Who caused the major drop in the US stock market in August? Goldman Sachs: "Zero-day options", UBS: I agree!

高盛和瑞銀髮現,零日期權看跌期權交易激增,導致投資者大舉拋售。零日期權的風險堪比 “在壓路機前撿硬幣”。野村估算,8 月才過半,就有四天的 0DTE 交易量躋身十大最高交易日之列。花旗發現,最近交易員青睞的零日期權從看漲轉變為看跌。

本週二,三大美股指尾盤加速下跌,收盤接近日低,集體跌至少 1%,標普和道指分別創 8 月 2 日和 7 月 6 日以來最大跌幅。

研究資金流二十載的專家、高盛董事總經理兼高級衍生品策略師 Scott Rubner 認為,尾盤拋售的元兇是和標普 500 指數掛鈎的零日到期期權(0DTE),這類期權加劇了美股大盤的跌勢,導致標普在 20 分鐘內跌約 0.4%。

Rubner 指出,做市商需要保持賬面平衡,因此必須在期權交易單大量湧入時大舉買賣股票,週二執行價為 4440 的看跌 0DTE 期權交易激增,整個交易日內有將近 10 萬份合約易手,名義價值 450 億美元,這迫使做市商採取行動。

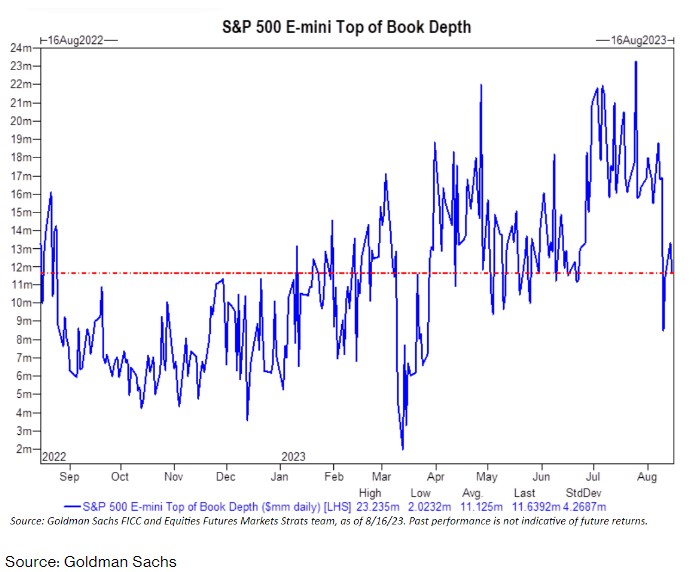

由於這些期權的成本在週二交易日尾聲時迅速從 0.7 美元飆升至 9 美元,做市商紛紛採取對沖措施,保持市場中立,這種情況下就意味着資金大舉撤離股市。Rubner 稱:“屏幕上沒有足夠的流動性應對做市商在短短 20 分鐘內進行如此戲劇性的 Delta 對沖。”

0DTE 期權——“在壓路機前撿硬幣”

華爾街見聞今年稍早曾介紹過 0DTE 期權,並援引華爾街人士的比喻稱,出售它的風險就像 “在壓路機前撿硬幣”。

因為這類期權的到期時間只剩下不到 24 小時,所以它可以在短短几個小時內獲得鉅額回報。但它帶來的既有高收益的可能,也有巨大的風險,讓給賣出期權的做市商和交易員可能面臨重大的風險管理問題。

摩根大通的首席市場策略師兼全球研究聯席主管 Marko Kolanovic 今年 2 月警告稱,0DTE 交易量的爆炸式增長可能造成與 2018 年初同一級別的市場災難。Kolanovic 的模型顯示,0DTE 的每日名義交易量目前約為 1 萬億美元。一旦市場出現大幅下跌,做市商被迫平倉引爆的危機,0DTE 可能帶來盤中 300 億美元的賣盤規模。

本週稍早,野村證券和花旗公佈的研究就體現了 0DTE 本月交易極為活躍帶來的拋售威脅。

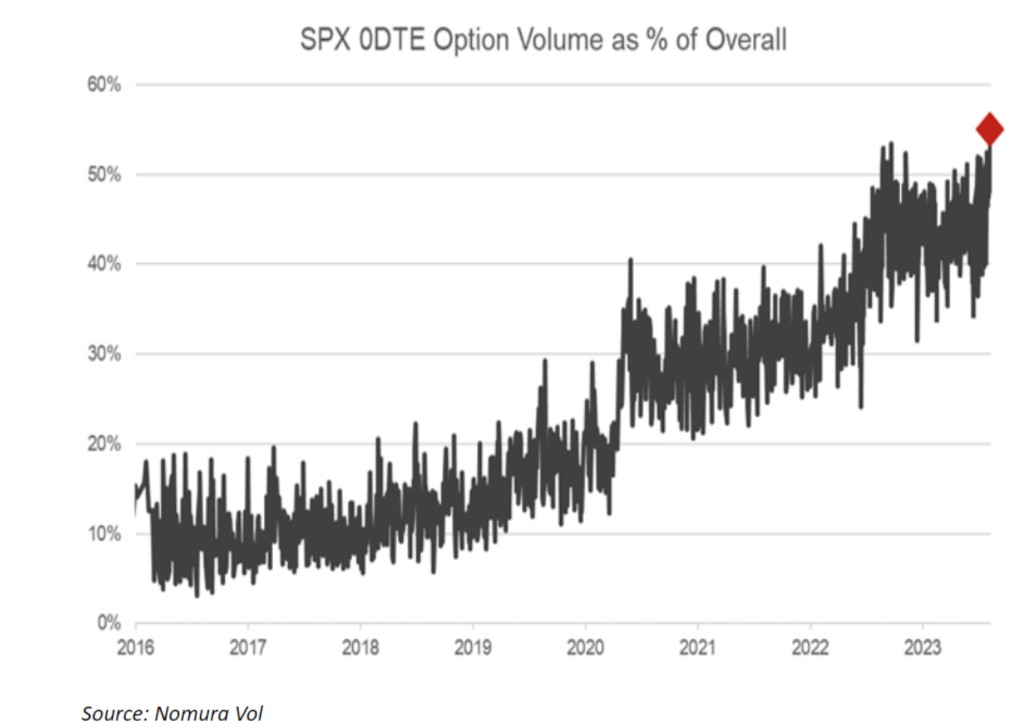

野村估算,上週四,約有 186 萬份和標普 500 掛鈎的 0DTE 期權換手,佔標普總成交量的 55%,佔比創最高紀錄。8 月才過半,月內就有四天的 0DTE 期權交易量躋身十大最高交易日之列。

野村的策略師 Charlie McElligott 稱,交易日內的拋售推動了 0DTE 期權的行為變化,他們的行為和我們過去看到的大幅反彈截然不同。無論是交易波動、區間還是超調,0DTE 作為完美工具的環境已經成熟,可它同時也助長了這類波動。

“得益於 0DTE,股市的有限下跌(低於 1%)可能會導致均值迅速回歸到正常狀態……但任何更痛苦的事情都會讓一切打賭都失敗。”

花旗的美股交易策略主管 Stuart Kaiser 則是注意到,交易員青睞的 0DTE 期權從看漲轉變為看跌。其數據顯示,過去 20 天內,看跌期權的交易量比看漲期權多了將近 10%,而之前兩個月,都是投資資金主要都流入看漲期權。

瑞銀:拋售恰逢 0DTE 看跌期權購買浪潮

瑞銀集團的交易部門也贊同這一觀點。在週二的一份報告中,該團隊對 0DTE 的三個特別繁忙的交易日進行了案例研究:7 月 27 日,有關日本央行可能採取鷹派貨幣政策的消息傳出;8 月 4 日,美國最新月度非農數據公佈;8 月 10 日,美國 CPI 通脹指標發佈。

瑞銀團隊發現,7 月 27 日和 8 月 4 日下午的拋售恰逢一波 0DTE 看跌期權購買浪潮。8 月 10 日,早盤的暴跌同樣是由看跌期權交易推動的,當投資者在盤中晚些時候開始在這些合約上獲利時,市場風向發生轉變,然後吸引交易員買入看漲期權追逐收益,進一步推高股市。

Rubner 表示,放大 0DTE 的影響是因為,在不影響股票價格的情況下交易股票變得越來越困難。據他估計,過去兩週流動性狀況惡化了 56%。

標普 500 指數當地時間收盤自 3 月底以來首次低於 50 日移動均線。彭博社彙編的數據顯示,過去五個交易日該指數的高低波動幅度平均為 1%,波動幅度幾乎是 7 月份水平的兩倍。

Rubner 警告説,波動性加劇以及上漲勢頭減弱可能會使基於規則的投資者變成賣家。 “這不再是逢低買入的市場。” 市場情緒和基調正在發生新的變化,