Leveraged ETFs drop 60% in two days! Silver becomes a "retail investor graveyard," with Reddit speculators in despair

白銀市場經歷劇烈波動,價格在三天內下跌超過 40%,導致散户投資者遭受重大損失。儘管週二反彈 9%,但市場動盪已造成 1500 億美元市值縮水,尤其是槓桿 ETF 遭受重創。此次暴跌的原因包括美聯儲主席提名和提高保證金要求,分析師警告稱這種極端波動是 “等待發生的事故”。散户投資者在 1 月份向白銀 ETF 注入了創紀錄的資金,導致投機行為加劇。

白銀市場的歷史性漲勢近日遭遇劇烈逆轉,演變為一場令散户投資者措手不及的崩盤。在投機狂潮推動下,這種貴金屬的波動性一度堪比新冠疫情期間的 “Meme 股”,但隨後迅速轉跌,不僅抹去了鉅額市值,更重創了追高入場的散户羣體。

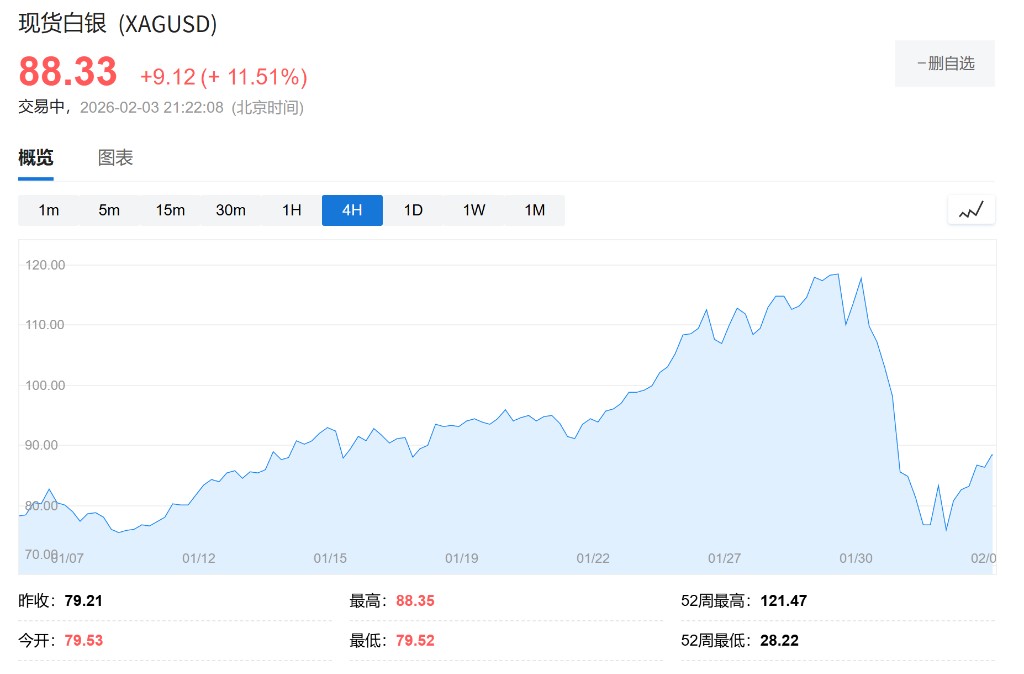

白銀價格在上週四觸及每盎司 120 美元以上的高點後,遭遇了慘烈的三日連跌,跌幅超過 40%。儘管週二價格反彈了 9%,但市場的極端波動已造成顯著破壞。與此同時,黃金價格也經歷了從高點下跌 21% 後反彈 6% 的劇烈震盪。

此次暴跌的導火索包括美國總統特朗普提名沃什擔任美聯儲主席,以及交易所提高保證金要求等因素。然而,交易員普遍認為,暴跌的速度和殘酷程度主要歸因於近期投機狂潮的迅速逆轉。此前數月,尤其是來自亞洲的散户資金大舉湧入,試圖利用這一波動性極高的資產獲利。

市場數據顯示,追蹤黃金和白銀的 ETF 自上週市場見頂以來,市值已縮水約 1500 億美元。其中,深受散户青睞的槓桿類 ETF 遭受重創,一隻兩倍做多白銀的 ETF 在兩天內暴跌近 70%,令活躍於 Reddit 等論壇的投機者蒙受了毀滅性損失。分析師警告稱,白銀因其高波動性常被稱為 “打了類固醇的黃金”,這種極端的市場走勢實為一場 “等待發生的事故”。

“Meme 股” 式的投機狂潮

雖然一月份出現了實物白銀的搶購潮,甚至導致國家造幣廠供應緊張、精煉廠加班熔鍊首飾,但市場參與者指出,最狂熱的投機行為主要集中在與貴金屬掛鈎的金融資產上。

Vanda Research 的數據顯示,散户投資者在 1 月份向白銀 ETF 注入了創紀錄的 10 億美元資金。作為散户最青睞的標的,白銀 ETF SLV 在上週的交易活動創下多項紀錄。1 月 26 日,當銀價接近歷史高點時,SLV 的交易額高達 394 億美元,與追蹤標普 500 指數的最熱門 ETF SPY 的 419 億美元交易額幾乎持平。而在去年同一天,SPY 的交易量是 SLV 的 70 倍。

摩根大通全球數據資產和阿爾法小組負責人 Eloise Goulder 指出,1 月份社交媒體上散户關於白銀的提及量是過去五年平均水平的 20 倍。精煉商 MKS Pamp 的分析師 Nicky Shiels 表示:“一月將被銘記為白銀像 ‘Meme 股’ 一樣交易的月份。” 她甚至收到人們的留言,戲稱她 “正式在賭場工作”。

槓桿 ETF 重創散户投資組合

對於在價格高位通過槓桿工具入場的散户而言,此次回調是災難性的。Global X ETFs 的 Trevor Yates 指出,槓桿 ETF 通常由散户資金流驅動,因為機構投資者有更有效的方式獲得槓桿。

其中,頗受歡迎的兩倍做多白銀價格的 ETF——AGQ,在上週五暴跌 60%,隨後在本週一又下跌了 9%。這種劇烈的單邊下跌讓許多高位接盤者損失慘重。

在 Reddit 論壇上,散户投資者的哀嚎隨處可見。一名在上週接近銀價歷史高點買入 AGQ 的用户表示,截至週末已浮虧超過 2.5 萬美元,並寫道:“我今天失去了相當於税後年薪的資金,幾乎是我的整個投資組合。” 另一位交易白銀衍生品的用户稱自己 “崩潰了”,因為在上週五銀價單日創紀錄下跌 27% 時,他損失了 “天文數字般的金錢”。

StoneX 分析師 Rhona O’Connell 直言:

“白銀一直是一個死亡陷阱。過去幾周這種拋物線式的走勢,確實是一場等待發生的事故。”

政策觸發與市場結構的脆弱性

此次拋售最初由宏觀消息觸發。特朗普提名沃什為美聯儲主席候選人,部分投資者認為沃什相比其他候選人更不可能屈服於降息壓力,這在一定程度上緩解了市場對央行信譽喪失的擔憂,而此前的擔憂正是推動貴金屬過去六個月反彈的動力之一。此外,中美兩地交易所提高貴金屬交易保證金要求,以及農曆新年前的季節性拋售,也加速了跌勢。

然而,白銀市場的深度不足放大了這些影響。分析師指出,白銀市場相對小眾,無法應對今年湧入的巨規模熱錢。CRU 分析師 Kirill Kirilenko 解釋稱,這也是白銀被稱為 “打了類固醇的黃金” 的原因,它往往會在兩個方向上都出現超調。當投資者急於退出看漲押注時,市場缺乏足夠的流動性來承接,導致了價格的崩塌。

多空分歧與後市展望

儘管遭遇了戲劇性的暴跌,但目前的銀價僅回落至 1 月中旬的水平。過去一年長期持有黃金和白銀的投資者依然坐擁鉅額收益。

部分市場人士將此次下跌視為深度反彈中的一次回調。諮詢公司 Acumet 的 Sébastien Le Page 認為:

“這只是膝跳反應,我們仍處於牛市區域。”

而在在線投資論壇中,白銀最忠實的擁躉們依然試圖維持樂觀情緒。儘管市場在上週四急轉直下,一名 Reddit 用户仍呼籲 “繼續囤積”。甚至在週一跌幅加深後,仍有發帖者堅持看漲,稱 “這是有史以來最明顯的長期買入信號”。市場的極度分歧預示着未來的波動性可能仍將持續。

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。