This week, the wolf of "AI disrupts everything" has finally arrived

Morgan Stanley warns that the market's pricing of AI disruption risks is showing a domino effect: within a month, the weight of risks facing European indices has surged from 4% to 24%. GPT-5.2 has reached human expert levels in 71% of professional tasks, up from just 24% five months ago. It is advised to avoid easily replicable software and bank stocks, and to embrace "value anchors" that cannot be replicated by AI, such as utilities, defense, and physical assets, while also paying attention to the computing power shortage crisis

The market has finally realized that the disruption caused by AI is no longer a distant threat.

On February 14th, according to news from the Chasing Wind Trading Desk, Morgan Stanley stated in its latest research report that as AI models advance non-linearly and at an accelerated pace, the market's pricing of disruption risks has begun to show a domino effect:

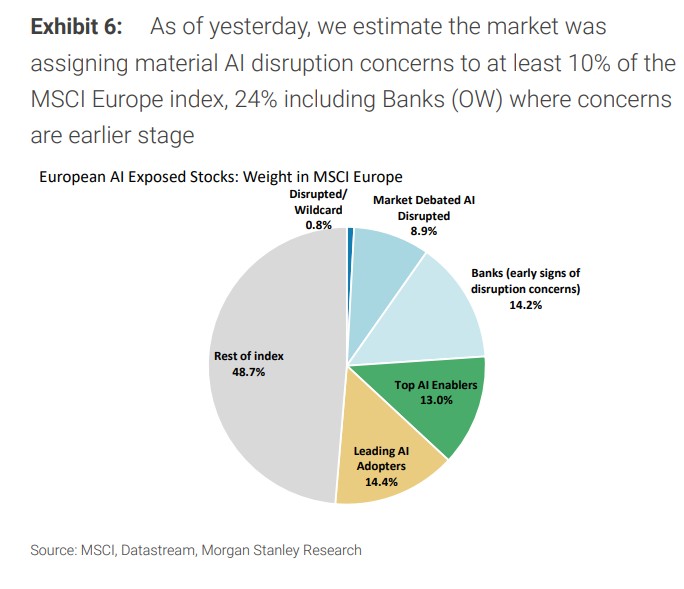

Just a month ago, the market estimated that about 4% of the MSCI Europe Index weight faced the risk of AI disruption; a week ago, this proportion rose to 7%; and by February 13th, this figure had jumped to 24% (including the banking sector).

The report pointed out that Morgan Stanley believes that as cutting-edge AI model capabilities break through critical points—GPT-5.2 has reached or surpassed human expert levels in 71% of professional tasks—investors must reassess their asset allocation logic.

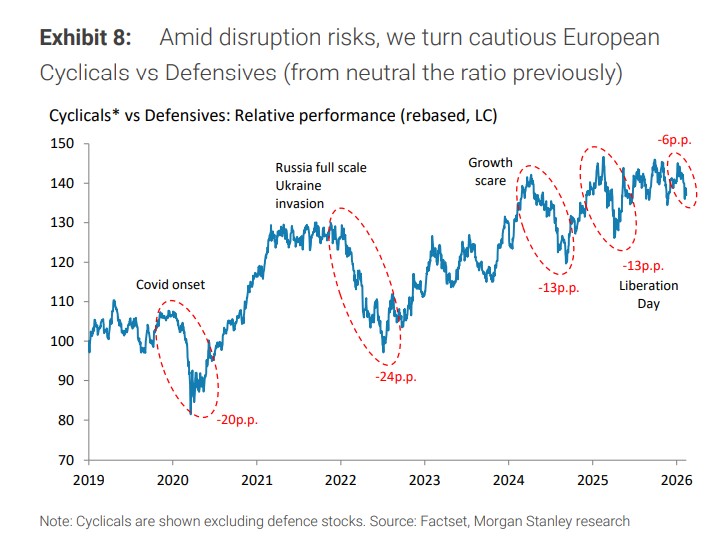

Morgan Stanley has shifted its stance from neutral to cautiously viewing cyclical stocks relative to defensive stocks, noting that the European credit market offers cheap downside hedging opportunities, with a focus on utilities, semiconductors, defense, and tobacco, which are seen as the most resilient safe havens.

The bank emphasized that it is necessary to reassess which assets cannot be "replicated" by AI—these will become the value anchors of the new era. In an age where intelligence and labor can be infinitely replicated, true value will return to those things that cannot be replicated—physical assets, regulatory barriers, network effects, human experiences, and proprietary data.

The Astonishing Leap in AI Capabilities: 71% of Professional Tasks Have Been Conquered

Humans are not good at understanding nonlinear changes, and the progress of AI models is a typical example of nonlinear acceleration.

Morgan Stanley stated that the data shows an astonishing pace of progress: Grok 4, launched in July 2025, scored 24% on the GDPVal test, meaning that this model can reach human expert levels on 24% of real professional tasks; just five months later, the GPT-5.2 released on December 12, 2025, scored a soaring 71%.

What is GDPVal? It is a metric that measures the performance of AI models in real-world knowledge work, covering actual tasks of experienced professionals across various industries. Research by OpenAI found that cutting-edge models complete these tasks about 100 times faster than industry experts and at about 1/100th of the cost.

The report emphasizes that even more shocking breakthroughs are on the horizon. If the scale laws of training large language models (LLMs) continue to hold in 2026—which Morgan Stanley believes is very likely—multiple cutting-edge LLMs from the U.S. are expected to be launched in the first half of 2026, with capabilities far exceeding current models. The reason is simple: the five major LLM developers in the U.S. are currently using about 10 times the computational power to train the next generation of models compared to current models.

The Domino Effect of Disruption Risks: From Software to Banking

The speed of change in market perception is equally astonishing.

Morgan Stanley's tracking shows that the market initially began to question whether the revenue growth of the software industry could sharply slow down in the coming years, but soon this concern spread like a domino effect to broader economic disruption risks—changes in competitive landscape, employment impacts, deflationary pressures, etc.

This is reminiscent of the evolution of market psychology at the beginning of the COVID-19 pandemic in early 2020: In January, it was merely about demand and supply chain risks; by February, it expanded to industries such as travel and leisure, industrials, and banking; by March, it evolved into a full market sell-off, ultimately triggering significant policy actions.

Currently, Morgan Stanley estimates that about 10% of the MSCI Europe Index weight (excluding banks) is perceived by the market to face substantial AI disruption concerns, which rises to 24% when including banks. The concerns regarding the banking sector are relatively new, primarily focused on broader economic deflation and employment issues, as well as (to a lesser extent) deposit competition concerns related to AI.

Notably, these "disruptive stocks in market debates" have fallen from a peak price-to-earnings ratio of 24 times in early 2025 to today's 16.4 times. However, Morgan Stanley warns that referring to the valuation trends of those "undisputed disruptive stocks" (which fell from 24.7 times to 11.1 times), valuations may have further downside potential.

Who Can Survive in the AI Era?

In the face of this disruption storm, Morgan Stanley provides a framework for assessment, combining five dimensions to judge the resilience of sectors and individual stocks:

AI Exposure Level: Is it the disrupted party, the "disruption target in market debates," an enabler, or a protected party?

Nature of Business: Service provider, physical assets, commodities, or computing power?

Cyclicality: Cyclical stocks, defensive stocks, or others?

Investor Holdings: Current position levels?

Individual Stock Momentum: Fundamental overlay factors.

Based on this framework, Morgan Stanley believes the most resilient sectors, in order, are: utilities, semiconductors, defense, tobacco, and personal and household care products.

Morgan Stanley states that European utility companies almost monopolize the top 20 list of the most disruption-resistant stocks. The common characteristic of these companies is that they provide physical infrastructure that AI cannot replicate, belong to defensive industries, and are relatively underweight in the current environment.

In contrast, sectors such as software, business services, media and entertainment, travel and leisure, as well as transportation, diversified finance, and banking, are considered to face the highest pressures from the spread of disruption risks.

Eight Asset Classes That Cannot Be Replicated by AI

Meanwhile, Morgan Stanley emphasizes that once AI reaches a transformative level, the value of asset classes that cannot be "replicated" by AI will rise. This is a key framework for understanding future asset allocation:

A. Physical Scarcity: Real estate, energy and power assets, transportation infrastructure, data centers, mineral metals, water resources, casino licenses in limited jurisdictions, theme park land, cruise ports and dock rights, spectrum licenses, fiber optic cable networks, etc.

B. AI Adopters with Pricing Power: The threshold for demonstrating pricing power is rising.

C. Unique Luxury Goods, Properties, and Services.

D. Network Effects: Large tech platforms, online marketplaces, healthcare businesses with patient relationships.

E. Genuine Unique Human Experiences: Media businesses with strong brands, sports assets/teams, music, and other performances that value the human element.

F. Regulatory Scarcity: Businesses with various licenses, approvals, and protected franchises.

G. Proprietary Data and Brands: AI adopters with proprietary datasets and IP libraries.

H. A Range of Semiconductor Assets: Such as leading processes, ASML's EUV lithography, TSMC's manufacturing expertise, and chip rare earth processing.

Credit Market: Cheap Downside Protection

Although concerns about AI disruption have begun to affect some credit markets, particularly in the leveraged loan sector, European investment-grade spreads remain near post-global financial crisis lows. Even as implied volatility in the stock market has been rising, credit volatility remains unusually subdued.

However, if concerns about AI disruption spread to more sectors (along with the anticipated acceleration in issuance), it could begin to challenge the resilience of the credit market.

Morgan Stanley believes that the credit options market provides a good entry point for investors to prepare for spread widening. Given Europe's relatively low tech exposure, overall yields still at high levels, policy support, and economic growth resilience, the cost-effectiveness of these hedging tools is particularly notable.

Computing Power Demand Gap: An Invisible Supply Crisis

On the other side of AI disruption is the frantic demand for computing power infrastructure. Multiple data points indicate that the growth rate of computing power demand far exceeds current supply forecasts:

-

Google executives recently stated that the company may need to double its computing power every six months, "reaching 1000 times in 4-5 years." In comparison, Morgan Stanley predicts a compound annual growth rate of about 210% for Nvidia's computing power sales from 2025 to 2028; extrapolating over five years, the cumulative computing power would be about 300 times—far below the 1000 times required by Google.

-

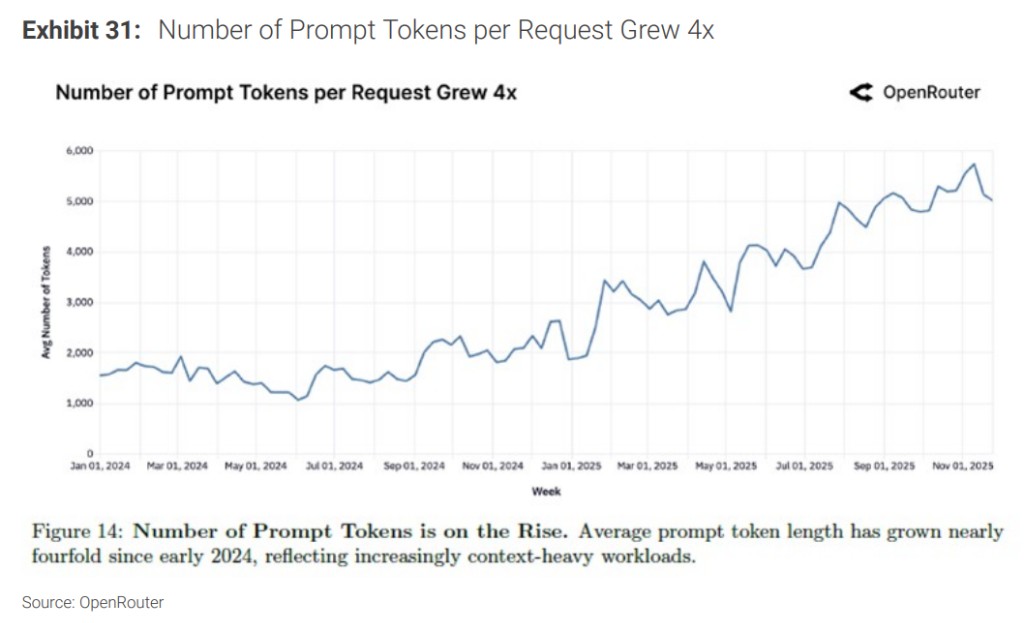

OpenRouter data shows that from the end of November 2024 to the end of November 2025, the average weekly token demand is expected to grow by over 2200%. Token usage is a direct proxy for computing power demand.

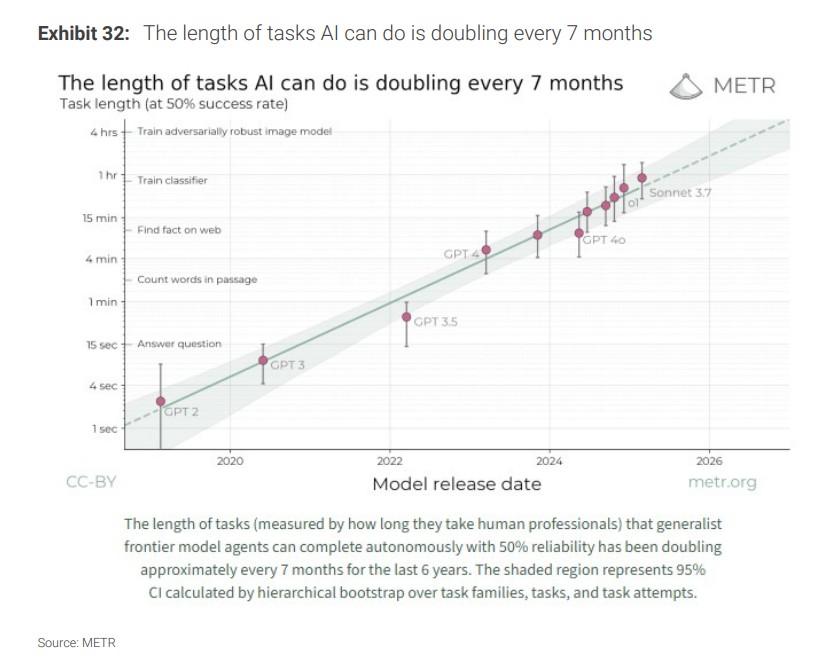

- More critically, the computational intensity of individual LLM queries is rapidly increasing. Research institution METR points out that the average duration of "work" performed by AI for each customer query doubles every seven months

According to research reports, even if the number of customers remains unchanged, this growth indicates that the demand for computing power will significantly exceed NVIDIA's projected annual compound growth rate of approximately 120%.

Morgan Stanley stated that this supply-demand imbalance has already manifested in the market:

CoreWeave is able to renew leases for the older generation of NVIDIA GPUs (Hopper) at 95% of the original price, which is much higher than the price implied by the economic depreciation of the chips over time;

The "power shell" leasing deal guaranteed by Google for Anthropic and FluidStack has provided Bitcoin miner Hut8 with an approximately 18.5% unleveraged capital return, equivalent to a power access premium of about 300%