Japan's foreign exchange chief: We are in close contact with the United States to address yen exchange rate fluctuations

Atsushi Mimura, the foreign exchange chief of Japan's Ministry of Finance, stated that Japan will closely cooperate with the U.S. when necessary, in accordance with the spirit of the joint statement by the Japanese and U.S. finance ministers last September, to continue to respond appropriately to exchange rate fluctuations. According to media reports, the New York Federal Reserve called major financial institutions last Friday to inquire about the USD/JPY exchange rate quotes at the direction of the U.S. Treasury

As the Japanese yen suddenly strengthened last Friday, with market speculation that Japanese and American authorities might intervene in the foreign exchange market together, Atsushi Mimura, the foreign exchange chief of Japan's Ministry of Finance, stated that Japanese authorities would closely coordinate with the U.S. authorities as needed to respond appropriately to fluctuations in the foreign exchange market.

According to Bloomberg, Mimura told reporters upon arriving at the Ministry of Finance on Monday morning that Japan would cooperate closely with the U.S. side as necessary, in accordance with the spirit of the joint statement by the Japanese and U.S. finance ministers in September last year, to continue responding appropriately to exchange rate fluctuations. He declined to comment on market speculation regarding authorities conducting exchange rate checks last Friday.

Japanese Prime Minister Sanae Takaichi stated on Sunday that Japan will "take all necessary measures" to address speculative and highly abnormal exchange rate fluctuations. Finance Minister Shunichi Suzuki also mentioned last Friday that authorities are monitoring exchange rate trends with a sense of urgency. These statements have reinforced market expectations that Japan may intervene in the foreign exchange market.

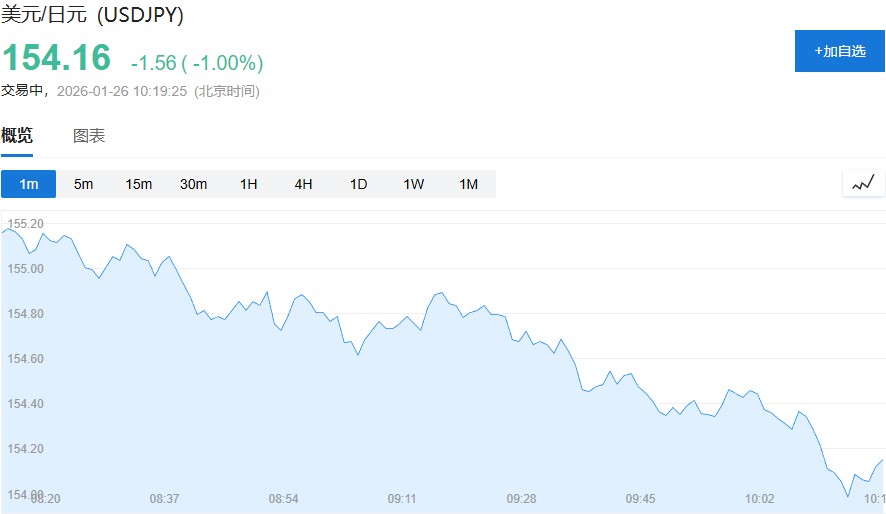

On Monday, the yen continued its upward trend, with traders remaining highly vigilant about the possibility of Japanese intervention. The yen rose nearly 1% at one point to 154.16 yen per dollar.

Last Friday's Yen Fluctuation Triggered Intervention Speculation

The yen strengthened during the New York session last Friday, following a sharp fluctuation within an hour after Bank of Japan Governor Kazuo Ueda's press conference. The Bank of Japan kept its benchmark interest rate unchanged that day.

According to Bloomberg, informed sources revealed that the New York Federal Reserve, under the direction of the U.S. Treasury, called major financial institutions last Friday to inquire about the dollar-yen exchange rate quotes.

This so-called "exchange rate check" is a practice where the central bank asks traders for currency quotes against the dollar. Although it does not involve actual yen trading, it can sometimes be a precursor to intervention actions. The market interpreted this as a signal that the Japanese and U.S. authorities were prepared to work together to curb the yen's decline, triggering a large-scale short covering of the yen.

Japan's Four Interventions Last Year Cost Nearly $100 Billion

Japanese authorities intervened in the foreign exchange market four times in 2024, spending nearly $100 billion to purchase yen when the yen depreciated beyond 160 yen per dollar. This action established a rough line for market participants, indicating the level at which the Ministry of Finance might intervene again.

In September last year, Japanese and U.S. finance officials reiterated their fundamental commitment in a joint statement to let the market determine exchange rates and not to use exchange rates as a competitive advantage. However, the statement also left room for intervention in specific circumstances, indicating that intervention should be reserved for addressing excessive or disorderly fluctuations in the foreign exchange market.

Market Vigilance on the Possibility of "Joint Intervention"

If the Federal Reserve intervenes to assist Japan in supporting the yen, it would mean that the intervention is no longer a unilateral action by Japan. Analysts point out that this potential expectation of joint intervention is reshaping investors' risk preferences and may even evoke associations with "Plaza Accord 2.0."

As the Bank of Japan faces dual pressures to maintain stability in the bond market and curb inflation, this potential exchange rate defense battle involving U.S. participation could have far-reaching impacts on the dollar, U.S. Treasuries, and global risk assets. The market is currently highly vigilant about the possibility of Japanese intervention