The king returns! Samsung Electronics' Q4 revenue reaches a record 93.8 trillion won, with operating profit from the memory business soaring 465%, reclaiming the top spot in the DRAM market

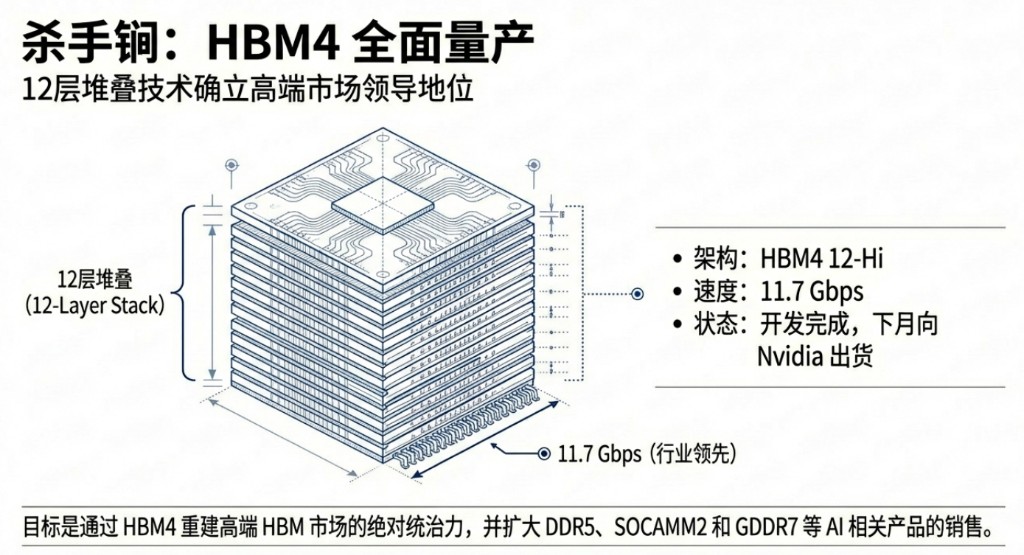

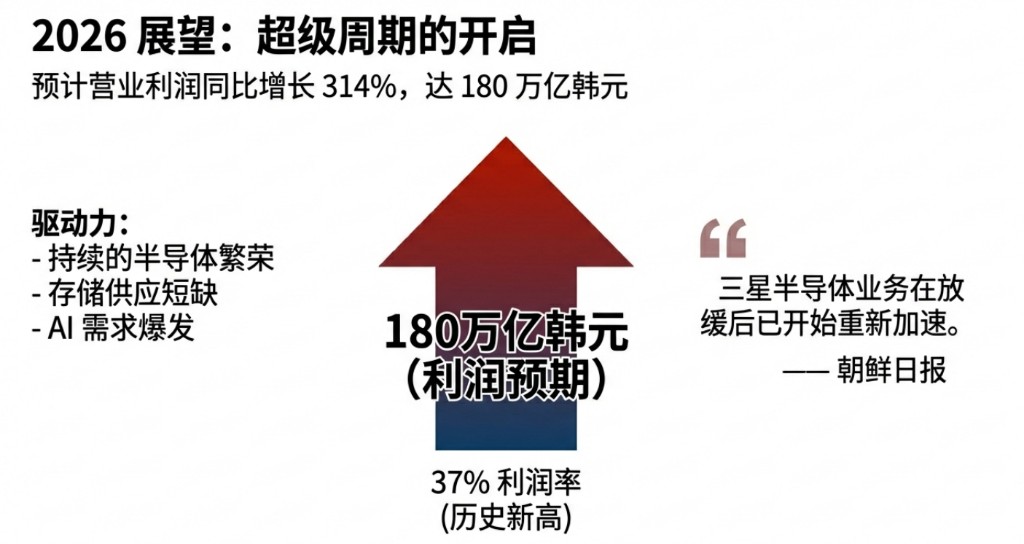

The financial report shows that Samsung Electronics' Q4 operating profit reached 20.1 trillion Korean won, soaring by 209%. The semiconductor division contributed 80% of the profit, with the storage business's operating profit skyrocketing by 465%, successfully entering the supply chains of NVIDIA and Google with HBM3E, reclaiming the title of DRAM market sales champion. The company has completed the development of HBM4, achieving a running speed of 11.7Gbps, and will fully ship to NVIDIA next month. Institutions predict that operating profit will reach 180 trillion Korean won in 2026, a year-on-year increase of 314%

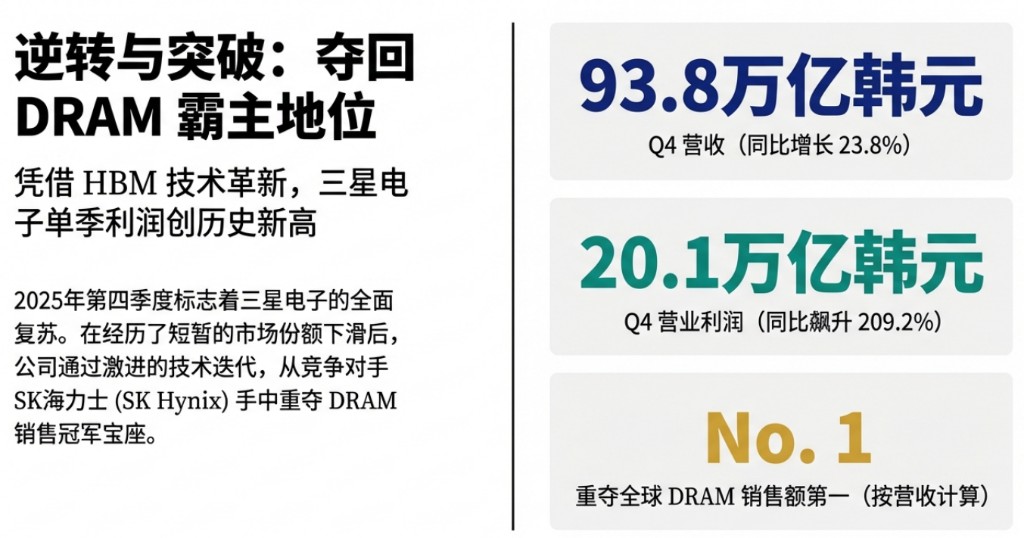

The giant that once dominated the global semiconductor market finally announced its strong return in Q4 2025. This largest memory chip manufacturer in the world achieved record quarterly revenue and operating profit in Q4 2025, thanks to breakthroughs in high bandwidth memory (HBM) technology and rising market prices, reclaiming the title of dynamic random-access memory (DRAM) sales champion from competitor SK Hynix.

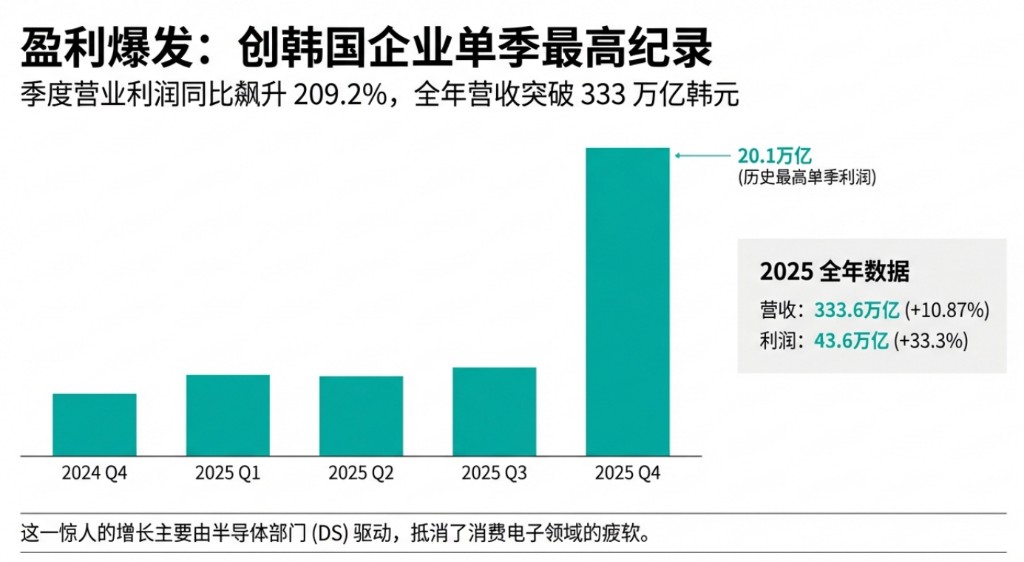

On January 29, Samsung Electronics announced its latest financial report, showing that Q4 2025 revenue reached 93.8 trillion Korean won, a year-on-year increase of 23.8% and a quarter-on-quarter increase of 9%; operating profit was 20.1 trillion Korean won, soaring 209.2% year-on-year, both setting records for the highest quarterly figures for a South Korean company. For the full year of 2025, revenue was 333.6 trillion Korean won, and operating profit was 43.6 trillion Korean won, representing year-on-year increases of 10.87% and 33.3%, respectively.

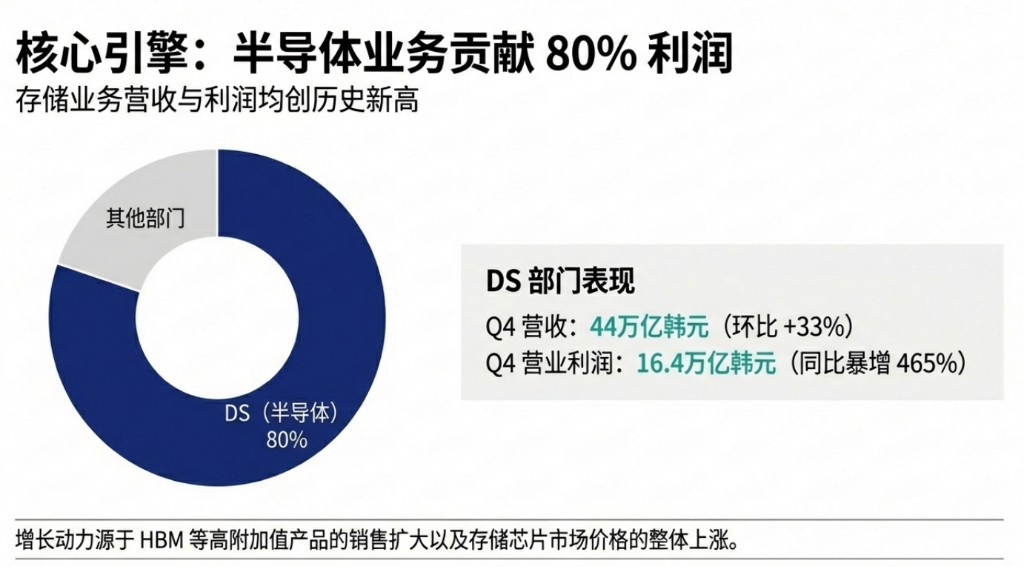

The financial report indicated that Samsung's semiconductor division (DS) contributed 80% of the group's operating profit, with Q4 revenue of 44 trillion Korean won, a quarter-on-quarter increase of 33%, and operating profit of 16.4 trillion Korean won, a year-on-year surge of 465%. The storage business set historical highs for quarterly revenue and operating profit, mainly benefiting from the expansion of high-value products like HBM and the overall price increase in the market.

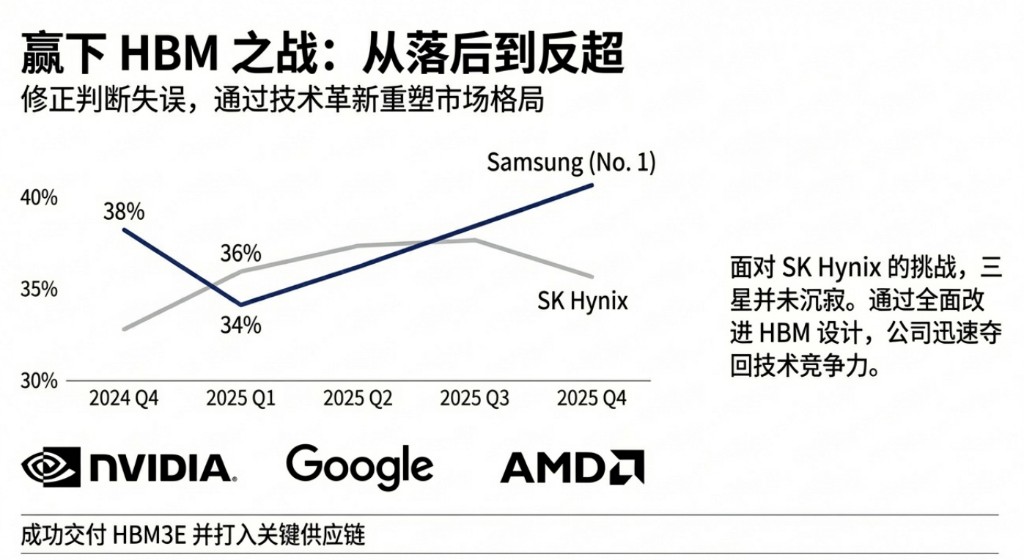

According to South Korean media outlet Chosun Ilbo, after temporarily losing the initiative due to misjudgment, the company regained its technological competitiveness through comprehensive improvements in HBM design and reclaimed the top position in DRAM sales (by revenue) in Q4. Market institutions expect that, benefiting from the semiconductor boom and storage supply shortages, Samsung's operating profit this year could reach 180 trillion Korean won, a year-on-year increase of 314%.

Record-breaking storage business, HBM4 deliveries begin this quarter

Amid the wave of AI, memory chips have become the absolute core of Samsung Electronics' performance growth. Samsung's storage business achieved record highs in both quarterly revenue and operating profit in Q4.

Despite limited supply, the business achieved this milestone by meeting strong traditional DRAM demand while expanding HBM sales against the backdrop of overall price increases. The focus has shifted to enhancing profitability through high-value products such as HBM, server DDR5, and enterprise-grade SSDs.

The company's competitive position in the HBM field has undergone a dramatic shift. According to data from market research firm Counterpoint Research, Samsung maintained a 38% DRAM market share in Q4 2024, but fell to 34% in Q1 2025, surpassed by SK Hynix (36%) However, Samsung did not remain silent for long. In order to regain its technological competitiveness, Samsung has completely revamped its HBM design. Key signals revealed in the financial report indicate that Samsung has successfully delivered HBM3E to NVIDIA and has entered the supply chains of Google and AMD.

More strikingly, Samsung announced that it has completed the development of HBM4, which operates at an industry-leading speed of 11.7Gbps, and plans to start full shipments to NVIDIA next month. The delivery of these 12-layer HBM4 products aims to restore its leadership position in the high-end HBM market.

Looking ahead to 2026, the storage business plans to continue close collaboration with customers by timely delivering competitive HBM4 and expanding sales of AI-related products such as DDR5, SOCAMM2, and GDDR7 to meet customer demands. In the NAND sector, the business will actively respond to AI-related needs, focusing on expanding sales of high-performance TLC products for inference in Key Value SSDs.

Chip Foundry Mass Production of First Generation 2nm and Focus on Advanced Process for System LSI

Samsung's chip foundry business achieved overall revenue growth in Q4 due to strong demand from major market customers, but profit improvement was limited by temporary costs. The business has initiated mass production of the first generation 2nm products and has begun shipping 4nm HBM base chip products.

In Q1, due to seasonal weakness, chip foundry revenue is expected to decline sequentially, but orders are expected to expand, primarily from HPC and mobile customers.

For the full year of 2026, the business aims to achieve double-digit revenue growth and improved profitability, driven by advanced processes, and plans to increase the production of second-generation 2nm products while preparing for performance and power-optimized 4nm process production, while providing optimized solutions through the integration of logic, storage, and advanced packaging technologies to enhance competitiveness.

The system LSI business saw a decline in profits in Q4 due to seasonal demand weakness and adjustments in major customer product timelines. However, revenue from image sensors grew due to new 200MP and 50MP large pixel products.

Q1 profits are expected to recover with the launch of new products, while strengthening the leadership position in image sensors by expanding the 200MP product line. In 2026, this business will focus on improving profitability by expanding sales through differentiated SoC performance and stable yields.

Mobile and Consumer Electronics Under Pressure, R&D Investment at Record High

In contrast to the strong performance of the semiconductor business, Samsung's consumer business is facing challenges.

The financial report shows that the combined revenue of the mobile and network businesses in Q4 was 29.3 trillion won, with an operating profit of only 1.9 trillion won, a sequential decline of 8%, mainly due to the weakening effect of new smartphone model releases and intense market competition

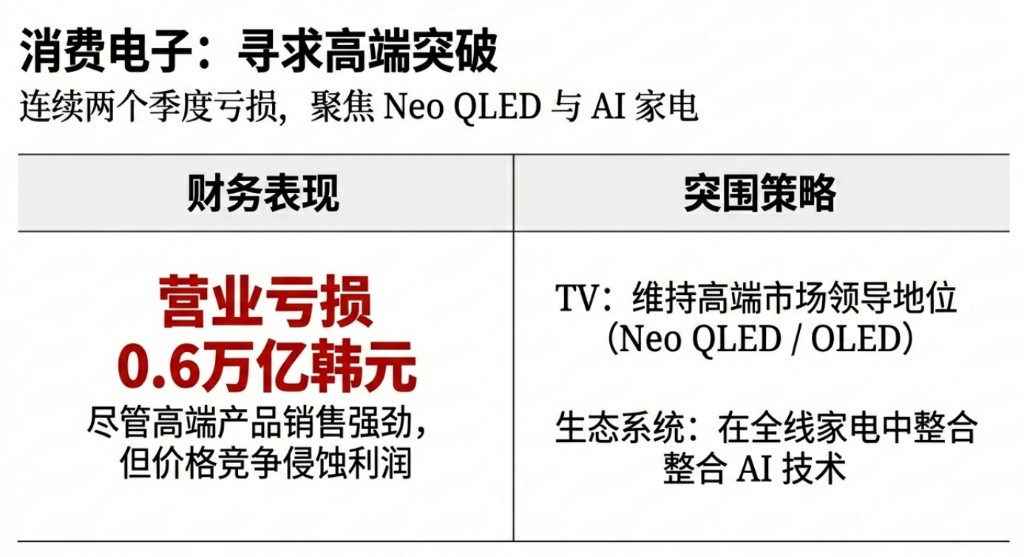

The home appliance and television business recorded losses for the second consecutive quarter following the third quarter. The combined revenue of the display panel and home appliance business in Q4 was 14.8 trillion won, with an operating loss of 0.6 trillion won.

Although the television business expanded revenue through strong sales of high-end products such as Neo QLED and OLED and effectively responded to seasonal peak demand, profitability remains under pressure due to ongoing intense market competition.

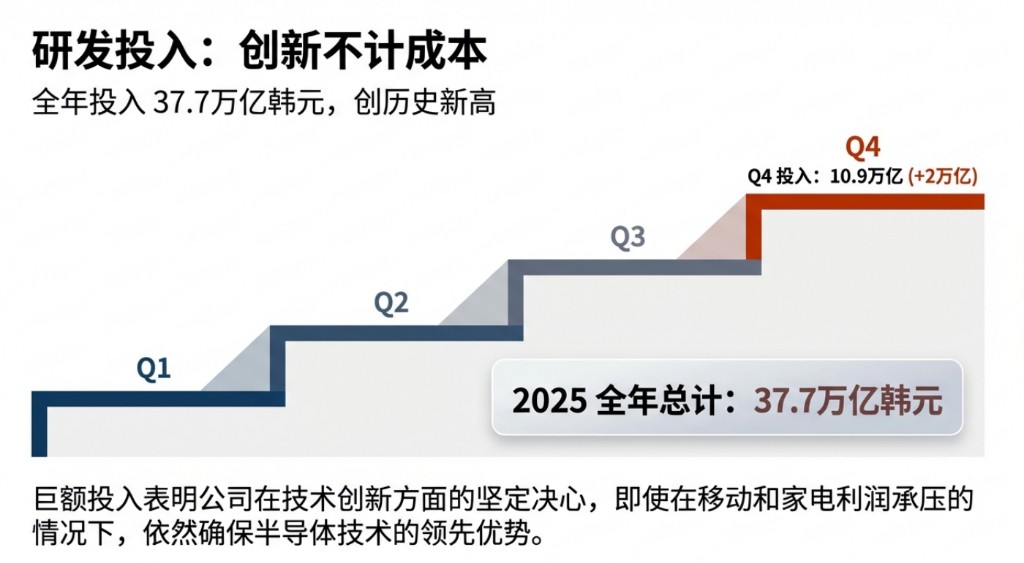

Samsung's R&D investment in Q4 reached 10.9 trillion won, an increase of 2 trillion won quarter-on-quarter, with total annual R&D spending reaching a historic high of 37.7 trillion won. This indicates the company's continued commitment to increasing investment in technological innovation.

Looking ahead to Q1 2026, the mobile business plans to enhance its AI smartphone leadership by launching the Galaxy S26 series, providing an Agentic AI experience. For the entire year of 2026, this business intends to consolidate its mobile AI leadership through next-generation AI experiences and innovations in thinner and lighter designs, while remaining committed to profitability through process optimization amid ongoing cost pressures.

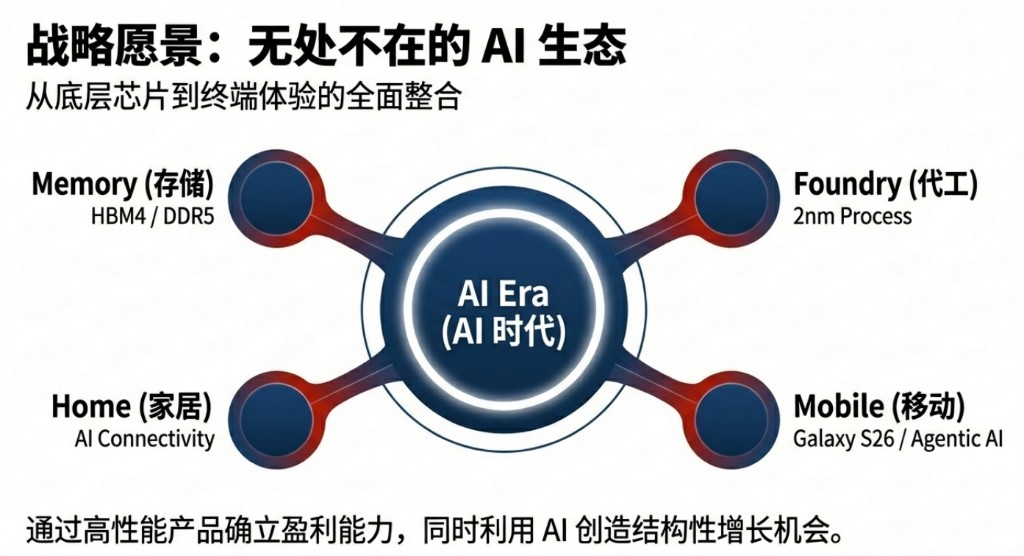

Focus on Growth Opportunities in the AI Era in 2026

The financial report shows that Samsung expects demand for AI and servers to continue growing in Q1 2026, bringing more structural growth opportunities. The semiconductor division will continue to focus on profitability by emphasizing high-performance products.

For the entire year of 2026, this division aims to lead the AI era with product competitiveness in a rapidly growing demand environment, particularly by expanding sales of AI-related products in DRAM and NAND.

According to South Korean media outlet Chosun Ilbo, industry insiders have indicated that Samsung's semiconductor business has begun to accelerate again after a slowdown. The current global shortage of memory supply is expected to directly benefit Samsung, which has significant production capacity.

SK Securities predicts that Samsung's operating profit will increase by 314% year-on-year to 180 trillion won this year, with an operating profit margin of 37%, setting historical highs in both profit and profitability.

The Device Experience Department (DX) plans to expand its AI-driven product offerings by 2026 and integrate AI technology across the entire ecosystem of devices, features, and services.

The Device Experience Department (DX) plans to expand its AI-driven product offerings by 2026 and integrate AI technology across the entire ecosystem of devices, features, and services.

The department will maintain its focus on profit growth by ensuring the stability of component supply, implementing efficiency measures, and providing customers with the best AI experience as a leader in the AI era.

The display panel business will advance its leadership position in the smartphone market based on differentiated technology, continue its high-end market leadership in the television sector by focusing on new high-brightness products, and plan to drive sales expansion in the monitor segment based on differentiated performance advantages