Wall Street boldly predicts: To hedge against the labor shortage, Waller may tolerate inflation of 2.5%-3.5%!

The Federal Reserve may tolerate an inflation rate of 2.5%-3.5% under the leadership of Waller to address the balance of supply and demand in the labor market. Analysts point out that the current labor demand and supply in the United States are both at 172 million people, indicating a state of "perfect balance" in the market. If immigration enforcement tightens, labor supply will shrink, threatening economic expansion. The Federal Reserve is expected to continue cutting interest rates, driving down short-term real interest rates, weakening the dollar, and leading stock assets to outperform bonds. BCA Research recommends an overweight position in the MSCI Global Consumer Discretionary sector

The Federal Reserve's monetary policy framework may be on the verge of a significant shift. BCA Research analyst Dhaval Joshi predicts that under the leadership of future Federal Reserve Chairman Waller, the Federal Reserve may effectively tolerate an inflation rate rising to the range of 2.5% to 3.5% to support the U.S. economy operating at a higher temperature. The core motivation behind this strategy is that the U.S. labor market has reached a rare balance point between supply and demand, and any contraction on either side could lead to an economic recession.

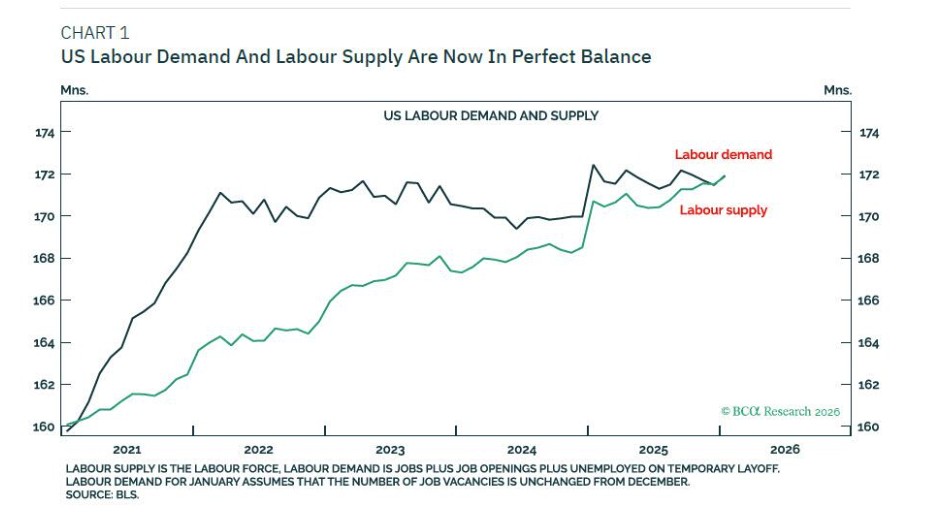

Data shows that the current labor demand and supply in the U.S. both stand at 172 million people, with job vacancies and non-temporary unemployment numbers stabilizing at 6.6 million, indicating that the market is in a theoretically "perfect balance" state. Joshi points out that at this critical juncture, if tightening immigration enforcement leads to a contraction in labor supply, it will directly threaten economic expansion. Therefore, the Federal Reserve may increase its tolerance for inflation to stimulate total demand while enhancing labor participation rates in a "hot" environment, thus offsetting supply-side shrinkage.

This policy shift will profoundly reshape asset pricing logic. The report predicts that even if the inflation center rises to the 2.5%-3.5% range, the Federal Reserve will continue to cut interest rates, accelerating the decline of short-term real interest rates. The U.S. dollar will continue to weaken due to the narrowing of the real interest rate differential, while the U.S. Treasury yield curve will face "bear steepening" pressure, meaning that rising long-term yields will cause long-term government bonds to underperform cash and other sovereign bonds.

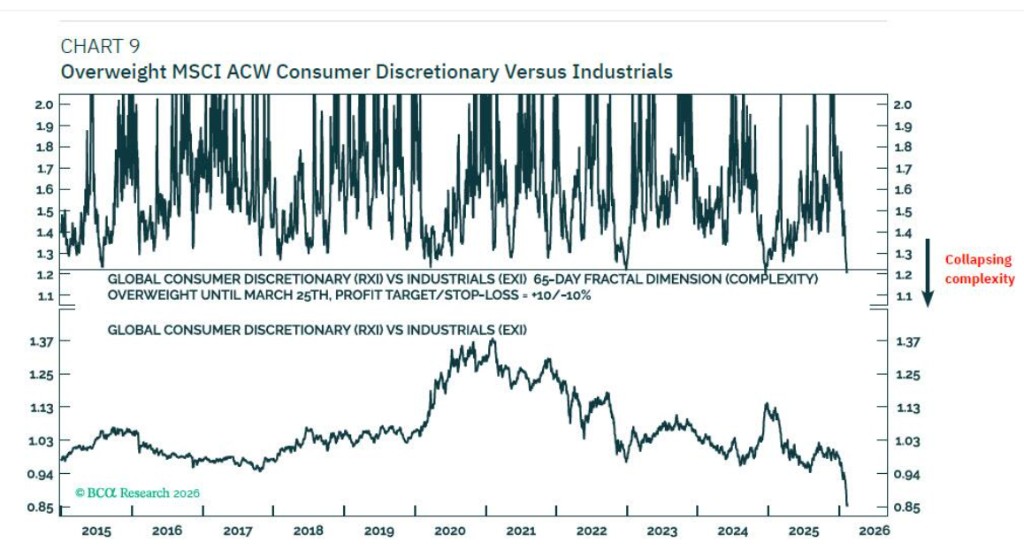

In this macro context, equity assets are expected to continue leading over bonds. BCA Research recommends tactically overweighting the MSCI Global Consumer Discretionary sector relative to the industrial sector. This sector has significantly underperformed by nearly 20% over the past 65 trading days, indicating substantial room for recovery.

Labor Market Balance Brings "Dual Risks"

The U.S. labor market is entering a rare "balance moment," marking the first time since the outbreak of the pandemic that supply and demand have achieved numerical parity.

By definition, labor supply includes both employed and unemployed individuals; labor demand encompasses employed individuals, job vacancies, and temporarily unemployed workers. When the number of "jobs seeking workers" equals the number of "workers seeking jobs," the market is in a strictly defined equilibrium state.

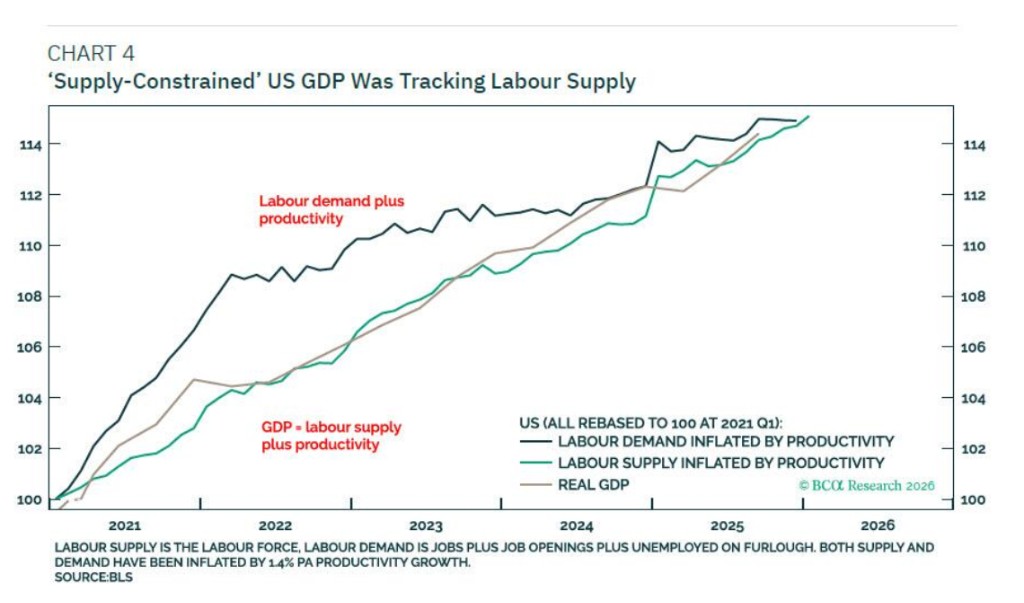

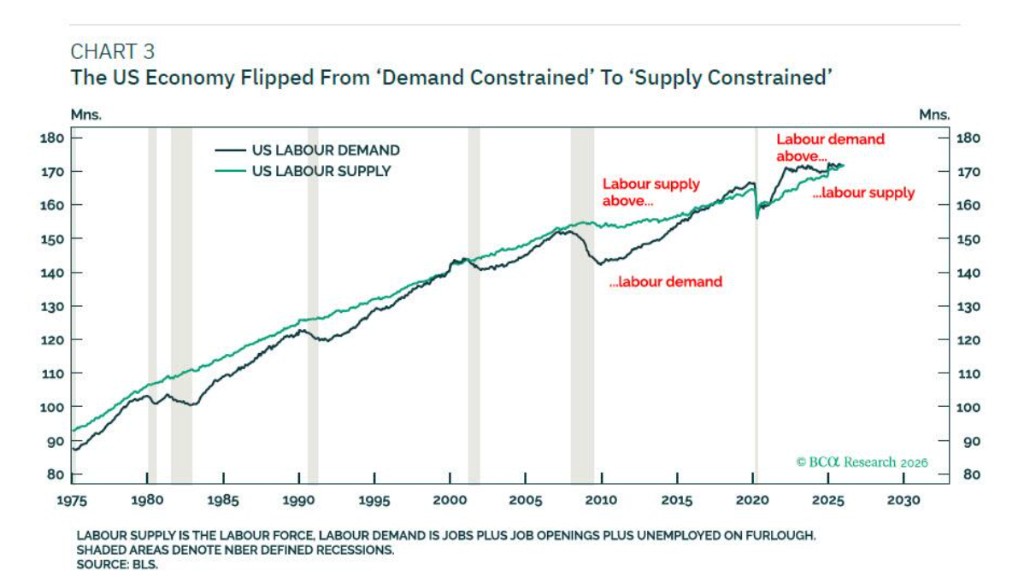

This balance state is rare due to the fundamental shift in the underlying economic logic. For decades prior to the pandemic, the U.S. economy was in a state of chronic demand deficiency, with labor demand consistently falling short of supply. However, post-pandemic, the supply-demand relationship has reversed, with labor supply becoming a growth bottleneck, leading the economy to transition into a "supply-constrained" operating model. In this model, a slowdown in demand does not directly trigger a GDP recession, which also explains why, despite weak demand performance, the U.S. economy has maintained positive growth between 2023 and 2024 However, the current balance also means that the market has entered a "dual risk" zone: whether demand or supply contracts, it will directly lead to a decline in output. Therefore, policies must promote simultaneous expansion on both the demand and supply sides. This means that the Federal Reserve needs to keep the economy operating in a "high-temperature" state: stimulating total demand through a loose environment while expanding supply by increasing labor participation rates to offset the potential outflow pressure on the workforce due to stricter immigration enforcement.

Structural Rise in Wage Inflation Difficult to Reverse

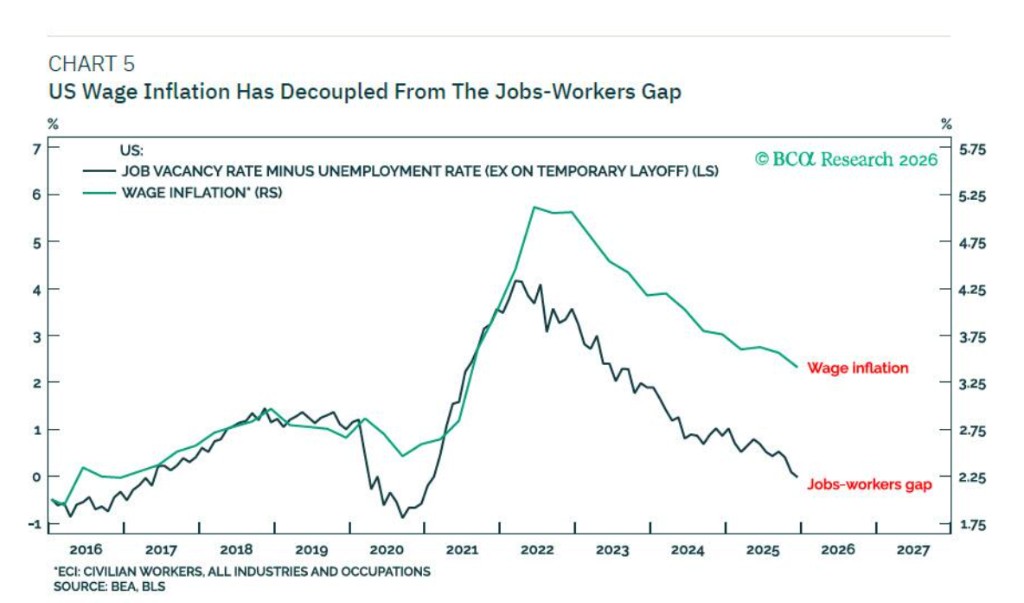

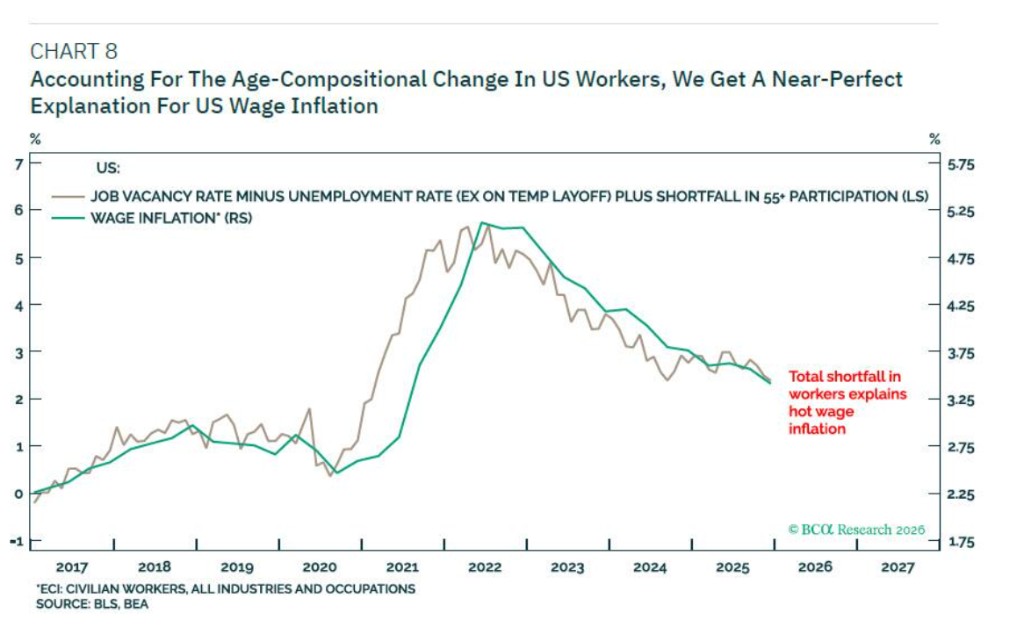

Although the U.S. labor market has returned to a supply-demand balance similar to pre-pandemic levels, wage inflation remains significantly higher than pre-pandemic levels. In the fourth quarter of last year, the U.S. Employment Cost Index (ECI) rose 3.4% year-on-year, exceeding the 3% threshold that aligns with the 2% core PCE inflation target.

This deviation is not a short-term fluctuation. Historical experience shows a stable 1 percentage point gap between the ECI and core PCE inflation, which means that to achieve the 2% core inflation target, the year-on-year growth rate of the ECI must fall to 3%. Although this implicit assumption corresponds to a productivity growth of only 1%, which seems low, it reflects a long-established statistical relationship between the two macro data sets.

The market generally hopes that artificial intelligence technology can drive a leap in productivity, thereby providing a buffer for higher levels of wage growth. However, to date, the aforementioned gap has not shown a trend of widening, which warns investors not to bet on an AI-driven surge in productivity as the baseline scenario.

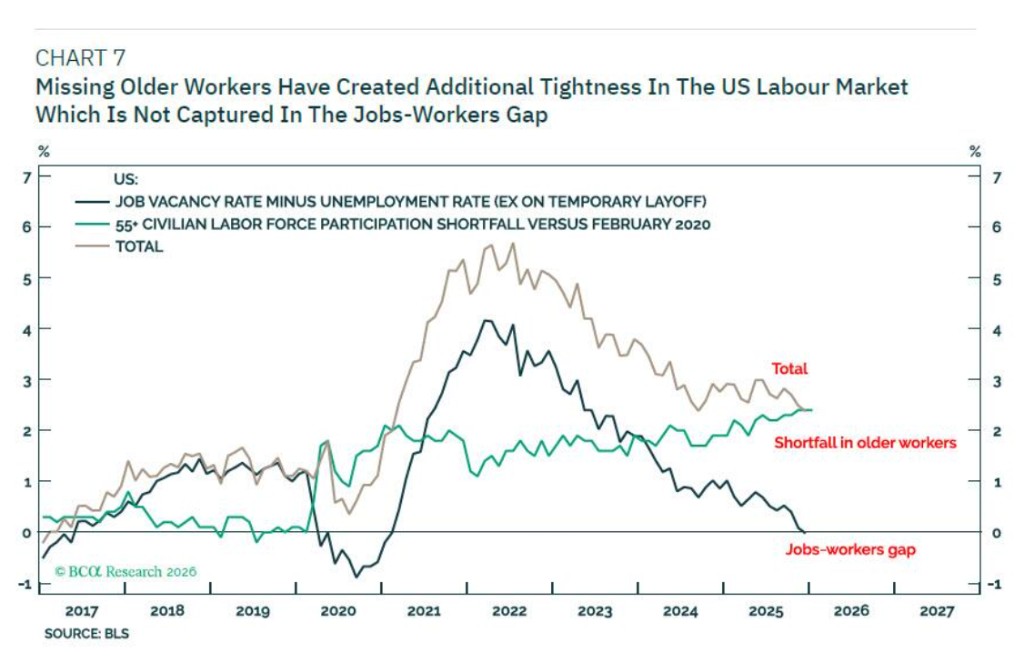

The deep-rooted reason for the structural rise in wage inflation lies in the persistent changes in the composition of the labor force. Compared to pre-pandemic levels, the U.S. labor supply has decreased by nearly 3 million older workers. Due to the significant functional complementarity among different age groups in the labor market, older workers find it difficult to engage in physically demanding jobs, while younger workers cannot replace specialized roles that require decades of experience. The absence of older workers creates additional structural tension beyond the overall job gap. Models show that when this structural factor is taken into account, it can almost perfectly explain the evolution of wage inflation in the U.S.

Stocks Outperform Bonds

In the face of the dual risk of contraction on both the supply and demand sides of the labor market, the Federal Reserve may choose to tolerate structurally elevated wage inflation, effectively raising the inflation target range to 2.5% to 3.5%. This shift in policy stance will trigger a series of chain reactions at the asset class level.

First, short-term real interest rates are expected to decline further. Even if inflation runs in the higher range of 2.5%—3.5%, the Federal Reserve may continue to push for interest rate cuts to support economic growth. Second, the U.S. dollar will remain under pressure due to the narrowing of the real interest rate differential, entering a weak phase. The U.S. Treasury market faces the pressure of "bear steepening": as inflation expectations gradually warm up, long-term yields tend to rise, causing long-term government bonds to underperform cash and other major sovereign bonds. In this macro context, equity assets are expected to continue to lead fixed income products.

Based on the above judgment, BCA Research has proposed a new tactical trading recommendation: overweight the MSCI Global Consumer Discretionary sector relative to the Industrial sector. Data shows that the Consumer Discretionary sector has significantly underperformed the Industrial sector by nearly 20% over the past 65 trading days, and this nearly vertical decline has reached excessive levels in both magnitude and speed.

Market sentiment may welcome a repair window. Considering the ultra-low real interest rate environment, potential fiscal stimulus support, and a still resilient labor market, market pricing for U.S. consumers may become more optimistic again.

Risk Warning and Disclaimer

Markets are risky, and investments should be made with caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk