"The 'Anchor of Global Asset Pricing' flexes its muscles as both US stocks and bonds suffer this week. The Dow Jones Industrial Average experiences its worst weekly decline since March, while the S&P 500 continues its downward trend for the eighth consecutive month."

“全球資產定價之錨” 週五暫未發威,美股艱難反彈。道指勉強止住三連跌,創硅谷銀行倒閉以來五個月最大周跌幅。納指四連跌,再創七個月最長連跌周,標普幾乎收平,創近半年最長連跌周。特斯拉一週跌 11%。芯片股指盤中轉漲,英偉達上週大跌後本週反彈 6%。中概回落,蔚來跌超 7%,財報後小鵬汽車跌超 5%,京東跌超 4%。十年期美債收益率回落,未繼續逼近 2007 年來高位,仍連升四周。美元指數再創兩月新高後轉跌,仍連漲五週。離岸人民幣漲超 200 點後轉跌。原油連日反彈,全周仍跌超 2%,兩月來首次累跌。黃金終結九連跌,暫別五個月低位,仍創近兩月最大周跌幅,連跌四周。

避險情緒升温,投資者湧入債市避險,歐美國債價格反彈、收益率回落。週五 “全球資產定價之錨” 未繼續發威,基準十年期美國國債收益率未再逼近 2007 年來高位,美股艱難反彈,但全周美國股債雙殺,道指一週跌幅為五個月前硅谷銀行倒閉以來最慘。

本週公佈的歐美經濟數據或是體現經濟強勁,或是顯示高通脹的黏性,製造央行加息空間。週三的美聯儲會議紀要放鷹,警告通脹上行風險仍高,可能為此進一步加息,加劇市場對主要央行將高利率保持更久的擔憂。美國為首的歐美國債價格下挫、收益率齊升,基準十年期國債收益率創造或接近多年高位。

週五公佈的歐元區 7 月 CPI 同比增長如預期放緩,核心 CPI 持平初值,有核心通脹見頂跡象。歐美國債收益率全線回落,但全周美債收益率上行衝擊風險資產,對收益率敏感的科技股為首承壓,歐美股市全周下行。市場同時關注中國房地產業、經濟數據和政策動向。週四中國資產的反彈未能延續,追隨大盤累跌。

美元指數週五再創兩個月來新高後很快轉跌,但本週延續一個月來單週累漲勢頭,體現市場加碼押注美聯儲將更久保持高利率,以及對主要經濟體經濟形勢的關注。週四大反彈的離岸人民幣盤中回落,漲超 200 點後一度失守 7.31、跌超百點。日元兑美元週五脱離九個月高位,但全周都未能收復去年 9 月日本干預匯市時跌破的關口 145.00,和人民幣全周均累跌。投資者繼續警惕日本政府幹預的風險。

本週多種大宗商品遭拋售。國際原油週五在美元回落的助推下繼續反彈,仍 6 月中旬以來首次單週累跌。評論稱,美債收益率定價體現了市場預期美聯儲的高利率環境會持續更久,對未來幾個月和幾個季度的油市需求施加負面影響,前半周主要打擊油市的是經濟數據,後半周是美聯儲的鷹派會議紀要。

金屬中,在美元和美債收益率回落的支持下,黃金週五小幅反彈,暫時止住六年來最長連跌日,但因此前連日下跌,仍創 6 月下旬以來最差單週表現;包括經濟風向標 “銅博士” 在內,多種工業金屬累跌,和上週一樣,繼續體現市場對亞洲金屬消費大國經濟形勢的關注。

納指再創七個月最長連跌周 標普近半年最長連跌周 英偉達本週反彈 6% 中概回落

三大美國股指集體低開,盤初道瓊斯工業平均指數跌超 210 點跌逾 0.6%,標普 500 指數跌 0.8%,納斯達克綜合指數早盤曾跌近 1.2%,後均跌幅收窄。道指早盤尾聲時轉漲,午盤不止一次轉跌,但尾盤保住漲勢。標普午盤和尾盤均曾短線轉漲,納指尾盤也曾短線轉漲。

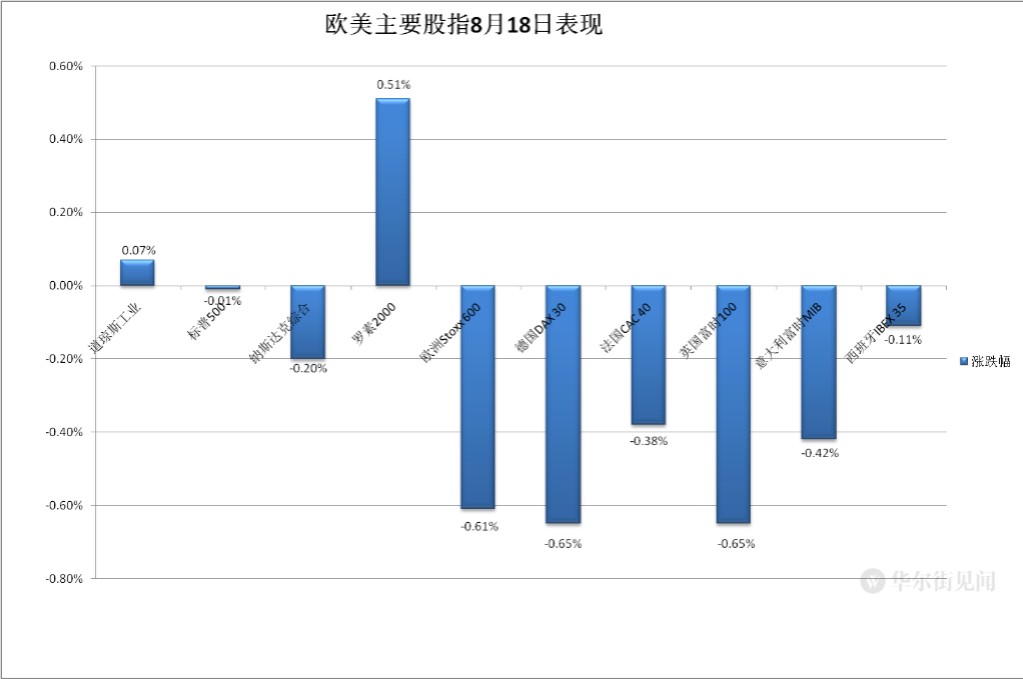

最終,三大指數只有道指成功反彈,結束三連跌,標普幾乎收平,納指連跌四日。道指收漲 25.83 點,漲幅 0.07%,報 34500.66 點,暫別週四刷新的 7 月 13 日以來低位。標普收跌 0.01%,報 4369.71 點,繼續刷新 6 月 26 日以來低位。納指收跌 0.2%,報 13290.78 點,連續兩日刷新 6 月 9 日以來低位。

價值股為主的小盤股指羅素 2000 收漲 0.51%,告別連跌四日所創的 7 月 6 日以來低位。科技股為重的納斯達克 100 指數收跌 0.14%,連跌四日,連續三日刷新 6 月 26 日以來低位。

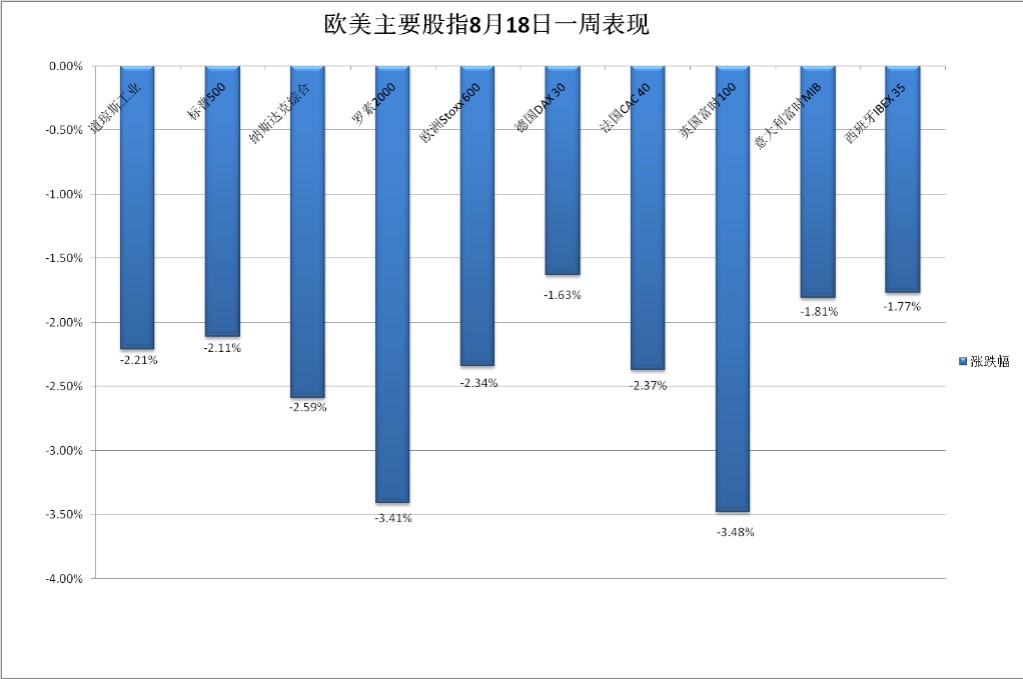

本週主要美股指全體累計下跌,週五均收於 50 日均線下方。標普累跌 2.11%,跌幅接近上上週所創的 3 月 10 日一週以來最大周跌幅,納指累跌 2.59%,納斯達克 100 累跌 2.22%,羅素 2000 累跌 3.41%,均連跌三週。

標普創 2 月 24 日以來最長連跌周,納指自去年 12 月以來首次三週連跌,繼續創七個多月來最長連跌周。道指累跌 2.21%,創 3 月 10 日一週、即硅谷銀行倒閉當週以來最大周跌幅,抹平上週漲幅,最近六週內第二週累跌。

標普 500 各大板塊中,週五共五個未收漲,谷歌所在的通信服務跌約 1%,跌幅遠超其他板塊,非必需消費品跌超 0.3%,金融和材料跌約 0.1%,醫療幾乎收平。收漲的六個板塊中,受益於原油繼續反彈、週四獨漲的能源漲超 0.9%,連續兩日表現最佳,其他板塊漲不足 0.4%。

本週這些板塊均累跌,上週跌近 3% 領跌的 IT 跌 0.8%,其他板塊至少跌超 1%。非必需消費品跌超 4% 領跌,凸顯特斯拉影響,對利率敏感的房產跌超 3%,金融跌 2.8%,通信服務、工業、材料、必需消費品也都跌超 2%,公用事業跌約 2%。

多數龍頭科技股週五繼續下跌。特斯拉盤初曾跌超 2%,收跌 1.7%,連跌六日至 6 月 2 日以來低位,在中國重新掀起價格戰的本週,股價累跌約 11.2%,連跌三週,跌幅遠超此前,前兩週每週跌超 4%。

FAANMG 六大科技股盤中收窄跌幅,少數轉漲。週四逆市收漲的谷歌母公司 Alphabet 收跌約 1.9%,回落到 7 月 25 日以來低位;Facebook 母公司 Meta 收跌近 0.7%, 繼續刷新 6 月 29 日以來低位,亞馬遜收跌近 0.6%,連續四日刷新 8 月 3 日以來低位,微軟收跌逾 0.1%, 繼續刷新 5 月 24 日以來低位,均連跌四日;而盤初跌超 1% 的蘋果午盤轉漲,收漲近 0.3%,暫別 5 月 25 日以來低位盤初曾跌超 1%;週四連跌三日至 6 月 7 日以來低位的奈飛盤初跌超 1%,收漲近 0.4%。

這六大科技股中本週齊跌,Meta 累跌超 6%,奈飛跌超 4%,亞馬遜跌近 3.8%,蘋果跌約 1.9%,微軟跌 1.4%,上週逆市漲超 1% 的 Alphabet 跌 1.6%。

芯片股總體午盤轉漲,在連跌四日驚險反彈,費城半導體指數和半導體行業 ETF SOXX 盤初都曾跌超 1%,收漲約 0.5%,走出 6 月 5 日以來低位,但本週分別累跌約 1.5% 和 1.2%。英偉達早盤一度跌約 3.9%,收跌 0.1%,但因週一傳出沙特和阿聯酋大量採購芯片消息後大漲超 7%,本週得以累漲約 6%,在上週跌約 8.6% 創去年 9 月 2 日以來最大周跌幅後反彈。截至收盤,應用材料漲超 3%,AMD 漲近 1%,拉姆研究漲近 0.7%,英特爾漲約 0.5%,德州儀器漲 0.4%,高通、美光科技微漲。

AI 概念股部分反彈。 C3.ai(AI)和 Palantir(PLTR)收漲約 1.8%,而 SoundHound.ai(SOUN)跌超 1% ,Adobe(ADBE)跌 0.7%,BigBear.ai(BBAI)收平。

週四總體扭轉四日連跌的熱門中概股回落。納斯達克金龍中國指數(HXC)收跌約 3.5%,本週累跌近 7.1%。個股中,盤前公佈二季度虧損擴大、創上市以來最大虧損且三季度營收指引低於預期後,小鵬汽車盤初曾跌超 9%,收跌逾 5%;收盤時,比特幣礦機巨頭嘉楠科技跌超 12%,儘管二季度 EPS 盈利高於預期,唯品會仍跌 8%,蔚來汽車跌超 7%,愛奇藝跌近 7%,B 站跌超 6%,京東、理想汽車、微博跌超 4%,百度、拼多多跌超 3%,阿里巴巴、騰訊粉單跌超 2%,大全新能源跌超 1%,而晶科能源、電子煙第一股霧芯科技漲超 1%。

銀行股指數齊跌,在週一惠譽警告可能下調包括大行在內多家美國銀行評級後,本週加速下跌,連跌三週。整體銀行業指標 KBW 銀行指數(BKX)收跌 0.4%, 繼續刷新 7 月 10 日以來低位,本週累跌 5.6%;地區銀行指數 KBW Nasdaq Regional Banking Index(KRX)繼續微幅收跌,連續四日刷新 7 月 17 日以來低位,地區銀行股 ETF SPDR 標普地區銀行 ETF(KRE)收跌不足 0.1%,刷新 7 月 17 日以來低位,本週分別跌約 6.3% 和 6.4%。

大銀行多數繼續下跌,摩根士丹利收跌約 1%,花旗、美國銀行 高盛跌不足 0.8%,而摩根大通收漲超 0.2%,富國銀行微漲。地區銀行中,阿萊恩斯西部銀行(WAL)漲超 1%,西太平洋合眾銀行(PACW)漲約 1%,Keycorp(KEY)漲約 0.5%,而 Zions Bancorporation(ZION)跌近 0.7%。

公佈財報的個股中,儘管第三財季的收入和利潤高於預期,農機巨頭 Deere(DE)仍收跌 5.3%;預計第一財季 EPS 虧損、而分析師預期盈利的美妝巨頭雅詩蘭黛(EL)收跌 3.3%;第四財季和全年營收指引均低於預期的電子測試儀生產商 Keysight Technologies(KEYS)收跌 13.8%;而二季度盈利和收入高於預期的折扣零售商 Ross Stores(ROST)收漲 5%。

波動較大個股中,“越南特斯拉” VinFast(VFS)早盤曾跌近 42%,一度因大跌暫停交易,收跌 23%,在週二通過合併 SPAC 在美上市首日暴漲超 250% 後,連續第三日兩位數大跌;宣佈反向拆股計劃的共享辦公公司 WeWork(WE)收跌 11.3%;在宣佈夏威夷火災後計劃繼續作為一家財力雄厚的公用事業公司而存在、不打算重組後,夏威夷電力公司(HE)收漲 14.5%,終結八日連跌,本週累跌,主要源於週一因火災擔憂及被標普下調評級至垃圾級後,當天收跌近 34%。

歐股方面,泛歐股指連跌四日。歐洲斯托克 600 指數刷新 7 月 7 日以來收盤低位,連續四日創一個多月來新低。主要歐洲國家股指連續兩日齊跌。各板塊中,房產跌超 1.7% 領跌,關注金屬主要消費國中國的礦業股所在板塊基礎資源跌 1.5%。個股中,中國市場吃重的奢侈品巨頭 LVMH、開雲分別跌 0.7% 和 1.1%,也有可觀中國業務歐洲最大行滙豐、英國保險公司保誠集團分別跌 1.4% 和 3.2%。

本週斯托克 600 指數連跌第三週,繼惠譽意外下調美國評級所在的上上週之後,再度一週跌超 2%。各國股指均累跌,有能源巨頭在英上市的英股跌超 3% 領跌,和德意西股均連跌三週,上週反彈的法股跌超 2%。各板塊中,對利率敏感的房產跌超 4% 領跌,上週跌超 4% 領跌的基礎資源本週跌 3.8%,緊隨其後,因原油轉而累跌,連續兩週累漲的油氣本週跌超 1%,上週漲超 3% 逆市領漲的醫療跌超 1%。

十年期美債收益率回落 未繼續接近 2007 年來高位 仍連升四周

歐洲國債價格集體反彈,收益率回落,普遍在歐元區 CPI 公佈後刷新日低。到債市尾盤,英國 10 年期基準國債收益率收報 4.67%,日內降 7 個基點, 脱離週四升破 4.75% 所創 2008 年 10 月以來盤中高位;基準 10 年期德國國債收益率收報 2.62%,日內降 9 個基點,未再像週四升破 2.71% 那樣向 3 月所創的 2011 年來高位靠近。

本週英債收益率大幅攀升,凸顯英國週二公佈二季度薪資增速創最高紀錄後,市場對英央行加息的預期明顯升温。10 年期英債收益率累計升約 15 個基點,連續兩週升超 10 個基點,連升四周;而 10 年期德債收益率本週五大致回落到上週五水平,止步三週連升。

週三盤中升破 4.32% 刷新去年 10 月以來高位後,美國 10 年期基準國債收益率未繼續上測去年 10 月所創的 2007 年來高位,在週四歐股盤中曾下破 4.22 刷新日低,日內降約 6 個基點,美股盤前曾轉升、一度接近 4.28% 刷新日高,抹平日內降幅,開盤後回到 4.27% 下方,早盤曾下破 4.23%,到債市尾盤時 4.25%,日內升約 2 個基點,連升三日,在僅週二回落的本週,收益率累計升約 10 個基點,連升四周。

對利率前景更敏感的 2 年期美債收益率在歐股盤中曾下破 4.90% 刷新日低,日內降逾 3 個基點,美股盤前曾上測 4.95% 刷新日高,日內升約 2 個基點,但未像週四盤中那樣逼近週二接近 5.02% 刷新的 7 月 6 日以來高位,美股盤初抹平升幅轉降,早盤曾下破 4.91%,後持續回升,到債市尾盤時約為 4.94%,日內升約 1 個基點,在週四回落後反彈,本週累計升約 1 個基點,連升兩週,最近六週內第三週攀升。

美元指數再創兩月新高後轉跌 仍連漲五週 離岸人民幣漲超 200 點後轉跌

追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)多數時間保持跌勢,亞市早盤跌破 103.30 刷新日低,日內跌超 0.3%,後跌幅持續收窄,美股盤前曾轉漲並接近 103.70,連續兩日刷新 6 月 13 日以來盤中高位,日內漲 0.1%,但未到美股開盤即轉跌,。

到週五美股收盤時,美元指數處於 103.50 下方,日內跌超 0.1%,在週四大致收平止步五連陽後回落,本週累漲近 0.6%;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數跌近 0.1%,在連漲五日後連跌兩日,繼續跌離週三刷新的 5 月 31 日以來高位,本週累漲近 0.5%,和美元指數均連漲五週。

離岸人民幣(CNH)兑美元在亞市早盤曾漲至 7.2825 刷新四日內高位,日內漲 216 點,亞市和歐股盤中均曾轉跌,歐股盤前曾跌至 7.3188 刷新日低,日內跌 147 點,美股早盤轉漲後午盤又轉跌,但未逼近週四跌至 7.3497 刷新的去年 11 月 3 日以來低位。北京時間 8 月 19 日 4 點 59 分,離岸人民幣兑美元報 7.3064 元,較週四紐約尾盤跌 23 點,在週四大反彈、漲超 300 點後回落,最近七個交易日內第六日下跌,本週累跌 463 點,連跌三週,跌幅較上週的 722 點明顯緩和。

其他非美貨幣中,週四盤中轉漲的日元兑美元繼續反彈,但連續五日未能收復去年 9 月日本政府幹預匯市的門檻 145.00,在週四漲破 146.50 至 146.57 而連續四日創去年 11 月以來新高後,美元兑日元在週五美股盤中曾接近 145.10,日內跌約 0.5%,美股收盤時跌超 0.3%,仍連漲三週;歐元兑美元亞市早盤曾逼近 1.0900 刷新日高,日內漲約 0.2%,歐股盤中轉跌,美股盤前曾跌破 1.0850,刷新 7 月 6 日以來低位,美股早盤轉漲,收盤時大致持平週四同時段水平;英鎊兑美元在美股盤前曾跌破 1.2690 刷新日低,也在美股早盤轉漲,午盤迴落,收盤時微跌,未靠近上週四接近 1.2620 所創的 6 月末以來低位。

比特幣(BTC)在亞市盤初曾跌穿 2.6 萬美元、部分平台跌至 2.5 萬美元下方,創兩個月來新低,後很快重上 2.6 萬美元,美股午盤曾跌回 2.6 萬美元下方,美股收盤時徘徊 2.62 萬美元一線,最近 24 小時跌超 5%,最近七日跌超 10%。

原油連日反彈 本週仍跌超 2% 兩月來首次累跌

國際原油期貨在週五亞市和歐美交易時段曾不止一次轉跌,美股盤前刷新日低時,美國 WTI 原油跌落 80 美元至 79.59 美元,日內跌約 1%,布倫特原油跌至 83.33 美元,日內跌逾 0.9%,美股早盤轉漲後保持上行,午盤漲幅擴大到 1% 以上。

最終,原油連續兩日收漲。WTI 9 月原油期貨收漲 1.07%,報 81.25 美元/桶;布倫特 10 月原油期貨收漲 0.81%,報 84.80 美元/桶,和美油繼續脱離各自週三分別創的 8 月 2 日和 7 月 26 日以來低位。

因前三日連跌,本週原油未能保持漲勢,美油累跌 2.33%,布油累跌 2.32%,均在連漲七週後回落,6 月 16 日以來首次單週累跌。上週原油已有頹勢,漲幅不足 0.7%,遠不及前三週,但上週仍創去年初以來最長連漲周。

歐洲天然氣連續三日回落,因週二大反彈,全周得以連續第三週累漲,但漲幅遠不及明顯擔憂澳大利亞部分 LNG 工廠工人罷工的上週,上週三一日就漲近 30%。週二收漲 13.36% 英國天然氣期貨收跌 2.2%,報 90.89 便士/千卡,在上週漲 22.6% 後本週累漲 1.64%;週二收漲 12.72% 的歐洲大陸 TTF 基準荷蘭天然氣期貨收跌 1.13%,報 36.41 歐元/兆瓦時,在上週漲 22.3% 後本週累漲 3.14%。

美國汽油和天然氣期貨繼續漲跌不一。週四回落 8 月 7 日以來低位的 NYMEX 9 月汽油期貨收漲 0.05%,報 2.8232 美元/加侖,在上週反彈 6.5% 後本週累跌 4.78%;NYMEX 9 月天然氣期貨收跌 2.67%,報 2.5510 美元/百萬英熱單位,抹平週四結束兩連陰的漲幅,刷新 8 月 2 日以來低位,本週累跌 8.14%,悉數回吐上週漲幅,最近四周內第三週累跌。

倫銅兩連陽仍連跌三週 倫錫一週跌超 4% 黃金終結九連跌 仍創近兩月最大周跌幅

倫敦基本金屬期貨週五漲跌互見。倫銅和倫鋅連漲兩日。倫銅收盤站穩 8200 美元上方,繼續脱離週三跌穿 8200 美元后所創的 5 月末以來低位,倫鋅繼續告別 6 月初以來低位。倫鉛連漲三日至三週來高位。

而週四終結九日連跌的倫鎳回落,收盤守住 2 萬美元,還未逼近週三跌穿這一關口後所創的 13 個月來低位。週四止住七日連跌的倫錫也回落,開始靠近週三所創的 5 月末以來低位。週四小幅反彈的倫鉛回落至六週低位。

本週大多基本金屬累跌。倫錫跌 4.5% 領跌,和跌近 0.7% 的倫銅、跌超 0.5% 的倫鎳都連跌三週。倫鋅跌超 4%,和跌超 1% 的倫鋁連跌兩週。漲近 2% 的倫鉛一枝獨秀,結束兩週連跌。

紐約黃金期貨週五全天保持反彈勢頭,終結了連跌九日的 2017 年 3 月 10 日以來最長連跌日,美股早盤刷新日高至 1926 美元,日內漲近 0.6%,午盤迴吐多數漲幅。

最終,COMEX 12 月黃金期貨,收漲 0.07%,報 1916.5 美元/盎司,暫別週四刷新的 3 月 14 日以來收盤低位。本週期金累跌約 1.55%,繼續創 6 月 23 日一週以來最大周跌幅,連跌四周,最近三週每週跌超 1%。