AI demand is realized but supply will reach a "lowest point," Intel's Q1 guidance is disappointing, and it plummeted over 10% in after-hours trading | Earnings Report Insights

Q4 英特爾營收同比降 4% 仍高於分析師預期,EPS 增 15% 大超預期,數據中心和 AI 業務收入超預期增 9%;當季完成向英偉達售股 50 億美元;18A 成首個在美量產的領先製程節點。CEO 稱需求 “相當強勁”,公司 Q4 用盡大部分庫存,而製造良率未達標準;打造代工業務需時間,代工客户將下半年做決定,公司重建將耗時多年;CFO 稱,Q1 指引疲軟部分源於 “未滿足季節性需求所需的供應”,供應問題 Q1 將達峯值,Q2 及之後會改善;下半年將出現 14A 技術客户。

英特爾去年第四季度的總營收和調整後 EPS 盈利均強於預期,人工智能(AI)相關業務實現中高個位數增長,驗證了 AI Agent 推動服務器 CPU 需求回暖的判斷,但公司因供應瓶頸給出了疲軟的一季度指引,導致股價盤後大跌。

財報顯示,四季度英特爾的營收同比由增轉降,但沒有華爾街預期的下滑嚴重,得益於數據中心與 AI(DCAI)業務收入同比大增 9%,抵消了個人電腦(PC)業務加速下滑的影響。一季度英特爾從營收到利潤端的指引均低於市場預期。

財報揭示了英特爾當前最核心的矛盾——需求正在抬頭,而供給成為約束變量。英特爾管理層表示,一季度可供貨量將降至低點,二季度才會逐步改善。這一判斷與摩根士丹利在前瞻中提出的 “產能瓶頸是雙刃劍” 觀點吻合。

評論認為,英特爾正在努力恢復技術優勢,但製造良率問題成為最新的挫折,英特爾面臨執行方面的挑戰。

英特爾 CEO 陳立武在接受採訪時表示,需求 “相當強勁”,但公司正艱難應對製造良率問題,“我們的良率和生產製造未達到我的標準,我們需要改進。” 他透露,公司在四季度用盡了大部分庫存,並在業績電話會上表示,打造代工業務需時間,代工客户將下半年做決定,公司重建將耗時多年。

英特爾首席財務官 David Zinsner 指出,一季度的供應將跌至 “最低點”,“第二季度及之後會有所改善”。Zinsner 告訴媒體,公司的一季度指引疲軟部分源於 “未滿足季節性需求所需的供應”,並指出供應問題將在一季度達到峯值。

公司業績和指引公佈後,週四小幅收漲 0.1% 的英特爾股價盤後跳水,財報發佈後不久,盤後已跌超 4%,此後持續下行,盤後跌幅擴大到 10% 以上。

截至本週四收盤,英特爾股價連續兩日創 2022 年 1 月以來新高,進入 2026 年以來已累漲約 47%,過去 12 個月累漲近 150%。這一強勁走勢主要源於數據中心業務的樂觀預期,以及陳立武去年 3 月上任以來激進改革措施的市場認可,美國政府、英偉達和軟銀的高調投資也推動了股價。

去年英特爾與英偉達達成協議,將共同開發面向超大規模數據中心、企業級和消費級產品市場的多代定製數據中心和 PC 產品,英偉達還同意斥資 50 億美元買入英特爾普通股。本次英特爾財報披露,四季度已完成向英偉達出售 50 億美元普通股的交易。

美東時間 1 月 22 日週四美股盤後,英特爾公佈 2025 年第四季度財務數據和 2026 年第一季度業績指引。

1)主要財務數據:

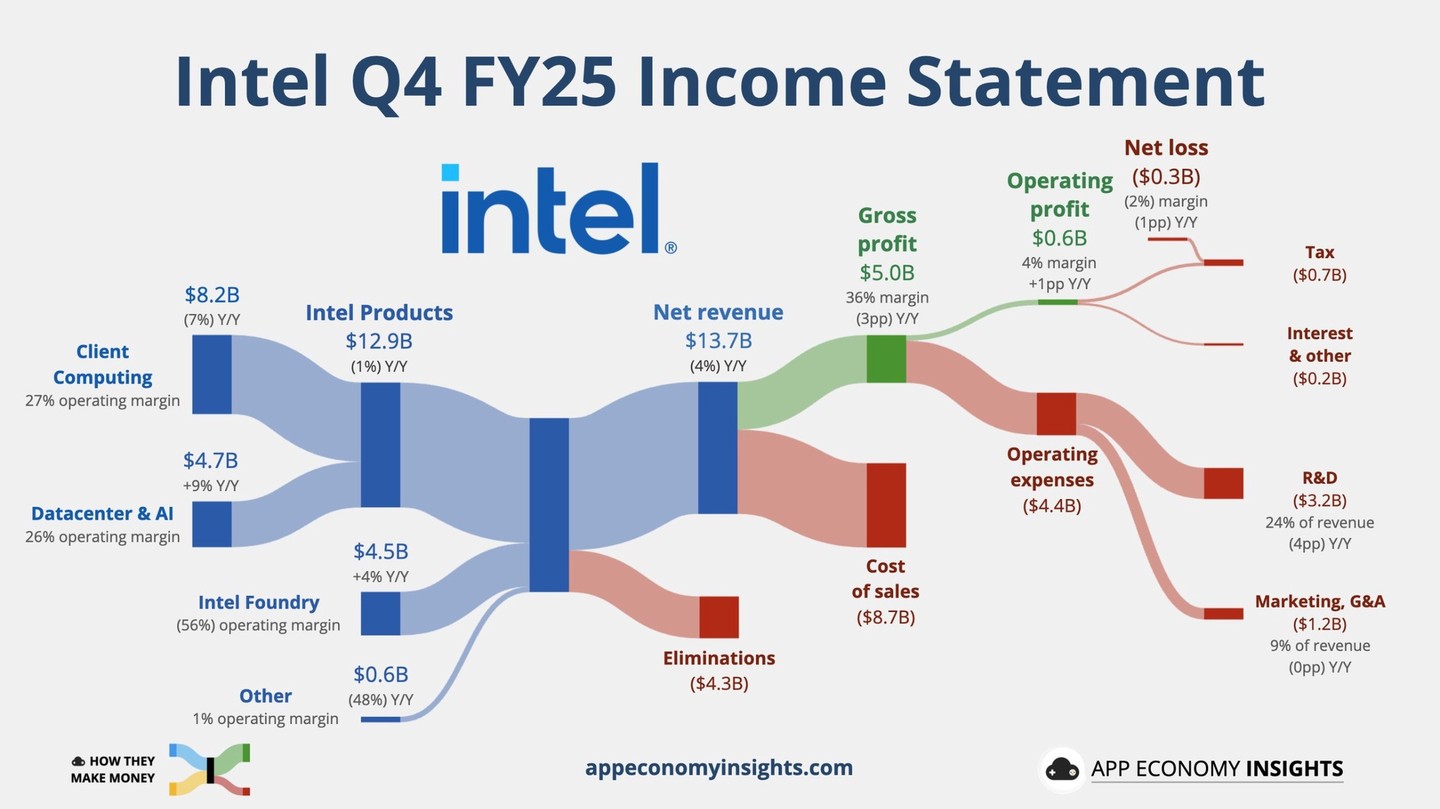

營收:四季度營收 136.7 億美元,同比下降 4.1%,分析師預期 134.3 億美元,英特爾指引為 128 億至 138 億美元,三季度同比增長 3%。

EPS:四季度非 GAAP 口徑下調整後每股收益(EPS)為 0.15 美元,同比增長 15.4%,分析師預期 0.087 美元,英特爾指引為 0.08 美元,三季度 EPS 為 0.23 美元。

毛利率:四季度調整後毛利率為 37.9%,分析師預期 36.5%,英特爾指引為 36.5%,三季度為 40.0%,上年同期為 42.1%。

營業利潤率:四季度調整後營業利潤率為 8.8%,分析師預計 6.29%,三季度為 11.2%,上年同期為 9.6%。

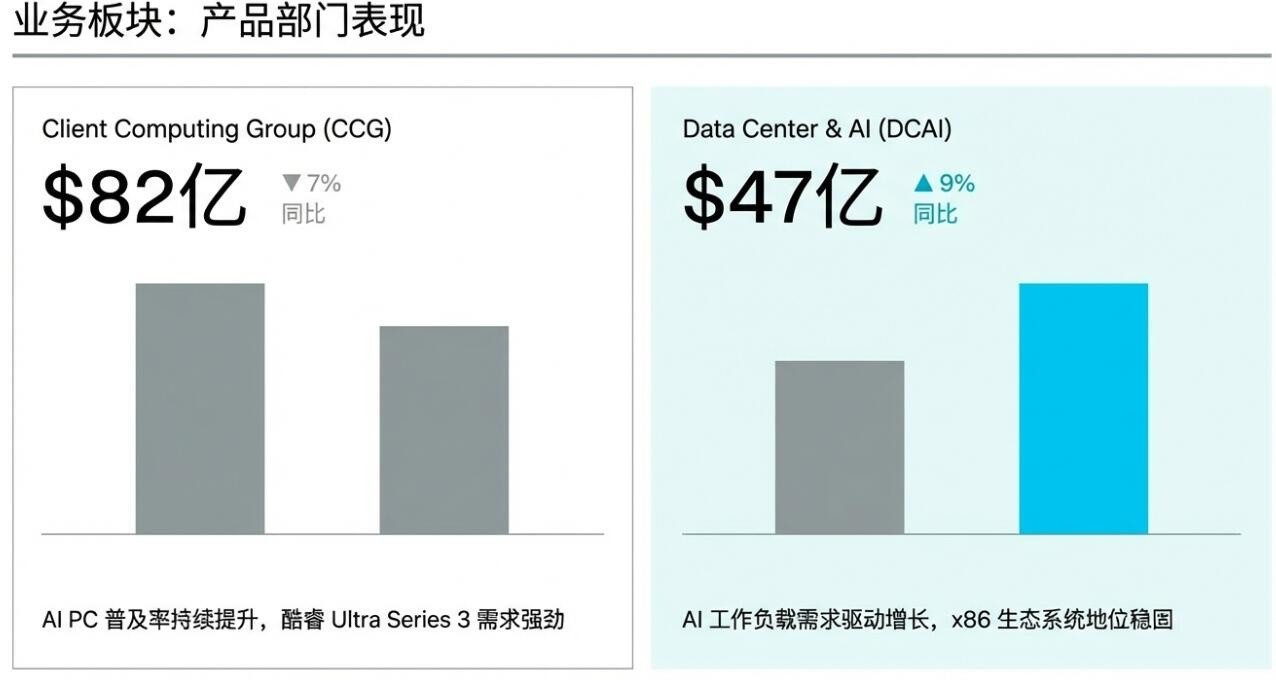

2)細分業務數據:

CCG:客户計算業務(CCG)四季度營收 81.9 億美元,同比下降 6.6%,分析師預期 83 億美元,三季度同比增長 5%

DCAI:數據中心和人工智能(DCAI)四季度營收 47.4 億美元,同比增長 8.9%,分析師預期 44.2 億美元,三季度同比下降 1%。

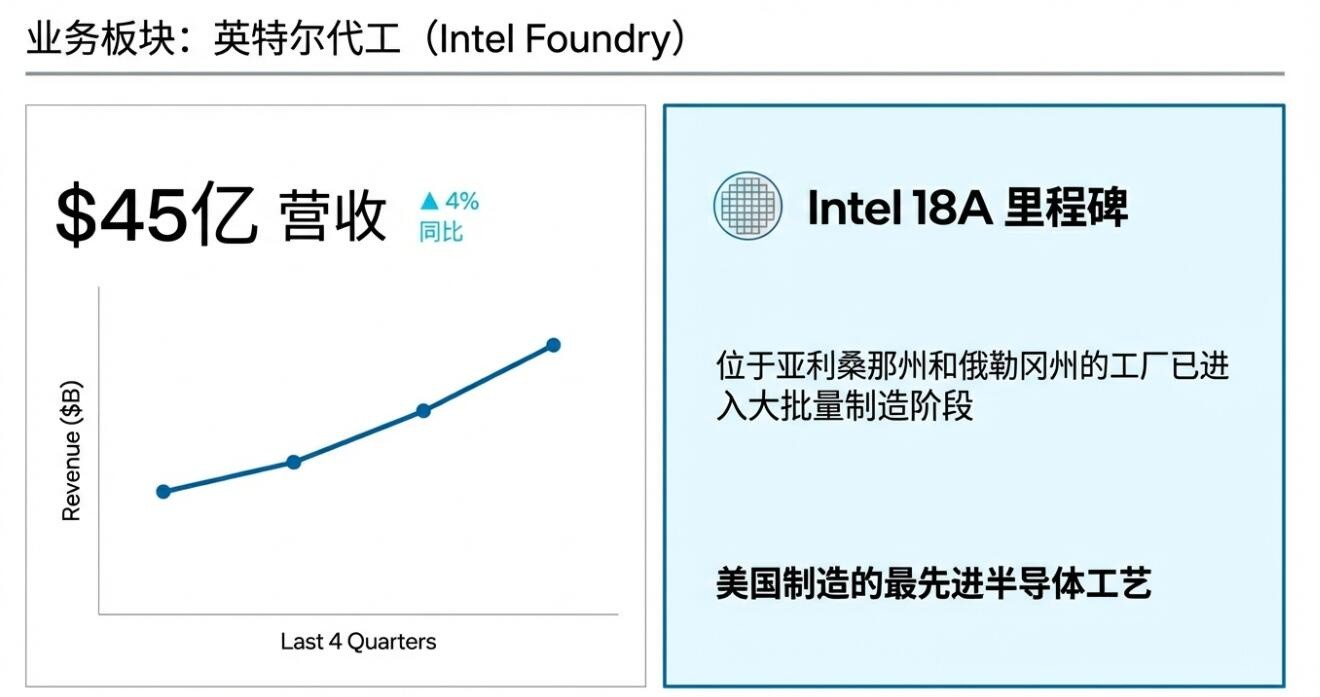

代工:代工業務(Intel Foundry)四季度營收 45.1 億美元,同比增長 3.8%,分析師預期 43.6 億美元,三季度同比下降 2%。

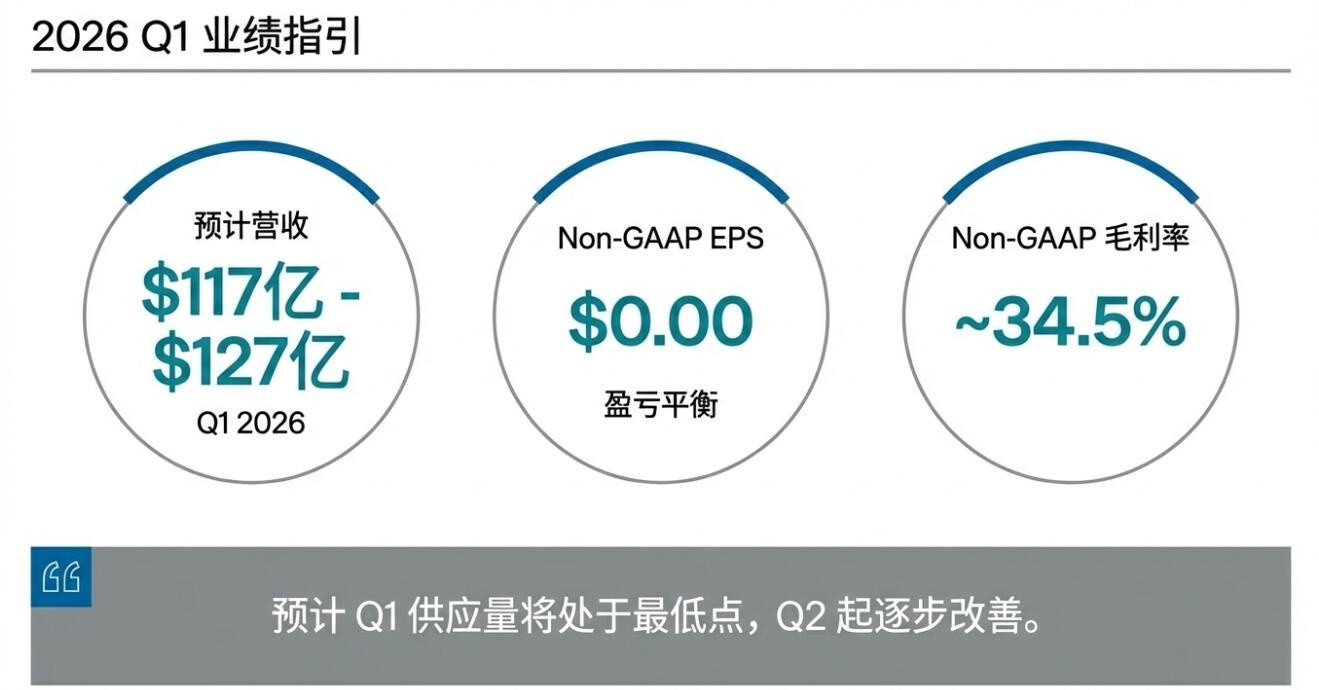

3)業績指引:

營收:預計一季度營收 117 億至 127 億美元,分析師預期 125.6 億美元。

EPS:預計一季度調整後 EPS 為零,分析師預期 0.08 美元。

毛利率:預計一季度調整後毛利潤率 34.5%,分析師預期 36.5%。

四季度業績強於預期但仍現虧損

英特爾第四季度營收下降 4.1% 至 137 億美元,略高於分析師平均預期的近 134 億美元。調整後 EPS 為 0.15 美元,較分析師預期的將近 0.09 美元高將近 82.3%。但公司出現淨虧損 6 億美元,合每股虧損 12 美分,去年同期淨虧損為 1 億美元。

分業務部門來看,客户端計算業務(CCG)營收將近 82 億美元,略低於分析師預期的 83 億美元。數據中心和 AI 業務(DCAI)營收 47 億美元,超過預期的 44 億美元,同比增長 9%。英特爾代工服務部門營收 45 億美元,同比增長 3.8%,該部門目前幾乎完全依賴英特爾產品部門的訂單。

陳立武在財報聲明中表示:“我們的優先事項很明確:提升執行力,重振工程卓越性,充分利用 AI 在我們所有業務中帶來的巨大機遇。” 他在本月的 CES 展會上強調,英特爾的 CPU 因 AI 系統建設而變得更加重要。

雖然四季度總體表現優於市場預期,但英特爾 2025 年全年營收 530 億美元,仍較 2021 年創下的峯值營收低約 250 億美元。公司在本月早些時候宣佈基於 Panther Lake 設計的處理器現已在設備中提供,這是採用 18A 製程的首批產品。

供應瓶頸拖累一季度指引

業績指引顯示,英特爾預計的一季度營收區間中值為 122 億美元,低於分析師預計的將近 126 億美元;預計一季度 EPS 為零,而分析師預計 0.08 美元;預計調整後毛利率為 34.5%,低於分析師預期的 36.5%。公司預計調整後運營支出約 160 億美元,高於預期的 159.3 億美元。

英特爾將一季度指引疲軟主要歸咎於製造良率問題導致的供應短缺。陳立武在採訪中表示,公司正在努力解決製造問題,但在四季度用盡了大部分庫存。陳立武説:

“歸根結底,英特爾面臨的是執行力挑戰。我們作為團隊正在集中精力改進這一點。坦率地説,就是我們的執行力需要提高。”

製造良率是指工廠生產出的可用芯片所佔百分比,這一指標直接影響產能和成本。供應短缺使得英特爾難以滿足客户需求,錯失了 AI 相關需求激增帶來的市場機會。

Zinsner 表示,公司下一代 14A 技術的客户將在今年下半年出現。他説,公司不太可能公開宣佈客户信息,“一旦我們獲得客户,我們就需要開始真正在 14A 方面投入資本,這樣你們就會知道了。”

英特爾管理層將壓力明確歸因於供給而非需求,並預計二季度開始逐步改善。這一表態與華爾街機構預計的一季度將為產能低點判斷高度一致。

對市場而言,這意味着短期財務表現或難以持續超預期,但若二季度供給改善兑現,英特爾的業績彈性仍有望釋放。

18A 戰略里程碑已至 經濟性仍待驗證

18A 是本次財報中被反覆強調的關鍵詞。英特爾宣佈,該工藝已在亞利桑那與俄勒岡實現高產量製造,成為首個在美國本土量產的領先製程節點。

從戰略層面看,這一進展意味着英特爾已從 “路線圖承諾” 走向 “實質交付”,也解釋了市場在財報前對其製程能力重新定價的原因。但從財務角度看,18A 仍處於投入期:良率爬坡、初期成本與產能限制,繼續對毛利率形成壓力。

這與華爾街機構對英特爾財報的前瞻判斷一致——18A 決定的是中長期競爭力,而非短期利潤彈性。真正的考驗,在於未來幾個季度能否同步改善良率、成本與外部客户信心。

代工業務收入改善 但 “信任問題” 仍未消除

代工業務四季度收入 45 億美元,同比增長 4%,全年收入增長 3%,在整體半導體行業分化的背景下展現出一定韌性。

同時,公司披露與英偉達完成 50 億美元股權交易,並在系統層面展開合作。這一動作在財報前已被市場視為 “戰略背書”,顯著改善了資產負債表。

但代工業務的核心挑戰仍未改變。財報顯示,該業務在經營層面仍處於虧損狀態;而當前產能緊張的現實,也使潛在外部客户對英特爾能否同時滿足 “自用 + 代工” 產生疑慮。這正是此前投行反覆強調的風險點。

總體看來,本次財報驗證了 AI 趨勢,但也暴露了英特爾所受的限制約束。AI Agent 需求確實正在推動服務器 CPU 回暖,18A 製程完成關鍵節點,代工業務開始具備資本與技術層面的支撐;但產能、良率與執行節奏,仍是決定英特爾能否將 “故事” 轉化為 “業績” 的核心變量。