Relying on the consumption downgrade of foreign nationals, MNSO achieved multiple performance records in the Q4 of the 2023 fiscal year | Earnings Report

名创优品多项季度业绩刷新历史记录,FY23Q4 营收 32.5 亿元,同比增长 40%,调整后净利润达到 5.7 亿元,同比增长 156%,双双创新高。海外市场表现尤其亮眼,收入增长 42%,贡献了 40% 以上的经营利润。

在拼多多 Temu 和 Shein 之外,背靠中国强大供应链的 “10 元店” 名创优品,也在出海过程中赢得一众饱受通胀困扰的外国友人的青睐,狂揽创纪录营收和利润。

8 月 22 日周二晚间,港股盘后美股盘前,名创优品发布截至 6 月 30 日的 FY23 第四财季及全年财报。

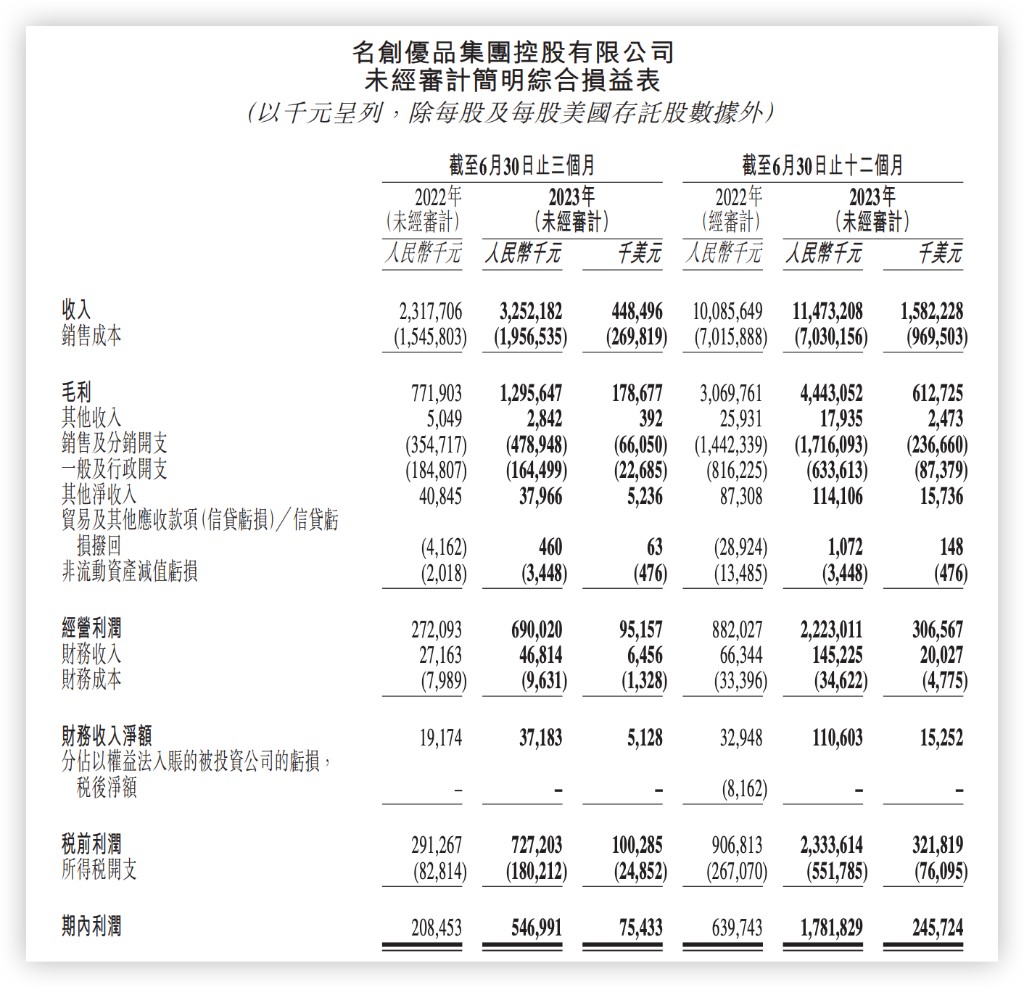

财报显示,名创优品本季营收 32.5 亿元,同比增长 40%,高于市场预期的 31.72 亿元,且为上市以来首次营收突破 30 亿元;本季调整后净利润也达到 5.7 亿元,实现了同比 156% 的增长,创历史新高,整后净利润率也取得历史性突破,达到 17.6%;毛利润首次达到近 13 亿元,毛利率为 39.8%,较上季提升 0.5pct。

全年来看,本财年名创优品经调整净利润增长 155% 至 18.45 亿元,此外,公司表示,将支付不少于全年经调整净利润的 50% 作为股息。对于 2023 财年,董事会批准了每股美国存托股 0.412 美元的末期现金股息,约为经调整每股美国存托股收益 0.81 美元的 50%,现金支付总额预计约为 1.285 亿美元或人民币 9.317 亿元。

截至发稿,名创优品美股盘前大涨近 7%。

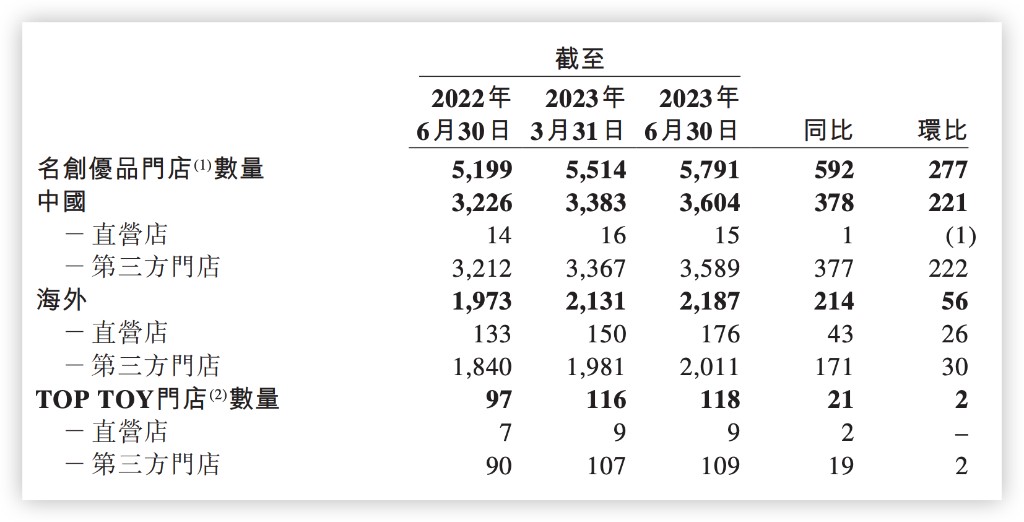

随着疫后经济复苏,名创优品的门店数量也在同步扩展。截至 2023 年 6 月 30 日,名创优品门店数量为 5791 家,同比增长 592 家,环比增长 277 家。其中,位于中国的门店数量为 3604 家,同比增长 378 家;位于海外的门店数量为 2187 家,同比增长 214 家。

分地区看,名创优品第四财季中国营收 21.37 亿元,同比增长 39.4%。名创优品表示,这一增长主要来自门店数量增长,且平均单店收入同比增长约 30.8%,整个中国市场,名创优品线下门店的收入同比增长约 42.3%。

海外市场收入 11.15 亿元,同比增长 42%。公司表示,第四财季海外名创优品门店的平均门店数量同比增加 11.0%,平均单店收入同比增加 27.9%,来自海外市场的收入贡献了第四季度总收入的 34.3%,而 2022 年同期为 33.9%,前一季度为 27.1%。

对于本季业绩超预期增长的原因,名创优品首席财务官兼副总裁张靖京表示:

“主要得益于海外直营市场收入同比增长 85%,本季度公司海外业务整体收入在去年同期的高基数之上同比增长了 42%,达到人民币 11.1 亿元,超过了我们之前最乐观的预期,也刷新了海外业务 6·30 季度的历史纪录。

随着直营市场经营杠杆释放,海外业务盈利能力显著提升。本季度海外市场贡献了公司经营利润的 40% 以上,相比上一季度约 25% 有了 长足进步。直营市场的毛利率提升尤为明显,尤其是以美国为代表的直营市场, 随着收入快速增长、门店模型持续优化,6 月份美国盈利门店占比近 90%,带动了海外直营市场经营利润率大幅提高。”