SanDisk conference call: "Data centers will become the largest market for NAND," CEO says "unable to meet demand" but refuses to blindly expand production

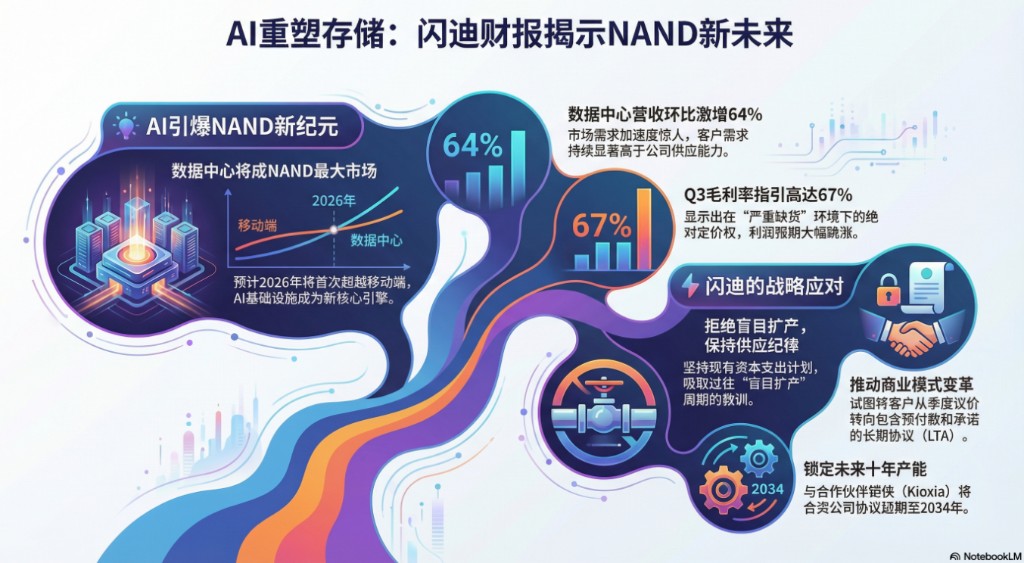

SanDisk has established that AI is reshaping the storage industry, with management stating that NAND is shedding its cyclical commodity attributes to become "a key component of AI infrastructure." The company's data center revenue surged 64% quarter-over-quarter, and it is expected to surpass mobile as the largest NAND market by 2026. The Q3 gross margin guidance is as high as 67%, demonstrating its strong pricing power in a "severe shortage" environment. However, SanDisk still insists on its existing capital expenditure plan and refuses to blindly expand production

After hours on Thursday, U.S. stocks saw storage giant SanDisk hold a conference call for its Q2 fiscal year 2026 earnings report.

In the face of a stock price that surged 15% after hours, the company's management not only confirmed the impressive performance that exceeded expectations during the call but also conveyed a clear message to the market: The demand for storage driven by AI is not a fleeting trend, but a structural transformation that is currently underway.

Not just a trend, but real money: "Data centers will become the largest market for NAND in 2026"

The most pressing question for the market is: Has the hype around AI translated into actual revenue? Is storage merely a short-term trend or a long-term structural change?

In response, SanDisk CEO David Goeckeler candidly stated during the meeting: “For the first time, data centers are expected to become the largest market for NAND in 2026 (calendar year).”

This may indicate that the era dominated by smartphones and PCs in the storage cycle over the past decade is coming to an end, with AI infrastructure construction becoming the new core engine. As AI inference scenarios explode, the demand for NAND capacity in each deployment unit has significantly increased.

Data shows that the company's data center revenue surged 64% quarter-over-quarter this quarter. Even more astonishing is the acceleration of demand:

Two quarters ago, the market expected the company's data center Exabyte growth in 2026 to be over 20%;

Last quarter, this expectation was raised to over 40%;

This quarter, SanDisk has directly raised its 2026 data center Exabyte demand growth expectation to nearly 70% (High-sixties).

Additionally, Goeckeler revealed that the company's high-performance TLC drives are driving revenue growth, while the BiCS8 QLC storage-class product, codenamed "Stargate," will begin generating revenue in the coming quarters.

AI reshaping the NAND industry: "NAND becomes a key component of AI infrastructure"

During the call, CEO Goeckeler also provided a direct assessment of the industry changes. He stated:

“NAND is now seen as an indispensable technology to meet global storage demands.” “This is driving fundamental changes in the business relationships between suppliers and customers.”

He further pointed out that as AI deployment in data centers and edge computing continues to expand, the role of storage has changed:

“Artificial intelligence is driving a leap in demand, and the expansion of data center and edge workloads has significantly increased the system's demand for storage capacity.” In his view, this change means that NAND is shedding its traditional cyclical attributes: "We believe that NAND is becoming a more resilient industry, structurally more attractive, with higher long-term average returns."

"NAND is increasingly becoming a key component of AI infrastructure," said CFO Luis Visoso.

When discussing the recent rapid rise in storage prices, Gokler provided a very clear judgment:

"Everything happening in the current market is a phenomenon completely driven by demand."

The CFO also stated, "In this quarter, we are unable to meet all customer demand." "Customer demand continues to significantly exceed our supply capacity."

Supply and Demand Game: Maintain Capital Expenditure, Refuse Blind Expansion

Despite the strong short-term prices for storage, the CEO emphasized that the company will not rashly expand production due to the strong short-term prices:

"Any substantial increase in capital expenditure requires us to have high confidence in multi-year demand at attractive price levels."

During the conference call, management repeatedly mentioned "unable to meet customer demand," indicating that the current market is in a severe "Allocation Environment." However, SanDisk appears to be very restrained.

Despite the booming demand, the company still insists on maintaining its capital expenditure plan, sustaining mid-to-high single-digit bit growth, and refusing blind expansion. This shows that storage giants have learned lessons from past cycles of "blind expansion."

Some analysts also suggest that SanDisk is using the shortage as leverage, attempting to force customers to abandon traditional quarterly negotiations in favor of signing long-term agreements (LTA) that include prepayments and supply commitments. The CEO bluntly stated that without changing this business model, the company has no motivation to increase investment.

However, customers are clearly resistant to this. When asked about the progress of LTAs, the CFO revealed a somewhat awkward fact: As of now, only one agreement has been signed and completed. This indicates that although buyers urgently need capacity, they remain cautious about locking in long-term prices at high levels, and the tug-of-war between both parties continues.

Strategic Layout: Locking in Kioxia's Decade of Capacity

The conference call also announced an important strategic move: SanDisk has reached an agreement with its partner Kioxia to extend their joint venture (JV) until 2034, establishing a capacity base for the next decade.

To this end, SanDisk will pay approximately $1.165 billion in manufacturing service fees over the next few years.

This move undoubtedly reassures customers who are concerned about long-term supply stability.

Guidance Explosion: Gross Margin Aiming for 67%, Pricing Power Completely Reversed

The company is also very confident about its future performance guidance.

If the company delivered a gross margin of 51.1% in Q2 (up from only 29.9% in the previous quarter), then the guidance for Q3 is even more surprising to analysts. CFO Luis Visoso expects that the non-GAAP gross margin for the third fiscal quarter will reach 65% to 67%, with EPS guidance jumping from $6.20 this quarter to $12-14 Behind this ultra-high guidance is the absolute control of storage manufacturers over pricing power. Western Digital stated that NAND capacity will automatically flow to the most profitable market (i.e., data centers), which forces other markets to accept price increases even when demand is lukewarm.

Shadows of Traditional Markets: PC and Smartphone Sales Face Decline

However, it is worth noting that, beyond the halo of AI, the fundamentals of the traditional consumer electronics market are not solid.

CEO Goeckler acknowledged that entering 2026, the PC and smartphone markets will face base effects pressure from declining unit sales.

Although the increase in single-unit capacity (Content growth) can partially offset this impact, the expression "declining sales" still reveals the fatigue of markets outside of AI.

Financial "Footnotes": One-Time Gains Beautify Profits, Tax Rates Will Rise

At the same time, for investors pursuing precise models, the profit quality for this quarter may need to be discounted.

-

One-Time Gains: Operating expenses (OpEx) for this quarter were significantly lower than expected, mainly due to a one-time gain of approximately $35 million from changes in accounting treatment for new product introductions (NPI). The CFO indicated that this portion is not sustainable.

-

Tax Rate Headwinds: As the company transitions from significant losses to high profits, the previously accumulated tax loss deductions have been nearly exhausted, and the effective tax rate is expected to rise from a low level to 14%-15%.

The full translation of the SanDisk earnings call is as follows:

Presentation Segment

Operator:

Hello everyone, and welcome to the SanDisk fiscal year 2026 second quarter earnings call. All participants will be in listen-only mode. (Operator instructions) After today's presentation, there will be an opportunity for questions. (Operator instructions) Please note that this event is being recorded.

Now I will turn the meeting over to Investor Relations Director Ivan Donaldson. Please go ahead.

Ivan Donaldson, Vice President of Investor Relations:

Before we begin, please note that today's discussion will include forward-looking statements based on management's current assumptions and expectations, which are subject to various risks and uncertainties. These forward-looking statements include expectations regarding our technology and product portfolio, business plans and performance, market trends and opportunities, and future financial results.

We do not undertake any obligation to update these statements. Please refer to our annual report on Form 10-K and other documents filed with the U.S. Securities and Exchange Commission (SEC) for more information about the risks and uncertainties that could cause actual results to differ materially from those anticipated. Today we will also reference non-GAAP financial metrics. A reconciliation table between non-GAAP financial metrics and comparable GAAP financial metrics has been posted in the written materials in the investor relations section of our website

Next, I will hand the phone over to David.

David V Goeckeler, Chairman and CEO:

Thank you, Ivan. Good afternoon, and thank you all for joining SanDisk's Q2 earnings call. This quarter, revenue was $3 billion, a 31% quarter-over-quarter increase, with a non-GAAP earnings per share of $6.20.

Artificial intelligence continues to drive a leap in demand, with increased complexity in systems and storage content requirements due to data center and edge workloads. This shift, combined with disciplined business actions and strategic capacity allocation, has strengthened our business outcomes. Before discussing our end markets, I would like to outline the evolution of the NAND industry. NAND is now recognized as an indispensable part of global storage demand, driving a fundamental shift in the structure of business relationships between suppliers and customers.

Supply certainty, longer planning cycles, and multi-year commitments are becoming critical to support structural demand that exceeds our market's traditional cyclical patterns. Therefore, we are engaging in discussions with customers to evolve from quarterly negotiations to multi-year agreements with firmer supply and pricing commitments, enabling better planning practices and more attractive returns. These changes will better align our planning cycles with customer demand conditions, resulting in mutual benefits. Consequently, our supply plans will continue to be designed around predictable long-term demand under current and forecasted market prices. These dynamics reveal the true value of our NAND technology and reinforce the necessity for ongoing innovation and rigorous execution. Our products benefit from decades of sustained R&D and innovation investment in NAND and system solutions, supported by significant capital investments in world-class front-end and back-end manufacturing. Therefore, we believe NAND is becoming a more durable, structurally attractive industry with higher average returns. Turning to our end market highlights.

This quarter, we continued to execute according to our roadmap, advancing next-generation product innovation and certification across the business, with key customer projects on track. In the data center space, we are at the center of the broad expansion of AI infrastructure. As AI workloads expand, enterprise SSD demand is accelerating throughout the ecosystem, particularly as inference drives a significant increase in NAND content per deployment. This momentum reflects our deepening engagement with a broader range of customers building and deploying AI at scale, reshaping our data center business, which we expect to grow significantly in both the near and long term.

We are seeing strong adoption of our products by all types of AI infrastructure builders, including cloud hyperscalers, edge and enterprise data centers, OEMs, and system integrators deploying AI at scale. Our technology has become a key driver of these deployments, providing the performance characteristics needed to optimize AI infrastructure. The widespread adoption by customers across the AI ecosystem highlights the strength of our technology and the depth of our product portfolio

In terms of hyperscale enterprises, we have completed the certification of PCIe Gen 5 high-performance TLC drives for our second hyperscale enterprise and expect to complete certifications for more hyperscale enterprises in the coming quarters, with the BiCS8 TLC solution following closely behind. This product is driving significant revenue growth in our data center portfolio, which has increased by 64% quarter-over-quarter. The BiCS8 QLC storage-class product, codenamed "Stargate," continues to undergo certification with two major hyperscale enterprises and is expected to start generating revenue in the coming quarters, providing additional momentum for data center growth. In edge computing, demand has significantly outstripped supply as the replacement cycles for PCs and mobile devices and AI adoption have driven richer configurations and higher single-device storage capacities.

In this allocation environment, we are working with key edge customers to prioritize their mission-critical needs and optimize our product portfolio within the available supply range to ensure the best long-term returns across our entire product portfolio. In the consumer product segment, the portfolio is shifting towards high-end products and higher-value configurations, supporting storage capacity, growth, and profitability. We launched a groundbreaking product in the USB form factor—Sandisk Extreme Fit, which is our smallest high-capacity USB-C flash drive. This groundbreaking "stay-put" product provides our customers with a seamless and affordable way to significantly expand their PC and smartphone storage.

We have expanded our key licensing programs with globally recognized brands Crayola and FIFA, fully implementing the commitments emphasized by the colorful Sandisk Crayola USB-C flash drive and the officially licensed 2026 FIFA World Cup products first launched in February last year. This strong momentum continued during the holiday season, driven by targeted gaming-led initiatives, including our "Don't Delete Your Game" campaign. At CES 2026, we launched the Sandisk OptiNAND series, rebranding the WD Black and WD Blue NVMe SSDs to strengthen brand architecture and consolidate performance leadership. These actions collectively reflect our ongoing focus on driving demand through branding, innovation, and rigorous market entry execution, solidifying Sandisk's leadership position in the gaming, creator, and everyday consumer segments.

These victories in the end markets reflect our operational agility and the resilience of our broad product portfolio. Looking ahead, we continue to see customer demand well above supply beyond the 2026 calendar year, necessitating careful allocation plans aligned with our customers. We remain focused on rigorous execution through the BiCS8 transition, supporting mid-to-high single-digit average long-term bit growth while maintaining our capital expenditure plans. We are working hard to support customer demand while ensuring profitability can sustain the substantial R&D and capital investments required to deliver some of the world's most advanced semiconductor technologies

Next, I will hand the phone over to Luis to delve into our financial performance and guidance.

Luis Visoso, Executive Vice President and Chief Financial Officer:

Thank you, David. Before diving into the financial data, I will provide a brief market overview. We believe the NAND market is undergoing a structural evolution driven by AI. This evolution is more pronounced in data centers, where data growth is accelerating with rising data temperatures, token intensity is increasing, and storage is a key driver for inference. Therefore, NAND is increasingly becoming a critical component of AI infrastructure. The higher demand for NAND in data centers is impacting other markets, as NAND flows into the most attractive markets, which are also growing. We believe this structural evolution is sustainable and should reduce the cyclicality of our NAND business, creating higher average long-term profit margins and returns. In the December quarter, we experienced a noticeable and significant improvement in end-market conditions, leading to higher pricing.

In this quarter, due to demand for our products continuing to exceed supply, we made strategic allocation decisions. Our framework for allocating bits (bids) is to maximize value creation. We prioritize supplying our strategic customers, those who recognize that we can create value together. These are the customers we intend to establish valuable partnerships with, thereby building sustainable multi-year business practices with highly predictable demand, returns, and capital deployment.

Given the strength of the market, we were unable to meet customer demand this quarter. We are improving the way we define strategic participation, prioritizing those customers with multi-year supply frameworks and joint planning commitments, rather than transactional short-term demand signals. We remain cautious and do not change our capital expenditure plans, which support mid-to-high single-digit bit growth through the transition to BiCS8. Our investment posture remains focused on servicing attractive ongoing demand and healthy profitability levels.

Any substantial increase in capital deployment requires confidence that demand at attractive price levels will be enduring over a multi-year horizon with financial commitments. In the current environment, we are committed to supplying our three end markets, as we believe diversification can maximize value creation. We plan to continue building strategic relationships with a diverse customer base in these markets, allowing us to gain deeper insights into their long-term needs. This quarter, we continued to make progress with customers in establishing joint commitments, which enhances the predictability of the business.

Customer commitments and agreed commercial terms are the most effective mechanisms for providing supply certainty and predictable returns on invested capital, enabling us to manage capital-intensive businesses in various regions more prudently. In this context, I will delve deeper into the quarterly performance. Second-quarter revenue was $3.025 billion, a 31% increase quarter-over-quarter and a 61% increase year-over-year. This figure exceeded our guidance of $2.55 billion to $2.65 billion

Revenue exceeded expectations due to price increases across various segments, strengthening during the quarter. Bit shipments increased by 22% year-over-year, with a low single-digit quarter-over-quarter growth. In the second quarter, we saw strong sequential demand across all end markets. Revenue from edge computing was $1.678 billion, a quarter-over-quarter increase of 21%.

Consumer revenue was $907 million, a quarter-over-quarter increase of 39%. Data center revenue was $440 million, a quarter-over-quarter increase of 64%. Our non-GAAP gross margin for the second quarter was 51.1%, up from 29.9% in the previous quarter. This figure exceeded our guidance of 41% to 43%.

The gross margin outperformance was driven by higher pricing. The expected reduction in unit costs further strengthened the improvement in margins. In the second quarter, we incurred $24 million in startup costs. Excluding this cost, the non-GAAP gross margin would have been 51.9%.

Non-GAAP operating expenses for the second quarter were $413 million, accounting for 13.7% of revenue. This figure was better than our guidance range of $450 million to $475 million, reflecting a one-time benefit from changes in the management of new product introductions. Therefore, the non-GAAP operating margin was 37.5%, up from 10.6% in the previous quarter. The non-GAAP earnings per share (EPS) for the second quarter was $6.20, up from $1.22 in the previous quarter.

This figure exceeded our guidance range of $3 to $3.40. The non-GAAP EPS outperformance reflected higher-than-expected revenue and lower costs. Key GAAP to non-GAAP adjustment items included $52 million in stock-based compensation after tax (1.7% of revenue) and $93 million related to certain legal matters. Turning to the balance sheet.

At the end of the quarter, we held $1.539 billion in cash and cash equivalents, with debt of $603 million. During the quarter, we repaid an additional $750 million in debt and ended the quarter with a net cash position of $936 million. Turning to free cash flow, we generated $843 million in adjusted free cash flow this quarter, representing a free cash flow margin of 27.9%. This included $1.019 billion from operations, partially offset by $176 million in net cash capital expenditures.

Our total capital expenditures amounted to $255 million, accounting for 8.4% of revenue. Earlier today, we announced that we have reached an agreement with Kioxia to extend the Yokkaichi joint venture until December 31, 2034. With this extension, the Yokkaichi and Kitakami joint ventures will have the same expiration date. Based on over 25 years of partnership, we believe the joint venture reflects our operational scale and the tremendous shared value created over time.

The joint venture enables both companies to design and manufacture the highest-performing, lowest-cost NAND technology to power the world's infrastructure. As part of this extension, SanDisk agreed to pay a total of $1.165 billion for the manufacturing services that Kioxia will provide (ensuring a continuous product supply). This amount will be paid between the calendar years 2026 and 2029 This cost will be accounted for in our cost of sales over the next nine years.

Guidance shift. For the third quarter, we expect revenue to be between $4.4 billion and $4.8 billion. We anticipate the market will be more undersupplied than in the second quarter. We expect a mid-single-digit decline in bit shipments due to benefiting from the accelerated strength of data centers, leading to seasonality below historical levels.

Our forecast for the third quarter non-GAAP gross margin is between 65% and 67%. For the third quarter, we expect non-GAAP operating expenses to be between $450 million and $470 million. We anticipate non-GAAP interest and other expenses to be between $25 million and $30 million, and non-GAAP tax expenses to be between $325 million and $375 million. Assuming fully diluted shares of 157 million, we forecast non-GAAP earnings per share for the third quarter to be between $12 and $14.

Next, I will hand the call back to David.

David V Goeckeler, Chairman and CEO:

Thank you, Luis. In summary, we will continue to successfully navigate the early stages of the profound evolution of our business. In addition to playing a core role in the technologies we use daily in PCs, smartphones, tablets, cloud, automotive, gaming devices, and robotics, NAND is also a key technology supporting the development and proliferation of artificial intelligence.

Driven by some of the largest and most capitalized technology companies in the world, data centers are expected to become the largest market for NAND for the first time in 2026. Fueled by the performance our technology provides, customers across all our end markets are increasingly seeking commercially attractive terms that are financially aligned with our existing supply plans based on mutual commitments and agreements. Our supply plans will continue to align with this attractive, real, and sustainable long-term demand. In this context, margins are expected to reset at structurally higher levels, providing fair returns for the necessary substantial innovation and investment.

Our technology and product portfolio intersect with these evolving market dynamics at the perfect moment, enabling us to manage a balanced portfolio and deliver industry-leading financial performance. Now, let's begin the Q&A.

Q&A Session

Operator:

Questions and answers

Operator:

Thank you. We will now begin the Q&A session. (Operator instructions) The first question comes from Mark Newman of Bernstein. Please go ahead.

Mark Newman:

Hi, thank you very much, and congratulations on achieving excellent numbers today. Really, really great numbers, especially the guidance for the third quarter.

So, it’s clear that what’s happening is that prices are expanding at an unprecedented rate. I guess my question is regarding Dave's opening comments. How are you thinking about long-term agreements (LTA)? Of course, long-term agreements have their pros and cons, as they lock in prices, and with prices rising so quickly, I imagine you don’t actually want that many long-term agreements But I would like to understand how you consider this, how we should view this in terms of the proportion of long-term agreements you have reached, and what the implications are for the future.

That would be great. If you could briefly discuss the long-term supply and demand balance, whether there are plans to increase supply in this very, very large and currently quite serious supply shortage situation, or how you are considering this, that would be great. Thank you very much.

David V Goeckeler, Chairman and CEO:

Thank you, Mark.

I appreciate your comments. There are a series of business dynamics that have contributed to the results you see, and I’ll say a few words about that. First, it stems from our product portfolio and innovation. You know, our BiCS8 node, we have started mass production and continue to ramp up, and this is just an excellent node.

Performance, QLC performance, 2Tb die, a lot of things put us in a very favorable position. By the way, I want to point out that we have extended the joint venture (JV), and we are very pleased about this, which will last for another ten years. This is supporting a very strong enterprise SSD product portfolio.

This is something we have been pushing for a while. Last quarter I mentioned that we would see growth for the entire fiscal year. We saw, I think, a 29% quarter-over-quarter growth in the first fiscal quarter. Now we are seeing a 64% quarter-over-quarter growth in the second fiscal quarter, and I think you will see acceleration from here in the second half of the fiscal year.

So, the third pillar of major business innovation, frankly, is happening in the consumer business. A lot of new products are being launched. The Extreme Fit product we announced this year is indeed a breakthrough product. It allows our customers to seamlessly and economically increase the storage capacity of their devices.

This is considered an innovation in the USB space. You might think such things wouldn’t happen anymore, but this is not a removable product. It is designed to be plugged in and stay there. You can see the agreements we are reaching with partners like FIFA, which could be the biggest event of the year. We have great co-branded products there. Looking at our consumer business, we saw a 50% year-over-year growth, so the performance there is really strong. The excellence of this product portfolio innovation has allowed us to have a better mix of portfolios, and if we look back over the past few quarters, we have actually been able to replace the lowest profit businesses with the highest profit businesses now, which has also provided significant tailwinds for the business. In addition, there are supply and demand dynamics that are driving the entire market forward.

So it really is the combination of all these factors that is driving the business forward. It’s not just a pricing issue, although being in a strong pricing environment is obviously great. Speaking of long-term agreements (LTA), I will say a bit, and I know Luis will have some good comments as well. So, when we reach a point where we believe our technology is receiving a fairer return, and frankly, customers are seeking more supply assurance.

What I mean is that I want to point out a current market phenomenon that is entirely demand-driven regarding what is happening in the market. We have been very transparent about our supply plans for over a year. We have invested a significant amount of money in this market. We are going to invest hundreds of millions of dollars in R&D funding to drive the roadmap.

We are investing billions of dollars in capital expenditures, and we have been very clear that we will continue to drive mid-to-high single-digit growth, which we believe is a good market. What is happening now is that we just do not have enough visibility to understand what the demand side really is. I mean, if we look at data centers, we have now gone through three forecast cycles. Last quarter, we adjusted our growth from mid-20% growth in that market to mid-40% growth. Now what we are seeing is high-end 60% Exabyte growth in that market by 2026. I think our customers are aware of this, especially in the data center market. Their numbers are large, and what they need in 26, 27, and 28, we are even talking to some of them about 29 and 30. They are doing their own planning. The amount of Exabytes they will need is enormous. Therefore, long-term agreements are about proposing a model that gives us confidence to supply that level of demand on a continuous basis. For us, it is not about what the demand is for next quarter or the quarter after that. Given the dynamics of our business, we cannot do anything about that. But we want to align long-term growth rates with long-term sustainable demand, as you said, with attractive financials. Let me hand this question over to Luis. Luis, what are your thoughts on this?

Analyst (Luis Visoso):

Yes, I mean, David covered most of it. What I want to say is, Mark, we are seeing customers across end markets and regions reaching out to us. So it’s not just a few. We are indeed seeing a broad base, which is very interesting for us. We are making significant progress. We have made significant progress with several customers who really want us to prioritize or guarantee supply, as David pointed out, and they see it as a key driver of their business, which is exactly what they are looking for.

Now, on your point, we are very thoughtful about how we define several metrics. One is the length of the agreement, the price of the transaction, the quantity, the volume of business we are putting into it, and any prepayment portion of it. So we are very thoughtful that this should be value-added, not the other way around.

Analyst (Mark Newman):

Great, thank you very much. Can you quickly comment on how you view long-term supply and demand and any flexibility in increasing supply?

David V Goeckeler, Chairman and CEO:

No, I mean, Mark, we have our supply plans

Once again, we have been very clear about what our capital expenditure plans are and what our bit growth plans are, and that's it. The key is to meet our customers at that supply level and understand how we allocate, and then, as we said, it's about all of us looking up and seeing further on the horizon what the demand in this market will be, what the sustained demand will be, and we really need to get away from the idea that this is just a trading market where we can only get a strong signal for one quarter at a time. I mean, to be fair, we do get demand signals from customers every year, but we are actually only trading that. We negotiate prices every quarter, which makes it very, very difficult to increase any form of spending because we just don't have visibility on the economics, and again, especially as the market transitions to data centers, I think data center customers are more willing.

As Luis said, this spans all customers, but I think data center customers, given their demand profile and how much they are frankly growing, are more proactive in engaging in this dialogue, really wanting to understand supply assurance years down the line, and how we can propose a—what kind of business practices can we formulate around it? And that is one, as I mentioned in my prepared remarks, I said we are in the early stages of this transition, and that is the early part. I think business practices will change, and I think it will all be for the better. We have to complete these dialogues in the coming quarters. Thank you very much, Himanshu.

Mark Newman:

Thank you very much.

Congratulations again, guys.

David V Goeckeler, Chairman and CEO:

Thank you, Mark. We appreciate it.

Operator:

The next question comes from Joe Moore of Morgan Stanley. Please go ahead.

Joseph Moore:

Great. Thank you. At CES, Jensen (Huang Renxun) talked about this Key-Value Cache and gave some numbers regarding the bytes per GPU, which looks like a pretty large market.

Have you received any related signals? Do you think we should take this as a direct mathematical calculation? Does everyone have different implementations? And what impact will this have on data centers and NAND?

David V Goeckeler, Chairman and CEO:

Yes, Joe. We are currently looking into this. We are working with NVIDIA to study this issue and how they are considering it.

Of course, then we will work with our customers to study how they will configure it in their deployments. So it's still a bit early. I would say a few things about this. First, this demand is not currently included in the demand numbers we are discussing

I think this is just a perfect example that illustrates the need for more collaboration in various aspects of future demand. Secondly, our preliminary view on this is that when we look at, say, the demand for 2027, we believe that it will be approximately an additional 75 to 100 exabytes. Then in the following year, you can double that number. So, this is a huge demand.

I think this, once again, is just another example of NAND being central to AI architecture. It is very, very clear at this point. If it wasn't before, the AI architecture is changing, right? It's not surprising. With any technology that is so profound and being deployed at such a large scale, we will continue to see innovation and evolution in architecture.

So we will be watching this very closely. NAND will be an important component of that architecture. It is the most scalable semiconductor storage technology, or possibly the most scalable semiconductor technology. So we are looking at those configurations.

This is very real demand. We are just trying to figure it out. Then we may incorporate it into the numbers in the second half of this year, moving into 2027 and 2028.

Joseph Moore:

Great.

Thank you. Great. Thank you. As a follow-up question, how is the opportunity for enterprise SSDs currently segmented between TLC and QLC, and how is that expected to change in the future?

David V Goeckeler, Chairman and CEO:

I think we are currently tracking the market roughly.

Primarily TLC. I would say it leans towards TLC, especially for us. Then, we have not yet launched the QLC-based Stargate product. It is in certification. So we will start shipping that product for revenue in the coming quarters, which excites us and provides another growth tailwind for our data center portfolio. That will elevate the mix of QLC. But at the moment, I think the overall market and our portfolio lean towards TLC.

Analyst:

Great.

Thank you. Great numbers.

David V Goeckeler, Chairman and CEO:

Thank you, Joe. Much appreciated.

The next question comes from CJ Muse of Cantor Fitzgerald. Please go ahead.

C J Muse:

Yes. Good afternoon.

Thank you for taking my question. I want to ask the first question, is there any way to quantify the incremental NAND demand associated with AI infrastructure build-out? I'm not including KvCache, but previously we were in the mid-single digits, and I'm curious now, based on your conversations with customers and the trends you are seeing, looking at 2026, 2027, and 2028, what do you think the new demand's compound annual growth rate (CAGR) is approximately?

David V Goeckeler, Chairman and CEO:

I believe the best proxy indicator we have right now, CJ, is the demand for AI bytes that we see in the data center. As I mentioned earlier, I mean, two cycles ago we were looking at, for example, a mid-range growth of 20% in AI bytes for data centers in 2026.

Last quarter we talked about, considering the capital expenditure cycle that has occurred, we raised it to a mid-range of 40%. Our current forecast is that data centers will see a high-end growth of 60% in AI bytes, which does not include any capital expenditure increases within this reporting cycle. So, just the quarter-over-quarter demand has seen a significant increase, and we believe this is almost entirely driven by AI, obviously.

CJ Muse:

Perfect.

Thank you. And then I think you paid down a significant amount of debt this quarter. You only have $600 million outstanding, which could potentially be paid off this quarter. So I'm curious, when you are fully in a cash position, how should we think about capital returns, especially regarding stock buybacks in the coming quarters?

Luis Visoso, Executive Vice President and CFO:

Yes, we feel very proud of the progress we've made in reducing debt.

Remember we started at $2 billion, and it has come down very, very quickly, with a $600 million reduction this quarter, and we will continue to lower it. CJ, our top priority is to continue investing in the business as we have been and to build prudent cash resources, which is a business that benefits from having cash on hand. We will not waste your cash, don't worry, but we want to build prudent cash resources, and we will continue to reduce our debt, and at the appropriate time, we will continue to expand and give you updates. But so far, these are our priorities.

CJ Muse:

Thank you.

David V Goeckeler, Chairman and CEO:

Thank you, CJ.

Operator:

The next question comes from Jim Schneider of Goldman Sachs. Please go ahead.

James Schneider:

Good evening.

Thank you for taking my question. First, on the supply side, I would like to know if you could briefly outline the status of the Yokkaichi and North factories, and what the current situation is. I assume utilization is basically at full capacity, but as you think more tactically about the high double-digit growth prospects after this year, how do you expect to enhance your overall joint venture factory network in the future, say, over the next 18 months, and perhaps give us any insights on your views regarding the recent announcements of industry greenfield capacity expansions by some of your competitors?

David V Goeckeler, Chairman and CEO:

So, first of all, we have - as you mentioned, we have two main bases, Yokkaichi and Beishang. I think a significant step this quarter is our announcement to extend the joint venture agreement around Yokkaichi to align it with the agreement in Beishang, so they both now run until 2034, which gives us a very good supply assurance for the next nine years. We will continue to discuss what will happen after that, but the relationship with Kioxia has lasted for decades, which is simply incredible and will continue for a long time. So, we feel we are in a very good position there.

Listen, we haven't had underutilization in the factory for several quarters now. We overcame that point a few quarters ago. There might still be a little bit of memory regarding cost turnover. I think those are things from last quarter.

We are done. So, they are operating at full capacity. Beishang is where we are expanding. We just opened K2 FAB, so we have additional space there. I think the joint venture led by Kioxia has just done a very good job of capacity planning in this part, and there are good plans for how we will expand to the Beishang base as needed for many years to come. So, we feel really good about our positioning there. As for the rest of the industry, it is - as you know, it has a long delivery cycle. We have seen some announcements recently.

I would consider those to be normal processes. We are all continuously building cleanroom space. As I mentioned earlier, this is a market where we are very consistent in supply. We will grow at a mid-to-high single-digit rate in bits.

We will achieve this through innovation. We will - this innovation will require additional cleanroom space. That is all in the plan. I expect to see continued spending to reach that number, but we are not seeing anything unusual.

And I think as we need to know, if you want to start building a new FAB, it takes years to build and put into operation and start producing products. So that’s a little bit of how we view the market. Final comment, when we talk about supply and demand, all of this has been factored into our numbers.

James Schneider:

Thank you.

And perhaps as a follow-up, could you maybe talk about, clearly you mentioned the certification with another enterprise-level SSD hyperscale customer at the end of this calendar year, for example, what percentage of your enterprise-level SSD exposure do you expect to be of total revenue? Thank you.

David V Goeckeler, Chairman and CEO:

Yes, we are not going to give a specific number right now, but I just want to say stay tuned. I think we have said this, our business will continue to grow in this market. We have already seen a 29% quarter-over-quarter growth, followed by a 64% quarter-over-quarter growth, without getting into too much detail. I think next quarter you will also see a significant uplift. So we feel really good about the positioning of our product portfolio. As I said, the customer feedback, not just from hyperscale enterprises, but from the entire ecosystem that is building AI infrastructure Our market-focused TLC products are indeed driving this growth. We will see our BiCS8 QLC products start shipping for revenue in the coming quarters, which will be another tailwind for growth. As we discussed, the performance of BiCS8 QLC has been very well received. So we continue to see very high interest in these products and are in the process of certification. We look forward to continued growth, which will be part of the balanced product portfolio we have been talking about, regarding how we will allocate our supply to that segment of the market. But we are excited about where we are and where we are going.

James Schneider:

Thank you.

David V Goeckeler, Chairman and CEO:

Thank you, Jim.

Operator:

The next question comes from Mehdi Hosseini of SIG. Please go ahead.

Mehdi Hosseini:

Yes, thank you for taking my question. I have two follow-up questions for the team. When I look at your guidance for the March Q3 fiscal quarter, assuming low single-digit bit growth, there is a significant jump in ASP and blended pricing. I want to ask how we should consider the mixed factors affecting ASP? Clearly, as you expand SSDs, there will be a higher premium.

Compared to bits, you are capturing more premium or economic value. Is there any way you can help me understand? Because just considering the absolute value of ASP might give us a misleading impression. So any help you can provide would be great. I have no further questions.

Luis Visoso, Executive Vice President and CFO:

Yes, so the mixed impact we have is less related to the changes in the market we are targeting and more related to the customers, right? And how we serve the market. I touched on this a bit in my prepared remarks. What you see is that we are driving a better mix. We are working with customers who value our relationships and our products.

Therefore, we are getting better gross margins from that. So there is a mix component to your point. Mehdi and Wilco, and there are some pricing factors. Now, we believe the market will.

Continue, sorry.

Mehdi Hosseini:

Oh, I just wanted to say, just a quick follow-up. Can you provide any breakdown of the mix so that we don't focus too much on the trends in ASP?

David V Goeckeler, Chairman and CEO:

Yes, we will provide that to you in the next quarter's report. Mehdi, regarding guidance, I don't have anything to share with you at this time.

Mehdi Hosseini:

Okay, great. There's another question for David. Look, we need to be here, the shortage is increasing. It's intensifying.

You and your peers are engaged in discussions about multi-year contracts. As you emphasized, these projects take years. Building fabs and placing equipment is a very lengthy process. Why isn't there more urgency? Why are your customers reluctant to commit more? They are committing investments throughout the AI supply chain.

But when it comes to memory or NAND, I don't feel the urgency. If this is going to wait until the second half of this year, that means the shortage will intensify, unless the 60% growth in SSDs might just be a short list. But how can I reconcile the two?

David V Goeckeler, Chairman and CEO:

I have a lot of thoughts on this, Mehdi. I mean, first—I'd argue that there is actually quite a bit of urgency, and things are changing quite dramatically and quite rapidly.

Right? I mean, you're talking about a market that has operated in its way for, you could say, decades. The way that market operates is that there is essentially a NAND auction every quarter, which sets the price. So, that sets the price. Then we all have to discuss what the price is every quarter.

Then on the supply side, we try to get a handle on how much we supply, but we often get it wrong. When you get it wrong, the economics completely collapse. So, we're trying to get out of that world. There are many reasons why we want to get out of that world. There are many technical reasons and various things we've talked about in the past, we could talk a lot about. But for something you've been doing for ten years, to just wake up in one quarter and decide to completely change the business practices of an industry is almost really, really hard to do. So, but I do think it's happening. I do think customers are starting to look, as I said, they are starting to look further out, especially in data centers.

I think this point cannot be underestimated, that now data centers are the largest market for NAND. I mean, this is a market that was once dominated by—or not dominated by, but when the primary customers were smartphones and PCs, I viewed it as the traditionally commodity NAND market. I hate that term, but that's how people view it. Data centers are not that market. Just as data centers are not the commodity NAND market.

Data centers are—NAND is a highly strategic product, part of a very complex AI architecture. I need extremely high performance, I need innovation, I need specific enterprise-grade SSDs that fit my configuration. That is in stark contrast to the idea of "I just need the same product that I can plug in from any of five different suppliers." That's not—so that market is now becoming the primary market, and particularly the main growth engine, really, I think, is starting to challenge the business practices of how the market traditionally operates.

Once again, I am actually quite optimistic about how quickly this is happening. Now let's see how fast. I mean, are we actually at the point of announcing contracts? We are not quite there yet. We have some things in progress.

But in my view, relatively speaking, the progress is quite fast. For such a large market, with so many participants, trading so much business every quarter, to see it change as quickly as it is now is actually quite remarkable.

Mehdi Hosseini:

Thank you for your detailed explanation.

David V Goeckeler, Chairman and CEO:

No problem. Thank you, Mehdi.

Operator:

(Operator instructions) The next question comes from Wamsi Mohan of Bank of America. Please go ahead.

Analyst:

Hi. This is Ruplu standing in for Wamsi. May I ask Luis a question? This quarter, operating expenses (OpEx) have decreased. You mentioned that you have gained from managing new product introductions (NPI). Can you elaborate on what that gain is? Can you talk about the capital allocation plan? How much do you expect to spend on HPF and data center expansion, as well as any capital return plans or acquisition plans? Thank you.

Luis Visoso, Executive Vice President and CFO:

Yes. So, let me try to unpack the OpEx question, as I thought someone would ask. We made a recurring change in the way we sell products. Basically, we are now starting to charge for our certified units. In the past, we were used to recording costs as they occurred, right? They were period costs. This is a non-recurring factor, this is a gain, a one-time gain, because we are moving from period costs to inventory as we are now selling these certified units. Does that make sense?

Analyst:

Yes. That is clear.

Okay. So, we will achieve ongoing savings because we are charging customers for these certified units, and as we transition and move through inventory, there will be a one-time gain. Regarding the capital allocation question, as I mentioned before, our capital allocation strategy has not changed. We will continue to invest in the business.

We will build prudent cash reserves, which is very helpful for this business, especially considering where we need to be positioned. We believe we need to continue to build cash reserves, and we will continue to reduce debt. So we have reduced from $2 billion to $650 million, so we are making great progress, and we will continue to make progress in that area. We are fully funding the business.

We are funding the business through the transition from BiCS8. We are funding our OpEx, and we feel we are appropriately funding the business itself.

Mehdi Hosseini:

Are there any underutilized expenses in the guidance?

Luis Visoso, Executive Vice President and Chief Financial Officer:

No, there are none in the guidance, nor in the actual data.

Mehdi Hosseini:

Okay, thank you very much.

Operator:

The next question comes from Vijay Rakesh of Mizuho. Please go ahead.

Joseph Moore:

Hi, Dave and Luis. Great quarter, very impressive numbers. I just wanted to know what kind of bit growth you are looking at for 2026-27? Clearly, ASP pricing has been skyrocketing, but I just wanted to know how the price trends are across different segments, from data centers to retail to consumer SSDs, if you could give us some color, thanks.

David V Goeckeler, Chairman and Chief Executive Officer:

Yes, so the bit growth we see in 27 and 28 is consistent with what we talked about in early February. We are still talking about mid-single-digit bit growth annually. We will not change our assumptions unless we see that demand is present, sustainable, and profitable.

So our plan remains—our record plan is that kind of high single-digit annual bit growth. Regarding the pricing of what we will call end markets, it's very interesting, right? What you see is that prices are not moving in exactly the same way, but are essentially moving at the same rate. What we see happening now is that NAND can ultimately flow into any market. So NAND will naturally flow to the most attractive markets.

So when data center prices go up, they do have an impact on other markets, for example, right? So that's what we see across various markets. Prices are basically rising across the board.

Operator:

The next question comes from Karl Ackerman of BNP Paribas. Please go ahead.

Karl Ackerman:

Hi, thank you for taking my question. I want to congratulate you on a very good quarter. What is the product roadmap? I think now that your data center share has reached 15%, NAND flash is increasingly being attached to AI computing. So I think this is creating new demands on performance, so can you update us on your product roadmap to meet these new requirements? For example, I want high IOPS SSDs, you have exposure on HPF, so how do those new products look?

David V Goeckeler, Chairman and Chief Executive Officer:

Yes, so I think this is a great example of a lot of innovation driven by data centers, as I mentioned earlier.

So, you are right, what we will call compute-focused, TLC high-performance drives are exactly what is driving the portfolio right now. As I said, we just saw a 64% quarter-over-quarter growth, so we continue to see very strong pull for those high-performance products As I mentioned, when we started migrating these to BiCS8, we felt we were in a very favorable position. However, as you said, there is a whole bunch of new innovations underway. I believe the innovation engine remains active and well across the industry, which leads us to how we will meet the demand for AI storage. Models are getting larger, the generated tokens are increasing, and the cache is becoming larger. Naturally, this is something that makes you start considering NAND and its massive expansion characteristics. You are right; there is a lot of innovation happening. There are high IOPS enterprise-grade SSDs, which is certainly something you can imagine we are working on. You know, we had our own thoughts on this two years ago, and we talked about it on Investor Day. We believe there is an opportunity to re-architect NAND to bring it into AI. We registered it as High Bandwidth Flash (HBF). I think over the past year, this has become a more recognized path forward, and now many people are working on this. By the way, we continue to work on this. We are very, very pleased with the progress. We have had in-depth conversations with customers about use cases.

We are designing NAND die. We are building controllers, so that continues to move forward. Obviously, as we progress and finalize our plans, we will have more to say about this. However, I think all of this is just an example that as AI architectures continue to expand, there are huge innovation opportunities, which is very exciting. We are only in the very early stages of pushing this technology and scaling it globally, and we are, perhaps, in a very favorable position to do so within the entire tech industry. They are some of the largest and most capable tech companies in history.

Clearly, they are investing a tremendous amount—huge resources to drive this technology and scale it globally at a very fast pace. I think that is incredibly exciting. I believe this will continue. I think we are still super early in this regard, and I think this will last for a long time.

Operator:

The next question comes from Aaron Rakers of Wells Fargo. Please go ahead.

Michael Stadnoff:

Hi, guys. Thank you. I am Michael Stadnoff, representing Aaron.

I want to return to the discussion on LTA (Long-Term Agreements). Have you finalized any of these agreements? If so, does any part of the prepayment belong to, I guess, any finalized agreements? Is this something we should expect moving forward? I know you hinted at it a bit.

Luis Visoso, Executive Vice President and Chief Financial Officer:

Yes. So far, we have signed and completed one agreement.

We do not disclose the terms. There is a prepayment portion that we believe is important in such agreements, but that’s all I want to say, Michael. So we have one completed, and several more in the pipeline

Operator:

The next question comes from Asiya Merchant of Citigroup. Please go ahead.

Asiya Merchant:

Great. Thank you for taking my question, the results here are fantastic. David, last quarter, I think you shared some thoughts on how you view the edge markets, PCs, smartphones, and perhaps the consumer market.

Just considering the fact that memory is in allocation, people are talking about the decline in PC and smartphone sales, how are you thinking about this, and what signals are your OEM customers providing you regarding these markets, and how does this change your demand outlook for the second half of 2026 and into 2027? If I could insert a question for Luis. Structurally, NAND is experiencing this dynamic, which is obviously a highly strategic product. How are you thinking about your true cycle gross margins? It seems like it's been quite a while since you reached that level, but how are you structurally considering margins here? Thank you.

David V Goeckeler, Chairman and CEO:

Okay. Thank you, Asiya. So look, there are a few thoughts on this. So first, on the consumer market side, I think we are very pleased with the position of our consumer product portfolio.

As I mentioned, we just achieved over 50% year-over-year growth. I think the work we are doing there regarding how we think about branding, innovation, and product portfolio is a long-term market for us. It will continue to be a long-term market for us. We believe we can drive value there through the Sandisk brand.

So we think that is a great business and will continue to be so, and we will continue to invest in it. In some other markets, like, look, I think that’s one of the reasons. Clearly, when we look at the numbers in preparation, if you just look at 2026, our PC sales are 285 million units. I don’t think anyone would have picked that number at the beginning of the year.

So it’s just—very strong results in terms of unit growth and content growth in these markets. So look, as we enter 2026, or we are now in 2026, we will see some base effect on that side, some unit declines. I think we are still getting very strong signals from customers in those markets wanting supply. I mean, very strong signals on a continuing basis.

We are working as closely as possible with them. I think it’s extremely important to stay closely connected with our customers during this market period, and we are doing that. But you will get some base effect on units. I mean, there’s a lot of discussion about the mix in the market.

I just think that’s typically how this market operates. Of course, as components change, the configurations will change as well. Frankly, we saw that in 2023. Suddenly, the component mix ratio increased significantly because prices dropped dramatically. Suddenly, 1TB hard drives became very cheap Suddenly, it started appearing everywhere. As the market shifts a little in another direction, you see that kind of change. I think that's just the natural way this market operates.

I don't think it's something to be overly concerned about. So those markets are still strong. Customer relationships are very good. I expect we will continue to be deeply involved in these markets.

We have had a strong influence on the edge for a long time, and we will continue to maintain that. From a broader perspective, that's one of the reasons why I think this business is so valuable, because we are involved in every single device, every single technology, touching — we touch it or sell NAND to it. Now, with the deployment of AI in the cloud and that market becoming the largest market for NAND, it is changing the dynamics of how the entire industry operates. As we mentioned in our prepared remarks, we have invested a significant amount in R&D over the past 25 years to reach our current position.

We have invested a lot of capital to reach our current position, and we can manufacture all of this, both front-end and back-end. I think we are finally starting to reach the point where the value of this intellectual property, the value of this intensity is being recognized in our own results.

Luis Visoso, Executive Vice President and Chief Financial Officer:

Yes, I think the way to answer your question about cross-cycle profitability is similar to what David left off with, that in a high capital expenditure, high R&D industry or company, frankly, 35% is not where we want to be, right? So we are not going to give you a new number today, but it’s clear that’s not where we want to be. What I want to tell you is this is the first quarter, right? We are above 35%, reaching 51%, and we are getting to what you might call the midpoint of 66%, so we are making progress, and we are reaching a point where we believe we can justify capital expenditures and we can justify the R&D investments needed for the business.

Operator:

The next question comes from Tom O'Malley of Barclays. Please go ahead.

Analyst:

Hi, this is Matthew Panon standing in for Tom O'Malley. I just have a brief question, and I apologize if you’ve mentioned this, just jumping around during the call.

I was wondering if you mentioned the percentage of enterprise SSDs in total bit shipments for the quarter?

Luis Visoso, Executive Vice President and Chief Financial Officer:

I don’t think we mentioned that, but it’s probably in the high teens range (about 16%-19%).

Operator:

The next question comes from Blayne Curtis of Jefferies. Please go ahead.

Blayne Curtis:

Hey, guys.

Congratulations, and thank you for letting me jump in. I just want to talk about the model; it's clear that I mean doubling sales over two quarters. I just want to confirm my understanding of how you will handle OpEx. I think the percentage of revenue that it occupies has now been halved, right? So, will you accelerate the way you look at investing in R&D? And the tax rate, with this significant increase in profitability, is there anything to consider regarding the tax rate? I think you mentioned it might reach 20% at some point; is that inevitable?

Luis Visoso, Executive Vice President and Chief Financial Officer:

Yes.

So regarding OpEx, first, you should know that about 75% of our OpEx is R&D. That's where we invest our money, and why do we do that? Because this is a technology company, and innovation is our lifeblood. That's what we believe in, and that's where we invest our money. So, you shouldn't look at this quarter's OpEx as an indication of where we should be because, as I mentioned earlier, there is a non-recurring gain. If you want to quantify that, that number is about $35 million, so you can use that number for your model.

We believe that OpEx should not significantly increase from today's levels. We believe the run rate is healthy. We will always focus on where we need to invest and ensure we fund innovation, but on the other hand, we have also been looking at efficiency and how we ensure there is no waste in the system. So, after saying a lot, the spending levels from last quarter, what we got this quarter, those are currently more sustainable levels.

The tax rate is interesting because we have a lot of losses from previous years, especially accumulated in Malaysia, which we are consuming very quickly. This happens when you start generating profits, so I think you should see our tax rate hovering a bit higher than today, perhaps on a sustained basis around 14%-15%. That's what I would model right now.

Operator:

Our Q&A session has come to an end.

I would like to hand the meeting back to David for any closing remarks.

David V Goeckeler, Chairman and Chief Executive Officer:

Okay. Thank you all for joining us. We will keep in touch throughout the quarter.

Have a great day, everyone. Thank you.

Operator:

The meeting has now concluded. Thank you for attending today's presentation.

You may now disconnect. The event has ended