Microsoft's cloud business growth slows, record high capital expenditures raise concerns, stock price falls about 5% after hours | Earnings Report Insights

微軟第二財季業績整體超出市場預期,營收、利潤與每股收益均實現強勁增長,但公司資本支出同比大增 66%、創歷史新高,疊加雲業務增速較前一季度放緩,引發投資者對 AI 投入回報週期拉長的擔憂,股價盤後下跌約 5%。

微軟週三盤後公佈第二財季財報顯示,該公司季度資本支出飆升至歷史新高,同時雲業務銷售增速放緩,引發投資者擔憂其在人工智能領域的大規模投入可能需要比預期更長的時間才能見效,導致公司盤後股價下跌約 5%。

微軟第二財季營收 812.7 億美元,分析師預期 803.1 億美元。 智能雲營收 329.1 億美元,預期 323.9 億美元。

以下是微軟財報要點:

主要財務數據:

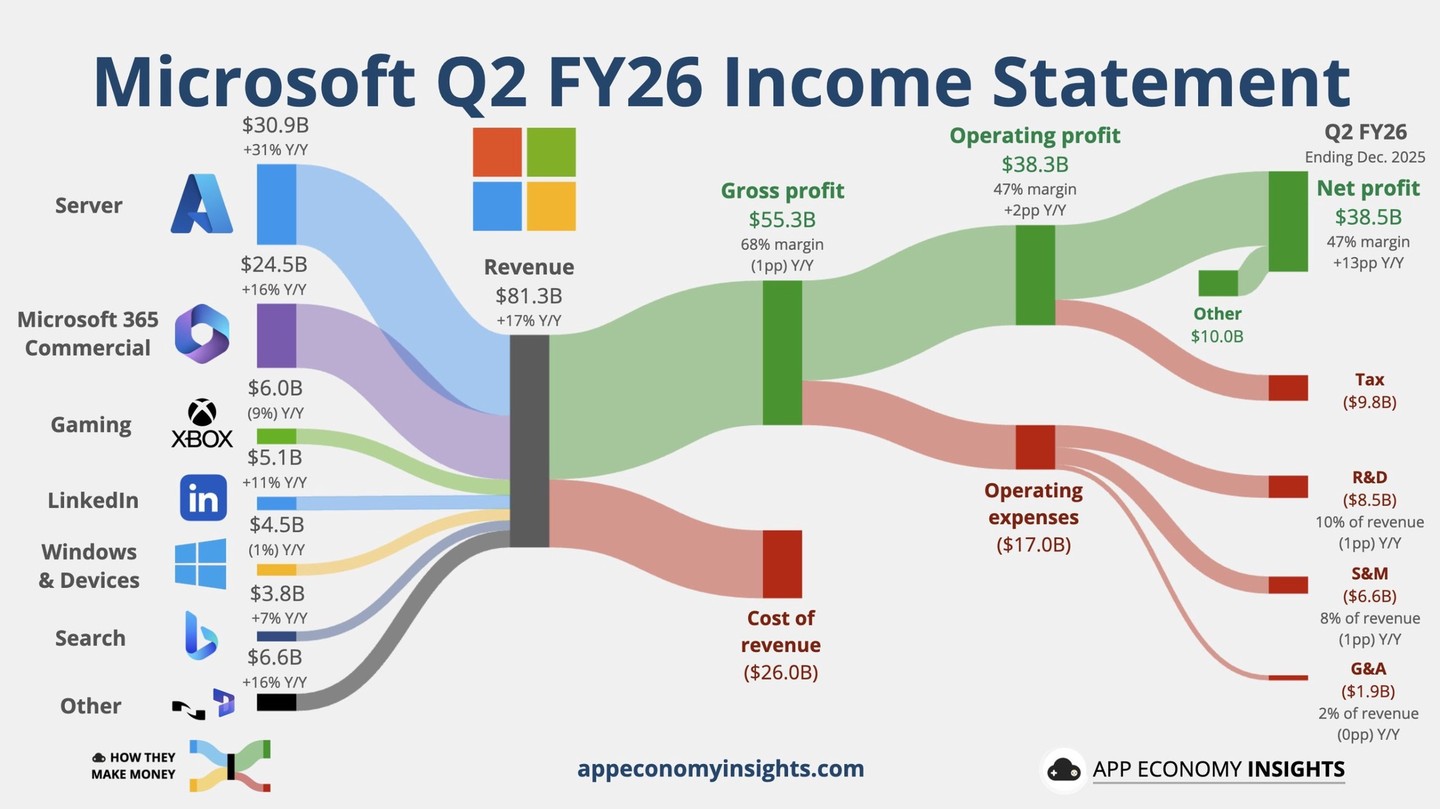

營收:第二財季營收為 813 億美元,同比增長 17%,高於分析師預期 803.1 億美元。

營業利潤:營業利潤為 383 億美元,同比增長 21%,同樣高於分析師預期。

淨利潤:按 GAAP 口徑計算,淨利潤為 385 億美元,同比增長 60%;按非 GAAP 口徑計算,淨利潤為 309 億美元,同比增長 23%;按固定匯率計算,同比增長 21%。

每股收益:按 GAAP 口徑計算,稀釋後每股收益為 5.16 美元,同比增長 60%,高於分析師預期的 3.92 美元;按非 GAAP 口徑計算,稀釋後每股收益為 4.14 美元,同比增長 24%;按固定匯率計算,同比增長 21%。

資本支出:微軟第二財季資本支出達到 375 億美元,同比增長 66%,不僅創下紀錄,也高於分析師預期的 362 億美元。

分業務數據:

雲業務:雲業務營收為 515 億美元,同比增長 26%;按固定匯率計算,同比增長 24%。商業剩餘履約義務同比增長 110%,達到 6250 億美元。

生產力與業務流程部門:營收為 341 億美元,同比增長 16%;按固定匯率計算,同比增長 14%

- Microsoft 365 商業雲收入同比增長 17%;按固定匯率計算,同比增長 14%。

- Microsoft 365 消費者雲收入同比增長 29%;按固定匯率計算,同比增長 27%。

- LinkedIn 營收同比增長 11%;按固定匯率計算,同比增長 10%。

- Dynamics 365 營收同比增長 19%;按固定匯率計算,同比增長 17%。

智能雲部門:營收為 329 億美元,同比增長 29%,高於分析師預期的 323.9 億美元;按固定匯率計算,同比增長 28%

- Azure 及其他雲服務收入同比增長 39%;按固定匯率計算,同比增長 38%,符合分析師預期。

更多個人計算業務部門:營收為 143 億美元,同比下降 3%。

- Windows OEM 及設備收入同比增長 1%;按固定匯率計算基本持平。

- Xbox 內容與服務收入同比下降 5%;按固定匯率計算下降 6%。

剔除流量獲取成本後的搜索與新聞廣告收入:同比增長 10%;按固定匯率計算,同比增長 9%。

微軟董事長兼首席執行官薩提亞·納德拉(Satya Nadella)表示:

“我們仍處在 AI 擴散的早期階段,但微軟已經打造出一個規模超過我們部分最大傳統業務的 AI 業務。我們正在整個 AI 技術棧上持續推進前沿創新,為客户和合作夥伴創造新的價值。”

微軟執行副總裁兼首席財務官艾米·胡德(Amy Hood)表示:

“本季度微軟雲業務營收突破 500 億美元,反映出市場對我們服務組合的強勁需求。我們的營收、營業利潤和每股收益均超出預期。”

由於公司披露的基礎設施支出高於預期(包括數據中心建設),同時遊戲業務相關銷售表現不及預期,微軟股價盤後下跌約 5%。

雲業務增速不如人意

根據財報在剔除匯率因素影響後,Azure 雲計算業務當季營收同比增長 38%,剛好符合分析師的預測。

不過,這一增速較上一季度放緩了 1 個百分點。DA Davidson 分析師吉爾·盧里亞(Gil Luria)表示,這樣的放緩,或許已經足以讓原本押注雲業務表現更強勁的投資者感到失望。

分析師和投資者指出,微軟 Azure 雲業務的增長,仍主要由其核心的非 AI 雲工作負載驅動。這些業務為企業提供數據和應用的存儲、管理與處理服務。微軟在相關建設上的資本支出達到 375 億美元,高於分析師預期。

微軟投資者關係主管詹姆斯·安布羅斯(James Ambrose)週三表示,基礎設施支出的增加,反映出微軟在 AI 相關和非 AI 工作負載方面,持續看到強勁的雲需求。

Stifel 投資公司的分析師布拉德·裏巴克(Brad Reback)表示,投資者非常關注 Azure 的增長速度是否能夠跑贏支出增速,從而證明微軟當前投入水平的合理性。

資本支出超預期引起不安

媒體稱,部分投資者對微軟及其他大型科技公司正在投入的鉅額資金感到不安,因為企業正在大規模建設數據中心,但尚未充分證明 AI 需求能否持續,或最終是否具備盈利能力。過去六個月裏,微軟股價已下跌超過 6%。

微軟正在建設大型、互聯的數據中心網絡,並將其稱為 AI“超級工廠”,專門用於 AI 訓練和相關工作負載。週一,微軟還發布了一款新的 AI 推理芯片 Maia 200,公司稱其在某些任務上的成本更低、速度更快,優於競爭對手的同類產品。

納德拉上月在一篇博客文章中寫道,目前 AI 能力的發展速度,已經快於其在現實世界中的實際影響。他上週在瑞士達沃斯舉行的世界經濟論壇期間也表達了類似觀點,指出如果 AI 應用不能走出科技行業、實現更廣泛落地,可能會引發金融泡沫風險。

微軟正在推動其 Copilot AI 聊天機器人獲得更廣泛的使用,但在競爭中仍落後於谷歌和 OpenAI 等領先對手。微軟此前大量依賴 OpenAI 模型來驅動 Copilot 工具,而近期則開始進行多元化佈局,在編程以及 Microsoft 365 生產力產品中,引入了初創公司 Anthropic 的模型。微軟在財報電話會上表示,企業客户已採購 1500 萬份 Copilot 許可。

去年 11 月,微軟表示將向 Anthropic 投資至多 50 億美元,而 Anthropic 則承諾從微軟 Azure 購買價值 300 億美元的雲計算服務。

分析師表示:

“所有公司都在試圖為新增的 AI 功能尋找最優定價方式,這不僅僅是微軟面臨的問題。”

被質疑過度依賴 OpenAI

微軟的超預期業績,主要得益於其與 OpenAI 達成的新協議。該協議於去年 10 月簽署,是 OpenAI 完成重組、設立營利性實體的一部分。微軟目前持有該營利性實體約 27% 的股份,其價值已體現在微軟的財報收益中。

微軟表示,當季淨利潤中有 76 億美元來自 OpenAI 相關收益。即便剔除這部分來自 OpenAI 的提振,微軟的盈利表現仍然超過市場預期。

微軟正加快步伐,將包括由 OpenAI 提供支持的 AI 工具嵌入其產品中,押注聊天機器人和自動化技術將推動公司生產力軟件和雲服務的銷售增長。

微軟在週三發佈的聲明中表示,當季總營收同比增長 17%,達到 813 億美元;每股收益為 5.16 美元。微軟表示,淨利潤數據受到微軟對 OpenAI 投資收益的提振,使每股收益增加了 1.02 美元。

微軟預計將在未來幾年轉化為實際銷售的客户承諾金額較去年同期增長了一倍以上,主要原因是一項與 OpenAI 簽署的、規模達 2500 億美元的新協議。

微軟表示,其雲業務的合同積壓金額同比翻倍以上,達到 6250 億美元。這一規模高於雲計算競爭對手甲骨文在 12 月公佈的 5230 億美元。

但其中約 45% 的剩餘履約義務僅由 OpenAI 一家公司貢獻,凸顯出微軟對這家初創公司的高度依賴。OpenAI 此前承諾在 AI 領域總投入約 1.4 萬億美元,但尚未披露具體的融資計劃。

Gabelli Funds 研究分析師牧野龍太(Ryuta Makino)表示:

“微軟股價的市場情緒,在很大程度上已經高度綁定在 OpenAI 的表現上。我認為,從微軟的角度來看,至少在當前 ChatGPT 與 Gemini 的競爭格局下,這是一個難以掌控的因素。”

微軟正在加速建設用於訓練和運行 AI 模型的雲計算基礎設施。市場需求極其旺盛。微軟去年 10 月曾表示,計劃在未來兩年內將數據中心容量翻倍,並在包括數據中心在內的 AI 基礎設施方面投入超過此前預期的資金。即便如此,微軟仍表示,要滿足不斷增長的需求,還需要更多產能。