无处可躲!美联储 “新游戏规则” 下,海外股债商三杀

在歐美央行本週表態比市場想的更為強硬,在長期利率較高的情況下,市場不得不接受 “更長期高息” 的現實,而隨着美國 10 年期國債收益率持續攀升,股市可能就快 “頂不住” 了。

市場已真正開始接受 “更高利率將維持更長時間” 的全新遊戲規則,股債商面臨三殺。

截至 9 月 21 日週五收盤,標普 500 收跌 1.64%,創 3 月 22 日以來最大收盤跌幅,三天累計跌幅達 2%。道指收跌 1.08%,刷新 7 月 10 日以來低位。科技股為重的納斯達克 100 指數收跌 1.84%,跑輸大盤,連跌三日至 6 月 26 日以來低位。

倫鎳創逾一年新低,倫銅回落至五週低位,黃金創七週最大跌幅,終結五連陽 ,COMEX 12 月黃金期貨收跌 1.40%,創 8 月 1 日以來最大收盤跌幅,刷新 9 月 14 日以來收盤低位。

美國 10 年期基準國債收益率在美股收盤後一度逼近 4.50%,連續三日刷新 2007 年來將近十六年高位,最近六個交易日內第五日攀升。對利率前景更敏感的 2 年期美債收益率在亞市早盤曾逼近 5.20%,連續三日刷新 2006 年以來十七年來高位。

與此同時,彭博數據指出,五隻主要跟蹤股票、債券或大宗商品的交易所交易基金(ETF)出現一個月來的首次同步下跌,在本週的四個交易日內 5 只主要的 ETF 至少下跌了 0.8%,這種同步下跌的情況使這五隻 ETF 處於自去年十月以來的第三差水平。

分析師普遍認為,本週美聯儲的態度比市場更為強硬,歐央行也傳達了加息還未結束的預期,挪威和瑞典也保留了進一步加息的可能性,現在市場開始適應 “更長期高息” 的遊戲規則。

如果各國央行堅持 “更高更久” 的觀點,未來股債商或面臨更多的痛苦,這可能會導致實際收益率上升,進一步影響股市和主權債券的收益。

市場不得不接受 “更長期高息”

本週三,美聯儲並未連續加息,暫時按兵不動,但同時通過上調此後兩年的利率預期,釋放了高利率將保持更久的信號。美聯儲主席鮑威爾表示,FOMC 堅決致力於將通脹率降到 2%,美聯儲依然堅守這一目標,並未做出改變。

分析指出,美聯儲的態度比市場更為強硬,在長期利率較高的情況下,實際收益率可能會再次上升。EverBank 全球市場總裁 Chris Gaffney 表示,美聯儲堅持己見,現在市場不得不適應美聯儲:

“很多投資者一直在等待美聯儲根據市場預期進行調整——他們以為美聯儲會遷就市場的預期去調整自己的想法,但現在時代變了。”

滙豐策略師 Max Kettner 和 Duncan Toms 在報告中表示,當下的這種情況 “令市場擔憂”,並可能引發與 2022 年類似的大規模拋售。他們援引過去兩年的數據稱,實際收益率上升往往會損害股市和主權債券:

但這次可能不會像 2019 年和 2021 年那樣永遠看到 “金髮姑娘”(金髮姑娘經濟指的是某個經濟體內高增長和低通脹同時並存,而且利率可以保持在較低水平的經濟狀態)。因為通脹的轉折點 “真的很重要”,這一次可能會有一些障礙。

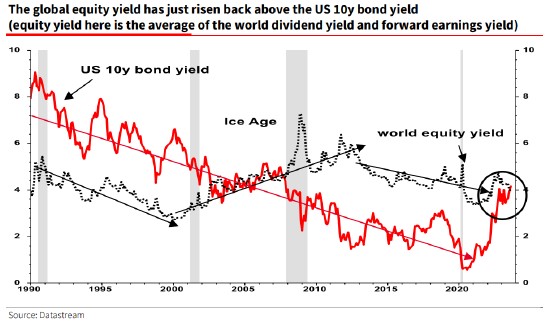

法興銀行的 Albert Edwards 在一份報告中説,在美聯儲鷹派暫停後,美國 10 年期國債收益率已回升至全球股市收益率之上,並補充説,收益率正處於數十年高位,目前的情況很像 2007 年,也就是 “萬物崩潰” 前夕:

現在股市還能忍受債券收益率上升帶來的多少痛苦?也許沒有了。還記得 ‘美聯儲模式’ 嗎?

不僅是美聯儲,將 “更高利率將維持更長時間” 的口號現在已成為歐洲央行和英國央行的官方立場。

無懼歐洲經濟放緩的風險,9 月歐央行繼續加息 25 個基點,存款便利利率達 2001 年以來最高水平,貨幣市場預計歐洲央行進一步加息的可能性為 30%。

歐洲央行行長拉加德在新聞發佈會上再次強調,通脹率在長時間內保持了過高的水平,確保通脹迴歸 2% 的目標,利率並非已達到峯值。

科技股又要跌落神壇?

利率長期保持高位,可能會對美元形成支撐,但對於科技股而言就不太妙了,尤其是那些估值較高的科技股。

要知道,多年以來,投資者對科技股的熱情不僅受到軟件和硬件公司創新的推動,而且還受到超低利率的推動,超低利率使這些公司承諾的未來利潤變得特別有價值。因此,投資者願意以較高的價格換取未來的收益。

Unlimited Funds 首席執行官兼首席信息官 Bob Elliott 表示,對於那些全力投資科技股但低估能源股的投資者來説,目前的情況並不樂觀,近幾周,能源股一直在上漲。Elliott 週四在推特上寫道:

“科技股估值上升、長端收益率上升以及油價上漲,正使這種倉位面臨擠壓風險”。

FactSet 的數據顯示,上週晚些時候,信息技術行業的市盈率為未來 12 個月預期市盈率的 25.5 倍,高於去年年底的 20 倍,也高於 18.5 的 10 年平均水平。

其中,科技股今年最大贏家 英偉達的預期市盈率為 31.7 倍,另外,微軟和蘋果的預期市盈率分別為 29.9 倍和 26.9 倍。

與此同時,對於一種將 60% 的資金分配給股票、40% 分配給債券的流行策略(60/40 投資組合)來説,債券和股票的回落尤其令人痛苦。60/40 組合模型在 9 月份迄今已下跌近 2%。

隨着標普 500 指數與基準美國國債之間的 60 天相關性攀升至 2 月份以來的最高水平,越來越多的步調一致的走勢讓人質疑固定收益在風險資產下滑時能否起到對沖作用。