New Stock Preview | Hong Kong Stock Exchange Receives Third Submission, China's Leading Potash Fertilizer Trader, Mi Gao Group, Faces Raw Material Price Increase Dilemma

三度遞表港交所,米高集團能否如願?

2016 年米高集團控股有限公司 (以下簡稱:米高集團) 從加拿大多倫多證券交易所私有化退市後,近兩年來多次向港交所發起衝擊,渴望再次登錄資本市場,然而情況並不樂觀。

據智通財經 APP 獲悉,米高集團曾於 2022 年 7 月 6 日、2023 年 2 月 28 日向港交所提交過上市申請,不過最終以 “失效” 告終。9 月 22 日,米高集團再次向港交所遞交上市申請書,廣發融資 (香港) 為獨家保薦人,這也是米高集團三度闖關港交所。那麼這次米高集團能否如願?

業績波動大,過度依賴大單品及大客户

智通財經 APP 瞭解到,米高集團成立於 2003 年,主要從事包括氯化鉀、硫酸鉀、硝酸鉀以及複合肥等各類鉀肥產品的生產和銷售。截止目前,米高集團擁有三條氯化鉀造粒線、40 條硫酸鉀生產線及三條複合肥生產線,並在中國黑龍江省、吉林省、貴州省以及廣東省運營合共五個主要的生產設施。

目前,公司的氯化鉀、硫酸鉀及複合肥產品的總估計產能分別為 39 萬噸、40 萬噸及 17.2 萬噸。2019 年 1 月因地方政府對成都生產設施所在區域改變區劃政策而停產前,公司亦在成都生產設施生產硝酸鉀產品。目前公司正計劃在四川省綿陽市興建新四川生產設施,預計將在 2025 上半年建設完成,建設完成後,其硫酸鉀、硝酸鉀以及複合肥估計產能分別為 8 萬噸、6 萬噸及 20 萬噸。

得益於生產設施的地理位置優越,使得米高集團在向客户交付產品時具備成本優勢,且能及時響應客户需求,在這一優勢之下,米高集團在化肥行業中也佔有一席之地。據弗若斯特沙利文報告,按 2022 年度鉀肥銷量計算,米高集團在中國鉀肥公司中排名第三,在中國非儲備型鉀肥公司中,公司按相同方式計算在 2022 年排名第二。公司佔同年中國鉀肥總銷售收入約 6.0%。分別按 2022 年度的氯化鉀、硫酸鉀及硝酸鉀銷量計算,在中國鉀肥公司中,公司排名第三、第四和第五,佔同年中國氯化鉀、硫酸鉀及硝酸鉀銷售收入約 7.0%、4.0% 及 0.3%。在中國五大鉀肥公司中,公司是唯一提供全面的產品線 (即氯化鉀、硫酸鉀、硝酸鉀以及複合肥) 的肥料供應商。

業績方面,受益於中國市場穩定增長的鉀肥需求,2021 財年至 2023 財年,米高集團的收入分別為 20.82 億元人民幣 (單位,下同)、38.41 億元以及 47.23 億元,同比增長分別為 84.48% 及 22.96%。同期,公司實現年內溢利分別為 2.07 億元、3.97 億元及 4.22 億元,同比增長分別為 91.78% 及 6.29%。

不難看出,作為化肥企業,米高集團的業績增長並不穩定,2022 財年業績暴漲主要源於公司的產品平均銷售價格大幅提升。據悉,2020 年以來,受全球糧食安全問題影響以及地緣政治導致鉀肥供需緊張,公司的氯化鉀、硫酸鉀及硝酸鉀產品的每噸平均售價由 2021 財年的 1723.9 元、2328.4 元及 3726.6 元提升至 2022 財年的 2867.7 元、3281.5 元及 4006.1 元。其中,氯化鉀及硫酸鉀是米高集團的主要收入來源,因此這兩大產品價格的大漲,也導致公司在 2022 財年業績大幅提升,而 2023 財年儘管產品價格也進一步上漲,但漲幅遠不如 2022 財年,因此業績增長較為緩慢。

拆分業務收入結構來看,截至 2021 財年、2022 財年及 2023 財年,氯化鉀及硫酸鉀的銷售總額分別佔公司總收入約 85.2%、96.7% 及 95.3%,而餘下收入主要產生自銷售硝酸鉀、複合肥,以及副產品及其他產品 (主要包括作為硫酸鉀製造過程副產品的鹽酸及肥料添加劑)。

其中,氯化鉀佔比逐年提升,由 2021 財年的 60.1% 提升至 2023 財年的 85.1%。而硫酸鉀收入佔比則由 2021 財年的 25.1% 下降至 2023 財年的 10.1%。不難看出,米高集團的業績增長基本上由氯化鉀所決定。

業績過度依賴氯化鉀以外,米高集團大客户依賴也十分明顯。據招股書顯示,米高集團的五大客户主要是煙草公司、農墾公司及農業綜合公司。2021 財年、2022 財年及 2023 財年,米高集團最大客户銷售額分別佔總收入比重的 27.9%、22.4% 及 20.0%;同期五大客户銷售額分別佔總收入比重的 58.1%、59.4% 及 52.4%。

除了依賴大客户外,米高集團向前五大供應商採購佔比也高度集中。招股書顯示,2021 財年、2022 財年及 2023 財年,米高集團向最大供貨商採購額分別約為 4.51 億元、7.07 億元及 9.77 億元,分別佔採購總額的 22.4%、19.1% 以及 29.2%;同期,五大供貨商採購額分別約為 15.32 億元、24.85 億元及 24.91 億元,分別佔採購總額的約 75.9%、67.0% 及 74.4%。

由此,可以看到,米高集團的業績不僅過分依賴於氯化鉀,同時對大客户以及大供應商依賴症也明顯,一旦大客户對公司需求的下降,公司的業績將受到明顯的不利影響,並且大供應商漲價,公司亦可能面臨原材料漲價,毛利率下降的風險。

銷貨成本大增,無法擺脱原材料價格的影響

作為米高集團最大的收入來源,氯化鉀價格波動將對公司業績產生明顯的影響,而在自身沒有鉀資源,需要靠外部採購的米高集團而言,氯化鉀的採購成本亦將明顯影響公司的毛利率。

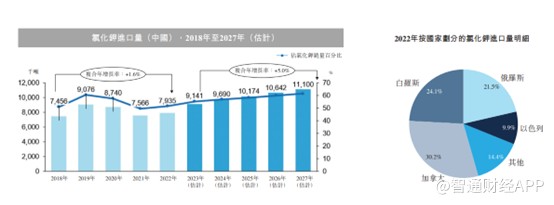

一直以來,氯化鉀是中國最常用的鉀肥,可用於種植多種作物。隨着中國農業的蓬勃發展,對氯化鉀的需求日益增長。根據沙利文報告顯示,2022 年中國按氯化鉀銷量達到 1538 萬噸,佔鉀肥總銷量的 77.4%;硫酸鉀及硝酸鉀的銷量分別達到 373 萬噸及 76 萬噸。展望未來,預測按鉀肥銷量計的市場規模進一步增加,氯化鉀銷量由 2023 年的 1653 萬噸增至 2027 年的 1805 萬噸,2023 年至 2027 年複合年增長率為 2.2%。硫酸鉀及硝酸鉀的銷量將分別達到 446 萬噸及 91 萬噸,2023 年至 2027 年的複合年增長率為 3.0% 及 2.5%。

由於中國鉀資源有限,每年對氯化鉀的需求中有很大一部分是通過海外進口彌補。2022 年,中國氯化鉀總銷量約 50% 來自外國。根據中華人民共和國海關總署發佈的數據,氯化鉀進口量由 2018 年的 745.6 萬噸增加至 2022 年的 793.5 萬噸,略有波動。2022 年,加拿大、白羅斯及俄羅斯為中國三大氯化鉀進口國,分別約佔中國氯化鉀進口總量的 30.2%、24.1% 及 21.5%。

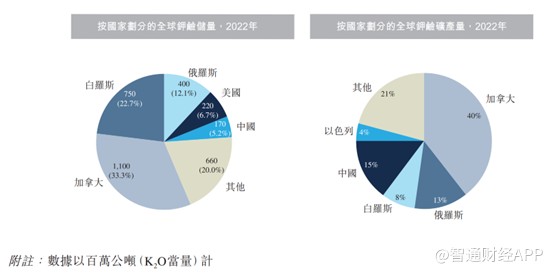

全球鉀鹼儲量分佈相對不均,可採儲量集中於少數國家。其中,加拿大、白羅斯及俄羅斯是世界上儲量最高的三個國家。根據 USGS(美國地質調查局) 的數據,2022 年這三個國家的鉀鹼儲量佔全球鉀鹼儲量的 60% 以上。中國約有 1.70 億噸鉀鹼儲量 (K2O 當量),居世界第四位。不過中國大部分鉀鹼儲量品位較低,或是深層滷水礦牀難以開採。

根據 USGS 的數據,2022 年,全球鉀肥產量 5020 萬噸,加拿大佔全球鉀鹼礦產量的 40%,中國第二佔 15%、俄羅斯 13%、白羅斯佔 8%。受俄烏衝突以及針對白羅斯生產商的國際制裁影響,2023 年,中國鉀鹼產量佔比略有增加,但是受限於儲量影響,中國鉀鹼產量增長較為困難。

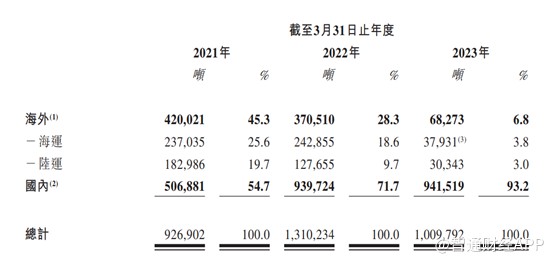

因此,中國鉀肥生產商及供貨商倚重少數境外氯化鉀生產商供應氯化鉀是業內常見做法,米高集團也不例外。2021 財年、2022 財年及 2023 財年,米高集團對外分別採購了約 92.7 萬噸、131 萬噸及 101 萬噸氯化鉀,總採購額分別約為 15.68 億元、32.09 億元及 30.26 億元,分別佔同期總採購額的約 77.7%、86.6% 及 90.4%。 2023 財年,按數量計算,公司向國內供應商採購佔比達到 93.2%,直接從海外供貨商採購佔比 6.8%。

誠然,米高集團向海外直接採購佔比較低,但其向國內採購的氯化鉀價格甚至高於直接向海外採購的價格。據招股書顯示,2021 財年、2022 財年及 2023 財年,米高集團向海外供貨商採購氯化鉀的每噸平均採購價分別約為 1539.8 元、2657.4 元及 2297.9 元;而同期,公司向國內供貨商採購氯化鉀的每噸平均採購價分別約為 1818.4 元、2366.6 元及 3047.1 元。而米高集團向國內採購氯化鉀的佔比由 2021 財年的 54.7% 提升至 2023 財年的 93.2%。國內氯化鉀價格高於直接向海外採購,但米高集團卻大幅提升國內的採購佔比,或源於烏俄衝突所致,因此米高集團被迫接受高價格向國內採購。

面對不斷上漲的原材料,米高集團也坦言其毛利率將受到影響。在銷貨成本之中, 2021 財年至 2023 財年,直接材料的成本分別佔銷貨成本總額約 95.9%、97.9% 及 97.5%。在所有直接材料之中,期內氯化鉀的採購成本分別佔所有直接材料採購總額約 77.7%、86.6% 及 90.4%。若氯化鉀價格進一步上漲,而公司卻無法轉嫁給下游客户,那麼公司的營收及利潤增長速度將進一步放緩,甚至出現負增長的可能。

值得一提的是,在成本持續上行的情況下,米高集團卻打算繼續擴產。對於此次 IPO 募資用途,公司在招股書中表示將在黑龍江物流及生產中心將建設包括造粒、加工、包裝及儲存氯化鉀的設施。完成黑龍江物流及生產中心建設後,公司的氯化鉀產能預計將由最後實際可行日期的 39 萬噸增至約 139 萬噸,儲存能力將增加 50 萬噸。

進一步擴產有望提升公司在行業中的規模,但無法轉嫁成本且擺脱不了原材料上漲的情況下,大規模擴張,反而可能侵蝕公司的利潤,甚至造成虧損的局面。