Global fiscal stimulus "loud thunder but little rain"? UBS expects it to contribute only 8 basis points to GDP growth in 2026

UBS Research pointed out that the actual impact of global fiscal stimulus in 2026 is close to neutral, contributing only about 8 basis points to GDP growth. Despite the high enthusiasm for legislation in countries like the U.S., Japan, and Germany, the actual strength is far below historical levels due to slow implementation and fiscal consolidation in emerging markets. The global economy still needs to seek endogenous momentum rather than relying on policy dividends

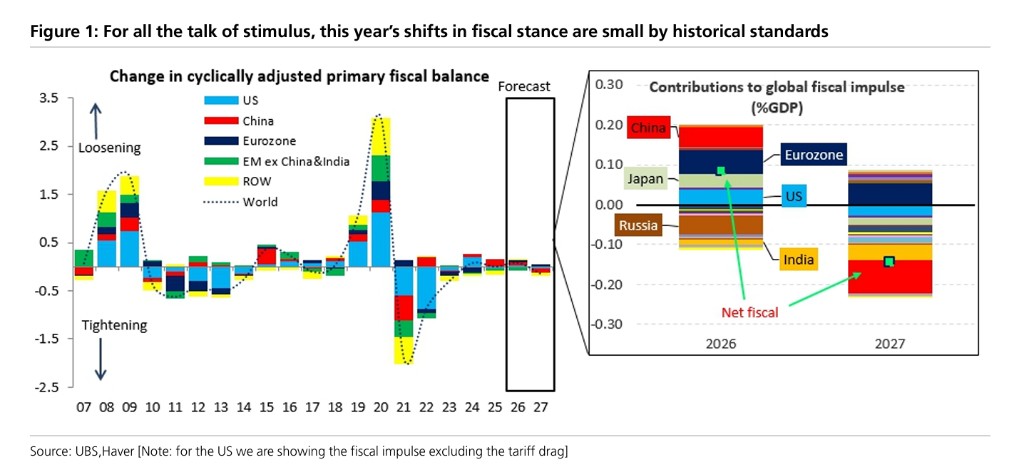

Despite major economies such as the United States, Japan, and Germany launching fiscal stimulus measures, the actual global impact may be far less than market expectations. UBS's latest research shows that the global fiscal shock is expected to contribute only about 8 basis points to global GDP growth in 2026, and in 2027, it will even turn into a drag of 14 basis points, with the overall fiscal stance close to neutral.

This judgment is based on an analysis of changes in the structural fiscal balance after cyclical adjustments. According to the Wind Trading Desk, UBS economist Arend Kapteyn pointed out in a report released on February 16 that, despite the market's high attention to the U.S. "Big Beautiful" plan, Japan's fiscal easing, and Europe's and Germany's plans to increase defense and investment spending, the change in fiscal stance this year is at a historically low level from a global perspective.

Specifically, the net fiscal shock in the U.S. after excluding tariff impacts is about 30 basis points, Japan has only eased by 0.9 percentage points of GDP so far, and Germany's stimulus is about 1 percentage point of GDP. UBS statistics show that in the past 20 years, in the 9 years when the U.S. implemented fiscal stimulus, the intensity of stimulus in all those years exceeded the forecast level for 2026.

This means that investors should not overly rely on fiscal stimulus to drive global economic growth. Emerging markets are generally in a state of fiscal consolidation, while the scale of stimulus in developed economies is also relatively moderate, and global economic growth still needs to rely on other sources of momentum.

Global Fiscal Stance Slightly Better than Neutral

UBS's calculation method for global fiscal shocks is to observe changes in the structural fiscal balance after cyclical adjustments, which means excluding the impacts of the economic cycle and interest payments. According to this method, the global fiscal shock is expected to provide support of 8 basis points to GDP growth in 2026, and in 2027, it will turn into a drag of 14 basis points, with both years' data close to zero.

UBS's historical data over the past 20 years shows that the global fiscal stance has fluctuated significantly at different times, but the forecast values for 2026 and 2027 are in a relatively moderate range compared to historical comparisons. This sharply contrasts with the current market discussions about large-scale fiscal stimulus in major economies.

The report points out that very few countries will see changes in fiscal stance exceeding 0.5 percentage points this year, and emerging markets (excluding China) are mainly in a state of fiscal consolidation, leading to a global fiscal stance that is only slightly better than neutral.

U.S. Stimulus Strength Below Historical Levels

The U.S. "Big Beautiful" plan is one of the focal points of market attention. UBS estimates that this plan will contribute about 45 basis points of support to U.S. economic growth. However, after excluding tariff impacts (which technically belong to revenue items, similar to taxes), it is necessary to consider a drag of about 10 to 15 basis points at the state and local government level, as well as the impact of expired stimulus measures, resulting in a net fiscal shock in the U.S. of about 30 basis points This figure then needs to be multiplied by the weight of the United States in global purchasing power parity (PPP) to derive its contribution to global GDP. UBS specifically pointed out that in the past 20 years, the United States implemented fiscal stimulus in 9 years, and the intensity of all these years exceeded the forecast level for 2026, indicating that the current round of stimulus is not particularly prominent in historical terms.

Japan and Europe Progressing Slower than Expected

In Japan, UBS estimates that the fiscal stance has only loosened by 0.9 percentage points of GDP so far, although more measures may be introduced in the future. This scale is relatively limited and is unlikely to have a significant stimulating effect on the global economy.

The situation in Germany and the Eurozone is also below previous market expectations. UBS has lowered its expectations for the speed of stimulus measures in Germany, now estimating that the fiscal stimulus scale in Germany this year will be about 1 percentage point of GDP, which accounts for about two-thirds of the total stimulus in the Eurozone. The overall growth rate of defense spending in the Eurozone is also relatively slow, at only 0.3 percentage points of GDP this year.

UBS's analysis indicates that although countries are showing a positive stance at the policy level, the actual execution strength and speed are relatively moderate, leading to a situation of "loud thunder but little rain" in global fiscal stimulus