The U.S. Supreme Court rejected tariffs, U.S. stocks closed higher, bonds and the dollar came under pressure, concerns about stagflation pushed gold back to 5,100, and silver surged 8%

The S&P 500 Index rose by 0.7%. Google increased by over 4%. Cybersecurity stock SailPoint plummeted by 9.4%, and Cloudflare dropped by 8%. The yield on the 10-year U.S. Treasury rose by 1.5 basis points. The dollar softened slightly by 0.06% during the day, but has gained nearly 1% this week. Tensions in Iran combined with persistent inflation led to gold rising by over 2%, while spot silver surged by 8%. Crude oil briefly reached a six-month high before retreating to close slightly lower

The U.S. Supreme Court rejected the IEEPA tariffs, despite Trump's threats to impose taxes through other means, creating uncertainty. Meanwhile, the U.S. GDP grew only 1.4% in the fourth quarter, below expectations, but the market leaned towards expectations of profit improvement following the removal of tariff barriers, with the three major U.S. stock indices closing higher.

The failure of tariff revenue expectations raised concerns about the expansion of the U.S. fiscal deficit and increased bond issuance, leading to rising U.S. Treasury yields and a weakening dollar during the day. The tense geopolitical situation in Iran, combined with persistent inflation, boosted safe-haven and anti-inflation assets like gold.

On Friday, the S&P 500 index rose 0.7%, with a cumulative increase of 1.07% for the week, marking the best weekly performance since January 9. The Nasdaq led the gains, with tech giants performing strongly, and Google rising over 4%.

Although the Supreme Court's ruling theoretically benefits risk assets, the actual impact remains difficult to assess. Bloomberg strategists pointed out that the ruling did not address whether importers, wholesalers, and retailers are eligible for tariff refunds. With pending cases reaching hundreds and likely continuing to rise, it remains unclear when and how lost revenue will be returned to U.S. importers.

More critically, the risk of tariffs has not been eliminated. The U.S. government may still attempt to impose taxes through different methods, even if this path has been blocked. This uncertainty prevents the market from confidently pricing winners and losers.

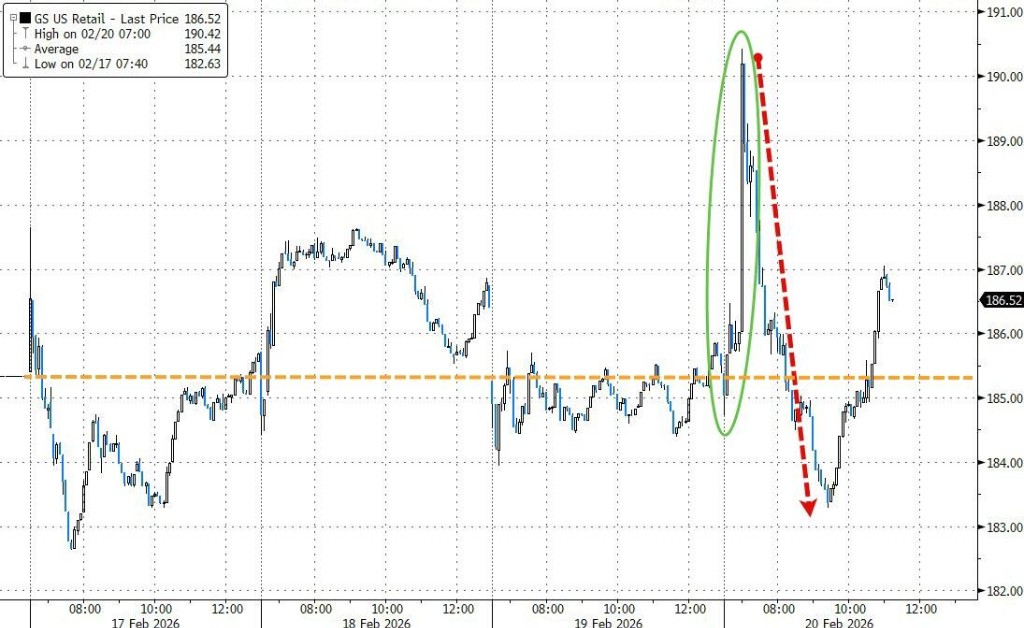

According to Vanda Research, retail investor flows were subdued following the Supreme Court's tariff ruling. Although overall activity was decent, there was no sustained increase in participation since the announcement. Tariff-sensitive stocks like Nike still closed slightly lower, with retail investors showing a trend of bottom-fishing during the day.

CNBC's Rick Santelli noted:

If you only look at the market and actual data, you wouldn't even know there was a court ruling on tariffs today.

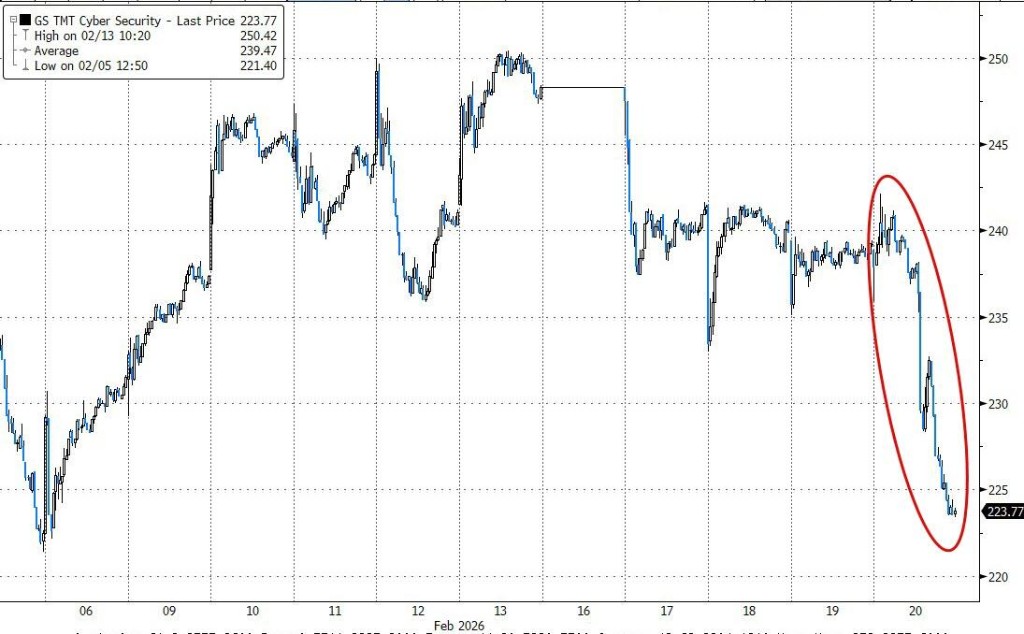

Anthropic's release of new safety features for Claude AI severely impacted the cybersecurity sector. This tool can scan code repositories for security vulnerabilities and suggest fixes. The company stated, "Given that the model has become very effective at discovering long-hidden vulnerabilities, a significant proportion of global code is expected to be scanned by AI in the future."

Cybersecurity stocks like SailPoint plummeted 9.4%, Okta fell 9.18%, Cloudflare dropped 8%, and the Global X Cybersecurity ETF closed down 4.9%, marking a new closing low for 2023.

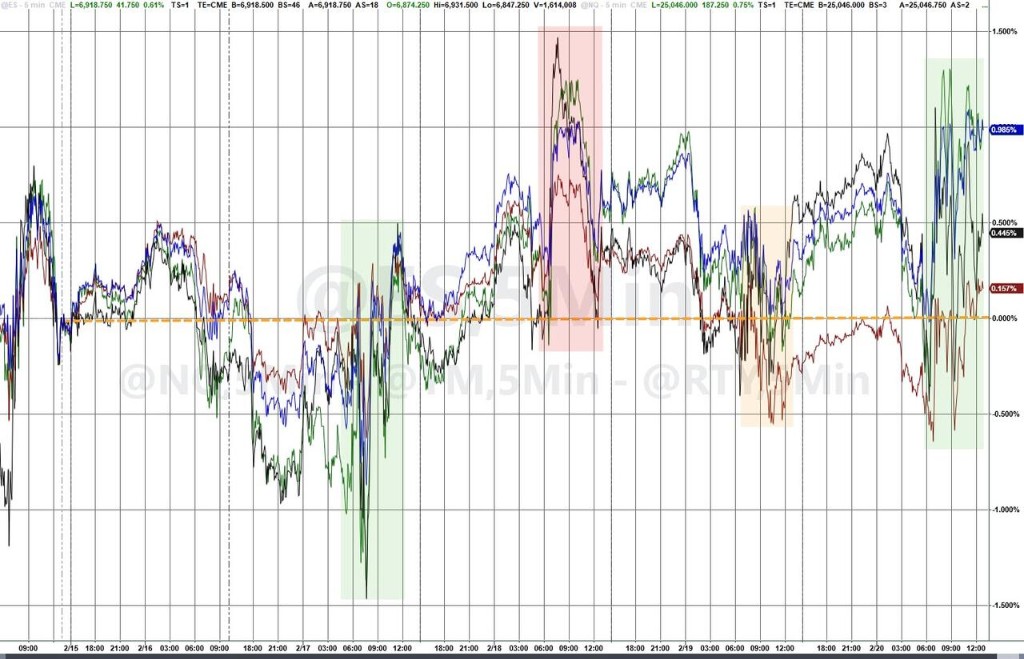

The S&P 500 index climbed this week to the key options risk pivot point of 6900 near the 50-day moving average, repeatedly contesting this level. The market digested multiple shocks during a shortened holiday week Geopolitical tensions, the U.S. Supreme Court's tariff ruling, the Federal Reserve's hawkish divisions, and concerns about stagflation intertwine.

According to Wall Street News, the U.S. GDP grew only 1.4% in the fourth quarter. The government shutdown dragged down by 1 percentage point. The U.S. core PCE price index rose 3% year-on-year, exceeding expectations. Additionally, the failure of tariff revenue expectations has raised concerns about the expansion of the U.S. fiscal deficit and increased bond issuance, leading to a rise in U.S. Treasury yields and a slight weakening of the dollar during the day.

U.S. Treasury yields rose broadly, with the 10-year Treasury yield up 1.5 basis points and the 2-year yield rising 2 basis points. The dollar weakened slightly by 0.06% during the day but has accumulated nearly a 1% increase this week.

The tense geopolitical situation in Iran, combined with sticky inflation, has pushed up safe-haven and anti-inflation assets like gold. Gold rose over 2%, returning to $5,100. Spot silver surged 8%. Crude oil briefly reached a six-month high before retreating to close slightly lower.

Ole Hvalbye, an analyst at SEB AB, stated:

Despite a slight pullback in crude oil, we still believe there is further upside potential in the current geopolitical context.

The crude oil term structure is responding to the increased risks. The one-year spread for Brent has widened to the widest spot premium structure since June of last year, and the six-month spread has also further widened. Analysts believe that the options skew for both Brent and WTI is more deeply biased towards call options.

U.S. stocks rose broadly on Friday, with the S&P 500 index up 0.7%, accumulating a 1.07% increase for the week, marking the best weekly performance since January 9. The Nasdaq led the gains, with tech giants performing strongly, and Google rising over 4%.

U.S. stock benchmark indices:

The S&P 500 index closed up 47.62 points, an increase of 0.69%, at 6,909.51 points.

The Dow Jones Industrial Average closed up 230.81 points, an increase of 0.47%, at 49,625.97 points

The Nasdaq rose by 203.34 points, an increase of 0.90%, closing at 22,886.069 points. The Nasdaq 100 index rose by 215.279 points, an increase of 0.87%, closing at 25,012.619 points.

The Russell 2000 index fell by 0.05%, closing at 2,663.78 points.

The VIX index fell by 5.68%, closing at 19.08.

U.S. Stock Sector ETFs:

The U.S. photovoltaic sector rose by 2.12%, while ETFs for chips, consumer discretionary, and regional banks rose over 1%. The S&P Energy ETF fell by 0.51%.

Cybersecurity stocks plummeted, with Anthropic releasing the Claude security tool. The Global X Cybersecurity ETF fell by 4.94%, with a year-to-date decline expanding to 16%.

(February 20, U.S. stock sector ETFs)

Tech Giants:

The Wind Information U.S. Tech Giants (Magnificent 7) index rose by 1.57%.

Alphabet - A rose by 4.01%, Amazon rose by 2.56%, Meta rose by 1.69%, Apple rose by 1.54%, NVIDIA rose by 1.02%, Tesla rose by 0.03%, and Microsoft fell by 0.31%.

Chip Stocks:

The Philadelphia Semiconductor Index rose by 1.07%, closing at 8,260.415 points.

TSMC ADR rose by 2.85%, while AMD fell by 1.58%.

Chinese Concept Stocks:

The Nasdaq Golden Dragon China Index fell by 0.05%, closing at 7,549.88 points, with a cumulative decline of 0.55% this week.

The China Technology Index ETF (CQQQ) rose by 0.22%, with a cumulative increase of 0.73% this week.

Other Individual Stocks:

Circle rose by 1.82%.

Cybersecurity stocks plummeted, with CrowdStrike Holdings falling by 7.95%, Cloudflare crashing by 8%, Zscaler falling by 5.47%, SailPoint crashing by 9.4%, and Okta falling by 9.18%. Anthropic released the Claude security tool, which can scan for security vulnerabilities in code repositories.

European stock markets hit a record closing high, while the U.S. Supreme Court ruled that Trump's tariffs were illegal. The Italian banking sector rose over 2.1%, with a weekly increase of over 3%, and the German defense ETF rose over 6.1%.

Pan-European Stocks:

The European STOXX 600 index rose by 0.84%, closing at 630.56 points, reaching a record closing high after one trading day, with a cumulative increase of 2.08% this week

The Eurozone STOXX 50 index closed up 1.18% at 6131.31 points, also setting a new closing historical high, with a cumulative increase of 2.44% this week.

National Indices:

The German DAX 30 index closed up 0.87% at 25260.69 points, with a cumulative increase of 1.39% this week.

The French CAC 40 index closed up 1.03% at 8515.49 points, with a cumulative increase of 2.23% this week.

The UK FTSE 100 index closed up 0.56% at 10686.89 points, with a cumulative increase of 2.30% this week.

(February 20th, Performance of Major European and American Indices)

Sectors and Stocks:

Among Eurozone blue-chip stocks, Air Liquide rose 4.80%, LVMH Group rose 4.37%, Hermès rose 3.58%, and Saint-Gobain rose 3.08%, ranking fourth.

Among all constituents of the European STOXX 600 index, luxury retailer Moncler rose 13.41%, Castellum rose 9.78%, Unipol Assicurazioni rose 8.67%, and BE Semiconductor Industries rose 6.65%, ranking sixth.

U.S. Commodity Futures Trading Commission (CFTC): For the week ending February 17, speculators reduced their net long positions in NYMEX WTI crude oil by 5,095 contracts to 81,219 contracts.

Crude Oil:

- WTI March crude oil futures closed down $0.04, a decrease of 0.06%, at $66.39 per barrel.

(WTI Crude Oil Futures)

- Brent April crude oil futures closed up $0.10, an increase of 0.14%, at $71.76 per barrel.

Natural Gas:

- NYMEX March natural gas futures closed at $3.0470 per million British thermal units