What changes and constants come with Waller taking over as Federal Reserve Chair?

Kevin Warsh has been nominated as the next Federal Reserve Chairman, pending Senate confirmation. He may advocate for a policy combination of "interest rate cuts + balance sheet reduction," believing that AI-driven productivity improvements will curb inflation, and hopes to shrink the balance sheet to reduce market distortions. However, market volatility may constrain the implementation of his policies, and balance sheet reduction could lead to turmoil in financial markets. Additionally, Warsh supports further easing of financial regulations

I. Kevin Warsh Nominated as Fed Chair Nominee

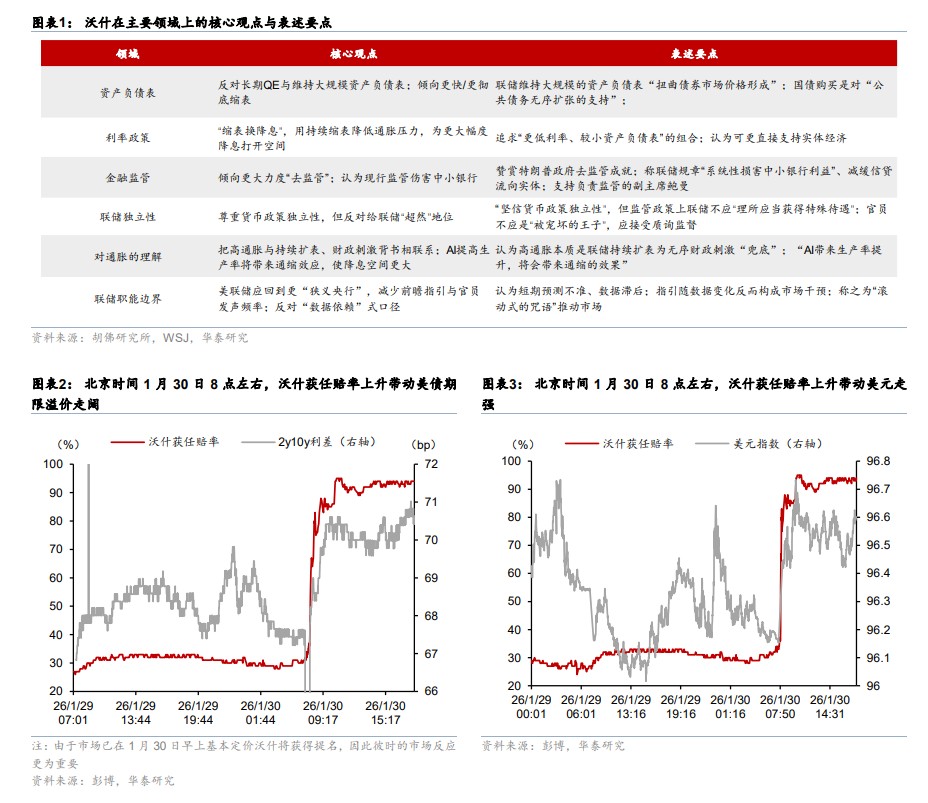

On January 30th, Beijing time, Trump announced the nomination of Kevin Warsh as the next Fed Chair. Since 2026, the market's expectations for the Federal Reserve Chair have been tumultuous. Among the four main candidates, Hassett and Reed once led, but ultimately Trump chose former Fed Governor Kevin Warsh. Warsh was appointed by George W. Bush in 2006 as the youngest governor in the history of the Fed, but he resigned from the Fed Board in 2011 due to differences with Bernanke on issues such as QE. He currently serves as a visiting scholar at the Hoover Institution. In 2017, Warsh competed with Powell for the position of Fed Chair but ultimately lost to Powell. Looking ahead, Warsh needs to be confirmed by the Senate before he can succeed Milan in the current Fed governor position and take over from Powell as Fed Chair on May 16, 2026.

II. Two Possible Changes with Warsh as Fed Chair

1) The Fed's policy direction may change, and Warsh may attempt to promote a "rate cut + balance sheet reduction" policy combination.

From an interest rate perspective, Warsh believes that the current AI-driven productivity improvements will suppress inflation, and if the central bank can significantly reduce its balance sheet, it will also lower inflationary pressures, thereby opening up space for rate cuts. From a balance sheet perspective, Warsh has long criticized the Fed's maintenance of a large balance sheet for distorting the market and affecting fiscal sustainability, hoping to reduce the balance sheet more aggressively and stop purchasing assets such as MBS. In terms of policy sequence, Warsh may first push for rate cuts and then attempt to reduce the balance sheet, but market volatility may significantly constrain him. On one hand, balance sheet reduction may lead to excessive market reactions, considering the Trump administration's relatively protective stance towards capital markets, market volatility will impose constraints on him.

Specifically, balance sheet reduction may push up term premiums and long-term interest rates, and may lead to a decrease in reserve levels, while the current financial market has become accustomed to the ample reserve framework since 2008, and balance sheet reduction may bring short-term financial market turmoil. On the other hand, the Fed announced the resumption of balance sheet expansion at the December 2025 meeting, and Warsh needs to persuade other Fed members to shift towards a combination of balance sheet reduction + rate cuts, so the pace of advancement may be affected. In addition, Warsh supports further deregulation in the financial sector and criticizes the Fed's forward guidance. Specifically:

- Regarding deregulation, Warsh praised the overall deregulation achievements of the current Trump administration and advocates for greater deregulation in the banking sector by the Fed. In the article "The Federal Reserve’s Broken Leadership," Warsh believes that Trump is liberating families and businesses from the shackles of regulatory agencies and bluntly states that the Fed's regulations systematically harm the interests of small and medium-sized banks, slowing the flow of credit to the real economy, and expresses support for Fed Vice Chair Bowman, who is responsible for regulation

- In terms of forward guidance, Walsh believes the Federal Reserve should reduce forward guidance and that Fed officials should lower their frequency of statements, opposing "data dependence." He argues that the short-term predictive accuracy of economic data is limited and that the data itself is lagging, thus the accuracy of such guidance is limited and instead interferes with the market. Walsh refers to this as "moving markets with rolling Fed incantations."

- Regarding the independence of the Fed, Walsh advocates for respecting the Fed's independence but also emphasizes that the Fed should not be granted a "transcendent" status. Walsh states that he "firmly believes that the independence of monetary policy is a wise political economy choice," but stresses that in regulatory policy, the Federal Reserve should not be "entitled" to special treatment. He believes that when the effectiveness of the Fed's monetary policy is poor, Fed officials should not be viewed as "spoiled princes" but should face serious questioning and strong oversight, and mistakes should be duly condemned. However, Walsh does not clarify how to evaluate the correctness of monetary policy or what issues can be used as a basis for questioning Fed officials, thus the relatively vague boundaries of independence may raise concerns about substantial erosion of that independence.

2) Communication with the President may be smoother

The current confrontation between the White House and the Federal Reserve has reached a historical extreme. Trump broke the traditional taboo against executive intervention, not only continuously exerting pressure on Fed Chairman Powell through social media and public occasions but also taking substantive "purge actions," including the dismissal of board member Lisa Cook, seen as a representative of the progressive faction, and even authorizing the Justice Department to unprecedentedly sue the current Fed chairman. Walsh's appointment as Fed chairman is expected to significantly improve the adversarial relationship between the White House and the Fed. Walsh has close ties to the Trump family; according to Politico, Walsh's father-in-law has been a long-time friend of Trump since college. These personal relationships help establish trust between Walsh and Trump, facilitating smoother communication and avoiding "crossfire" through media between the White House and the Fed, preventing Trump from politicizing monetary policy decisions.

III. Some basic logic and mid-term policy framework will not change

1) The Trump administration's nurturing of capital markets and broad liquidity orientation remains unchanged, and the overall orientation of monetary policy is still (relative to the strength of the economy) relatively loose.

In a speech in April 2025, Walsh criticized the Fed's path dependence on "asymmetric" policies, where the Fed actively intervenes and encourages fiscal spending when the economy faces difficulties, but fails to take symmetric actions to call for discipline or tighten policies during prosperous times. Walsh introduced the concept of "economic imprinting," which suggests that bailout measures reduce the economy's self-regulating ability (i.e., its capacity to endure pain and self-correct). To avoid the pain of short-term market adjustments, the Fed must continue to provide support in the next crisis, resulting in the accumulation of greater long-term risks (capital misallocation, asset bubbles). However, Walsh also pointed out that the Fed was established to respond to panic (under the Federal Reserve Act of 1913), and in times of crisis (such as 2008), the Fed used unconventional means (such as interest rate cuts, Quantitative easing) is necessary to stabilize the market. Therefore, if the financial market experiences a significant decline or encounters severe liquidity issues, the Federal Reserve led by Waller will still nurture the market and provide a Fed put. Especially considering that 2026 is an election year, Trump places great importance on economic and market performance. For example, Trump mentioned the U.S. stock market hitting new highs 52 times in his speech at Davos. Financial market volatility will affect Trump's election prospects, and Waller's long-standing relationship with the Trump family may make him more inclined to provide a Fed put.

2) In the medium term, the independence of the Federal Reserve is eroded, and the trend of the dollar's intrinsic value declining may not change.

The current contradiction between the sustainability of U.S. government finances and high interest rates still lacks a substantive solution. Increased defense spending, rising government interest expenses under high interest rates, and the expansion of rigid expenditures such as social welfare make it difficult for the U.S. fiscal deficit rate to decrease. The "big and beautiful" plan promoted by the Trump administration will add $4.1 trillion to the deficit over the next decade, leading to a fiscal deficit rate of around 6% for the U.S. over the next ten years. This means that the U.S. government's net debt/GDP ratio will further climb from the current 97%, with the CRFB predicting it will reach 127% by 2034. However, whether the Federal Reserve led by Waller has a "confrontation" or "cooperation" with the White House in the future, the influence of the White House on Federal Reserve policy may trend upward, and the independence of the Federal Reserve may be eroded in the long term. Since Trump resumed office, he has already broken through the "firewall" between Federal Reserve decision-making and the White House's stance. Even if Waller serves as the Federal Reserve Chair, regardless of his "loyalty" to Trump, it is expected that Trump will not give up pressure on the Federal Reserve, and the trend of eroding the Federal Reserve's independence may not change.

IV. Focus on short-term financial fluctuations, but asset allocation should still be anchored by the "unchanging" long-term logic

On January 30, Waller was previously considered an inflation hawk, so his appointment as Federal Reserve Chair led to a rise in U.S. Treasury yields, a stronger dollar, and adjustments in risk assets. However, asset allocation should be anchored by the "unchanging" long-term logic. We reiterate the conclusion of "The Implications of Gold Prices Near 5,000 and Silver Prices Breaking 100" (January 25, 2026). As global geopolitical restructuring and deteriorating fiscal sustainability enter the "fast lane," ① the trends of gold and silver under global changes indicate a decline in the "gold content" of currency and a rapid upward drift of the "valuation anchor," which may require adjustments to the pricing system for scarce physical assets and core equity assets. ② Changes in the supply-demand balance of global commodities, including scarce key products in AI and defense aerospace sectors, may continue to drive a broader revaluation of commodity and resource prices. Given that the global investment cycle after 2026 will be more "material-consuming" compared to before 2025, and the price sensitivity of incremental demand in core areas such as AI infrastructure and defense is relatively low; at the same time, the decline in the consumption of materials related to Chinese real estate is nearing its end, and global resource demand will no longer enjoy the "buffer" brought by this trend.

Risk Warning and Disclaimer

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at one's own risk