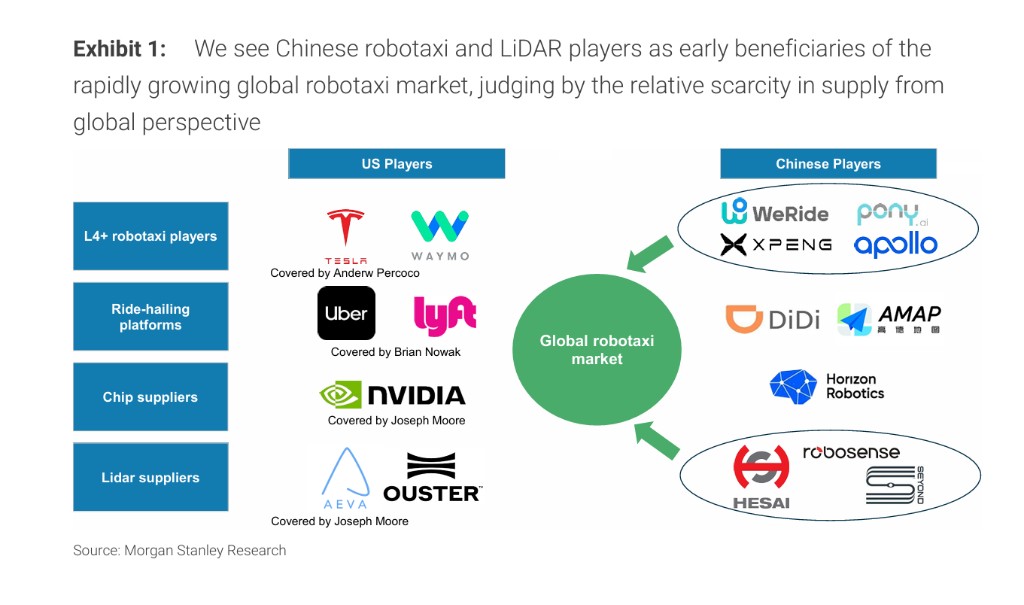

China's supply chain determines the winner of the global Robotaxi competition!

摩根士丹利認為,中國供應鏈憑藉成本降幅達 30% 及上市提速 40% 的絕對優勢,將成為全球 L4+ 自動駕駛的關鍵賦能者,尤其在硬件和激光雷達等領域。該行預測,受政策支持與技術競賽驅動,中國 Robotaxi 銷量未來五年複合增長率有望超 70%。

摩根士丹利最新研究顯示,在全球科技競賽推動下,中國自動駕駛監管支持力度將加強,路上運營的 Robotaxi 數量有望增長兩倍,中國供應鏈企業將憑藉成本和效率優勢成為早期受益者。

據追風交易台消息,該行分析師 Tim Hsiao 在 21 日發佈的預計,中國Robotaxi銷量未來五年複合增長率將超過 70%,且上行風險大於下行風險。中美兩國的 Robotaxi 生態系統已通過更完善的產業鏈在全球 L4+ 自動駕駛領域確立領先地位。

從全球市場看,出租車和網約車平台上的 1000 萬至 1500 萬輛活躍車輛每天提供超過 7000 萬次出行服務。扣除美中本土企業長期主導的 40% 市場份額,剩餘 60% 的全球市場——特別是司機成本高昂的發展中市場——將成為戰略高地。中東逾 12 萬輛出租車和網約車構成重要機遇,歐洲和新加坡等東盟市場則可能從 L4+ 技術普及中獲得最顯著收益。

摩根士丹利認為,從全球供應稀缺性角度看,中國硬件製造商——尤其是 Robotaxi 和激光雷達企業——將是早期受益者。

時間窗口決定市場格局

摩根士丹利強調,搶佔市場的時機至關重要。主要 Robotaxi 企業不僅希望在本土市場站穩腳跟,更渴望進軍全球市場。

該行指出,能夠率先從全球出租車和網約車平台 1500 萬輛車中前 1% 的車輛移除司機的企業,市值可能實現數倍增長,而第二批入場者則容易陷入同質化競爭。這種"贏家通吃"的市場特徵,正驅動全球主要 Robotaxi 企業加速佈局。

除中國和美國這兩個本土企業將長期佔據主導地位的市場外,剩餘 60% 的全球市場份額成為各方爭奪焦點。發展中市場的司機成本普遍較高,為自動駕駛技術提供了更強的經濟激勵。

中國供應鏈優勢凸顯

在技術進步之外,追求成本效益和可規模化運營正成為更艱鉅的挑戰。摩根士丹利研究顯示,雖然提高車輛利用率和降低運營成本需要與當地合作伙伴建立戰略聯盟,但持續降低物料清單 (BoM) 成本和快速擴張仍將嚴重依賴中國解決方案。

據該行估算,中國供應鏈可節省約 40% 的上市時間和 30% 的成本。到 2026 年,中國方案的成本優勢可達 3 萬至 3.5 萬美元。這種成本和效率優勢,使得全球 Robotaxi 企業為搶佔市場潛力和單位經濟效益,將越來越多地與中國供應鏈合作,將其視為實現 L4+ 自動駕駛的關鍵推動力。

摩根士丹利認為,物料成本的持續下降和快速規模化擴張能力,是中國供應鏈企業的核心競爭力所在。

基於全球供應相對稀缺的判斷,摩根士丹利認為中國硬件製造商將率先受益,其中 Robotaxi 和激光雷達企業尤為突出。

該行認為,禾賽科技和文遠知行有望在競爭中脱穎而出。從中國本土起步迅速登上國際舞台,正成為中國自動駕駛企業的發展路徑。