Goldman Sachs trader: The big logic hasn't changed, don't "overinterpret" the sharp decline in the past two days, especially considering the big rise in January

Mark Wilson, head of Goldman Sachs' trading division, stated that the direct trigger for this round of adjustment is the excessive crowding of investor positions. He emphasized that key variables such as the continued trend of the dollar, sustained enthusiasm for AI investments, strong momentum in U.S. economic growth, and the reshaping of geopolitical dynamics have not changed. This rapid pullback is more of a technical adjustment rather than a shift in fundamental logic

Mark Wilson, head of Goldman Sachs' trading division, stated that despite the recent severe market fluctuations, investors should not overinterpret this "position cleansing," as the core driving factors behind the market have not undergone substantial changes since the beginning of the year.

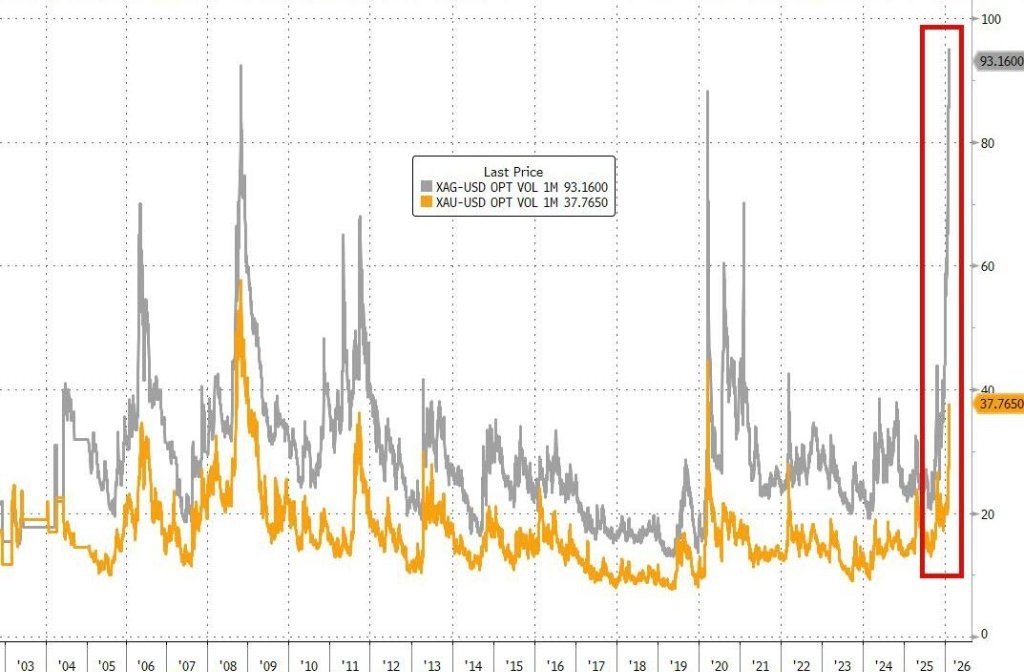

The market set multiple extreme records this week. Microsoft experienced the second-largest single-day market value loss in history, SAP plummeted 16%, and silver fell sharply by 30% in a single day. The nominal trading volume of the silver ETF SLV exceeded $32 billion, while the gold ETF GLD saw trading volumes surpass $30 billion for two consecutive trading days. The volatility of silver surged to extreme levels not seen since the global financial crisis and the COVID-19 lockdowns.

In his weekly report, Wilson pointed out that when assessing the severity of this adjustment, it should be compared to the gains since January. He emphasized that key variables such as the continued strength of the dollar, sustained enthusiasm for AI investments, robust U.S. economic growth, and geopolitical reshaping have not changed. The market performance year-to-date still reflects these core trends—rare earths up 35%, nuclear stocks up 21%, and European defense up 20%.

The direct trigger for this adjustment was the overcrowding of investor positions. Total exposure is at an extreme level in the 99th percentile, and the performance of systematic quantitative strategies shows that crowding has become a prominent issue. Wilson believes that this rapid pullback is more of a technical adjustment rather than a shift in fundamental logic.

Large Stocks Experience Record Volatility

The volatility in the market this week has been astonishing. Microsoft fell 10% in a single day, suffering the second-largest market value loss in history, while simultaneously achieving the highest nominal trading volume ever recorded. SAP plummeted 16%, also accompanied by record trading volumes. The gains were equally remarkable, with Meta rising 10% and Verizon soaring 11%.

The volatility in the precious metals market was even more extreme. Silver plummeted 30% in a single day, with SLV ETF trading volume exceeding $32 billion. The GLD gold ETF saw trading volumes surpass $30 billion for two consecutive trading days. Wilson jokingly referred to the head of metal trading as the "meme stock trading supervisor" during a conference call earlier this week, but in reality, even meme stocks have never seen such enormous trading volumes.

The volatility of silver surged to levels only seen during the darkest days of the global financial crisis and the COVID-19 lockdowns. This extreme volatility reflects the collision of leverage, retail frenzy, and momentum chasing.

The Core Driving Factors at the Beginning of the Year Remain Unchanged

Wilson emphasized that, from a broader perspective, the biggest variables and driving factors pushing the market since the beginning of the year have not truly changed. The trend of the US dollar continues to extend, as the dollar price challenges the range since the millennium and the new Federal Reserve Chairman begins to articulate his policy path, the subsequent developments will be fascinating.

The focus on AI remains high, and the expanding capital expenditure intentions confirm this. Meta's capital expenditures this year have reached $180 billion, indicating a potentially disruptive impact in the future. All signs suggest that the momentum of US economic growth remains strong. The changing geopolitical order is driving a new prioritization of "sovereignty," covering areas such as defense, supply chains, and industrial capacity.

The market scoreboard from the beginning of the year reflects these key trends—rare earths are up 35%, nuclear stocks are up 21%, European defense is up 20%, copper mining stocks are up 18%, US defense is up 17%, and high-beta 12-month winners are up 17%. No trade has captured currency depreciation, re-inflation, and geopolitical sentiment better than silver and gold.

Overcrowded Positions Trigger Adjustments

Wilson pointed out that the extreme level of investor positions cannot be ignored. Total exposure data shows that after experiencing an impressive period of strong broad returns, investor positions have significantly expanded. The net exposure and long-short ratio are relatively less concerning, but the performance of systematic quantitative strategies year-to-date indicates that overcrowding has indeed become an issue.

Semiconductors and semiconductor equipment currently account for 12% of hedge funds' net risk exposure. Two years ago, this ratio was only 1%, while the software sector has dropped from 18% in 2022 to just 3% now. The spending of hyperscale cloud service providers has been raised again, with positions at record extreme levels, and semiconductors remain a major focus.

Wilson stated that although many new macro discussion dimensions have emerged in January—including US liquidity issues, significant fluctuations in yen interest rates, the Federal Reserve's "rate check," inflation concerns triggered by rising commodity prices, and heightened uncertainties in the Middle East—none of these factors should overshadow the fact that investor positions have become excessively expanded. Therefore, the severity of this adjustment should be assessed in relation to the magnitude of the increase since the beginning of the month.

Adhering to Six Core Views for the Year

Entering the new year, despite a wealth of new information, Wilson stated that he still adheres to the six core views established in mid-December for the entire year.

First, the AI narrative in the market has already ended the "end of the beginning" phase. The majority of the value creation from AI is attributed to large language models, and the comprehensive bull market for all things related to AI may have come to an end. The identification of beneficiaries is about to become more stringent.

Second, the appointment of the incoming Federal Reserve Chairman may prove to be a key event for the market, and it should continue to hedge against the prospects of fiat currency depreciation and a weakening dollar Third, there are ample reasons for copper to break through to a historical high, as hard assets hold a very valuable position in investment portfolios, especially those related to infrastructure demand trends.

Fourth, given the current market landscape, diversification is now a cost worth paying to fully invest in the stock market, whether geographically or by factor, as evidenced by 2025.

Fifth, European large-cap stocks do not equate to the European macroeconomy, and the current outlook for European stock pricing is quite bleak.

Sixth, a question that requires ongoing attention is: "Are the conditions for a stock market bubble present?"

In addition, Wilson proposed three emerging themes. UK real estate stocks are trading at over a 30% discount to net asset value, with almost no new office and retail supply, and rents have correspondingly risen at a turning point. Secondly, European stock markets struggle to make significant progress at an overall level when the dollar weakens, as the drag on earnings per share is substantial. Thirdly, semiconductors and semiconductor equipment now account for 12% of hedge fund net risk, while software has dropped from 18% in 2022 to just 3% today; at some point, selecting for consistency in these trends will create real opportunities