Morgan Stanley shouts "Super Cycle Returns"! Predicts "Oil Price of $150" and foresees "Multiple Energy Crises" in the next decade.

摩根大通預計,到 2030 年全球石油缺口將擴大到驚人的 710 萬桶/日,這需要油價大幅上漲。

過去兩年,華爾街最大的能源牛市旗手非高盛莫屬,他們正確預判了 2022 年的油價史詩級暴漲,但在今年的油價暴跌中,高盛被啪啪打臉,其明星分析師、首席大宗商品策略師 Jeff Currie 更是黯然離職。

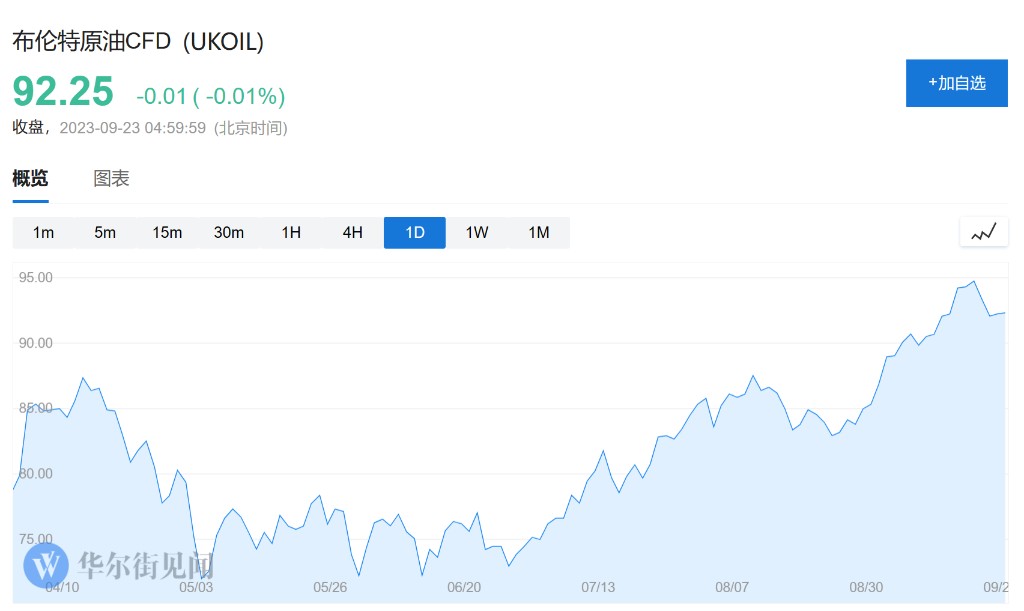

但隨着油價從年中低點反彈 30%,摩根大通決定重新站出來,從高盛手中接過 “牛市旗手” 的接力棒。

摩根大通能源分析師 Christyan Malek 在隔夜發表的報告中寫道,其 “超級週期” 系列報告強勢歸來。摩根大通在 2013-2019 年期間一直看跌油價,隨後於 2020 年推出了 “超期週期” 系列報告。今年以來,這家華爾街大行一直處於觀望狀態。

鑑於石油行業投資逐漸枯竭,光是綠色能源難以滿足全球能源需求,Malek 預計,短期或中期內,油價可能會升至 150 美元/桶,比布油當前的價格高出 62.6%,預計到 2030 年全球石油缺口擴大到 710 萬桶/日。

Malek 表示:

我們去年 12 月策略性地做空,在 4 月獲利了結,並從那時起保持中立。雖然自 6 月以來油價大漲 (油價上漲 30%,歐洲斯托克 600 石油和天然氣指數 SXEP 上漲約 10%),但能源股票一直落後。

我們再次看好全球能源綜合市場,重申 80 美元/桶的長期目標油價,並重申我們在 “超級週期 IV” 報告中的觀點,即短期至中期,油價可能會升至 150 美元/桶,長期為 100 美元/桶。

Malek 解釋稱,支撐油價上漲的主要因素是:

更長期高息的利率前景減緩了資本流入新供應;

股權成本上升推動布倫特原油現金盈虧平衡點超過 75 美元/桶(回購後),因為公司在結構上向股東返還更多現金,反過來又推高了石油的邊際成本;

體制和政策導向壓力加速了向綠色能源的過渡和需求見頂恐慌。

總而言之,結論是是一個自我強化的 “更長期高息” 前景下的能源宏觀展望,因為行業難以證明 2030 年之後大規模投資的合理性。

摩根大通預測,2025 年石油市場供需缺口為 110 萬桶/日,到 2030 年則擴大到 710 萬桶/日,這既是對需求前景的樂觀預期,也是對供應的悲觀預測。

而每天 700 萬桶的驚人短缺,將需要油價不僅要上漲,而且要大幅上漲。

全球能源股還有上行空間?

回到報告,摩根大通接着提到全球石油市場已從風險 “折價”(需求) 轉變為風險溢價 (較低超配產能/上升邊際成本),即風險從需求端轉向供應端。

我們的分析顯示,石油市場的供需缺口只能依靠沙特的閒置產能 (以及其他海灣產油國在較小程度上) 來滿足,這使其能夠在 2025-2030 年期間滿足創紀錄的約 55% 的邊際需求增長,相比之下 2005-2018 年平均為 18%。

我們估計,OPEC 增加產量和耗盡其閒置產能 (約 420-430 萬桶/日;沙特 320 萬桶/日) 可能會帶來約 20 美元/桶的風險溢價,而我們的長期油價預期為 80 美元/桶 (相比之下,後端曲線漲幅約 18%)。

此外,公司現金收益不僅支撐着長期 80 美元/桶的價格,而且表明大型能源公司支付資本支出、股利、債務和現金回報的所需油價繼續呈上升趨勢。

Malek 將全球能源股的評級上調至 “增持”,主要原因如下:

更積極的宏觀前景 (我們更偏好石油而非天然氣,因為前者具有結構性利好特徵和 OPEC 減緩的較低波動性);

企業現金實際收支平衡(與遠期相比),意味着 2024 年自由現金流收益率(FCF 收益率)約為 12%,油價若達到 100 美元/桶,FCF 收益率升至 15% 左右;

每股收益(EPS)的上行風險。按 MTM 計算,我們的 2024 年預期比市場高約 10%,而在 1 月份,我們的預期約 10%;

現金回報率>30%,支撐了相對於市場而言具有吸引力的估值;

如果全球庫存繼續下降、油價上漲,OPEC 可能會在未來 12 個月增加產量。從歷史上看,這對能源股有利,因為它通常意味着基本面 (需求) 正在改善。能源股往往跑贏大盤,並在產量增加時與油價出現正向脱鈎。

我們注意到,儘管自 6 月沙特啓動 100 萬桶/日的減產計劃以來,油價上漲 30%,但股票只上漲約 10%,即負向脱鈎。

繫好安全帶,未來十年或出現 “多次能源危機”

儘管看好油價,Malek 仍向基本面投資者發出了一個重要信號——“繫好安全帶”。

雖然我們認為該行業處於結構性牛市,油價應該正常化走高,但我們預計油價和能源股票將在更寬的價格範圍內交易,較高 “加權平均資本成本”(WACC)以及圍繞 ESG/需求見頂的擔憂可能加劇油價的波動性。

我們建議,未來幾年採用絕對價格修正( absolute price corrections),利用這些時機在綜合能源市場中建立方向性多頭頭寸,尤其是石油貝塔係數較高的股票。我們承認與全球衰退等因素相關的下行風險。然而,在這種情況下,供需基本面仍然緊張,能源板塊應該跑贏股市大盤。

重要的是,如果出現需求衝擊,我們認為 OPEC 可以進一步削減產量以幫助穩定油價。此外,由於股票估值面臨 “更長期高息” 帶來的風險,我們認為,當整體股市下跌時,能源行業通常表現優於大盤,因為該行業可作為宏觀對沖通脹、利率和地緣政治風險的工具。

最後,我們認為全球經濟能夠承受三位數的名義油價,因為按實際價格計算,油價仍低於 2008 年和 2011 年的峯值,也低於 “需求破壞區”(即石油在全球 GDP 中的比重>5%,而目前僅約為 2.5%)。

針對電動汽車興起對化石燃料的威脅反覆引發的石油需求見頂問題,摩根大通嗤之以鼻:

我們認為,我們的投資期限(2030 年)內,石油需求不會出現見頂,因為需要大量燃料來補充我們全球能源展望中提到的 11EJ 能源赤字。

由於供應鏈、基礎設施和關鍵材料瓶頸,清潔能源系統在接下來的十年中還無法走向足夠成熟,捕獲技術不夠完美,也無法向最終客户輸送足夠多的 “清潔” 電力。因此,這對傳統燃料施加了更大的壓力,以填補缺口並滿足新興市場帶動的不斷增長的需求。

Malek 警告稱,如果不增加石油和天然氣資本支出,全球仍將面臨能源短缺和整個大宗商品大幅漲價的風險。這可能會在未來十年內,多次引發石油為主導的能源危機,可能比去年歐洲爆發的天然氣危機嚴重得多。

此外,它還有助於使 OPEC 牢牢掌握全球石油市場的方向盤,在需求增長中佔據更大份額,同時有助於緩解油價急劇波動。