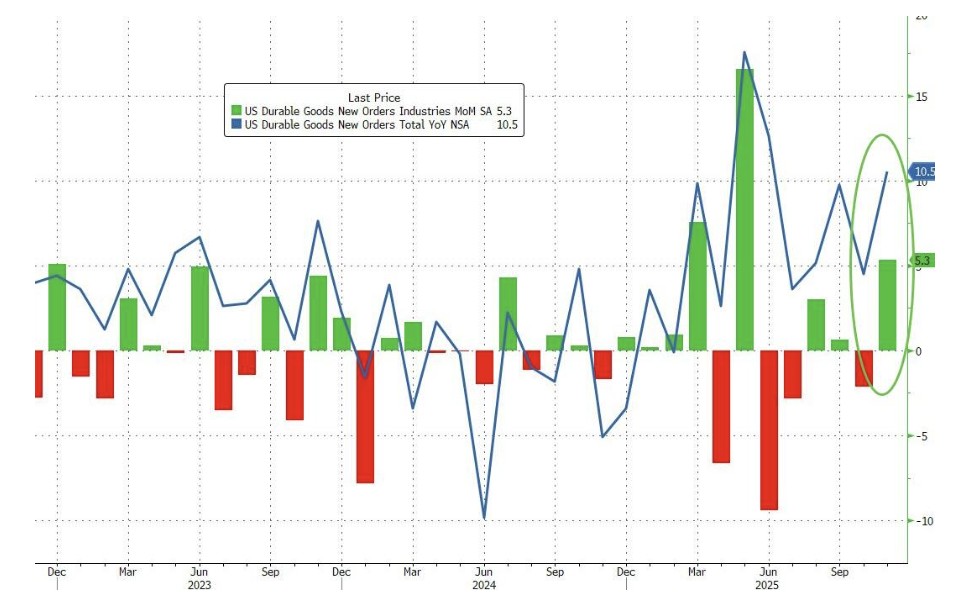

U.S. durable goods orders in November increased by 5.3% month-on-month, reversing the decline from the previous month and significantly exceeding expectations, marking the largest increase in six months

U.S. durable goods orders in November saw a significant month-on-month increase of 5.3%, marking the largest growth in nearly six months, far exceeding market expectations and reversing the decline from the previous month. The growth was primarily driven by a surge in orders for commercial aircraft, and core orders excluding transportation also rose for the eighth consecutive month, indicating a continued recovery in business equipment investment. Core capital goods orders increased by 0.7%, also better than expected, further confirming the improvement in manufacturing demand and the strengthening of corporate investment willingness. Although the data was delayed due to the government shutdown, it still provides a positive signal for economic momentum heading into the year-end

Driven by strong demand for commercial aircraft orders and other capital equipment, U.S. durable goods orders in November achieved the largest month-on-month increase in nearly six months.

On January 26, the U.S. Department of Commerce released data showing that November durable goods orders increased by 5.3% month-on-month, significantly higher than the market expectation of 3.8%, successfully reversing the previous decline of 2.2%.

Excluding transportation categories, core orders rose by 0.5% month-on-month, also exceeding expectations. This marks the eighth consecutive month of growth for this indicator, driving the year-on-year increase in overall equipment investment to 4.4%, the highest level since October 2022.

As a key barometer of corporate equipment investment willingness, core capital goods orders (excluding aircraft and defense-related capital hardware) increased by 0.7% month-on-month, outperforming market expectations.

Commercial Aircraft Orders Drive Overall Growth

The strong performance of U.S. durable goods orders in November was primarily driven by demand for commercial aviation. Data shows that non-defense aircraft and related parts orders surged significantly, becoming the core driver of overall order growth. In contrast, defense-related spending has declined, while automotive orders remained relatively stable, reflecting the structural characteristics of the order recovery.

Year-on-year, durable goods orders increased by 10.5%, marking the third highest growth rate since June 2022, indicating that manufacturing demand is gradually shaking off previous weakness. More notably, the continuous improvement in core order data: core orders excluding transportation equipment have risen month-on-month for eight consecutive months, demonstrating the sustainability of the recovery in corporate equipment investment. This category of orders is expected to drive equipment investment growth to 4.4%, the highest level since October 2022.

It should be noted that the release of this data was delayed compared to usual due to the previous federal government shutdown, reflecting the order situation in November, which has a certain lag. Nevertheless, the report still provides a key basis for assessing the momentum of U.S. manufacturing and economic resilience. Durable goods orders cover products with a lifespan of at least three years and are often seen as an important indicator of economic activity and corporate investment willingness. After a brief pullback in October, November orders rebounded significantly, providing strong support for year-end economic growth momentum