Western Digital's Q2 fiscal revenue exceeded expectations with a 25% growth, and net profit doubled, with a 1% increase in after-hours stock price | Earnings Report Insights

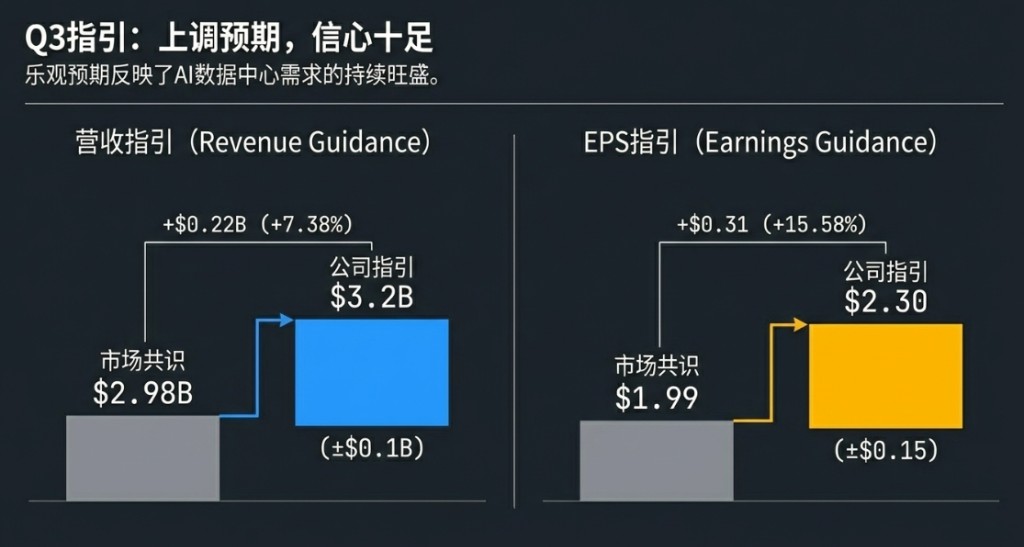

Western Digital's net profit for the second fiscal quarter reached USD 1.84 billion, approximately USD 4.73 per share, representing a 210% increase compared to USD 594 million (USD 1.27 per share) in the same period last year. The company expects third fiscal quarter revenue to reach USD 3.2 billion, with adjusted earnings per share of USD 2.30, significantly exceeding analysts' previous expectations of USD 2.98 billion in revenue and USD 1.99 earnings per share

Western Digital's second-quarter performance significantly exceeded Wall Street expectations, fully demonstrating the strong driving effect of the artificial intelligence wave on the data storage industry.

On Thursday, January 29th, after the U.S. stock market closed, Western Digital announced its second-quarter report, with revenue reaching $3.02 billion, a year-on-year increase of 25%, surpassing analysts' expectations of $2.96 billion. The specific performance of the financial report is as follows:

- Adjusted Earnings Per Share of $2.13, more than 10% higher than the market expectation of $1.93.

Net Profit reached $1.84 billion, approximately $4.73 per share, achieving a 210% increase compared to $594 million (or $1.27 per share) in the same period last year.

Adjusted Gross Margin reached 46.1%, higher than the market expectation of 44.5%.

The company expects third-quarter revenue to reach $3.2 billion (with a fluctuation of $100 million), and adjusted earnings per share of $2.30 (with a fluctuation of $0.15), significantly exceeding analysts' previous expectations of $2.98 billion in revenue and $1.99 earnings per share.

Driven by positive performance, Western Digital's stock price rose in after-hours trading. Notably, over the past 12 months, driven by the surge in AI-driven hard drive demand, Western Digital's stock price has increased by more than 470%, making it one of the biggest beneficiaries in this round of the AI market.

(Western Digital's stock rose over 1% in after-hours trading)

(Western Digital's stock rose over 1% in after-hours trading)

Significant Revenue and Profit Surge, Remarkable Improvement in Profitability

The financial report shows that the company's high-capacity hard drive products are favored by AI hyperscale data center customers.

These customers need to control costs while storing massive amounts of training data and models, and Western Digital's high-capacity HDD solutions precisely meet this demand.

Western Digital's net profit for the second quarter reached $1.84 billion, equivalent to $4.73 per share, more than doubling from $594 million (or $1.27 per share) in the same period last year.

In terms of revenue, the quarterly income of $3.02 billion represents a year-on-year growth of 25%, not only exceeding analysts' expectations of $2.96 billion but also marking the company's strong growth momentum over several consecutive quarters The adjusted gross margin reached 46.1%, exceeding the market expectation of 44.5%, indicating an improvement in the company's product mix optimization and pricing power.

Western Digital CEO Irving Tan stated that the strong performance this quarter reflects the company's execution in meeting market demand in the AI-driven data economy, as well as customer confidence in the company's ability to deliver reliable, high-capacity hard drives at scale.

Chief Financial Officer Kris Sennesael pointed out that with the continued growth in data center demand and the widespread adoption of high-capacity hard drives, the company expects revenue to maintain strong growth and profitability to further improve.

The overall industry is thriving, with strong cash flow performance

The capital market's enthusiasm for the AI infrastructure sector continues to heat up.

Over the past 12 months, Western Digital's stock price has surged over 470% driven by AI-driven hard drive demand, becoming a typical representative of the recovery in the data storage industry.

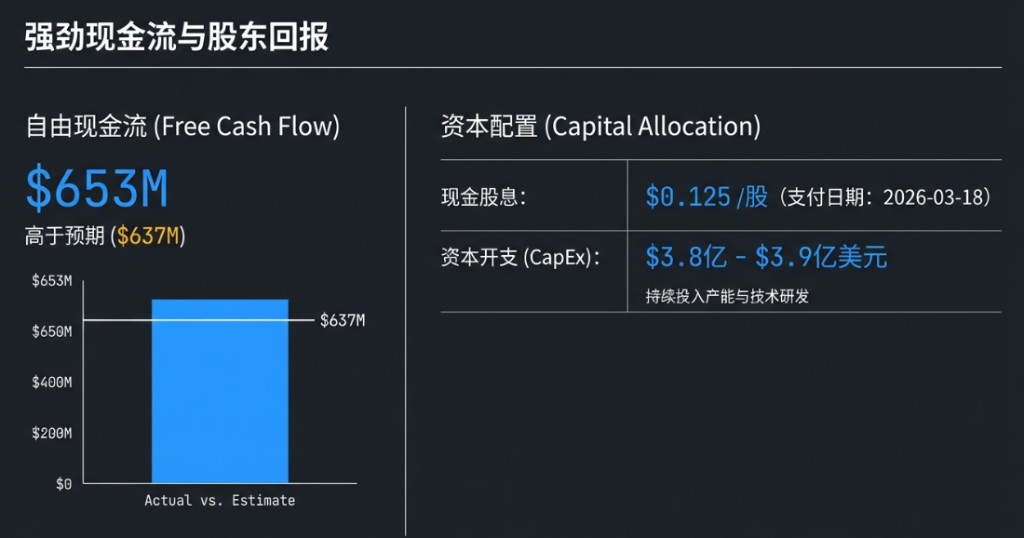

Western Digital's free cash flow for this quarter reached $653 million, slightly above the market expectation of $637 million. The strong cash flow situation provides a solid foundation for the company's investment in technology research and development and shareholder returns.

The company's board of directors announced a cash dividend of $0.125 per share, which will be paid on March 18, 2026, to shareholders registered as of the close on March 5.

At the same time, the company expects capital expenditures for the third fiscal quarter to be between $380 million and $390 million, with analysts believing that the company will continue to make strategic investments in capacity and technology while maintaining shareholder returns