Wei Long: Price Increase of Spicy Strips, Investors "Disheartened"?

Mid-term revenue growth is weak, does product price increase mean high-end?

Warrior Dragon (09985) can capture the hearts of spicy strip enthusiasts, but it is difficult to satisfy investors' appetites.

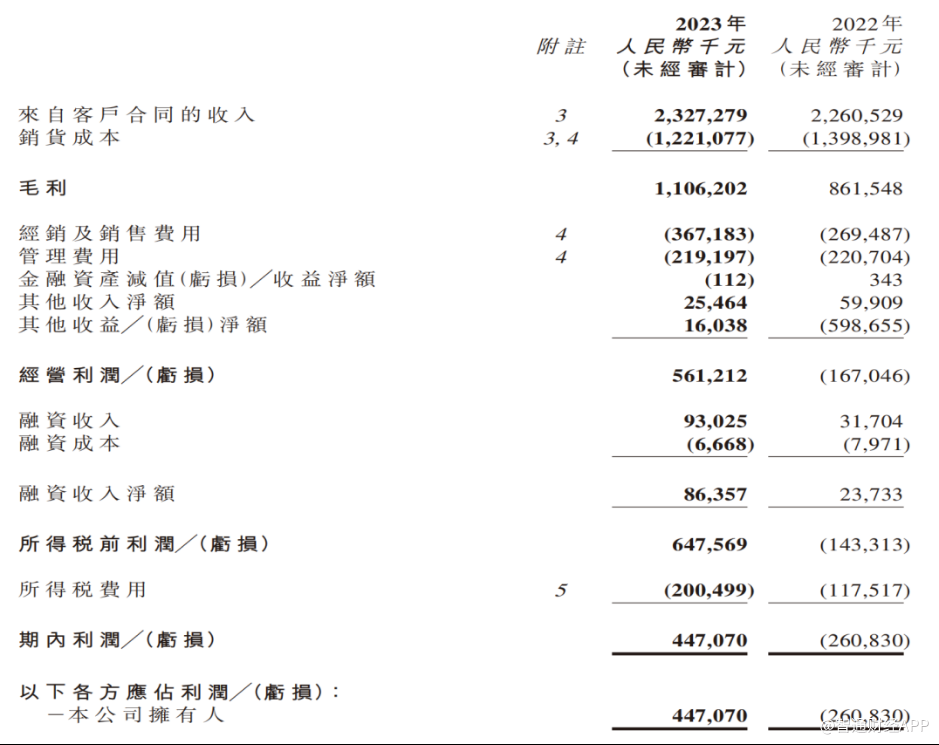

Zhitong Finance and Economics App noticed that after a brief "highlight moment" in the early stages of its listing, Warrior Dragon's stock price has been declining. As of August 22nd, the company's stock price once fell to HKD 6.31, a "halving" from its historical high of HKD 12.14. Even though the company achieved a net profit of RMB 447 million in the first half of the year, a significant turnaround compared to the same period last year, it failed to create much of a ripple.

"Price increase, quantity decrease" in product sales, does high price equal high-end?

Analyzing Warrior Dragon's financial report, it appears that the sluggish revenue growth may be a significant reason for investors' hesitation.

In the first half of the year, Warrior Dragon achieved a revenue of RMB 2.327 billion, with a year-on-year growth rate of only 2.95%. In contrast, according to data released by the National Bureau of Statistics, the total retail sales of grain, oil, and food products above the quota reached RMB 916.1 billion from January to June this year, with a year-on-year growth rate of 4.8%. This indicates that Warrior Dragon's revenue performance in the first half of the year lags behind the overall market.

In a horizontal comparison, several listed companies specializing in spicy snacks achieved rapid revenue growth in the first half of the year. For example, Yantai Shuangta Food's revenue increased by 56.64% year-on-year, Zhouheiya's revenue increased by 19.8% year-on-year, Juewei Food's revenue increased by 10.91% year-on-year, and Jinzi Food's revenue increased by 49.07% year-on-year.

Therefore, it can be seen that Warrior Dragon's weak revenue growth in the first half of the year cannot be solely attributed to the overall market environment. It requires further consideration of the subtle changes in the "price-quantity relationship" of the company's product sales.

According to observations from Zhitong Finance and Economics App, the growth of gross profit played a crucial role in Warrior Dragon's profit performance in the first half of the year. During this period, the company achieved a gross profit of RMB 1.106 billion, a significant increase of 28.4% year-on-year, with a gross profit margin of 47.5%, an increase of 9.4 percentage points compared to the same period last year. The increase in gross profit margin can be attributed to three main factors: firstly, the company's adjustment of the main product structure in the previous year led to an increase in average selling price; secondly, the decline in raw material prices during the reporting period; and thirdly, the company's continuous optimization of production processes, which improved cost management.

The Zhitong Finance APP noticed that in the first half of the year, the unit prices of Wei Long's seasoning noodle products, vegetable products, soy products, and other products were 20.8 yuan/kg, 34.1 yuan/kg, and 39.7 yuan/kg, respectively, with year-on-year growth rates of 26.83%, 16.38%, and 15.41%, respectively. Looking at the results, Wei Long's pricing strategy has promoted the increase of sales gross margin, achieving immediate results, but at the same time, the company's product sales have also become "unbalanced". In the first half of the year, the sales volumes of the three major categories mentioned above were 62,000 tons, 27,400 tons, and 2,600 tons, respectively, with year-on-year decreases of 24%, 1.8%, and 10.1%, respectively.

Despite the risk of declining sales, raising prices for products may be the only way for Wei Long to upgrade its brand. As we all know, for a considerable period of time in the past, spicy strips have been labeled as low-end and unhealthy. As a leading enterprise in the spicy strip industry, Wei Long has been committed to changing consumers' stereotypes.

For example, in 2022, the company upgraded its main products and product packaging, focusing on a new formula that is non-fried, zero artificial sweeteners, and zero trans fatty acids. At the same time, Wei Long also carried out a "tail-cutting" operation. In the 2023 interim report, the company stated that the sales volume of seasoning noodle products decreased by 24% compared to the same period last year, and one of the main reasons was the adjustment of the company's main product structure in May of the previous year, eliminating some low-priced products in this category.

Consumers often use price as one of the criteria for evaluating the grade of goods, and the perception of "low price = low-end" arises from this. Therefore, it is reasonable for Wei Long to raise prices for its products and eliminate some low-priced products. It should be noted that, against the background of declining product sales, whether the image of a high-end brand can be established through price increases will probably require a long-term test, and boosting sales will undoubtedly become the main focus of Wei Long's subsequent operations.

Emphasizing marketing and undervaluing research and development, how to break through in the stock era?

To grasp the growth potential of Wei Long's product sales, the situation of "natural growth" in the industry is an important reference dimension.

In the mid-term financial report, Wei Long cited the recent "2023-2024 China Snack Food Industry Status and Consumer Behavior Data Research Report" published by iMedia Consulting. From 2010 to 2022, the market size of China's snack food industry continued to grow from 410 billion yuan to 1.1654 trillion yuan, and it is expected to reach 1.2378 trillion yuan by 2027. However, the report also mentioned that the snack food market has shifted from a rapidly growing market to a slow-growing market, and the competition in the snack food market will become more intense in the future. According to data from iMedia Consulting, the Chinese snack food industry has entered an era of stock competition, which to some extent confirms the necessity for Wei Long to increase prices and improve profitability. Apart from raising prices, Wei Long can also achieve volume growth and improve revenue structure by expanding product categories and extending business boundaries.

Currently, Wei Long's product portfolio includes seasoning noodle products, vegetable products, soy products, and other product categories. Among them, seasoning noodle products (commonly known as spicy sticks) mainly include large gluten sticks, small gluten sticks, spicy bars, small spicy bars, kiss burn, and spicy spicy. Vegetable products mainly include konjac strips and crispy seaweed, while soy products and other products mainly include soft bean skin, 78° braised eggs, and meat products.

Although Wei Long has achieved a "multi-category" layout of products, the company's development strategy still focuses on "major single products." In 2022, the revenue proportions of seasoning noodle products and vegetable products were 58.7% and 36.6% respectively, totaling 95.3%. The annual retail sales of four single products exceeded 500 million yuan. In the first half of 2023, the combined revenue proportion of seasoning noodle products and vegetable products reached 95.5%, while the revenue proportion of soy products and other products was only 4.5%.

From Wei Long's revenue structure, it seems that soy products and other products should be the company's focus. However, in Wei Long's mid-year financial report for 2023, it was stated that the sales volume of soy products and other products in the period decreased by 10.1% compared to the same period of the previous year, mainly due to the optimization of marketing resource allocation and reduction of marketing activities for some soy products.

From this, we can see that Wei Long's product strategy does not focus on opening up new categories. As Wei Long stated in the financial report, the company will continue to enhance its research and development capabilities, deepen the exploration of existing categories, expand its product portfolio, and strengthen brand promotion.

Looking at Wei Long's past expenditure structure, the company's emphasis on marketing far exceeds that on research and development. The company raised a net amount of HKD 903 million when it went public, of which approximately HKD 226 million was used for expanding sales and distribution networks and brand building. As of the first half of 2023, HKD 118 million has been actually used. The net amount of funds raised for product research and development activities and enhancing research and development capabilities was HKD 90 million, and as of the first half of the year, the actual net amount used was only HKD 5.7 million.

In the first half of the year, Wei Long's distribution and sales expenses reached 367 million yuan, a year-on-year increase of 36.25%, and the sales expense ratio reached 15.8%, an increase of 3.9 percentage points compared to the same period last year. This is mainly due to the increase in online advertising investment, with advertising expenses increasing by 145.7% year-on-year, and the expansion of the sales team, with employee welfare expenses increasing by 48.2% year-on-year.

In the short term, the significant marketing investment by Weilong has had a limited impact on sales revenue. The company's earnings report also reflects that the increase in revenue from price hikes has to some extent been "subsidized" to marketing activities, thereby limiting the potential for higher profit levels. Therefore, the market's investment in Weilong remains uncertain, and it is still unknown when the "pain" of declining sales for Weilong will dissipate.