Goldman Sachs: Gold volatility has surged significantly, and central bank gold purchases will temporarily slow down

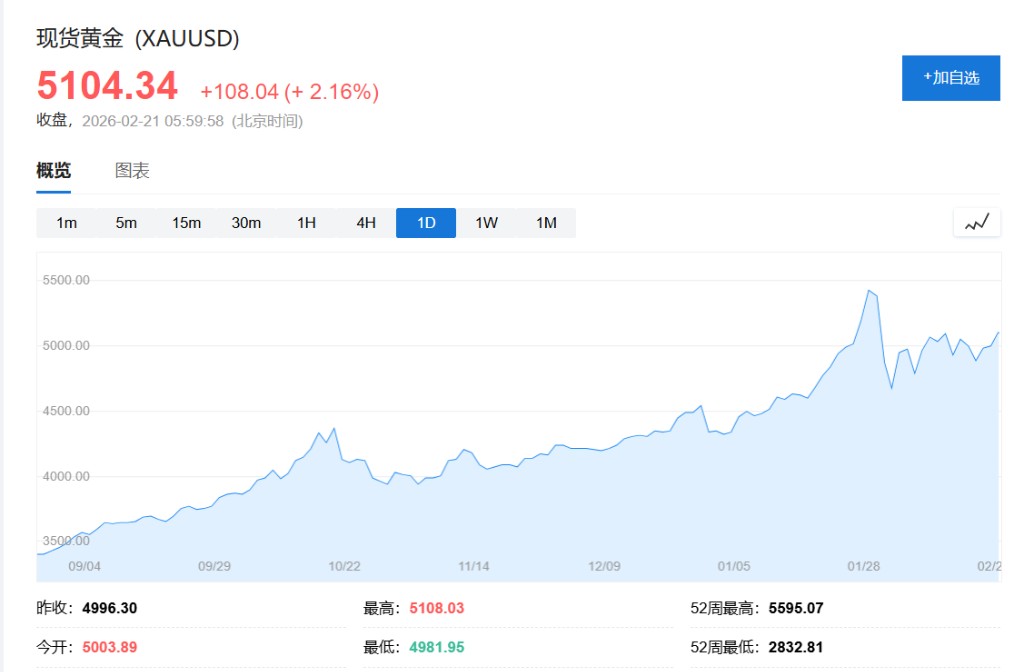

Goldman Sachs believes that the rising demand for call options forces option-selling traders to passively buy gold for hedging during the upward process, thereby mechanically amplifying the gains. More critically, even a slight pullback could prompt traders to switch from "buying on highs" to "selling on lows," triggering investor stop-loss orders and leading to further losses. Goldman Sachs warns that mild catalysts could also trigger deeper pullbacks, with a downside target of $4,700 per ounce

The dominant variable in the gold market is shifting from "buy or not buy" to "how much volatility there is." Goldman Sachs believes that the diversified demand expressed through bullish options structures in the private sector has driven up gold price volatility and temporarily suppressed the pace of central bank gold purchases, but this decline should be temporary.

Goldman Sachs analysts Lina Thomas and Daan Struyven pointed out in a report this week that the rising demand for call options has forced option-selling traders to passively buy gold for hedging during price increases, mechanically amplifying the gains. More critically, even a slight pullback could prompt traders to switch from "buying on highs" to "selling on lows," triggering investor stop-loss orders and leading to further losses. Goldman Sachs noted that this chain reaction was already evident in late January.

Against the backdrop of rising volatility, central bank demand has slowed, with a forecast of 22 tons for December 2025, while the current 12-month average is 52 tons. Goldman Sachs emphasized that central banks are still willing to buy gold to hedge against geopolitical and financial risks but prefer to resume purchases after price volatility subsides, making the slowdown more of a "waiting for volatility to converge" rather than a trend reversal.

For investors, this means an increase in short-term downside tail risks. Goldman Sachs warns that once options demand returns to record levels, some catalysts that typically only lead to mild pullbacks could trigger larger declines in gold prices, with an estimated downside boundary around $4,700 per ounce. However, in the medium term, Goldman Sachs still maintains a bullish outlook on gold, expecting prices to slowly rise to $5,400 per ounce by the end of 2026.

Options Structure Drives Up Volatility; Small Pullbacks May Amplify Losses

Goldman Sachs links the recent increase in gold price volatility to the diversified allocation demand from the private sector, part of which is expressed through bullish options structures.

The report cites data from Bloomberg and Goldman Sachs, stating that the open interest in call options (excluding put options) for GLD, the largest gold ETF, is at record levels, becoming an important "proxy indicator" for rising volatility.

Mechanically, Goldman Sachs explains that when gold prices rise, traders selling call options are forced to buy gold to maintain their hedges, amplifying the increase; however, even a small pullback could reverse traders' hedging behavior, switching from "buying on the rise" to "selling on the decline," potentially triggering investor stop-loss exits and leading to further losses. Goldman Sachs warns that similar "stop-loss cascades" occurred in late January.

Central Bank Demand Pauses: 22 Tons in December 2025, Below 12-Month Average of 52 Tons

Goldman Sachs points out that the rise in volatility has transmitted to the short-term behavior of central banks: its nowcast for central bank gold purchases shows 22 tons for December 2025, while the current 12-month average is 52 tons. Goldman Sachs previously viewed "the continued slowdown in central bank demand" as an important indicator for gold price prospects, but this slowdown is judged to be a temporary phenomenon Goldman Sachs provides three reasons: its communication with central banks, the structural change in risk perception among reserve managers after Russia's foreign exchange reserves were frozen in 2022, and its belief that the gold allocation of large emerging market central banks is still significantly below "possible target levels."

The report states that reserve managers still view gold as a tool to hedge against geopolitical and financial risks, but are more willing to accelerate purchases once prices stabilize.

Two Scenario Simulations: If Volatility Falls, Gold Purchases Rise; If Volatility Continues, Upside Risks Increase

Goldman Sachs presents two scenarios to characterize the combination of "volatility—central bank demand—gold price path."

The baseline scenario assumes that the private sector will no longer see additional diversification increments, leading to a decline in gold price volatility. Within this framework, Goldman Sachs expects central bank gold purchases to accelerate again, maintaining an overall accumulation pace roughly in line with 2025; while private investors will mainly increase allocations after the Federal Reserve cuts interest rates. The combination of both suggests that gold prices will "slowly rise" amid converging volatility, reaching $5,400 per ounce by the end of 2026.

The upside scenario assumes that private sector diversification demand further strengthens, driven by "perceptions of fiscal risks in some Western economies." Goldman Sachs believes that when such demand is expressed through bullish options structures, it naturally leads to higher volatility and may temporarily suppress emerging market central bank demand in the short term. In this scenario, Goldman Sachs sees significant upside risks to its gold price forecast, but volatility will also be more persistent.

Goldman Sachs Tactical Note: Mild Catalysts May Trigger Deeper Pullbacks, Downside Boundary at $4,700 per Ounce

On a tactical level, Goldman Sachs states that demand for GLD call options has been rebuilt after the "washout" in late January and is again at record levels. This means that factors that typically only trigger limited pullbacks, such as "mild stock market adjustments due to margin-related liquidations" or "marginal easing of geopolitical tensions," could also lead to extraordinary gold price pullbacks.

Goldman Sachs estimates the downside boundary for such pullbacks to be around $4,700 per ounce. At the same time, Goldman Sachs indicates that performances similar to late January suggest that pullbacks may be short-lived, as client feedback shows there is still potential demand for "waiting to add positions on pullbacks."

Based on this, Goldman Sachs reiterates that its medium-term gold price trajectory remains upward and maintains its recommendation to go long on gold