The market narrative battle affecting trillions of capital: on one side is "AI disrupts everything," and on the other side is "AI returns are not sufficient."

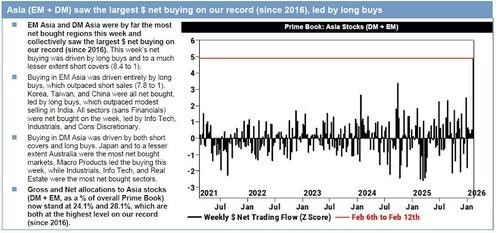

The market is caught in a dual narrative game of "AI disrupts everything" and "AI returns are insufficient": the former triggers panic selling of "victims" like software (with valuations halved), while the latter intensifies the scrutiny of capital expenditure returns. Funds are rapidly flowing into non-U.S. markets, with South Korea's KOSPI achieving its best weekly performance in five years, and non-U.S. funds inflowing $89 billion, far exceeding the $16 billion into U.S. stocks, indicating that investors are shifting from the crowded U.S. stock market to Asian markets

The current global market is in a rare "high noise, high velocity" period, with a level of chaos that even the most seasoned traders find perplexing. Tony Pasquariello, head of Goldman Sachs' hedge fund business, candidly stated that it is hard to recall a market environment as "extremely open" and unpredictable as this, except during major trauma periods like the global financial crisis or the COVID-19 pandemic. In his latest report, he warned: no one really knows how all of this will end.

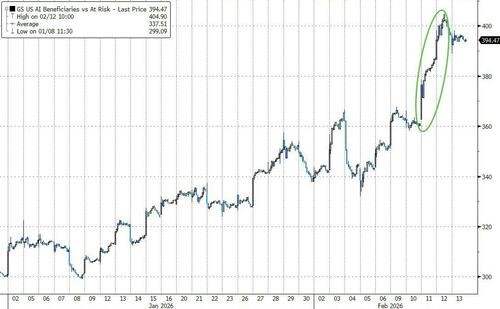

The core anxiety in the market stems from two diametrically opposed AI narratives that are fiercely competing: on one hand, the market believes that the disruptive risks brought by artificial intelligence are extending, leading to a fierce sell-off in the "victim" sectors; on the other hand, investors are beginning to question whether the returns on AI capital expenditures are sufficiently ideal. This inherent tension has resulted in extreme volatility—whenever the market perceives marginal AI risks, the sell-off becomes exceptionally fierce.

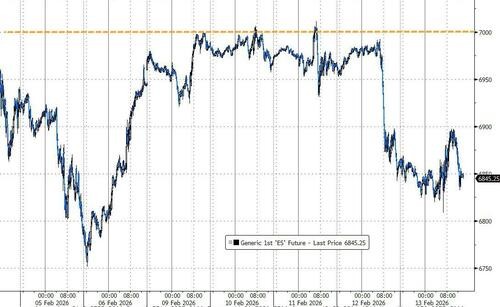

Currently, the S&P 500 index has stalled at the 7000-point mark this year, failing to break through, with undercurrents swirling beneath the calm surface of the index. Goldman Sachs' "AI Leaders vs. Laggards" pair trade set a record for the largest single-day gain last week, but this was primarily driven by shorting the "laggards." This "shoot first, aim later" shorting sentiment is causing dramatic narrative fluctuations and risk transfers in core sectors like software.

Meanwhile, due to the congestion and valuation pressures in the U.S. stock market, global capital allocation is undergoing a subtle yet significant shift. As the narrative in the U.S. domestic market becomes more complex, incremental funds are accelerating their flow overseas. The South Korean and Japanese stock markets have recently performed strongly, particularly the South Korean KOSPI index, which has doubled since the end of 2024, driven by "corporate value enhancement plans" and strong earnings expectations, recently achieving its best weekly performance in five years, indicating that investors are seeking new growth havens in non-U.S. markets.

Confusing Signals: Extremely Challenging Trading Environment

The current market environment is filled with contradictory signals, making investment extremely challenging. Tony Pasquariello pointed out that the market is simultaneously buying cyclical assets (such as industrial stocks and raw materials) and defensive assets (such as consumer staples and utilities), a phenomenon of "betting on both sides" that is quite rare.

Similar contradictions are also evident between the commodity and interest rate markets: prices of commodities like metals are being sought after, suggesting a strong economy; however, U.S. interest rates are declining and the yield curve is flattening, which is typically a signal of economic slowdown. Goldman Sachs technology expert Pete Callahan believes that this potential volatility and mixed signals make it exceptionally difficult to gauge the market's true sentiments and which narrative is about to shift.

The Battle of AI Narratives: Value Creation and Value Destruction

The current market debate focuses on the fundamental impact of AI: who are the beneficiaries and who are the victims? Is it value creation or value destruction? Is it light assets or heavy assets? This intense debate has directly led to a surge in the actual volatility of related stocks and thematic baskets.

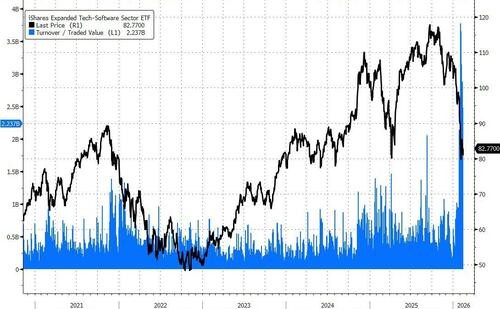

As the "epicenter" of market narratives, the performance of the software industry is particularly typical. Although the index level appears calm, beneath the surface, the punishment for AI "laggards" is ruthless. As more sub-industries come under scrutiny, market participants' concerns about the risks of AI disruption are intensifying.

Moreover, with the advancement of AI infrastructure construction, electricity demand has become a new complex variable. Goldman Sachs' research indicates that the pressure of AI on the power grid is translating into concrete macroeconomic spillover effects, which has also caused stocks related to the U.S. power grid transformation to release clear pressure signals.

Reversal of Capital Flows: Stagnation in U.S. Stocks and Prosperity in Asia

As U.S. stocks failed to break through key resistance levels after the non-farm payroll and CPI data releases, overseas markets experienced an explosion. Goldman Sachs strategist Ryan Hammond's data shows that non-U.S. equity funds have seen an inflow of $89 billion this year, while U.S. equity funds have only seen $16 billion. This does not mean that investors are directly selling U.S. stocks, but rather that marginal incremental funds are prioritizing non-U.S. markets.

The South Korean stock market has become the leader of this trend. The MSCI Korea Index has risen 28% in U.S. dollar terms this year. Goldman Sachs' Chief Equity Strategist for Asia Pacific, Tim Moe, maintains an overweight rating and has raised the KOSPI index target to 6,400 points. He provided four main reasons: first, astonishing earnings growth, with a 36% increase expected in 2025 and a 120% increase in 2026; second, extremely attractive valuations, with forward P/E ratios still below long-term averages; third, low foreign ownership; and fourth, substantial progress in corporate governance reforms.

The Japanese market has also performed well, with the Nikkei Index recently rising by 5%. Notably, the correlation logic between the Japanese stock market and exchange rates seems to have "flipped": in the past, a weak yen correlated with a strong stock market, while the current pattern is a strong yen and low interest rates, yet the stock market continues to rise. This indicates that the Japanese market may be shifting from "currency depreciation trades" to healthier "re-inflation trades."

The Resilience and Outlook of Hedge Funds

Despite the uncertainty in the macro environment, hedge funds have shown remarkable resilience. According to Tony Pasquariello's observations, macro discretionary funds accumulated significant profit buffers in January, while equity long-short strategies (both fundamental and quantitative) generally avoided risks.

Looking ahead to the next phase, market trends seem to favor active management over passive investing, and favor liquid assets over illiquid ones. In this market filled with "noise" and "high velocity," strategies that can flexibly respond to narrative changes appear to be gaining the upper hand