The US economy remains overheated, triggering bets on interest rate hikes and putting Wall Street traders in a predicament.

Strong US June ADP employment figures have sparked traders' bets on further tightening by the Federal Reserve.

After more than a year of major central banks implementing aggressive monetary tightening policies, the latest signs indicate that the US economy is still overheating. This has caught traders off guard, as it could foreshadow another sharp decline in the stock and bond markets, much like the terrible days of 2022.

According to the Zhitong Finance APP, the strong US ADP employment figures for June have prompted traders to bet on further tightening by the Federal Reserve. On Thursday, the two-year US Treasury yield soared to its highest level since 2007, while the ten-year Treasury yield jumped above 4%, once again testing last year's highs.

Despite a series of better-than-expected US economic data dispelling concerns of an imminent recession, Wall Street is not yet prepared for interest rates to remain high for an extended period. After ignoring the steadily rising US bond yields over the past few months, the calmness of the stock market is beginning to waver, with the Cboe Volatility Index (VIX) briefly surging to its highest level since the turmoil in regional banks in March.

To make matters worse, the one-month correlation between the ten-year Treasury yield and the S&P 500 index has turned negative for the first time in the past three months, which means that US bonds and stocks are often sold off simultaneously. If this trading pattern of the inflation era continues, it is bad news for almost everyone, especially those with trillions of dollars in 60/40 investment portfolios and so-called risk-parity quantitative analysts.

Harry Melandri, an advisor at Macro Intelligence 2 Partners, said, "The problem is that the economic slowdown is not happening fast enough, for whatever reason." "The Federal Reserve seems to have more to do, and if that's the case, many markets are a bit overextended. I don't think these positions are large, but they are not prepared for further rate hikes."

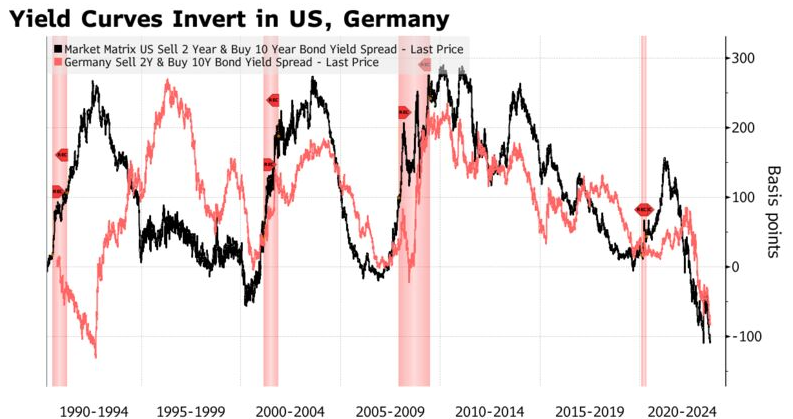

The renewed market tension highlights investors' unease that policymakers may have to raise rates to curb inflation, which could potentially lead to economic turmoil. From the US to Germany, yield curves are deeply inverted, which historically has often signaled an economic recession.

Compared to last year's volatility, the market's fluctuations this week have been insignificant. The volatility last year resulted in double-digit asset losses and shattered investors' confidence in hedging strategies. The S&P 500 index has risen in 6 out of the past 7 weeks, but has fallen 1% in the past two days. Additionally, in the credit market, the spread between junk bonds and US Treasuries remains close to its low for the year, indicating that the crisis has not yet spread to broader markets.

data were the driving forces behind the stock market's rise.

Supporting this shift is a reassessment of bets on the Federal Reserve's interest rate hikes. Dallas Fed President Lorie Logan said on Thursday that further rate hikes may be needed to stimulate meaningful anti-inflation measures, consistent with the tone of the Fed's June meeting minutes released on Wednesday. Currently, the interest rate market expects another rate hike in July.

Subadra Rajappa, Head of US Rate Strategy at Societe Generale, suggests that the more rate hikes the Fed implements, the more severe the economic downturn may be, ultimately leading to rate cuts. She advises clients to bet on steeper yield curves, which could result in a decline in short-term rates relative to long-term yields. However, she acknowledges that this trade is not easy due to market volatility, stating, "Unfortunately, this is a frustrating environment for investors on both sides of the trade."