Bank of America Survey: Betting on Soft Landing, Going Long on Large Tech Stocks Becomes the Most Crowded Trade

美國銀行 7 月基金經理調查結果顯示,有 68% 的受訪者認為,全球經濟將實現 “軟着陸”;大多數受訪者預計第二季度將是上市公司盈利的低谷,這意味着企業的盈利衰退已經結束。當月做多美國大型科技股是最擁擠的交易,其次是做多日本股票。

7 月 18 日週二,美國銀行公佈當月基金經理調查結果。

調查顯示,多數受訪者認為,全球經濟將在今年四季度或明年一季度陷入温和衰退,另外有 19% 的受訪者認為,全球經濟至少在 2025 年之前都不會陷入衰退。

有 68% 的受訪者認為,全球經濟將實現 “軟着陸”,另外有 21% 的受訪者認為,全球經濟將不得不經歷 “硬着陸”。

該項調查於 7 月 6 日至 13 日進行,受訪對象人數達 262 名,資產管理規模達 6520 億美元。

儘管受訪的基金經理們普遍對全球經濟依然存在悲觀情緒,但對全球上市公司盈利的共識已經明顯轉變。大多數受訪者預計第二季度將是上市公司盈利的低谷。美國銀行分析師 Michael Hartnett 表示,“受訪者對上市公司盈利的預期是自 2022 年 2 月以來最不悲觀的”,預計未來 12 個月全球每股收益將小幅上漲 0.5%。換句話説,基金經理們預計,企業的盈利衰退已經結束。

與此相關的是,基金經理們對股市更加樂觀。雖然接受調查的基金經理仍然減持全球股票(淨減持 24%),但這是年初至今的最低減持幅度。

當被問及人工智能浪潮帶給市場的影響時,42% 的受訪者認為人工智能在未來兩年內會帶給企業更高的利潤,1% 認為會帶來更多的就業機會,16% 的人則認為二者兼有,另有 29% 的人則認為,人工智能對就業機會和企業利潤都沒有積極影響。

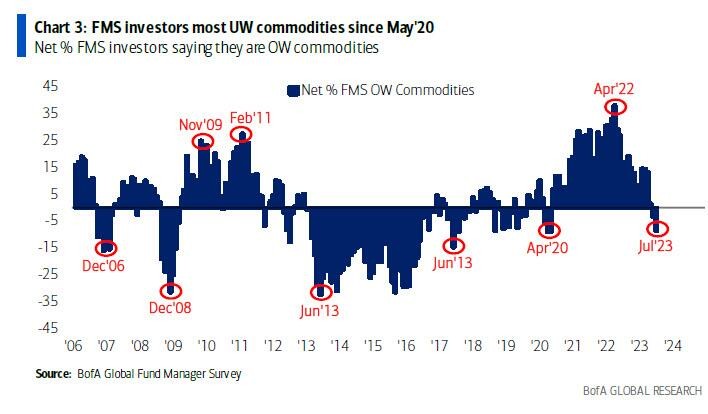

然而,儘管對股市的樂觀情緒有所上升,但基金經理們對大宗商品的情緒卻逐月冷淡。7 月份出現了自 2020 年 5 月以來最大規模的單月大宗商品減持。

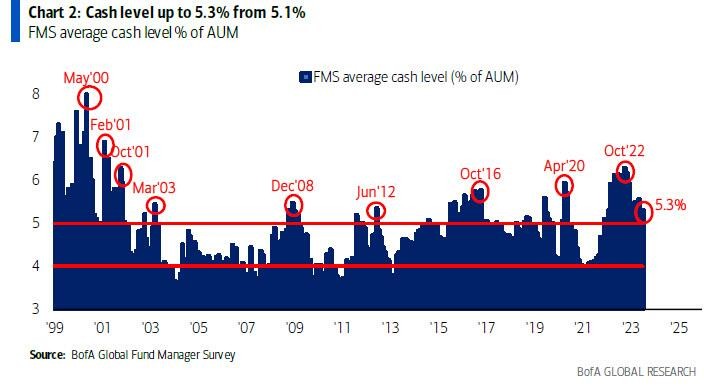

與此同時,基金經理們持有的現金水平則出現增加,從 6 月的 5.1% 升至 7 月的 5.3%。

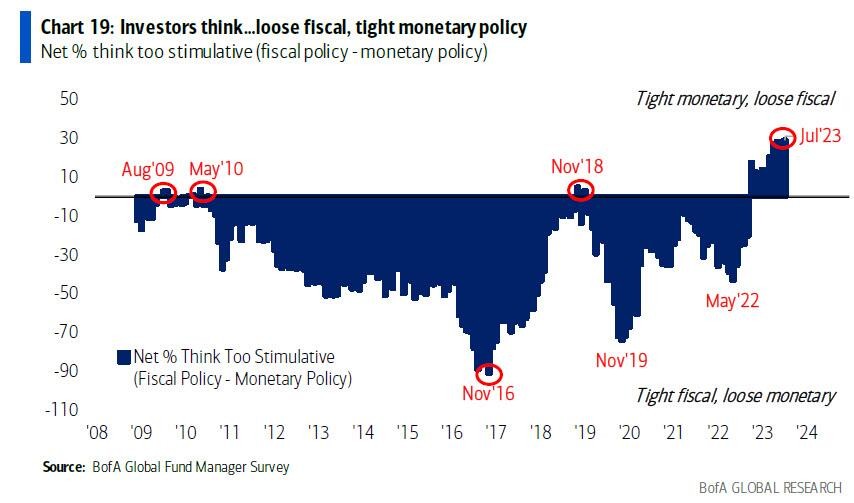

在這份調查中,基金經理們還普遍認為,當前美國的 “寬財政緊貨幣” 的政策是 2008 年以來最極端的。

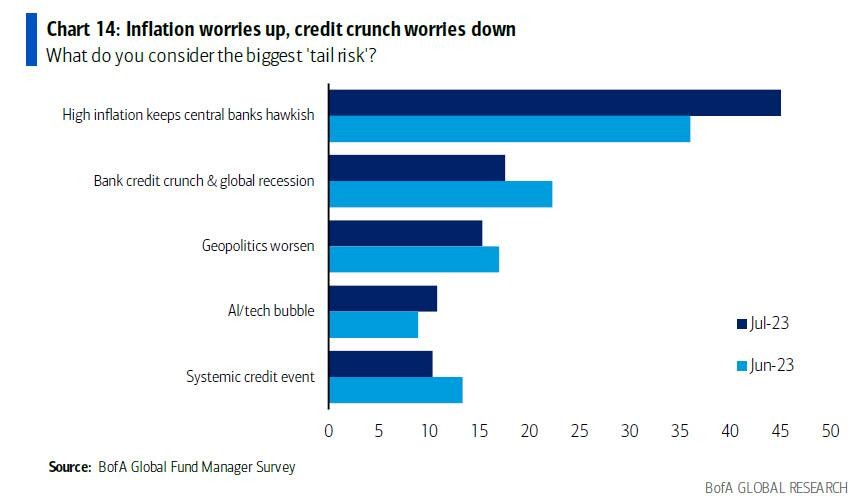

這也是為什麼有 45% 的基金經理認為,通貨膨脹/政策錯誤是最大的 “尾部風險”,其次是信貸緊縮——有 18%的基金經理這麼認為。

有 40% 的基金經理認為,商業房地產的違約,仍然是全球 “信貸危機” 最有可能的催化劑,儘管持有這一觀點的基金經理比例較 5 月份的高點有所下降。

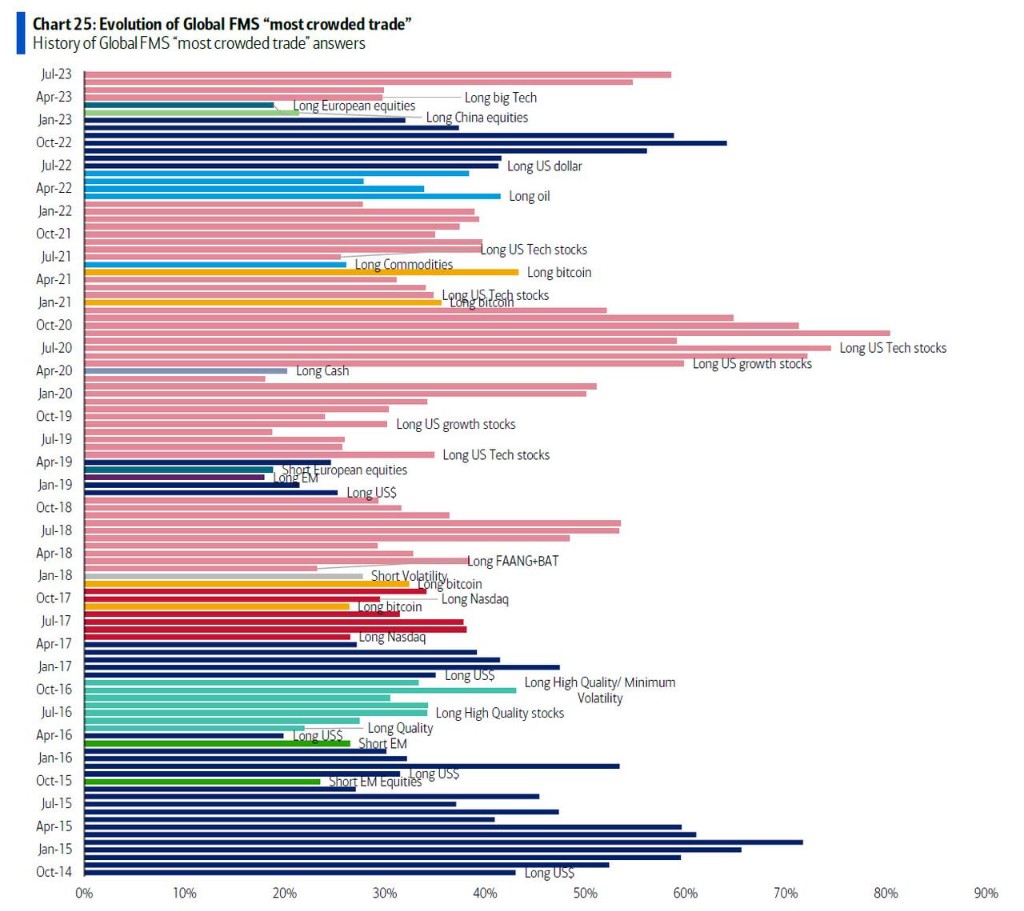

在各類交易中,做多大型科技股是最擁擠的交易,其次是做多日本股票。

儘管宏觀經濟前景黯淡,但美洲地區股票的大幅空頭回補使得基金經理對該地區股票的減持比例從 44% 降至僅 10%,為今年以來的最高水平。

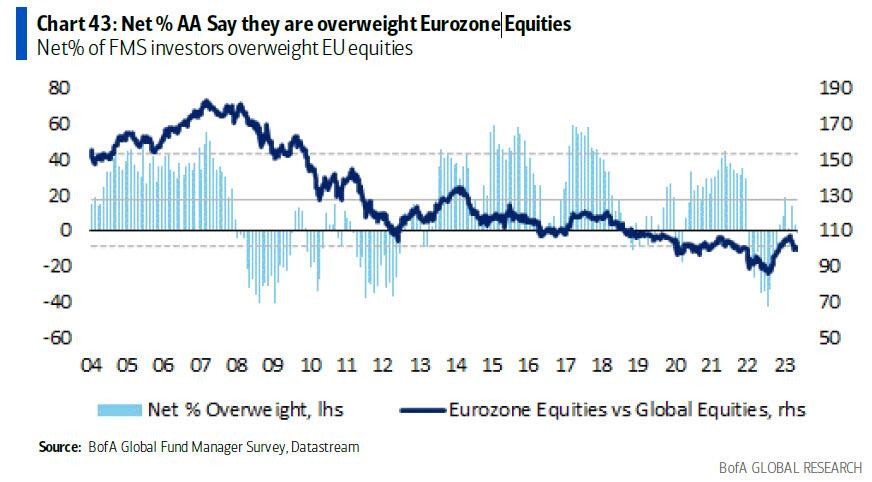

基金經理們今年首次看空歐元區股票。