"The largest customer" has made concessions! Korean media reports that Samsung and SK Hynix will double the DRAM supply prices to Apple in the first quarter compared to the previous quarter

In the first quarter, the price of low-power DRAM supplied to Apple by Samsung and SK Hynix doubled compared to the previous quarter, with increases of over 80% and about 100%, respectively. This marks a concession forced upon Apple, its largest customer, breaking its practice of low-price procurement. Due to supply shortages, both parties only completed negotiations for the first half of the year, and with the release of new iPhone models in the second half of the year, prices may rise further

Samsung Electronics and SK Hynix have recently succeeded in raising the price of low-power DRAM supplied to Apple by nearly double compared to the previous quarter, marking a significant acceptance of price hikes by one of the world's largest smartphone manufacturers amid a tight memory supply situation. Analysts believe that this price adjustment breaks Apple's long-standing practice of obtaining low-priced memory due to its market position, highlighting the severity of the current supply-demand imbalance in the memory market.

On January 27, according to South Korean media zdnet, Samsung Electronics proposed a price increase of over 80% for LPDDR chips in negotiations with Apple, while SK Hynix's increase was about 100%. Apple shipped approximately 250 million iPhones last year, making it a key customer for LPDDR.

The report states that the surge in memory prices is driven by aggressive investments in AI infrastructure by global tech giants, leading to a spike in DRAM demand, while suppliers have shifted their production capacity towards HBM (High Bandwidth Memory), exacerbating the supply shortage. Market research firm TrendForce predicts that general DRAM prices will rise by 55-60% quarter-on-quarter in the first quarter.

According to reports, industry insiders revealed that Apple typically signs long-term memory agreements each year, but due to the current memory crisis, it has only completed price negotiations for the first half of this year. With the launch of new products like the iPhone 18 in the second half of the year, prices may rise further.

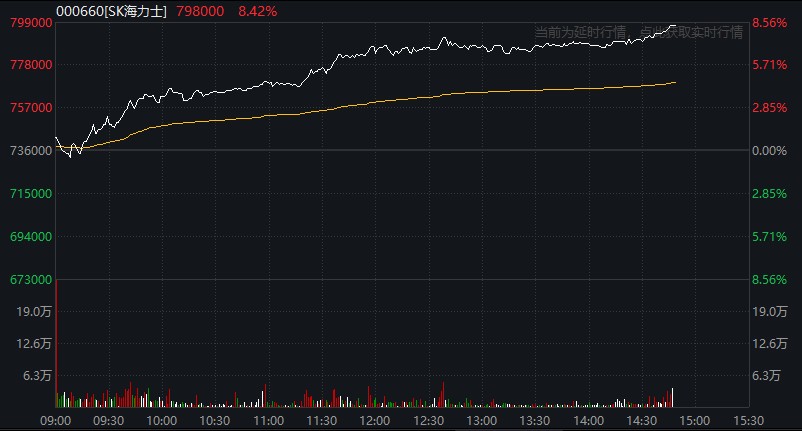

After the news broke, SK Hynix and Samsung Electronics saw their afternoon gains further expand, with SK Hynix rising over 8% and Samsung Electronics nearly 4%.

Supply Tightness Forces Apple to Accept Significant Price Hikes

Samsung Electronics and SK Hynix achieved significant results in their negotiations with Apple in the first quarter of this year.

Reports indicate that according to South Korean industry insiders, the price increase proposed by Samsung Electronics for LPDDR exceeded 80%, while SK Hynix's increase reached about 100%. This is the first time Apple, as a major customer, has accepted such a significant price adjustment in a short period.

It is reported that LPDDR is a type of memory that focuses more on energy efficiency compared to standard DRAM and is crucial for IT devices, including smartphones. Currently, the seventh generation LPDDR5X is the most widely used. With an annual shipment of about 250 million iPhones, Apple has been a key buyer in the LPDDR market.

The report points out that despite the significant price increase, the LPDDR price paid by Apple is not the highest in the market.

As a major player in the memory market, Apple has long leveraged its dominant position to procure LPDDR at prices lower than those of other companies. Industry insiders believe that this negotiation has significantly narrowed the price gap between Apple and memory suppliers.

AI Demand Squeezes Traditional Memory Supply

The fundamental reason for the sharp rise in memory prices lies in the imbalance of supply and demand.

Reports indicate that large global tech companies' massive investments in AI infrastructure have driven a surge in DRAM demand, while suppliers like Samsung Electronics and SK Hynix have shifted their production focus to more profitable HBM products, resulting in tight supply of traditional DRAM and LPDDR.

Market data shows that the price of LPDDR5 has increased by about 40% in the fourth quarter of last year. TrendForce predicts that the price of general-purpose DRAM will rise by 55-60% quarter-on-quarter in the first quarter. An industry insider stated:

"The increase in the first quarter is even larger, with an overall increase of at least 60%."

If Apple's memory price increases are fully reflected, the overall profitability of memory suppliers in the first quarter is expected to improve further. This means that for Samsung Electronics and SK Hynix, which experienced a low point in the industry cycle last year, the profitability of their DRAM business will be maximized in the first quarter.

Prices May Continue to Rise in the Second Half

Unlike previous practices, Apple has only completed the memory unit price negotiations for the first half of this year, rather than signing a long-term agreement for the entire year. A semiconductor industry insider explained:

"Apple usually signs long-term memory agreements every year, but considering the recent memory crisis, as far as I know, they have only completed the unit price negotiations for the first half of this year."

This change leaves room for further price increases in the second half of the year. The insider added, "With the launch of new products in the second half of the year, prices may rise further." Apple is expected to release its latest flagship smartphone, the iPhone 18, in the second half of the year, significantly increasing the demand for LPDDR.

Analysis points out that the signing of short-term contracts reflects the current uncertainty in the memory market and shows Apple's weakened bargaining power in a tight supply environment. For Samsung Electronics and SK Hynix, this means they may gain greater pricing initiative in the new round of negotiations in the second half of the year