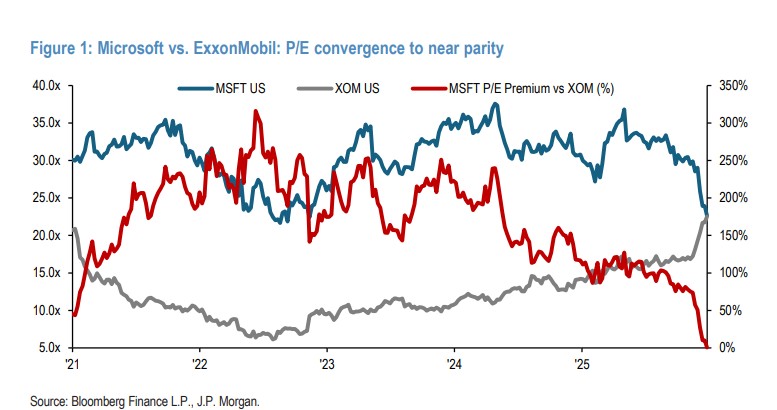

Microsoft's PE has become the same as Exxon Mobil's

JP Morgan: Due to concerns over AI disruption, technology sectors such as software have been severely impacted, leading to a broad rotation in the market towards value stocks in search of diversification. However, the report assesses that the rally in value stocks has completed about 85%, trading has become crowded, and the risk-reward ratio has deteriorated. The valuation gap in price-to-earnings ratios between high-quality growth stocks represented by Microsoft and commodity stocks represented by Exxon Mobil has nearly disappeared, highlighting that the trading in value stocks has become excessively crowded

JP Morgan:

Due to concerns about AI disruption, technology sectors such as software have been severely impacted, leading to a broad rotation in the market towards value stocks in search of diversification. However, the report assesses that the rally in value stocks has completed about 85%, trading has become crowded, and the risk-reward ratio has deteriorated. The valuation gap in price-to-earnings ratios between high-quality growth stocks represented by Microsoft and commodity stocks represented by Exxon Mobil has nearly disappeared, highlighting that the trading in value stocks has become excessively crowded.