The U.S. Supreme Court overturns "reciprocal tariffs," what will happen next?

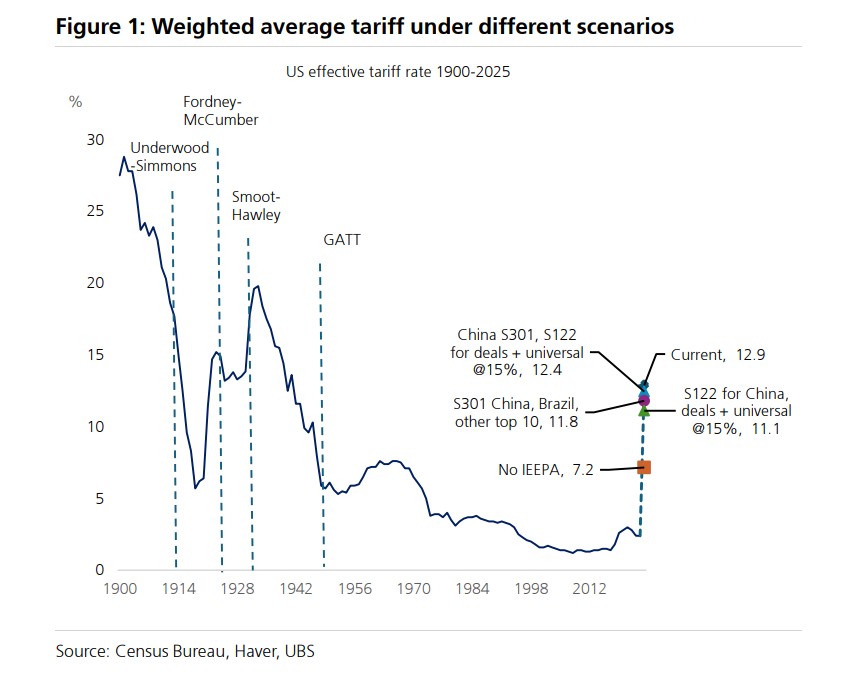

After the U.S. Supreme Court rejected the legal basis for tariffs under IEEPA, UBS assessed that "tariffs will be restructured rather than ended," and most measures can be applied under Section 122 or Section 301; if not replaced temporarily, the weighted average tariff rate may drop to 7.2%. HSBC, on the other hand, believes that Section 122 is merely a transitional tool, and the Section 301 investigation is the backup plan: first stabilizing the window period with uniform tariffs, then switching to a differentiated tariff system

After the Supreme Court rejected the legal basis for IEEPA tariffs, the market's focus shifted from "Are the tariffs still in place?" to "Refunds or not, how to change the legal provisions, and whether the trade framework agreement still counts."

According to CCTV News, the U.S. Supreme Court ruled on February 20 local time that the Trump administration's imposition of tariffs on U.S. imports under the International Emergency Economic Powers Act (IEEPA) was "illegal." In a subsequent press conference, Trump responded that he would sign an executive order that day to implement a "10% global uniform tariff" based on Section 122 of the Trade Act of 1974 and announced the initiation of several so-called Section 301 investigations.

Not All Tariffs Are Affected

According to news from the Wind Trading Platform, HSBC's latest research report cites key points from the ruling, stating that the Supreme Court determined that IEEPA does not authorize the president to impose general tariffs on imports under the guise of "emergency." UBS added in its interpretation that Chief Justice John Roberts, writing for the majority opinion, stated: "IEEPA does not authorize the president to impose tariffs."

This means that the tariff system established by the Trump administration using IEEPA in 2025—first imposing tariffs on Canada and Mexico, and then expanding "reciprocal/equal tariffs" to almost all trading partners on April 2, 2025—has had its core legal support removed.

However, not all tariffs are affected. HSBC emphasized that this ruling does not impact existing:

-

Section 232 (national security, industry tariffs)

-

Section 301

-

Section 201 (safeguards, such as the 2018 solar tariffs)

Tariff Reconstruction Rather Than Overturning

UBS believes that most IEEPA tariffs can be reconstructed using other trade authorizations, as many U.S. government officials have mentioned in recent months.

Option One: No Alternative Sought The government can choose not to replace the rejected tariffs. In this case, the currently estimated weighted average tariff rate (WATR) of 12.9% would drop to 7.2%. If this lower tariff level persists (although UBS believes this is unlikely), the bank estimates that actual GDP growth would increase by about 0.2 percentage points this year, and PCE inflation would decrease by about 30 basis points. By 2027, this would add about 0.1 percentage points to growth and reduce PCE inflation by about 20 basis points.

Option Two: Plan B However, as the bank previously pointed out, given the government's efforts and emphasis on the tariffs already implemented as an important part of its policy agenda (including recent investment deals linked to trade policy), a "Plan B" is expected. The government has other options.

- The government could utilize the so-called Section 122 to implement a 15% comprehensive tariff within 150 days.

- They may leverage existing Section 301 investigation results

10% Global Tariff is Just a Transition, Is the 301 Investigation the Next Card?

HSBC's latest research report also shows that Trump has announced a "one-size-fits-all" 10% tariff on all countries based on Section 122 ("across the board") and has initiated multiple 301 investigations.

The bank explains that Section 122 can be used to address balance of payments issues, characterized by: it allows for the imposition of temporary tariffs of up to 15% on all imported goods without a consultation period, but can only be implemented for a maximum of 150 days.

-

There is no need for lengthy consultations like industry tariffs;

-

But it can only be temporarily implemented, for a maximum of 150 days;

-

"Uniformly applicable to all countries" also means it is less suitable as a negotiation lever to pressure a single country.

HSBC's core judgment is: Section 122 is more like a "transitional solution." The reason is that it is "universally applicable," making it difficult to use as a negotiation threat to "escalate/de-escalate at any time" like the IEEPA. A more likely path is: to use Section 122 to buy time while pushing for the completion of the 301 investigation, and then switch to a differentiated tariff system.

Will Refunds Come? Why It May Drag into "Years of Litigation"

What the market is most sensitive to is not the "nominal tariff rate," but whether the tariffs already imposed need to be refunded, how much, and how to refund.

HSBC cites estimates that by the end of 2025, IEEPA tariffs will bring in about $133 billion in revenue; if related revenues are retroactively denied, the potential amount that may need to be refunded could reach about $175 billion.

In the Supreme Court's divided opinion, Justice Kavanaugh in his dissenting opinion reminded: “The U.S. may need to refund billions of dollars to importers who paid IEEPA tariffs.” He pointedly stated that the court "did not provide an operational path": “The court said nothing today about whether the government should refund the billions collected, and how.”

Trump, at a press conference, attempted to downplay the short-term impact: “The ruling did not discuss refunds.” He stated that the related issues “will likely involve litigation for more than two years,” implying that the government has no immediate large-scale refund plan.

UBS further mentioned that Bloomberg reported that nearly 1,000 companies have filed related cases in the Court of International Trade (CIT) to ensure refund eligibility; the CIT had previously stated that even if tariffs have been settled, the court may still order refunds through re-liquidation. But the key is: the eligibility, scope, and timing of refunds still need to be advanced through subsequent judicial procedures.

Do Those "Bilateral Framework Agreements" Reached Last Year Still Count?

HSBC pointed out that the Supreme Court ruling itself did not explicitly address various arrangements made with the UK, EU, Japan, and others over the past year. Kavanaugh, in his dissenting opinion, merely reminded that the ruling " may bring uncertainty to these trade arrangements."

More challenging is that many of these are "framework agreements" rather than complete trade agreements, and the president does not have the statutory authority to unilaterally implement complete trade agreements. The framework agreements themselves may not necessarily have strong binding force. HSBC cited the example of the "reduced to 15%" tax rate in the Japan framework agreement, which, according to its understanding of the executive order, still falls under the IEEPA system—if the IEEPA tariffs are deemed illegal, these "post-reduction IEEPA tax rates" may also become invalid.

Trump's statement is that Clause 122 will be "uniformly applicable," but " some agreements will be retained, and some will not." One interpretation from HSBC is that the IEEPA tax rates in the framework agreements may be replaced by a 10% uniform tariff; while parts involving the 232 clause limits may still continue—provided that trade partners continue to fulfill their commitments. However, if the "threat of higher IEEPA tariffs" is lost, some countries may reassess their existing commitments.

What it means for the market: Four lines of finance—interest rates—dollar—risk appetite

1) Finance: After a high increase in tariff revenue, there may be a "reversal risk."

Data from the U.S. Treasury Department shows that tariff revenue is expected to total $264 billion in 2025 (about 0.9% of nominal GDP), significantly higher than $79 billion (0.3%) in 2024. HSBC stated that if IEEPA-related revenues are retroactively overturned, approximately $175 billion could theoretically "enter into dispute." However, U.S. Treasury Secretary Yellen stated at an event in Dallas that as the government shifts to other legal tools, tariff revenue is expected to " change very little" in 2026.

2) Interest Rates: The core is the marginal increase in deficit and bond issuance demand.

HSBC believes that potential refunds and future revenue declines will increase existing high deficit pressures, pushing the yield curve steeper and tightening swap spreads; however, short-term volatility may be offset by "refund uncertainty + new tariff paths," with directional trends being relatively constrained.

3) Dollar: Policy noise increases, softening logic strengthens.

HSBC stated that the ruling reinforces its judgment of a "soft dollar." Even if the result is not entirely unexpected, U.S. policy uncertainty may still keep the dollar relatively weak.

4) Risk Assets: HSBC's "risk appetite view remains unchanged," even marginally positive.

HSBC believes that the ruling has little impact on its "constructive" multi-asset view; rather, because alternative tools are not as flexible as IEEPA, it may reduce the repeated volatility of "turning tariffs on and off," leading to a marginal improvement in the corporate decision-making environment.

The above excellent content comes from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ)

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】.

[](https://wallstreetcn.com/shop/item/1000309)